Financing Statement:

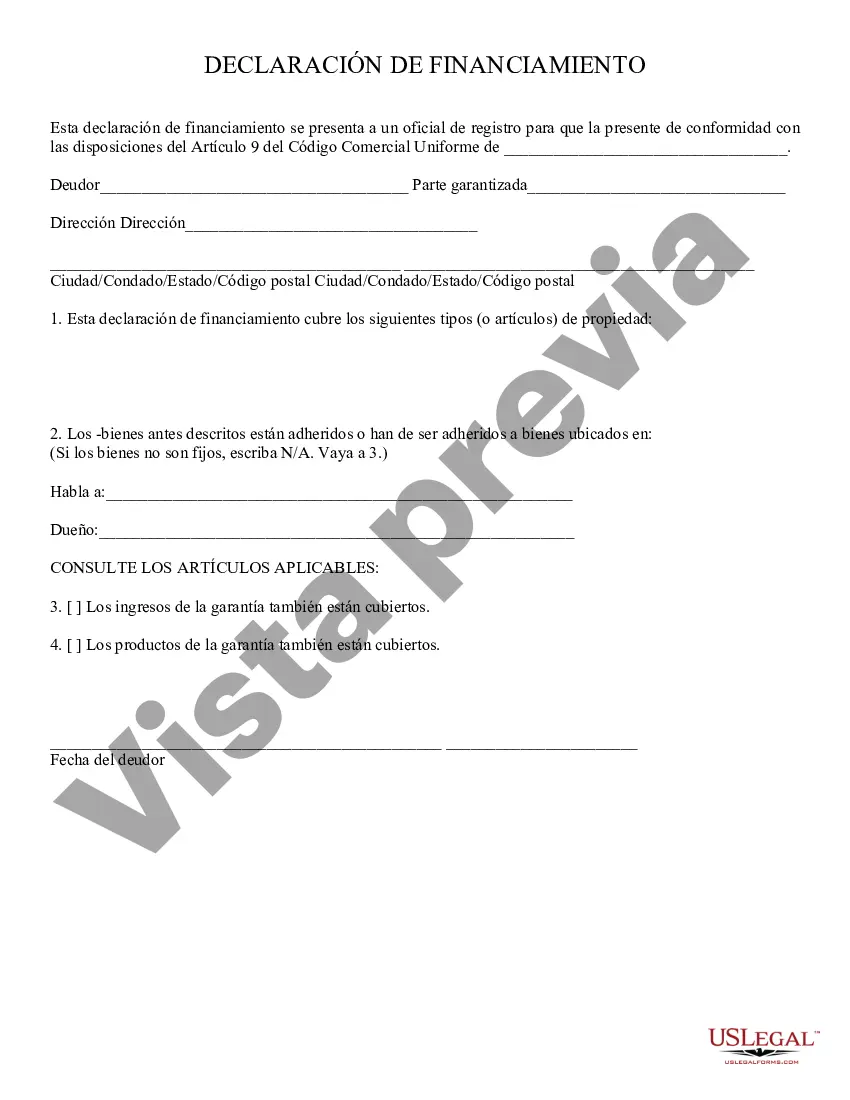

The Tempe Arizona Financing Statement is a legal document used to secure a loan or claim against personal property located in Tempe, Arizona. It is an essential part of the Uniform Commercial Code (UCC) system that ensures lenders have a legal right to the property pledged as collateral. When filing a Tempe Arizona Financing Statement, the debtor (borrower) provides important information such as their name, address, and social security number or employer identification number. The lender files this document with the Arizona Secretary of State's office to establish a public record of their claim to the specific property. The purpose of the Tempe Arizona Financing Statement is to inform other potential lenders of the existing claim on the property. It helps lenders to assess the priority of their own claim if the debtor defaults or files for bankruptcy. By filing this document, the lender safeguards its position and improves its chances of recovering its investment in case of default. There are various types of Tempe Arizona Financing Statements, depending on the specific transaction and property involved: 1. Real Estate Financing Statement: This type of financing statement involves the use of real property, such as land, buildings, or fixtures, as collateral. It is usually for larger loans and carries more complex legal requirements. 2. Personal Property Financing Statement: This is the most common type of financing statement and is used when personal property, such as vehicles, equipment, inventory, or intellectual property, is pledged as collateral. 3. Agricultural Financing Statement: This type of financing statement specifically applies to loans secured by agricultural property, such as crops, livestock, or farm equipment. 4. Fixture Financing Statement: When personal property (fixtures) becomes part of real estate by being permanently attached or incorporated into a building or land, this type of financing statement is used. It is important to note that the specific requirements, forms, and procedures for filing a Tempe Arizona Financing Statement may vary, so it is crucial for lenders and debtors to consult legal professionals familiar with Arizona state laws and regulations.The Tempe Arizona Financing Statement is a legal document used to secure a loan or claim against personal property located in Tempe, Arizona. It is an essential part of the Uniform Commercial Code (UCC) system that ensures lenders have a legal right to the property pledged as collateral. When filing a Tempe Arizona Financing Statement, the debtor (borrower) provides important information such as their name, address, and social security number or employer identification number. The lender files this document with the Arizona Secretary of State's office to establish a public record of their claim to the specific property. The purpose of the Tempe Arizona Financing Statement is to inform other potential lenders of the existing claim on the property. It helps lenders to assess the priority of their own claim if the debtor defaults or files for bankruptcy. By filing this document, the lender safeguards its position and improves its chances of recovering its investment in case of default. There are various types of Tempe Arizona Financing Statements, depending on the specific transaction and property involved: 1. Real Estate Financing Statement: This type of financing statement involves the use of real property, such as land, buildings, or fixtures, as collateral. It is usually for larger loans and carries more complex legal requirements. 2. Personal Property Financing Statement: This is the most common type of financing statement and is used when personal property, such as vehicles, equipment, inventory, or intellectual property, is pledged as collateral. 3. Agricultural Financing Statement: This type of financing statement specifically applies to loans secured by agricultural property, such as crops, livestock, or farm equipment. 4. Fixture Financing Statement: When personal property (fixtures) becomes part of real estate by being permanently attached or incorporated into a building or land, this type of financing statement is used. It is important to note that the specific requirements, forms, and procedures for filing a Tempe Arizona Financing Statement may vary, so it is crucial for lenders and debtors to consult legal professionals familiar with Arizona state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.