Surprise Arizona Financial Account Transfer to Living Trust: A Comprehensive Guide The process of transferring financial accounts to a living trust in Surprise, Arizona is a crucial step in estate planning. This detailed description aims to guide you through the various aspects of a financial account transfer, ensuring you understand the significance and types of transfers involved. What is a Living Trust? A living trust is a legal arrangement that holds your assets during your lifetime and ensures their efficient distribution after your demise. By establishing a living trust, you can avoid probate, maintain privacy, and have more control over how your assets are managed and allocated. Why Transfer Financial Accounts to a Living Trust? Transferring your financial accounts to a living trust ensures seamless management and distribution of your assets according to your wishes. By placing your accounts within the trust, they become subject to its terms and conditions, streamlining the overall estate planning process. Types of Surprise Arizona Financial Account Transfer to Living Trust: 1. Bank Accounts: This includes savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs). Transferring these accounts to a living trust offers increased control and flexibility for managing and distributing funds during your lifetime and after. 2. Investment Accounts: These encompass brokerage accounts, stocks, bonds, mutual funds, and other investment instruments. By transferring these accounts to a living trust, you maintain control over investment decisions and provide clear instructions on asset distribution. 3. Retirement Accounts: Retirement accounts such as 401(k)s, IRAs, and pensions can also be transferred to a living trust. However, it's vital to consult a financial advisor to understand any tax implications and evaluate if it aligns with your estate planning goals. 4. Life Insurance Policies and Annuities: While living trusts cannot directly own life insurance policies or annuities, they can be designated as the beneficiary. This ensures that the death proceeds are distributed according to the trust's instructions, avoiding probate and allowing for efficient administration. The Account Transfer Process: 1. Consult an Attorney: Seek professional legal advice from an experienced estate planning attorney in Surprise, Arizona. They will help you understand the implications of transferring your financial accounts to a living trust, ensuring compliance with local laws and regulations. 2. Establish a Living Trust: If you don't already have a living trust, you need to create one. The attorney will guide you through the process, helping define the terms and beneficiaries of the trust. 3. Identify Financial Accounts: Determine the accounts you wish to transfer to the living trust. Collaborate with your financial institutions to understand their specific procedures and requirements for account transfers. 4. Update Account Titles: Working closely with your attorney, change the ownership and beneficiary designations of the identified accounts to reflect the living trust. Provide the necessary documentation to your financial institutions to facilitate the transfer. 5. Ensure Continuity: During the transfer process, it's crucial to ensure uninterrupted access to funds. Coordinate with your bank or financial institution to maintain regular banking activities during and after the transfer. By completing the Surprise Arizona Financial Account Transfer to Living Trust, you can ensure a smooth estate distribution, protect your assets from probate, and gain peace of mind in knowing that your financial affairs are secure and managed as per your wishes. Remember, seeking professional advice tailored to your specific circumstances is essential for a successful financial account transfer.

