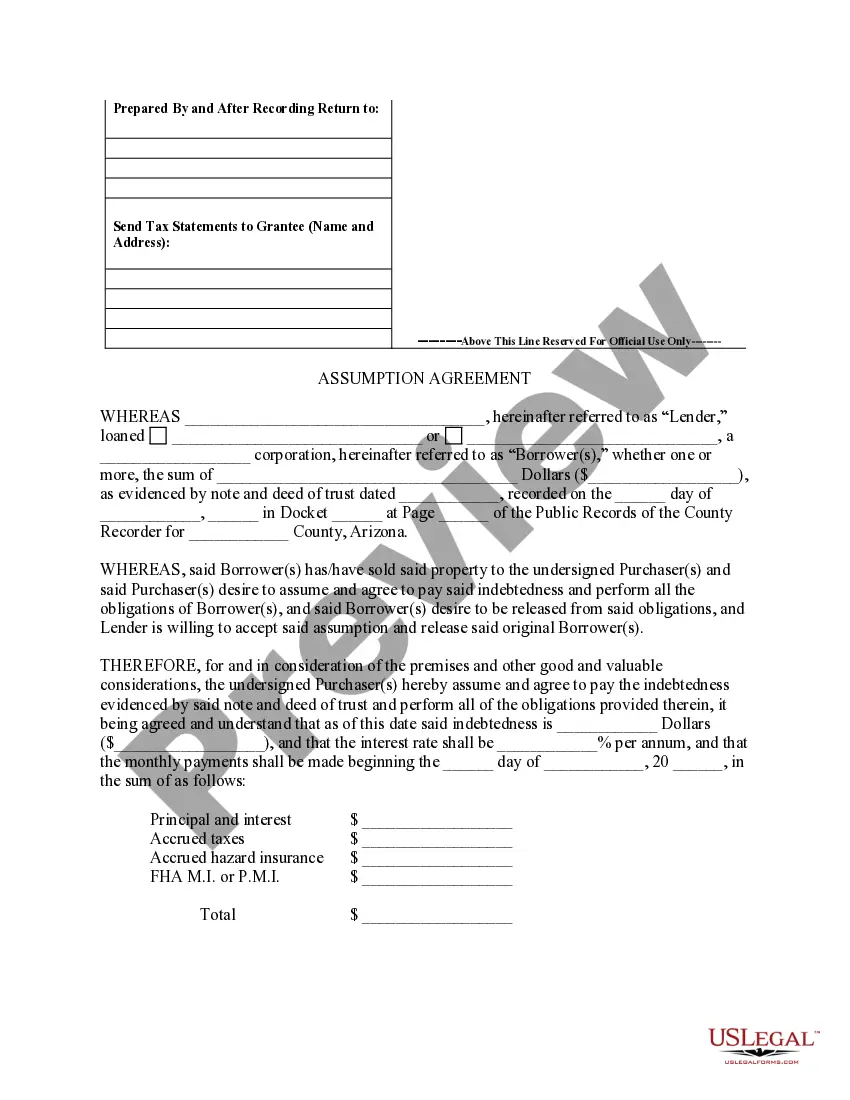

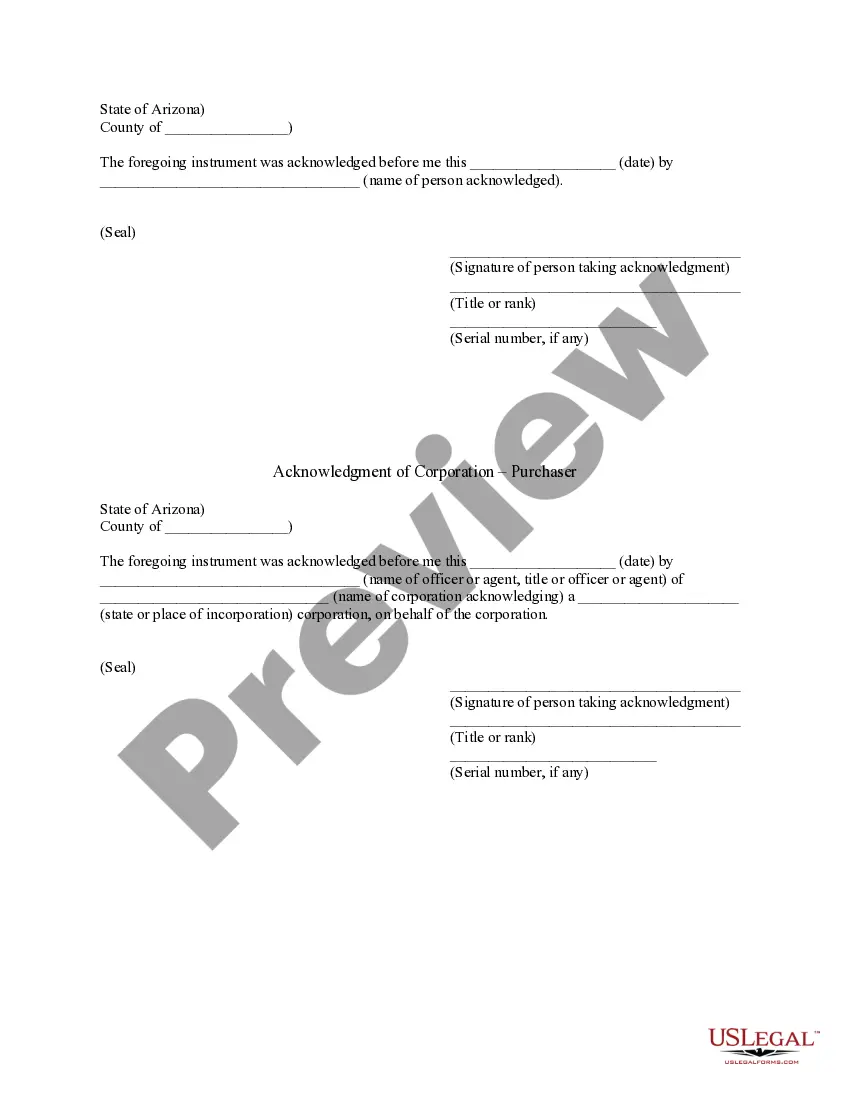

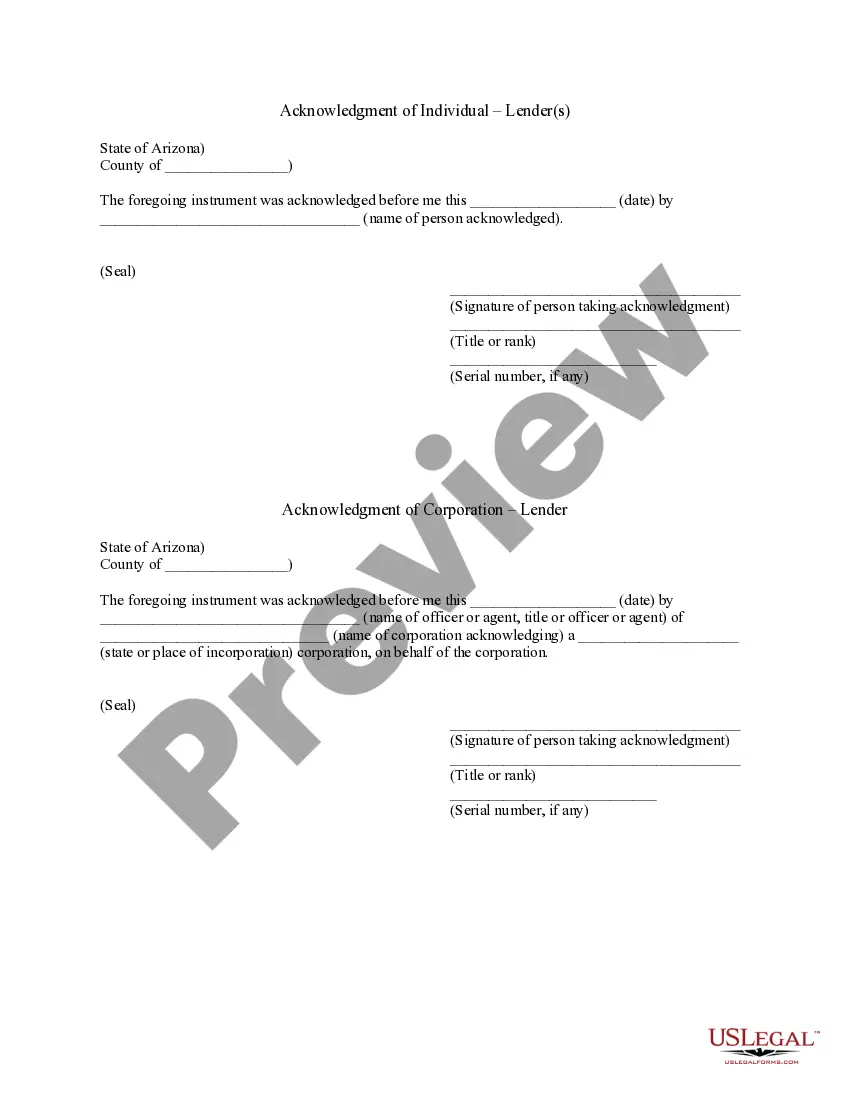

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Scottsdale Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that plays a crucial role in the transfer of property ownership in Scottsdale, Arizona. It is important to understand the various types of Scottsdale Arizona Assumption Agreements of Deed of Trust and Release of Original Mortgagors to comprehend their specific functions. One type of Scottsdale Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors is the Residential Assumption Agreement. This agreement pertains to residential properties, such as single-family homes, townhouses, or condominiums. It allows a new buyer to assume the existing mortgage loan of the property from the original mortgagor. By signing this agreement, the new buyer agrees to take over the legal obligations and responsibilities of the original mortgagor, including making timely mortgage payments, maintaining insurance coverage, and paying property taxes. Another type of Scottsdale Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors is the Commercial Assumption Agreement. This agreement applies to commercial real estate properties, such as office buildings, retail spaces, or industrial facilities. Similar to the Residential Assumption Agreement, the Commercial Assumption Agreement enables a new buyer to assume an existing mortgage loan from the original mortgagor. It outlines the terms and conditions under which the new buyer will take over the commercial property's mortgage obligations. The Assumption Agreement of Deed of Trust in Scottsdale Arizona is designed to protect the interests of both parties involved in the property transfer. It clarifies the rights, obligations, and liabilities of the original mortgagor, the new buyer, and the lender. The agreement outlines the terms of the assumption, including the loan amount, interest