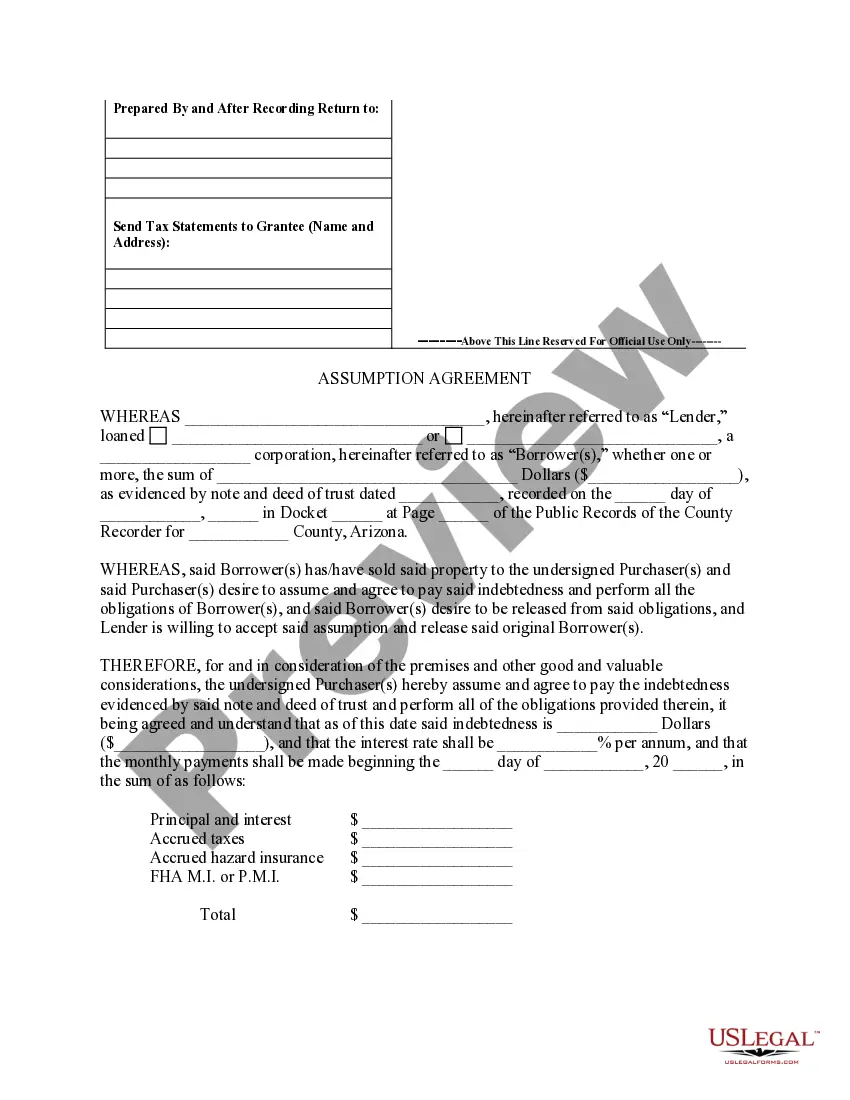

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Surprise Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that transfers the responsibility of a mortgage from the original borrowers (mortgagors) to a new borrower (assuming party). This agreement is commonly used in real estate transactions when the new buyer or borrower agrees to take over the mortgage obligations of the property. By signing this agreement, the assuming party assumes the liability for repayment of the mortgage, while the original mortgagors are released from any further obligations. This type of agreement is essential when a property is sold, and the new buyer wishes to assume the existing mortgage rather than applying for a new loan. The Surprise Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors includes specific details such as the property address, original mortgage terms, outstanding loan balance, and any modifications made to the original loan. It is crucial for all parties involved to carefully review and understand the terms and conditions stated in this agreement. Different types of Surprise Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors may include variations depending on the specific circumstances of the property and the agreement between the parties involved. Some examples of these variations may include: 1. Full Assumption: In this type of assumption agreement, the assuming party agrees to take over the entire mortgage debt, including the outstanding principal balance, interest, and any other applicable fees. 2. Partial Assumption: With a partial assumption, the new borrower takes on a portion of the mortgage debt while the original mortgagors remain responsible for the remaining balance. This could be a suitable option when part of the property is being sold or transferred to a new owner. 3. Assumption with Release: In some cases, the original mortgagors may seek to be released from all obligations related to the mortgage, even if the new borrower is assuming the debt. This type of agreement ensures the original mortgagors are no longer liable for any defaults or non-payment by the assuming party. It is important to consult with a qualified real estate attorney or mortgage professional to ensure that the Surprise Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors accurately reflects the intentions and requirements of all parties involved. The language and specific clauses of the agreement may vary, depending on the state laws, individual circumstances, and lender requirements.The Surprise Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that transfers the responsibility of a mortgage from the original borrowers (mortgagors) to a new borrower (assuming party). This agreement is commonly used in real estate transactions when the new buyer or borrower agrees to take over the mortgage obligations of the property. By signing this agreement, the assuming party assumes the liability for repayment of the mortgage, while the original mortgagors are released from any further obligations. This type of agreement is essential when a property is sold, and the new buyer wishes to assume the existing mortgage rather than applying for a new loan. The Surprise Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors includes specific details such as the property address, original mortgage terms, outstanding loan balance, and any modifications made to the original loan. It is crucial for all parties involved to carefully review and understand the terms and conditions stated in this agreement. Different types of Surprise Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors may include variations depending on the specific circumstances of the property and the agreement between the parties involved. Some examples of these variations may include: 1. Full Assumption: In this type of assumption agreement, the assuming party agrees to take over the entire mortgage debt, including the outstanding principal balance, interest, and any other applicable fees. 2. Partial Assumption: With a partial assumption, the new borrower takes on a portion of the mortgage debt while the original mortgagors remain responsible for the remaining balance. This could be a suitable option when part of the property is being sold or transferred to a new owner. 3. Assumption with Release: In some cases, the original mortgagors may seek to be released from all obligations related to the mortgage, even if the new borrower is assuming the debt. This type of agreement ensures the original mortgagors are no longer liable for any defaults or non-payment by the assuming party. It is important to consult with a qualified real estate attorney or mortgage professional to ensure that the Surprise Arizona Assumption Agreement of Deed of Trust and Release of Original Mortgagors accurately reflects the intentions and requirements of all parties involved. The language and specific clauses of the agreement may vary, depending on the state laws, individual circumstances, and lender requirements.