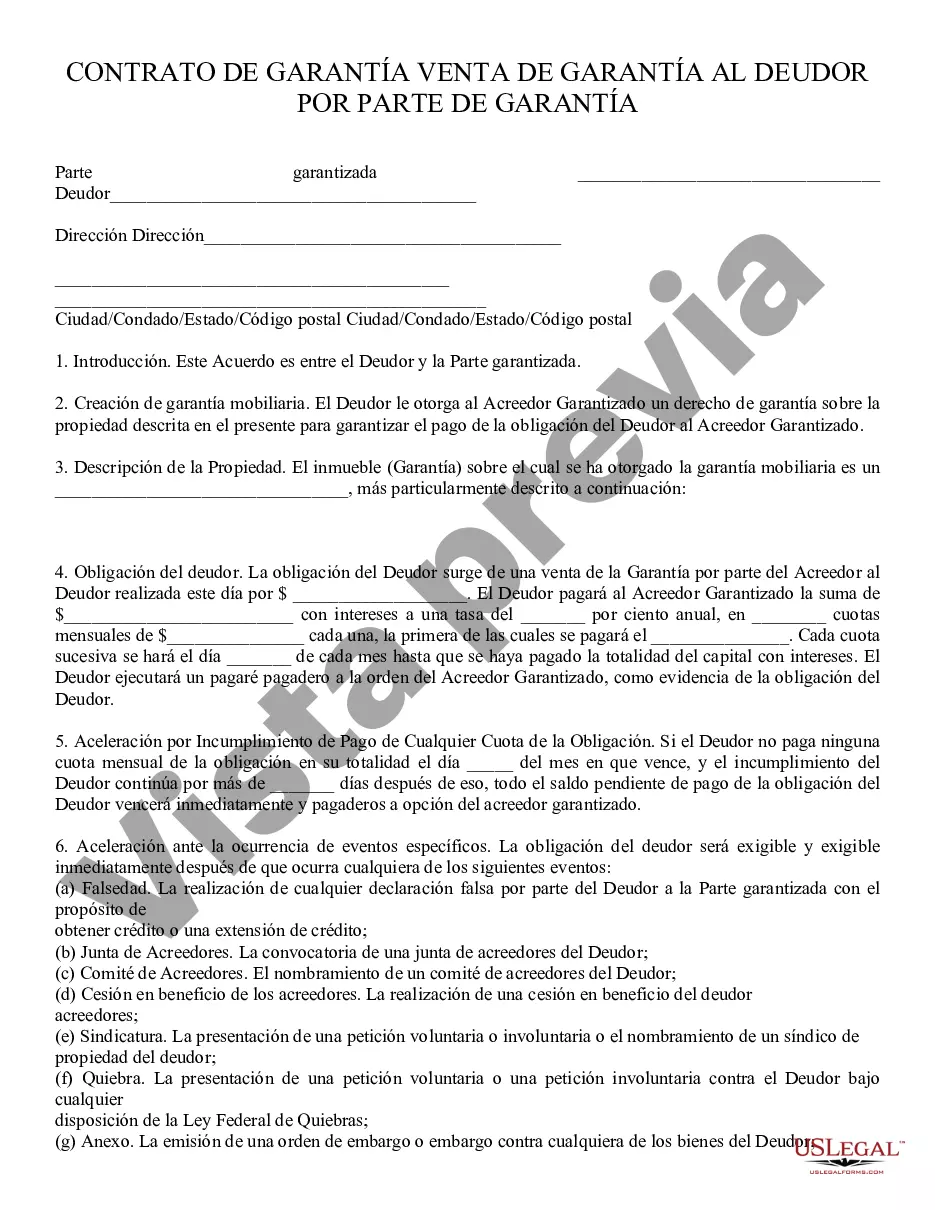

Security Agreement: This is an Agreement between a Debtor and Secured Party. The Debtor uses as collateral some type of property, and then agrees to pay the Secured Party monthly until his/her debt to them is satisfied. If the Debtor does not satisfy the debt, the property used as collateral, becomes the property of the Secured Party. This form is available in both Word and Rich Text formats.

