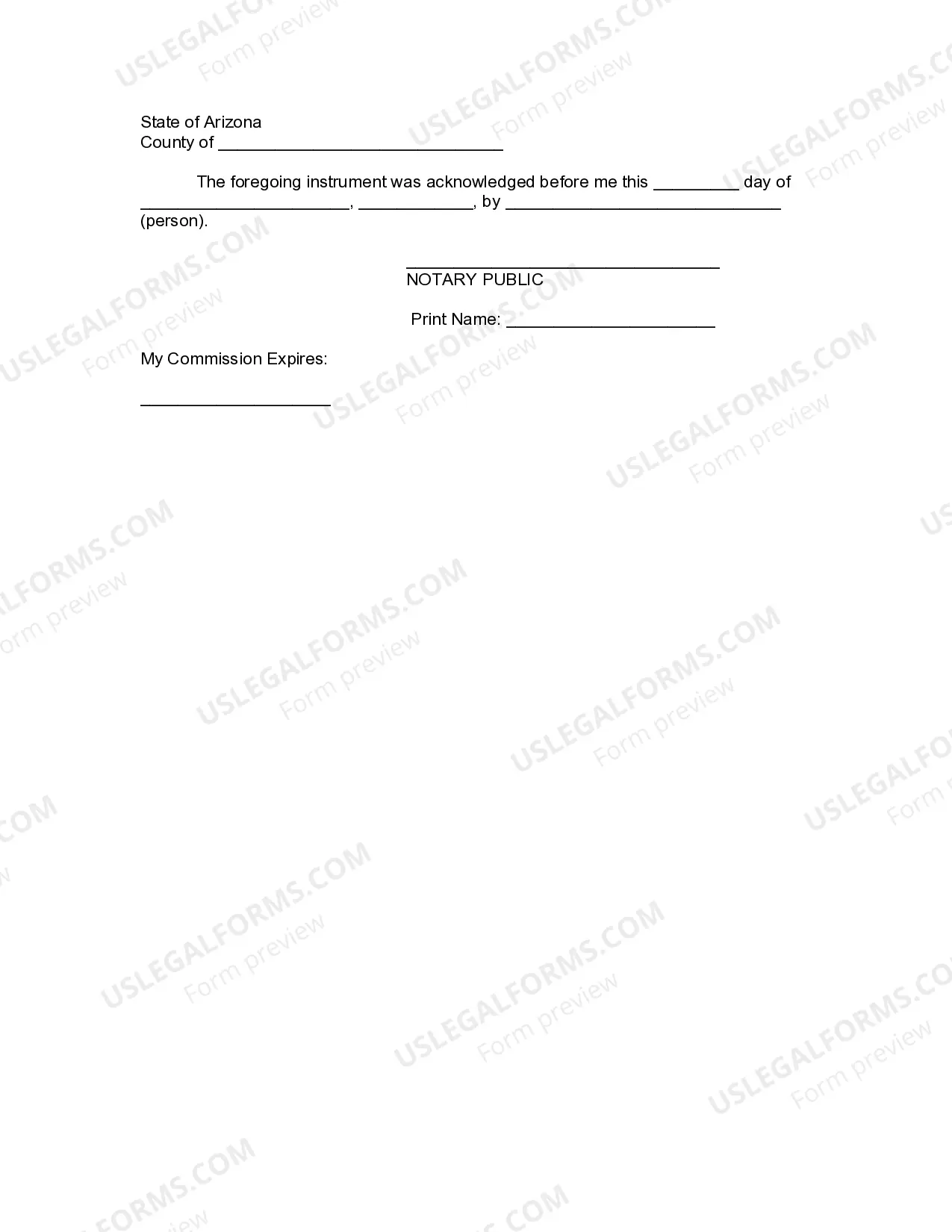

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Phoenix Arizona Revocation of Living Trust

Description

How to fill out Arizona Revocation Of Living Trust?

Utilize the US Legal Forms to gain instant access to any document you require.

Our user-friendly platform featuring thousands of files simplifies how to locate and obtain almost any document template you need.

You can save, complete, and sign the Phoenix Arizona Revocation of Living Trust in just minutes instead of spending hours online searching for the correct template.

Using our collection is an excellent way to enhance the security of your document submissions.

If you haven’t created an account yet, follow the steps below.

Locate the form you need. Ensure that it is the template you are seeking: verify its title and description, and use the Preview option when accessible. Otherwise, utilize the Search field to find the suitable one.

- Our expert attorneys consistently evaluate all the paperwork to ensure that the forms are suitable for a specific jurisdiction and comply with current laws and regulations.

- How can you obtain the Phoenix Arizona Revocation of Living Trust? If you possess a subscription, simply Log In to your account. The Download option will be available for all documents you view.

- Additionally, you can access all your previously saved documents in the My documents section.

Form popularity

FAQ

Once you've decided that you want to revoke a trust, you must take the following steps to dissolve it: Review the Trust Agreement. You will want to make sure that you are aware of any specific requirements contained in the trust.Consult an Estate Planning Attorney.Defund the Trust.Complete a Written Revocation.

In Arizona, you typically have two years to challenge a will. If you do not come forward within this time period, you may lose the right to do so. There are some exceptions, however, so we recommend talking to an attorney about your situation.

How a trust can be dissolved will depend on the trust in question. Some trusts will be terminated by the occurrence of a particular event (for example, on the death of a beneficiary or when they come of age) whereas others will be terminated by the actions of the trustees or beneficiaries.

It might be possible to terminate or modify an irrevocable trust if the settlor and all involved beneficiaries consent to it. When a trust is terminated, all of its assets are extinguished. Common disputes involving revocable trusts include: The trust's validity and ability to meet state requirements.

(a) A noncharitable irrevocable trust may be terminated upon consent of all of the beneficiaries if the court concludes that continuance of the trust is not necessary to achieve any material purpose of the trust.

An irrevocable trust cannot be revoked or changed. But the difference goes far beyond that fact. Revocable trusts and irrevocable trusts serve very different purposes in estate planning.

You can completely undo the trust if you decide the arrangement isn't working for you after all. But all a revocable trust can do for you is avoid probate of the property it holds when you die. You can name a successor trustee to take over management of the trust for you if you should become incompetent.

The trust is fully valid. It only comes to an end when the settlor fully revokes it.

Trust agreements usually allow the trustor to remove a trustee, including a successor trustee. This may be done at any time, without the trustee giving reason for the removal. To do so, the trustor executes an amendment to the trust agreement.