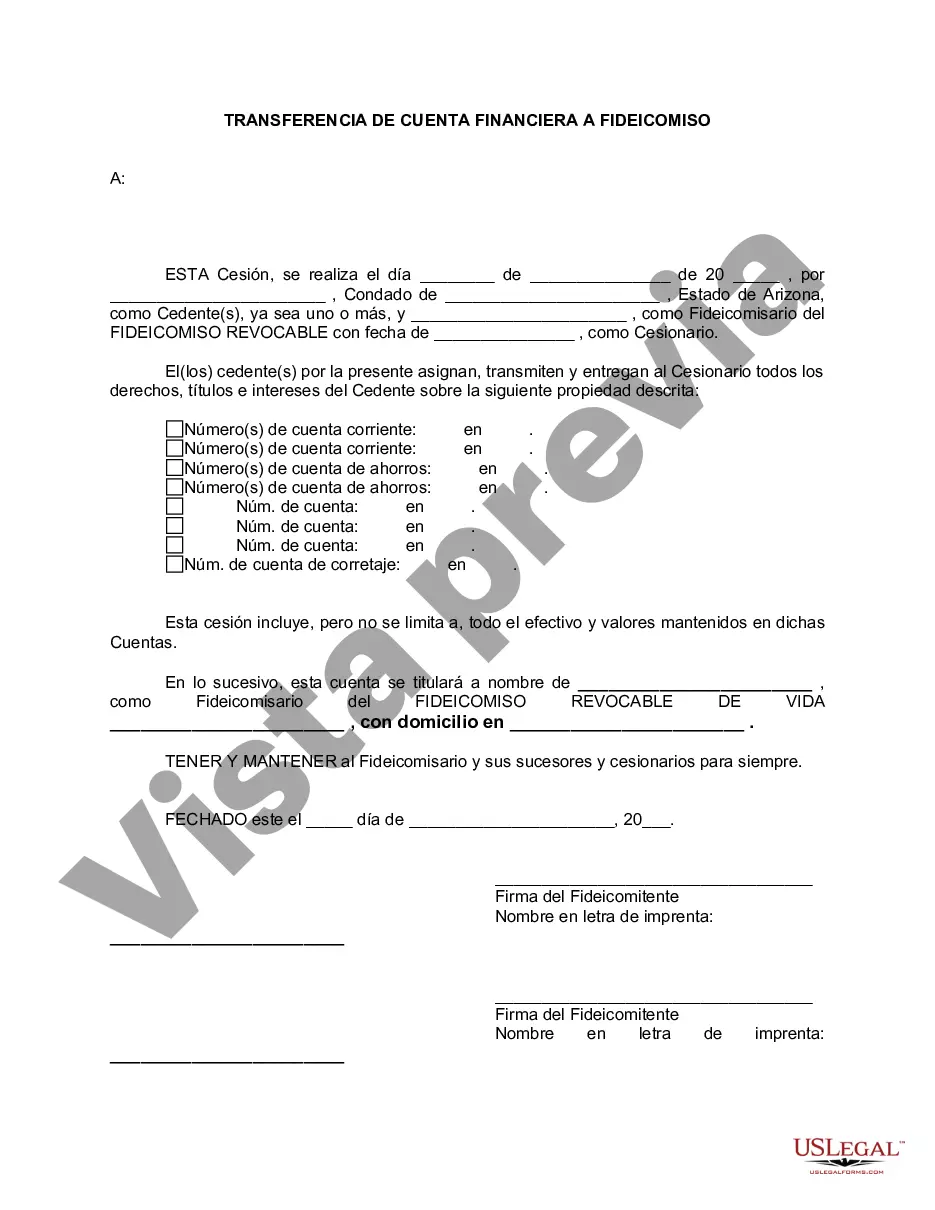

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Surprise Arizona Transferencia de cuenta financiera a fideicomiso en vida - Arizona Financial Account Transfer to Living Trust

Description

How to fill out Surprise Arizona Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you are searching for a relevant form template, it’s extremely hard to find a better platform than the US Legal Forms site – one of the most comprehensive libraries on the internet. With this library, you can find a large number of document samples for company and individual purposes by categories and states, or keywords. Using our high-quality search feature, finding the most recent Surprise Arizona Financial Account Transfer to Living Trust is as elementary as 1-2-3. In addition, the relevance of each and every document is confirmed by a group of professional attorneys that on a regular basis review the templates on our website and revise them in accordance with the latest state and county laws.

If you already know about our platform and have a registered account, all you should do to get the Surprise Arizona Financial Account Transfer to Living Trust is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have found the form you need. Look at its description and use the Preview function (if available) to see its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to find the needed record.

- Confirm your selection. Click the Buy now option. After that, select the preferred subscription plan and provide credentials to sign up for an account.

- Process the purchase. Make use of your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Choose the file format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the obtained Surprise Arizona Financial Account Transfer to Living Trust.

Each and every template you add to your account does not have an expiry date and is yours permanently. You always have the ability to gain access to them using the My Forms menu, so if you need to have an additional duplicate for editing or printing, you may return and download it once again at any moment.

Take advantage of the US Legal Forms extensive collection to get access to the Surprise Arizona Financial Account Transfer to Living Trust you were seeking and a large number of other professional and state-specific samples on one website!