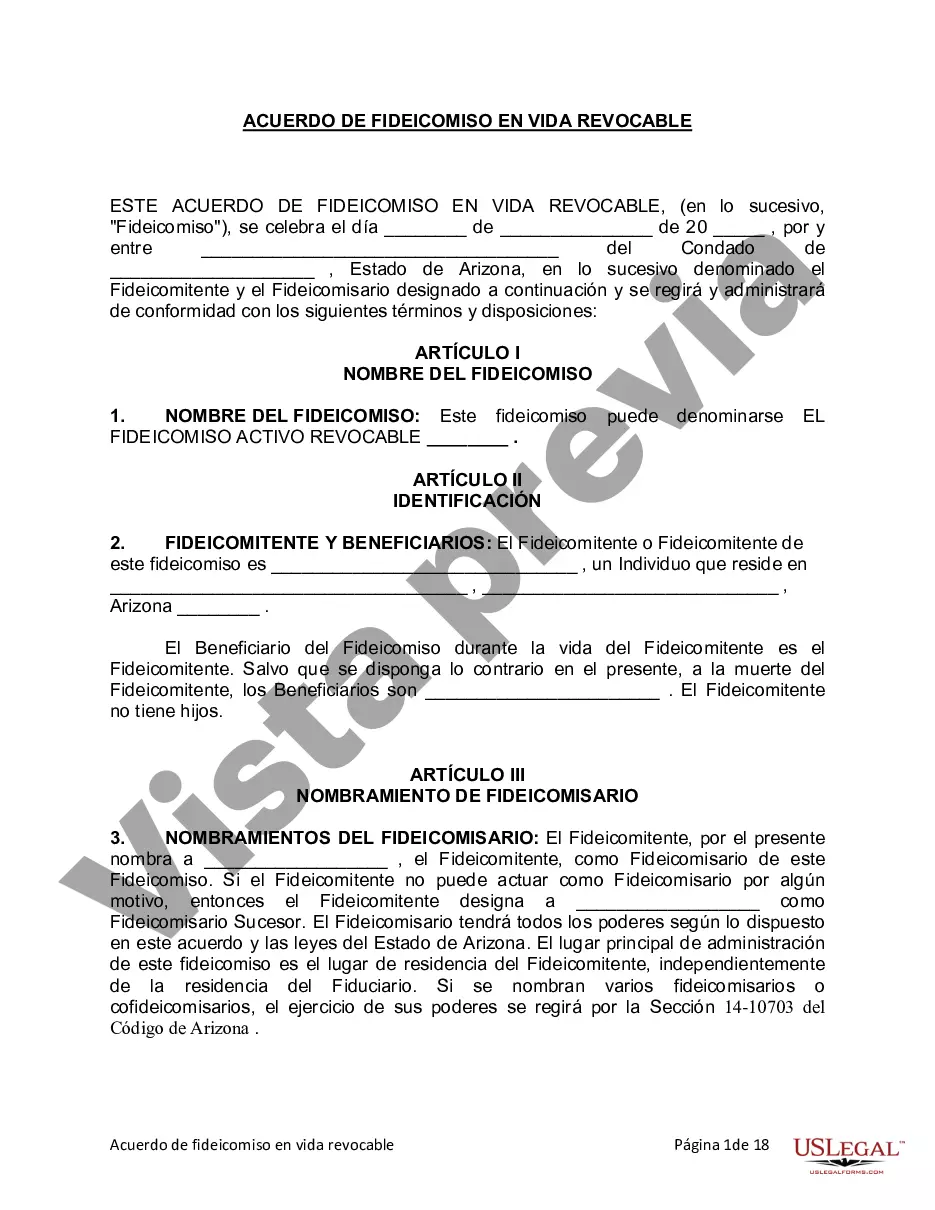

Glendale Arizona Living Trust for Individual as Single, Divorced, or Widow/Widower with No Children: A Comprehensive Guide If you are an individual residing in Glendale, Arizona, and find yourself single, divorced, or widowed with no children, it is crucial to consider the establishment of a living trust to secure and manage your assets. A living trust, also known as a revocable trust, is a legal document that allows you to transfer ownership of your assets into the trust, appoint a trustee to manage and distribute those assets, and determine how they are to be distributed upon your passing or incapacity. This comprehensive guide will shed light on the different types of living trusts available for individuals in such circumstances and provide insights into the key aspects, benefits, and considerations. Types of Glendale Arizona Living Trusts for Individuals as Single, Divorced, or Widow/Widower with No Children: 1. Basic Revocable Living Trust: — A basic revocable living trust serves as the foundation for individuals looking to establish an efficient estate plan. — It enables you, as thgranteror, to maintain complete control over your assets during your lifetime. — You can name yourself as the trustee or appoint a successor trustee to handle affairs in the event of incapacitation. — Upon your passing, the trust assets will transfer seamlessly to your designated beneficiaries without the need for probate. 2. Specialized Living Trust: — A specialized living trust can be customized to cater to the specific needs and circumstances of single, divorced, or widowed individuals in Glendale, Arizona. — It allows you to include provisions that address unique concerns, such as providing for charitable giving, caring for pets, or managing a business. — This type of trust grants you greater flexibility and control over the distribution of your assets according to your wishes. Benefits of Establishing a Glendale Arizona Living Trust: 1. Avoidance of Probate: — Probate is a lengthy and costly legal process that validates and administers the distribution of assets according to a will. — By implementing a living trust, you can bypass probate entirely, ensuring a smoother and more private transfer of assets to your chosen beneficiaries. — This helps to reduce administrative expenses, minimize delays, and maintain confidentiality. 