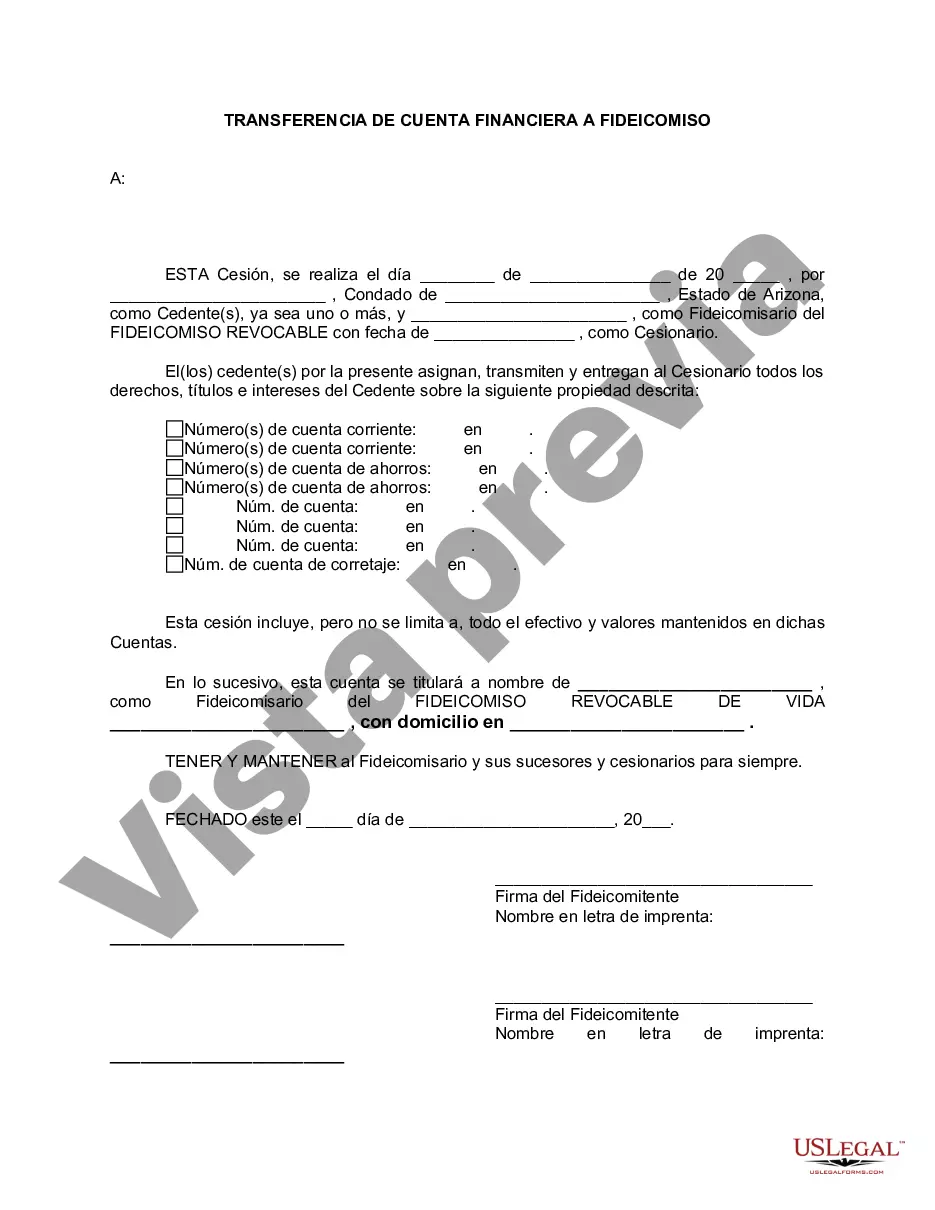

Chandler Arizona Financial Account Transfer to Living Trust In Chandler, Arizona, a Financial Account Transfer to Living Trust refers to the process of transferring ownership of financial assets, such as bank accounts, investment accounts, and retirement accounts, from an individual's name to a revocable living trust. This type of estate planning strategy is often employed to efficiently manage and distribute assets during and after the individual's life. By transferring financial accounts to a living trust, individuals can ensure that their assets are protected and managed according to their wishes, even in the event of incapacity or death. It allows for greater control over the distribution of assets, minimizing the need for probate proceedings and potentially reducing estate taxes. There are different types of Chandler Arizona Financial Account Transfers to Living Trust that individuals can consider based on their unique needs and goals. Some of these types include: 1. Bank Account Transfer to Living Trust: This involves transferring ownership of checking, savings, money market, and other types of bank accounts to the trust. It allows the trustee, often the individual themselves, to manage and distribute these funds according to the trust's instructions. 2. Investment Account Transfer to Living Trust: This includes the transfer of ownership of brokerage accounts, stocks, bonds, mutual funds, and other investment vehicles to the living trust. By placing these assets in the trust, individuals can ensure that their investments are appropriately managed and can be distributed to beneficiaries without the need for probate. 3. Retirement Account Transfer to Living Trust: Individuals can transfer ownership of their Individual Retirement Accounts (IRAs), 401(k)s, or other qualified retirement accounts to a living trust. This allows them to control the distribution of retirement assets to beneficiaries, potentially providing tax advantages and protection from creditors. 4. Real Estate Transfer to Living Trust: While not technically a financial account, transferring real estate holdings to a living trust is a crucial aspect of estate planning. By placing properties under the trust's ownership, individuals can ensure a seamless transfer of real estate assets and minimize the impact of any potential legal challenges. It is important to consult with an experienced estate planning attorney or financial advisor specializing in living trusts to determine the most appropriate type of financial account transfer for one's specific circumstances. These professionals can provide guidance on legal requirements, tax implications, and will ensure that the trust aligns with your unique goals and objectives. Overall, a Chandler Arizona Financial Account Transfer to Living Trust is a prudent strategy for individuals seeking to protect, manage, and efficiently transfer their financial assets in a manner aligned with their intentions, ultimately providing peace of mind for the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chandler Arizona Transferencia de cuenta financiera a fideicomiso en vida - Arizona Financial Account Transfer to Living Trust

Description

How to fill out Chandler Arizona Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Utilize the US Legal Forms and gain instant access to any form template you require.

Our valuable platform with a multitude of templates enables you to discover and procure nearly any document sample you will need.

You can download, fill out, and validate the Chandler Arizona Financial Account Transfer to Living Trust in just a few minutes instead of spending hours online searching for a suitable template.

Using our library is an excellent way to enhance the security of your document submissions.

- Our proficient attorneys frequently examine all the documents to ensure that the templates are applicable for a specific state and comply with recent laws and regulations.