rate, loan duration, and any special provisions or conditions. It is essential for both parties to carefully review and understand the agreement before signing it. Moreover, the Release of Original Mortgagors is a crucial component of the Scottsdale Arizona Assumption Agreement. This document absolves the original mortgagors from any further liability or responsibility for the mortgage loan after the assumption is complete. It legally releases them from their obligations, ensuring that they are no longer liable for the repayment of the loan or any potential foreclosure actions. In summary, the various types of Scottsdale Arizona Assumption Agreements of Deed of Trust and Release of Original Mortgagors play a pivotal role in the transfer of property ownership. Whether it's a Residential Assumption Agreement or a Commercial Assumption Agreement, these legal documents solidify the terms and conditions of assuming an existing mortgage loan. Understanding the specifics of each agreement is crucial for all parties involved to ensure a smooth property transfer process.The Scottsdale Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that plays a crucial role in the transfer of property ownership in Scottsdale, Arizona. It is important to understand the various types of Scottsdale Arizona Assumption Agreements of Deed of Trust and Release of Original Mortgagors to comprehend their specific functions. One type of Scottsdale Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors is the Residential Assumption Agreement. This agreement pertains to residential properties, such as single-family homes, townhouses, or condominiums. It allows a new buyer to assume the existing mortgage loan of the property from the original mortgagor. By signing this agreement, the new buyer agrees to take over the legal obligations and responsibilities of the original mortgagor, including making timely mortgage payments, maintaining insurance coverage, and paying property