2. Incapacity Planning: — A living trust provides crucial provisions and guidelines for managing your assets in case of incapacitation. — If you become unable to manage your affairs due to illness or injury, your chosen successor trustee can step in smoothly, avoiding the need for a court-appointed guardian or conservator. 3. Flexibility and Control: — As thgranteror of a living trust, you retain control over your assets during your lifetime. — You have the authority to make changes, amendments, or revoke the trust entirely should circumstances change. — This level of control ensures that your assets are managed according to your wishes and provides peace of mind. Considerations for Glendale Arizona Living Trust for Individuals: 1. Seek Professional Advice: — Establishing a living trust involves complex legal and financial matters, making it essential to consult with an experienced estate planning attorney. — Their expertise will help you navigate the process, draft the necessary documents, and ensure compliance with Arizona state laws. 2. Review and Update Regularly: — Life circumstances can change, and it is crucial to review and update your living trust regularly. — This ensures that it accurately reflects your current intentions, accounts for new assets or life events, and accommodates any legal or tax changes. In conclusion, for single, divorced, or widowed individuals in Glendale, Arizona, a living trust provides a comprehensive and flexible solution for estate planning. By establishing a living trust, individuals can avoid probate, plan for potential incapacity, maintain control over their assets, and ensure a smooth transfer of wealth according to their wishes. Seek professional advice to create an appropriate living trust that caters to your unique circumstances and goals, and remember to review and update it periodically to keep it up to date.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Glendale Arizona Fideicomiso en vida para individuos solteros, divorciados o viudos o viudos sin hijos - Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children