- Each document is carefully vetted for accuracy and compliance.

- Stay assured as you navigate through our extensive collection of legal forms.

Form popularity

FAQ

In Arizona, you do not need to record a living trust itself, but you will need to record certain documents such as deeds for property transferred to the trust. Ensure you follow local requirements and procedures for your Chandler Arizona Financial Account Transfer to Living Trust to maintain legal standing. Consulting a legal professional may help clarify the steps you need to take.

To transfer your bank account to your trust, start by contacting your bank for their specific procedure. This typically involves filling out a transfer request form and providing a copy of your trust document. Following these steps ensures your Chandler Arizona Financial Account Transfer to Living Trust is officially recognized by your bank.

Transferring property to a living trust in Arizona involves preparing a deed that transfers ownership from you to the trust. You must then record this deed with the county recorder's office. This step is critical in completing your Chandler Arizona Financial Account Transfer to Living Trust and securing your assets for future generations.

To transfer your Fidelity account to a trust, begin by contacting Fidelity's customer service for specific guidance. You will need to fill out the appropriate transfer forms and provide documentation for your Chandler Arizona Financial Account Transfer to Living Trust. By following these steps, you can ensure a smooth and efficient transfer.

Yes, you can transfer your brokerage account to a trust. This action is often beneficial for estate planning, as distributing assets in a trust can simplify the process for your beneficiaries. Make sure to follow the steps outlined for a successful Chandler Arizona Financial Account Transfer to Living Trust with your brokerage firm.

To move a brokerage account into a trust, you need to contact your brokerage firm. They will supply the appropriate forms for transferring assets into your Chandler Arizona Financial Account Transfer to Living Trust. Provide the required trust documents, and ensure they are signed correctly to avoid any delays in the process.

Yes, you can transfer ownership of a brokerage account. This process commonly involves completing a transfer form provided by the brokerage firm. When you initiate a Chandler Arizona Financial Account Transfer to Living Trust, ensure you have all necessary documents ready to facilitate a smooth transition.

The average trust fund amount can vary greatly based on individual circumstances and wealth levels. While some trust funds may start with a few thousand dollars, others can hold millions. Ultimately, the size of a trust fund depends on the family’s financial planning and goals. When considering a trust, it is beneficial to understand the concepts of Chandler Arizona Financial Account Transfer to Living Trust, as these can greatly affect fund amounts.

To transfer your checking account to your living trust, first, contact your bank to request the necessary paperwork. Banks usually require a copy of the trust document to confirm its validity. After you complete the paperwork, the bank will update the account records to reflect the Chandler Arizona Financial Account Transfer to Living Trust. This process allows your assets to be managed according to the terms of your trust.

Whether your parents should place their assets in a trust depends on their specific financial situation and goals. Trusts can provide benefits such as avoiding probate and protecting assets from creditors. It is important for them to consider their long-term wishes and consult with a legal professional experienced in the Chandler Arizona Financial Account Transfer to Living Trust. This step can help ensure their decisions align with their overall estate planning.