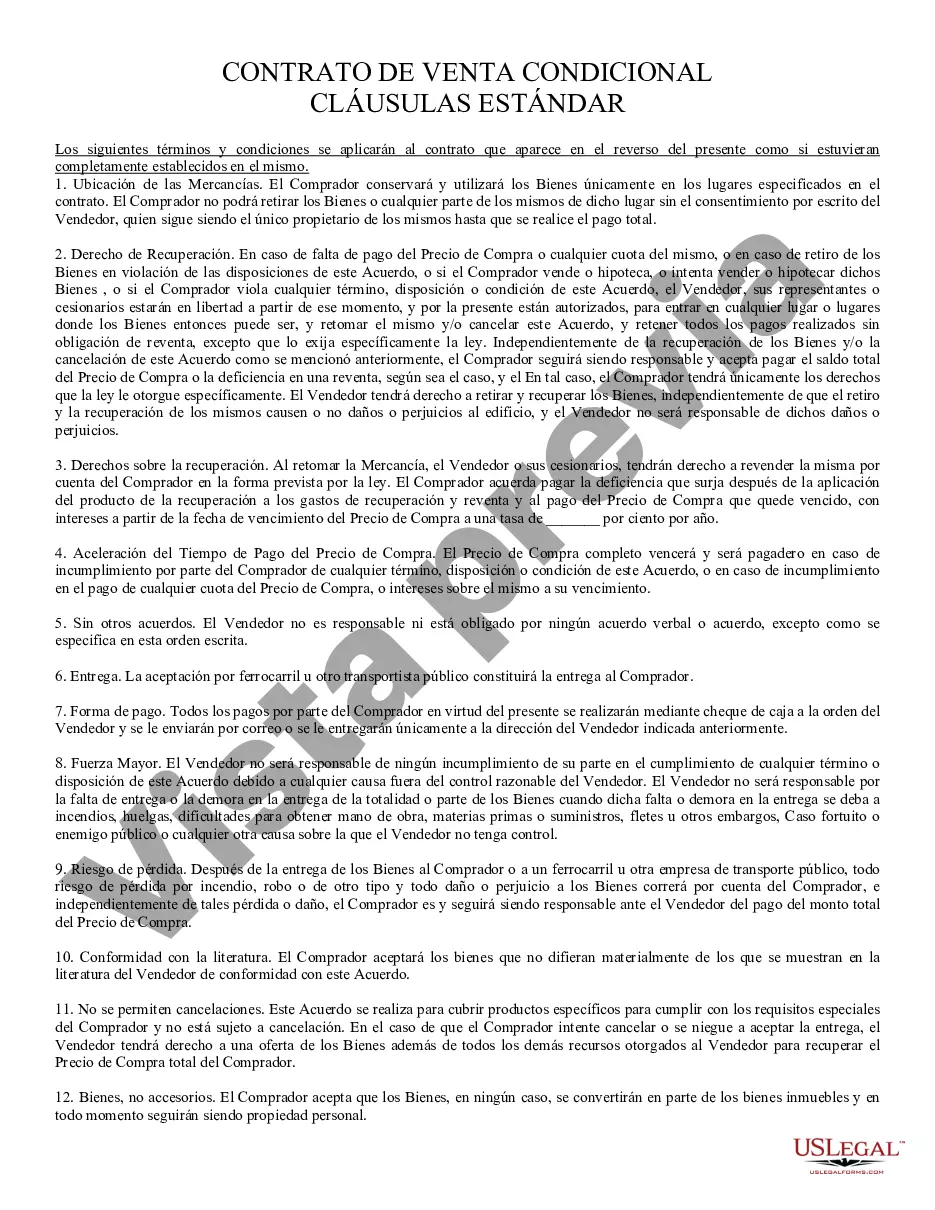

Conditional Sales Contract: A Condiitonal Sales Contract states that the Buyer or Seller can be relived of his/her duites concerning the contract, if the specified conditions are not met. Both the Buyer and Seller must sign for the document to be enforceable. This form is available in both Word and Rich Text formats.

A conditional sales contract in Phoenix, Arizona is a legally binding agreement between a buyer and seller for the purchase of a specific item or property. This type of contract is typically used when the buyer does not have the full amount of money upfront to make the purchase. In a conditional sales contract, the buyer agrees to make periodic payments to the seller over a specified period of time until the full purchase price is paid. The seller retains ownership of the item until the buyer has completed all payments, at which point ownership is transferred to the buyer. This type of contract often includes a provision that allows the seller to repossess the item if the buyer fails to make the required payments. The buyer may have the option to voluntarily surrender the item in the case of financial difficulties, but in most cases, repossession may occur without warning. Different types of conditional sales contracts in Phoenix, Arizona may include: 1. Vehicle Conditional Sales Contract: This type of contract is commonly used when purchasing a vehicle. It outlines the agreed-upon purchase price, the payment schedule, and other terms and conditions related to the sale of the vehicle. 2. Real Estate Conditional Sales Contract: This type of contract is used when buying a property, such as a house or land. It includes details about the agreed-upon purchase price, the down payment, and the payment schedule for the remaining balance. Additionally, it may outline any conditions related to the property, such as repairs or inspections. 3. Electronics and Appliances Conditional Sales Contract: This type of contract is commonly used when purchasing high-value electronics or appliances. It specifies the terms of the sale, including the purchase price, payment schedule, and any warranty or service agreements. It is important to carefully read and understand the terms of a conditional sales contract before signing it. Additionally, seeking legal counsel or advice is highly recommended ensuring that your rights and obligations are protected throughout the duration of the contract.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.