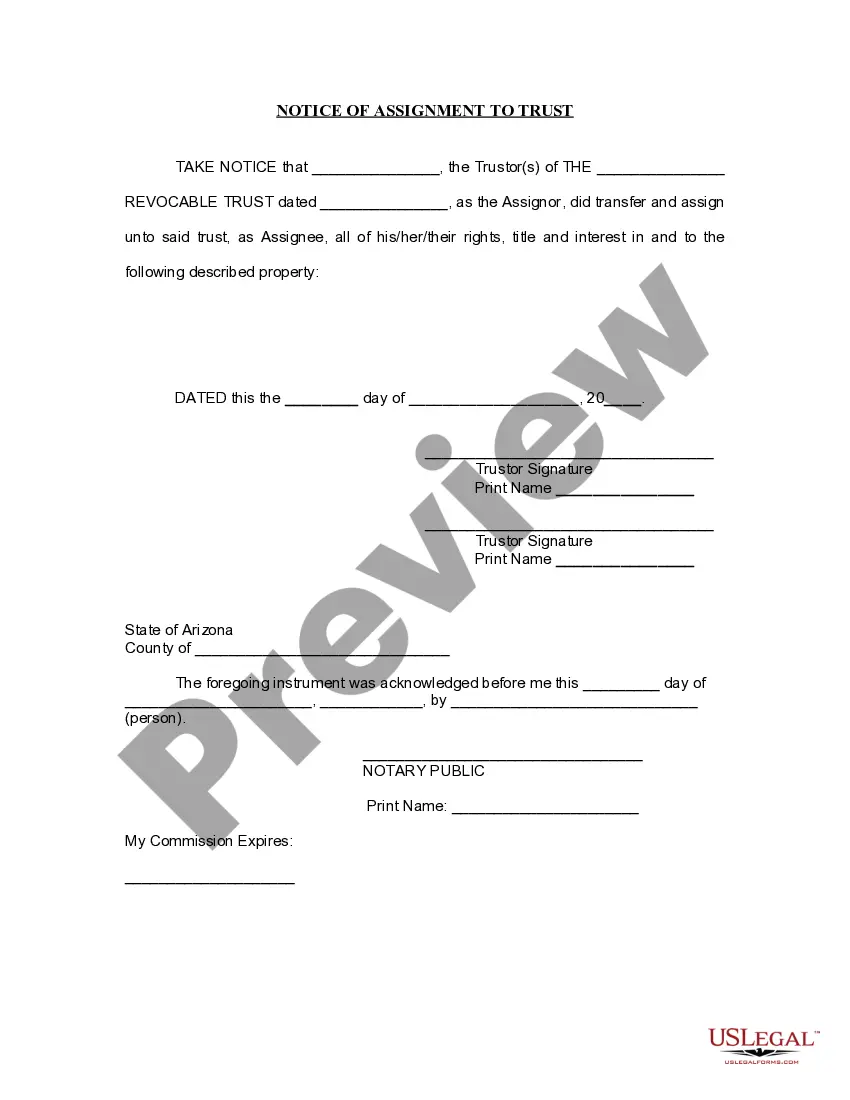

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Phoenix Arizona Notice of Assignment to Living Trust

Description

How to fill out Arizona Notice Of Assignment To Living Trust?

We consistently attempt to lessen or evade legal repercussions when handling intricate legal or financial matters.

To achieve this, we enroll in attorney services that, generally speaking, are exceedingly expensive.

However, not all legal concerns are comparably intricate.

The majority of them can be resolved independently.

Take advantage of US Legal Forms whenever you require to locate and download the Phoenix Arizona Notice of Assignment to Living Trust or any other form effortlessly and securely.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our repository enables you to manage your affairs on your own without the necessity of legal counsel.

- We offer access to legal form templates that are not always easily found in the public domain.

- Our templates are specific to states and regions, significantly simplifying the search process.

Form popularity

FAQ

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

To create a living trust in Arizona you need to create a trust document that lays out all the details of your trust and names the trustee and beneficiaries. You will sign the document in front of a notary. To complete the process, you fund the trust by transferring the ownership of assets to the trust entity.

As such, Arizona trustees must provide every trust beneficiary with notice, if the trust became irrevocable when the trustor died. Also, where there is a Will, the trustee must file it with the Superior Court in the trustor's home county.

Fortunately, Arizona law recognizes the private nature of trusts and helps to protect private information from being exposed to those who do not need it. Under Arizona Revised Statutes (ARS) 14-11013 a trustee of a trust does not have to give a full copy of the trust document to anyone who asks for it.

To create a living trust in Arizona you need to create a trust document that lays out all the details of your trust and names the trustee and beneficiaries. You will sign the document in front of a notary. To complete the process, you fund the trust by transferring the ownership of assets to the trust entity.

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

To create a living trust in Arizona you need to create a trust document that lays out all the details of your trust and names the trustee and beneficiaries. You will sign the document in front of a notary. To complete the process, you fund the trust by transferring the ownership of assets to the trust entity.

The new Arizona Trust Code requires the trustee to provide to the trust's beneficiaries an annual report of trust property, including trust liabilities, receipts, disbursements, a list of trust assets and, if feasible, the fair market value of the trust assets.

Real Estate ? Real estate which is to be transferred into a trust must be conveyed in an Arizona Deed. The document must be signed by all parties in front of a Notary Public and filed with the County Recorder's Office.

In Arizona, the average cost for a living trust is around $1,500. However, this price may vary depending on the location and size of the trust. For example, trusts in major metropolitan areas may be more expensive than those in rural areas. Smaller trusts may also cost less than larger ones.