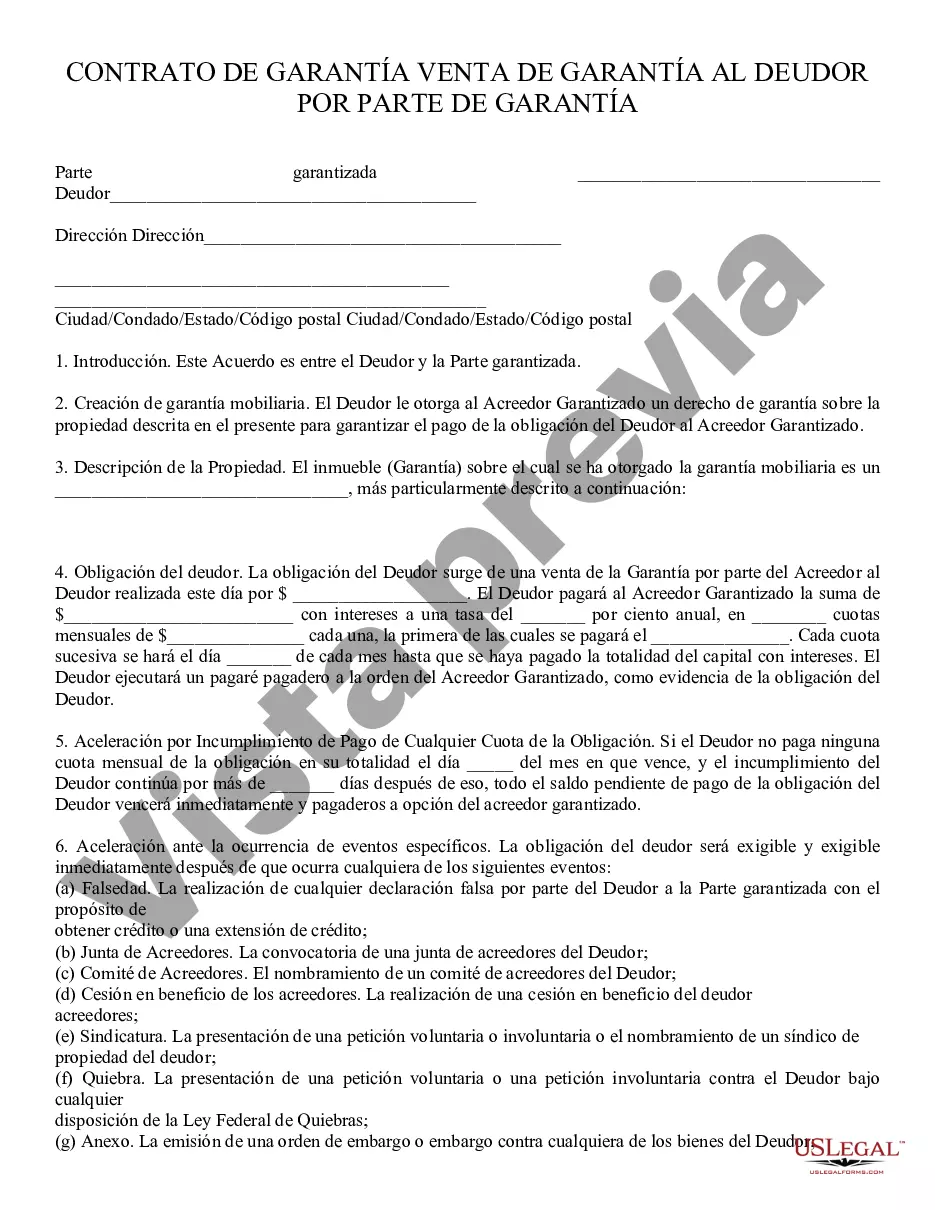

Security Agreement: This is an Agreement between a Debtor and Secured Party. The Debtor uses as collateral some type of property, and then agrees to pay the Secured Party monthly until his/her debt to them is satisfied. If the Debtor does not satisfy the debt, the property used as collateral, becomes the property of the Secured Party. This form is available in both Word and Rich Text formats.

