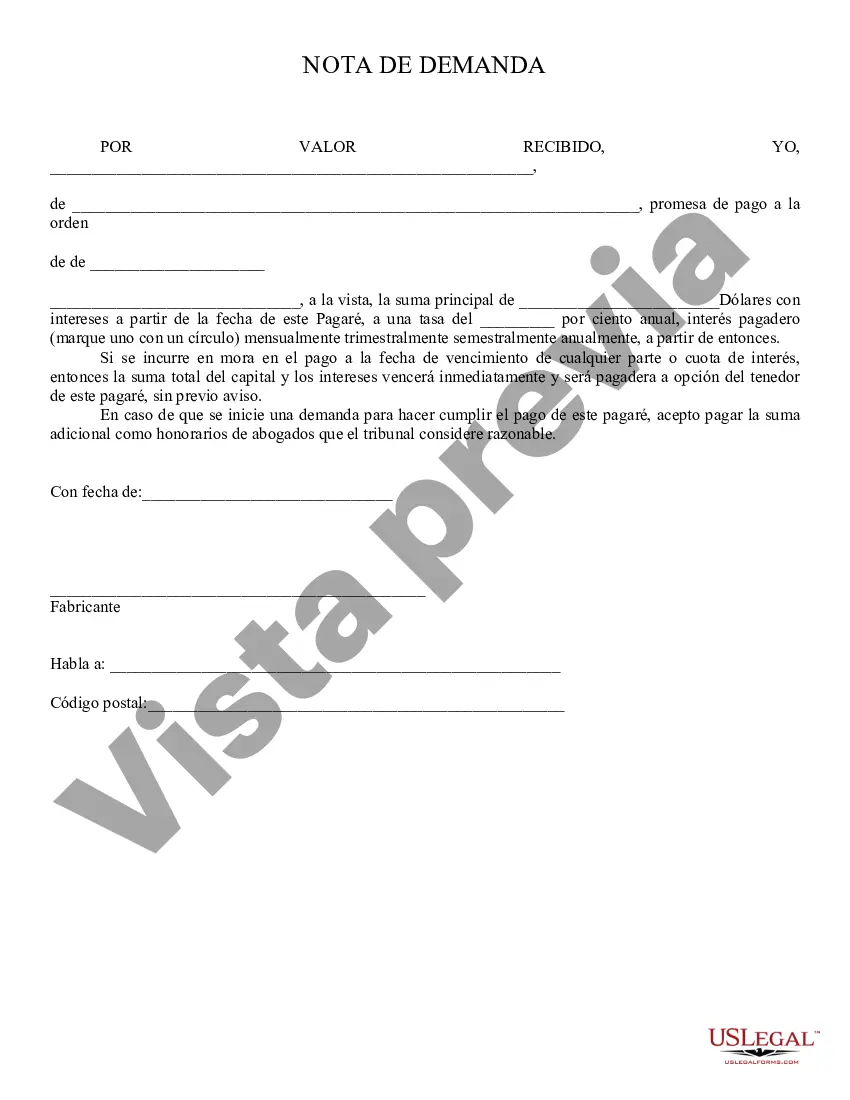

Demand Note: A Demand Note is signed by both the Borrower and the Lender. The note details and explains that if the Borrower misses any payments, the Lender can ask that he/she pay the entire amount, with interest, without prior warning. This form is available for download in both Word and Rich Text formats.