taxes. Another type of Scottsdale Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors is the Commercial Assumption Agreement. This agreement applies to commercial real estate properties, such as office buildings, retail spaces, or industrial facilities. Similar to the Residential Assumption Agreement, the Commercial Assumption Agreement enables a new buyer to assume an existing mortgage loan from the original mortgagor. It outlines the terms and conditions under which the new buyer will take over the commercial property's mortgage obligations. The Assumption Agreement of Deed of Trust in Scottsdale Arizona is designed to protect the interests of both parties involved in the property transfer. It clarifies the rights, obligations, and liabilities of the original mortgagor, the new buyer, and the lender. The agreement outlines the terms of the assumption, including the loan amount, interest rate, loan duration, and any special provisions or conditions. It is essential for both parties to carefully review and understand the agreement before signing it. Moreover, the Release of Original Mortgagors is a crucial component of the Scottsdale Arizona Assumption Agreement. This document absolves the original mortgagors from any further liability or responsibility for the mortgage loan after the assumption is complete. It legally releases them from their obligations, ensuring that they are no longer liable for the repayment of the loan or any potential foreclosure actions. In summary, the various types of Scottsdale Arizona Assumption Agreements of Deed of Trust and Release of Original Mortgagors play a pivotal role in the transfer of property ownership. Whether it's a Residential Assumption Agreement or a Commercial Assumption Agreement, these legal documents solidify the terms and conditions of assuming an existing mortgage loan. Understanding the specifics of each agreement is crucial for all parties involved to ensure a smooth property transfer process.