A Scottsdale Arizona Security Agreement is a legally binding contract that outlines the terms and conditions for securing a loan or granting credit in the city of Scottsdale, Arizona. It is a crucial document that establishes a relationship between a lender and a borrower, ensuring that the lender has a means to recover their funds in case of default by the borrower. The primary purpose of a Scottsdale Arizona Security Agreement is to provide a security interest in certain assets or property of the borrower, which can be liquidated or sold to repay the loan amount. This agreement offers protection to the lender, assuring them that they will have collateral to recover their investment if the borrower fails to meet their obligations. Typically, a Scottsdale Arizona Security Agreement will contain various clauses and provisions to define the responsibilities and rights of both parties involved. These may include: 1. Collateral Description: This section specifies the assets or property that will be pledged as collateral against the loan. 2. Grant of Security Interest: It outlines the transfer of rights and interest in the collateral from the borrower to the lender. 3. Obligations of the Borrower: This section elaborates on the borrower's responsibilities, such as making timely payments, maintaining insurance on the collateral, and ensuring its preservation. 4. Default and Remedies: It clarifies the consequences of default, giving the lender the right to take possession of and sell the collateral to repay the loan. It may also discuss the opportunity for the borrower to cure the default and reinstate the agreement. 5. Governing Law: Specifies the laws of Scottsdale, Arizona, that govern the validity, interpretation, and enforcement of the agreement. Regarding the types of Scottsdale Arizona Security Agreements, there can be several variations based on the nature and purpose of the transaction. Some common types include: 1. Real Estate Security Agreement: This agreement is specifically for securing a loan or credit against real property, such as a house, land, or commercial building, in Scottsdale, Arizona. 2. Vehicle Security Agreement: This type of agreement is used when financing a vehicle purchase or borrowing money against a vehicle as collateral. It ensures that the lender has a legal claim on the vehicle until the loan is fully repaid. 3. Business Security Agreement: This agreement is often utilized by businesses in Scottsdale, Arizona, to secure loans using their assets, equipment, inventory, or accounts receivable as collateral. 4. Personal Property Security Agreement: This type of agreement allows individuals to secure a loan using personal belongings, such as jewelry, electronics, or valuable collections, as collateral. In conclusion, a Scottsdale Arizona Security Agreement is a critical legal contract that protects both lenders and borrowers in financial transactions within the city. By defining the terms of collateral, obligations, default, and remedies, this agreement ensures transparency and clarity for all parties involved.A Scottsdale Arizona Security Agreement is a legally binding contract that outlines the terms and conditions for securing a loan or granting credit in the city of Scottsdale, Arizona. It is a crucial document that establishes a relationship between a lender and a borrower, ensuring that the lender has a means to recover their funds in case of default by the borrower. The primary purpose of a Scottsdale Arizona Security Agreement is to provide a security interest in certain assets or property of the borrower, which can be liquidated or sold to repay the loan amount. This agreement offers protection to the lender, assuring them that they will have collateral to recover their investment if the borrower fails to meet their obligations. Typically, a Scottsdale Arizona Security Agreement will contain various clauses and provisions to define the responsibilities and rights of both parties involved. These may include: 1. Collateral Description: This section specifies the assets or property that will be pledged as collateral against the loan. 2. Grant of Security Interest: It outlines the transfer of rights and interest in the collateral from the borrower to the lender. 3. Obligations of the Borrower: This section elaborates on the borrower's responsibilities, such as making timely payments, maintaining insurance on the collateral, and ensuring its preservation. 4. Default and Remedies: It clarifies the consequences of default, giving the lender the right to take possession of and sell the collateral to repay the loan. It may also discuss the opportunity for the borrower to cure the default and reinstate the agreement. 5. Governing Law: Specifies the laws of Scottsdale, Arizona, that govern the validity, interpretation, and enforcement of the agreement. Regarding the types of Scottsdale Arizona Security Agreements, there can be several variations based on the nature and purpose of the transaction. Some common types include: 1. Real Estate Security Agreement: This agreement is specifically for securing a loan or credit against real property, such as a house, land, or commercial building, in Scottsdale, Arizona. 2. Vehicle Security Agreement: This type of agreement is used when financing a vehicle purchase or borrowing money against a vehicle as collateral. It ensures that the lender has a legal claim on the vehicle until the loan is fully repaid. 3. Business Security Agreement: This agreement is often utilized by businesses in Scottsdale, Arizona, to secure loans using their assets, equipment, inventory, or accounts receivable as collateral. 4. Personal Property Security Agreement: This type of agreement allows individuals to secure a loan using personal belongings, such as jewelry, electronics, or valuable collections, as collateral. In conclusion, a Scottsdale Arizona Security Agreement is a critical legal contract that protects both lenders and borrowers in financial transactions within the city. By defining the terms of collateral, obligations, default, and remedies, this agreement ensures transparency and clarity for all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.