The Phoenix Arizona Security Agreement is a legally binding contract that outlines the terms and conditions between a debtor and a creditor regarding the use of collateral to secure a loan or credit transaction in the state of Arizona. This agreement is crucial in protecting the rights and interests of both parties involved in the transaction. The main purpose of the Phoenix Arizona Security Agreement is to establish a security interest in personal property, such as real estate, vehicles, stocks, or inventory, to ensure repayment of the debt if the debtor fails to fulfill their obligations. Key keywords associated with the Phoenix Arizona Security Agreement include collateral, loan, creditor, debtor, security interest, personal property, repayment, and obligation. There are various types of Phoenix Arizona Security Agreements that may be applicable depending on the specific circumstances of the transaction. These types may include: 1. Real Estate Security Agreement: This agreement secures a loan using real property, such as land, houses, or buildings, as collateral. It ensures that the creditor has a legal claim on the property if the debtor defaults on the loan. 2. Chattel Security Agreement: This agreement secures a loan using movable personal property, such as vehicles, machinery, or equipment, as collateral. It grants the creditor a right to possess and sell the collateral if the debtor fails to repay the debt. 3. Stock Security Agreement: This agreement secures a loan using shares of stock or other ownership interests in a corporation. It allows the creditor to take ownership or sell the stock if the debtor defaults on the loan. 4. Accounts Receivable Security Agreement: This agreement secures a loan using the debtor's accounts receivable as collateral. It grants the creditor the right to collect the outstanding invoices or payments if the debtor fails to meet their repayment obligations. 5. General Security Agreement: This agreement is a broader form of security agreement that covers a wide range of personal property owned by the debtor. It provides the creditor with a security interest in all the debtor's assets, both present, and future. It is important for both parties to carefully review and understand the terms of the Phoenix Arizona Security Agreement before entering into any transaction to ensure the protection of their respective rights and interests. Furthermore, it is also recommended seeking legal advice to ensure compliance with the applicable laws and regulations in Arizona.The Phoenix Arizona Security Agreement is a legally binding contract that outlines the terms and conditions between a debtor and a creditor regarding the use of collateral to secure a loan or credit transaction in the state of Arizona. This agreement is crucial in protecting the rights and interests of both parties involved in the transaction. The main purpose of the Phoenix Arizona Security Agreement is to establish a security interest in personal property, such as real estate, vehicles, stocks, or inventory, to ensure repayment of the debt if the debtor fails to fulfill their obligations. Key keywords associated with the Phoenix Arizona Security Agreement include collateral, loan, creditor, debtor, security interest, personal property, repayment, and obligation. There are various types of Phoenix Arizona Security Agreements that may be applicable depending on the specific circumstances of the transaction. These types may include: 1. Real Estate Security Agreement: This agreement secures a loan using real property, such as land, houses, or buildings, as collateral. It ensures that the creditor has a legal claim on the property if the debtor defaults on the loan. 2. Chattel Security Agreement: This agreement secures a loan using movable personal property, such as vehicles, machinery, or equipment, as collateral. It grants the creditor a right to possess and sell the collateral if the debtor fails to repay the debt. 3. Stock Security Agreement: This agreement secures a loan using shares of stock or other ownership interests in a corporation. It allows the creditor to take ownership or sell the stock if the debtor defaults on the loan. 4. Accounts Receivable Security Agreement: This agreement secures a loan using the debtor's accounts receivable as collateral. It grants the creditor the right to collect the outstanding invoices or payments if the debtor fails to meet their repayment obligations. 5. General Security Agreement: This agreement is a broader form of security agreement that covers a wide range of personal property owned by the debtor. It provides the creditor with a security interest in all the debtor's assets, both present, and future. It is important for both parties to carefully review and understand the terms of the Phoenix Arizona Security Agreement before entering into any transaction to ensure the protection of their respective rights and interests. Furthermore, it is also recommended seeking legal advice to ensure compliance with the applicable laws and regulations in Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.