Description

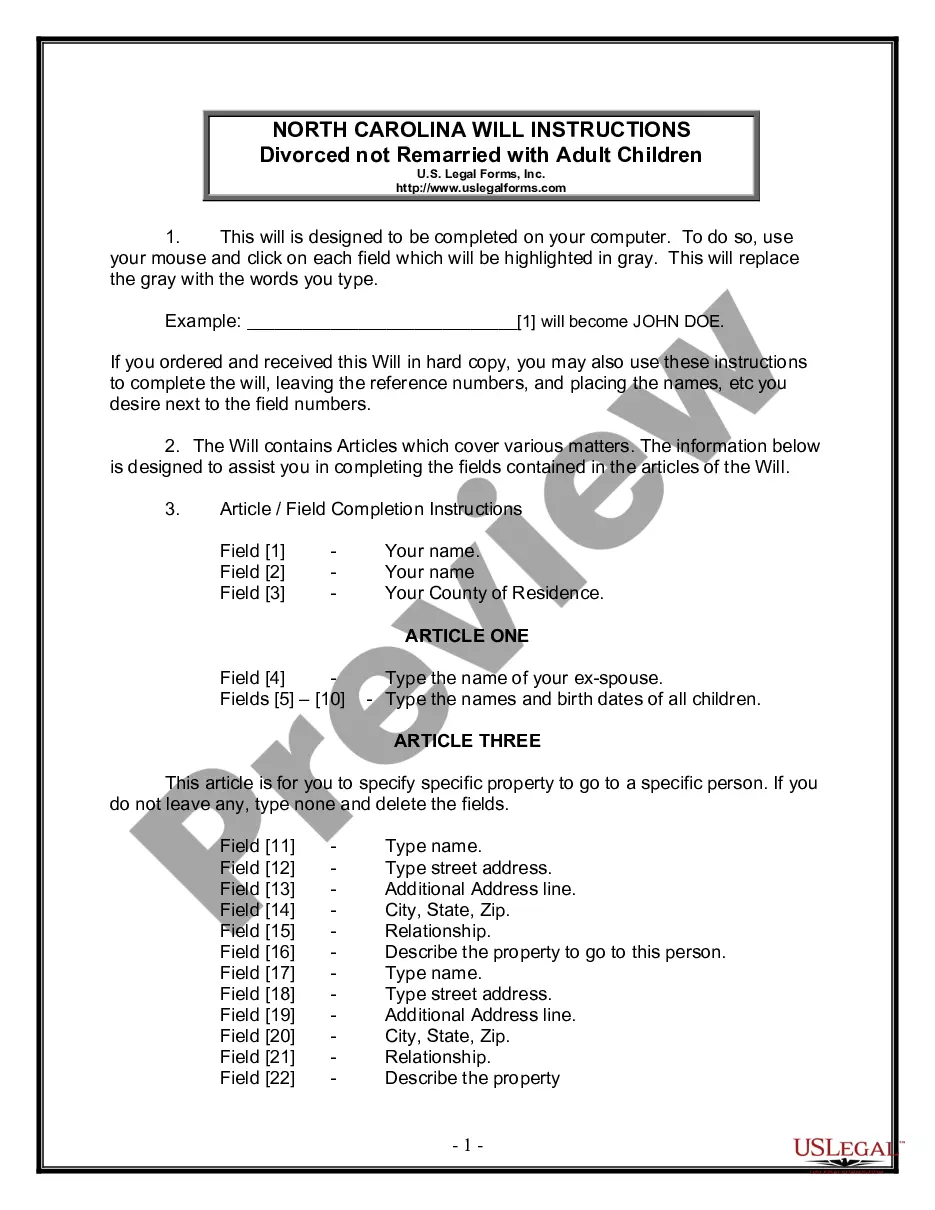

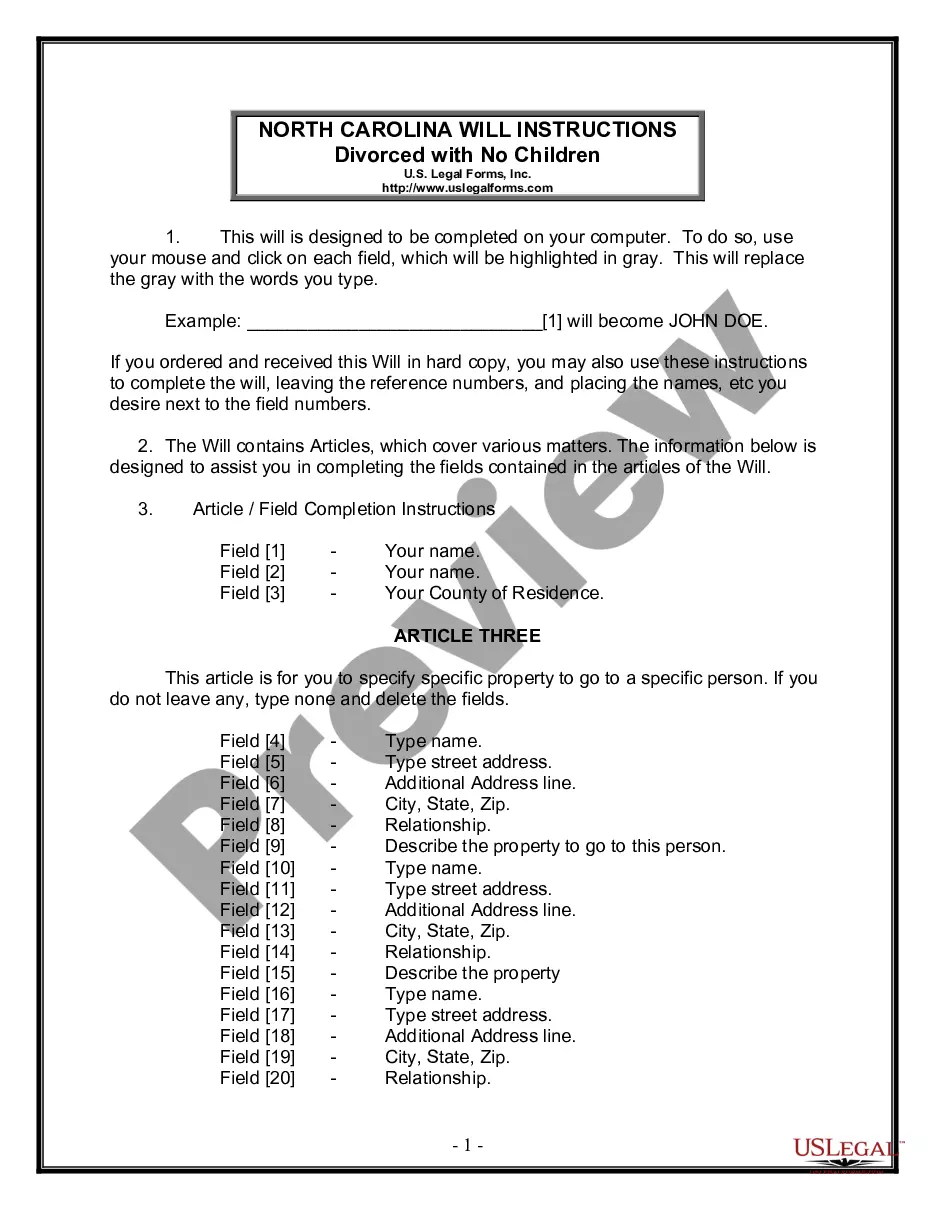

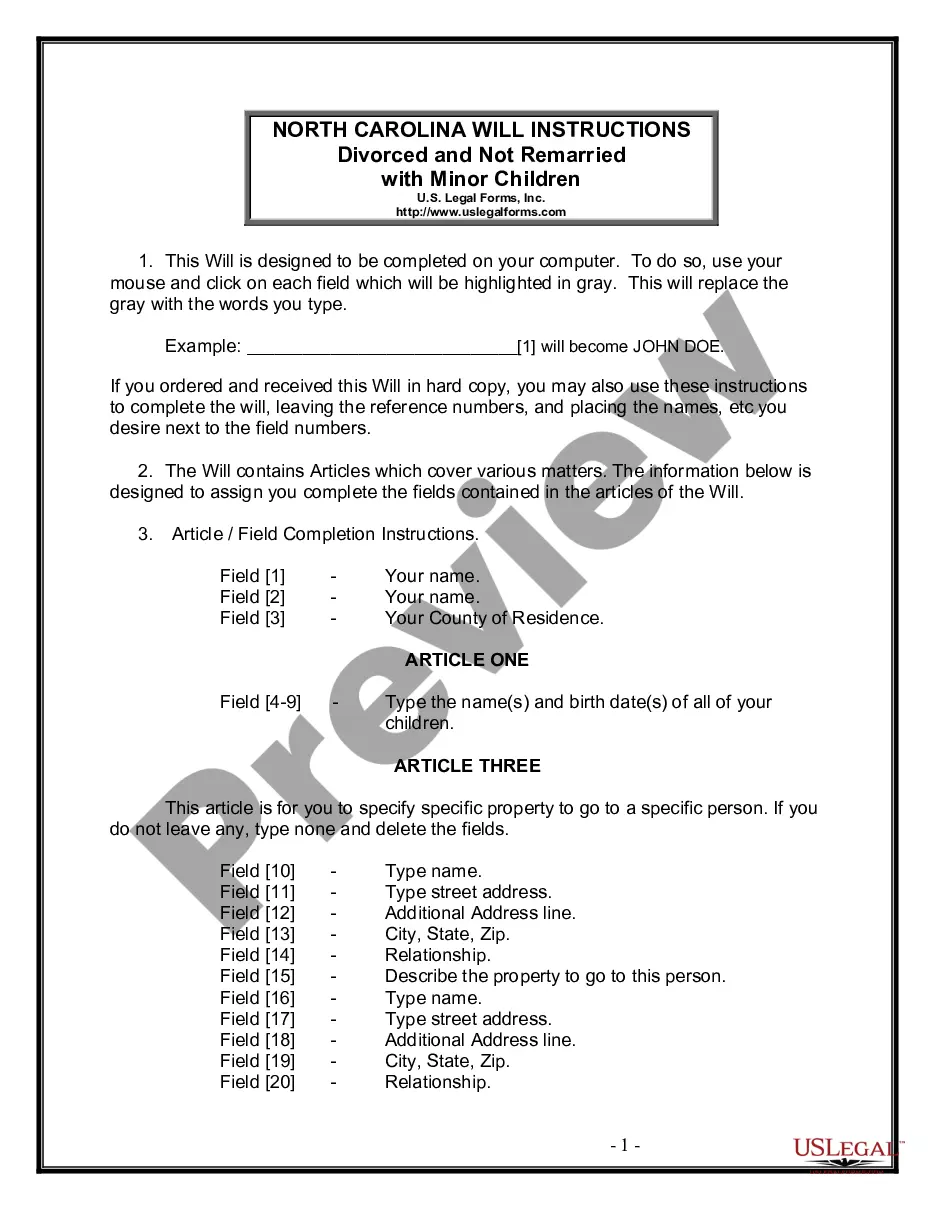

How to fill out Glendale Arizona Fideicomiso En Vida Para Individuos Solteros, Divorciados O Viudos O Viudos Sin Hijos?

If you are looking for a relevant form, it’s difficult to find a more convenient service than the US Legal Forms website – one of the most comprehensive libraries on the internet. Here you can get a huge number of templates for organization and personal purposes by types and states, or key phrases. With our advanced search function, getting the most up-to-date Glendale Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children is as easy as 1-2-3. In addition, the relevance of every document is proved by a team of skilled lawyers that regularly check the templates on our website and revise them based on the newest state and county laws.

If you already know about our system and have an account, all you need to get the Glendale Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children is to log in to your user profile and click the Download button.