Glendale Arizona Demand Note: A Comprehensive Overview A Glendale Arizona Demand Note is a financial instrument issued by the city of Glendale, Arizona, to raise capital for funding various infrastructure projects or operational requirements. It serves as a debt obligation that allows the city to borrow funds from individuals, financial institutions, or other entities, promising to repay the principal amount along with an agreed-upon interest rate. These demand notes are typically short-term in nature, meaning they come with a maturity period of one year or less. They offer a flexible repayment structure, allowing the borrower (the City of Glendale) to repay the borrowed amount on demand by the lender. This ensures that the lender can request the repayment of the principal and accrued interest at any time, hence the name "demand note." By issuing demand notes, Glendale can effectively manage its cash flow needs, responding promptly to funding requirements for ongoing projects or unforeseen expenses. These notes serve as a practical financing option by allowing the city to access funds quickly and efficiently. There are different types of Glendale Arizona Demand Notes, each catering to specific funding requirements and financial strategies. Some commonly seen types include: 1. General Obligation Demand Notes: These demand notes are backed by the full faith and credit of the City of Glendale, meaning they are secured by the city's taxing power. They generally offer a lower interest rate due to the lower perceived risks associated with repayment. 2. Revenue Demand Notes: These notes are backed by specific revenue streams generated by city projects or services. They provide lenders with a secured claim on the revenues generated, increasing the appeal to investors. The interest rates on revenue demand notes may be higher but are often offset by the increased security. 3. Special Assessment Demand Notes: These notes are issued to fund specific public improvements, such as infrastructure upgrades or urban development. The interest and principal repayments are generally secured by future assessments levied on the benefited properties. This type of note appeals to investors seeking collateralized investment options. It is important to note that investing in Glendale Arizona Demand Notes requires thorough due diligence and understanding of the associated risks. Potential investors should review the terms and conditions of each note, assess the financial stability of the city, and evaluate factors such as tax revenues, economic growth, and any legal constraints before making any investment decisions. In conclusion, Glendale Arizona Demand Notes offer a flexible and efficient financing solution for the City of Glendale to meet its short-term funding requirements. Various types of demand notes are available, each serving unique purposes and appealing to different types of investors. However, before engaging in any investment, it is crucial to gather comprehensive information and seek professional advice to make informed decisions.Glendale Arizona Demand Note: A Comprehensive Overview A Glendale Arizona Demand Note is a financial instrument issued by the city of Glendale, Arizona, to raise capital for funding various infrastructure projects or operational requirements. It serves as a debt obligation that allows the city to borrow funds from individuals, financial institutions, or other entities, promising to repay the principal amount along with an agreed-upon interest rate. These demand notes are typically short-term in nature, meaning they come with a maturity period of one year or less. They offer a flexible repayment structure, allowing the borrower (the City of Glendale) to repay the borrowed amount on demand by the lender. This ensures that the lender can request the repayment of the principal and accrued interest at any time, hence the name "demand note." By issuing demand notes, Glendale can effectively manage its cash flow needs, responding promptly to funding requirements for ongoing projects or unforeseen expenses. These notes serve as a practical financing option by allowing the city to access funds quickly and efficiently. There are different types of Glendale Arizona Demand Notes, each catering to specific funding requirements and financial strategies. Some commonly seen types include: 1. General Obligation Demand Notes: These demand notes are backed by the full faith and credit of the City of Glendale, meaning they are secured by the city's taxing power. They generally offer a lower interest rate due to the lower perceived risks associated with repayment. 2. Revenue Demand Notes: These notes are backed by specific revenue streams generated by city projects or services. They provide lenders with a secured claim on the revenues generated, increasing the appeal to investors. The interest rates on revenue demand notes may be higher but are often offset by the increased security. 3. Special Assessment Demand Notes: These notes are issued to fund specific public improvements, such as infrastructure upgrades or urban development. The interest and principal repayments are generally secured by future assessments levied on the benefited properties. This type of note appeals to investors seeking collateralized investment options. It is important to note that investing in Glendale Arizona Demand Notes requires thorough due diligence and understanding of the associated risks. Potential investors should review the terms and conditions of each note, assess the financial stability of the city, and evaluate factors such as tax revenues, economic growth, and any legal constraints before making any investment decisions. In conclusion, Glendale Arizona Demand Notes offer a flexible and efficient financing solution for the City of Glendale to meet its short-term funding requirements. Various types of demand notes are available, each serving unique purposes and appealing to different types of investors. However, before engaging in any investment, it is crucial to gather comprehensive information and seek professional advice to make informed decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.