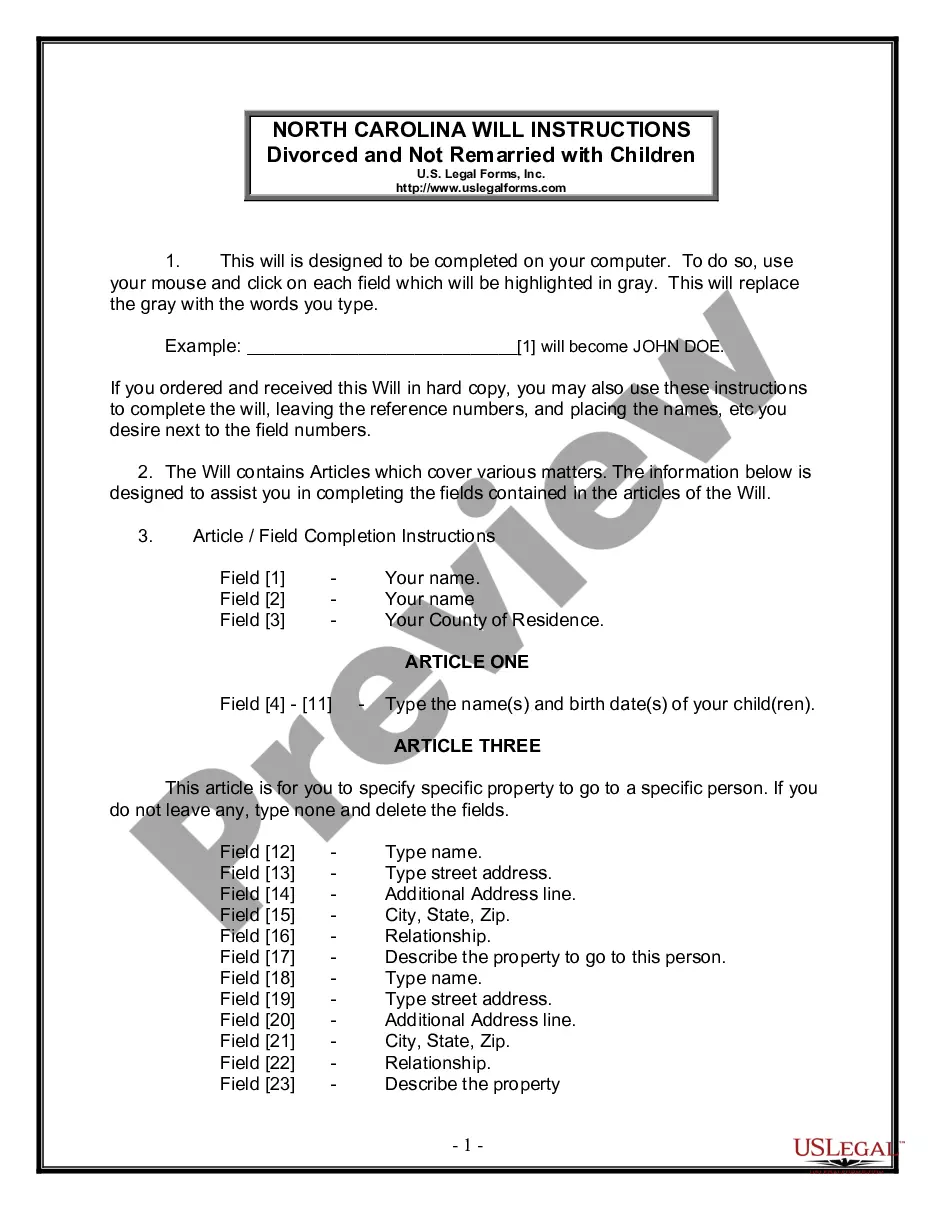

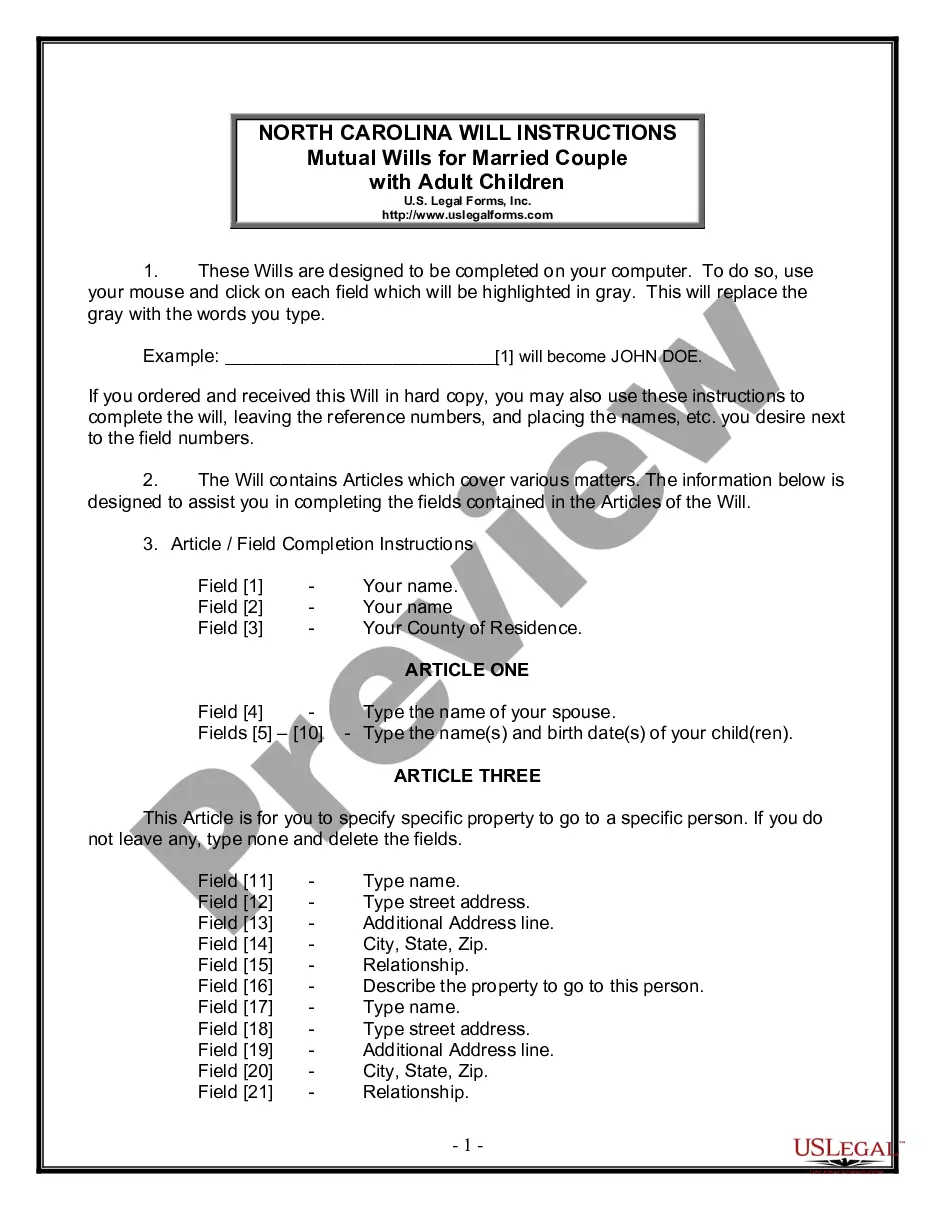

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have chosen the sample you want. Check its description and utilize the Preview feature (if available) to explore its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to discover the needed record.

- Affirm your decision. Click the Buy now button. Next, select your preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Obtain the template. Choose the file format and save it to your system.

- Make adjustments. Fill out, revise, print, and sign the received Glendale Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children.

Every template you add to your user profile has no expiration date and is yours forever. You can easily gain access to them using the My Forms menu, so if you want to have an additional duplicate for modifying or printing, feel free to return and export it again anytime.

Take advantage of the US Legal Forms extensive collection to gain access to the Glendale Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children you were seeking and a huge number of other professional and state-specific templates on a single platform!