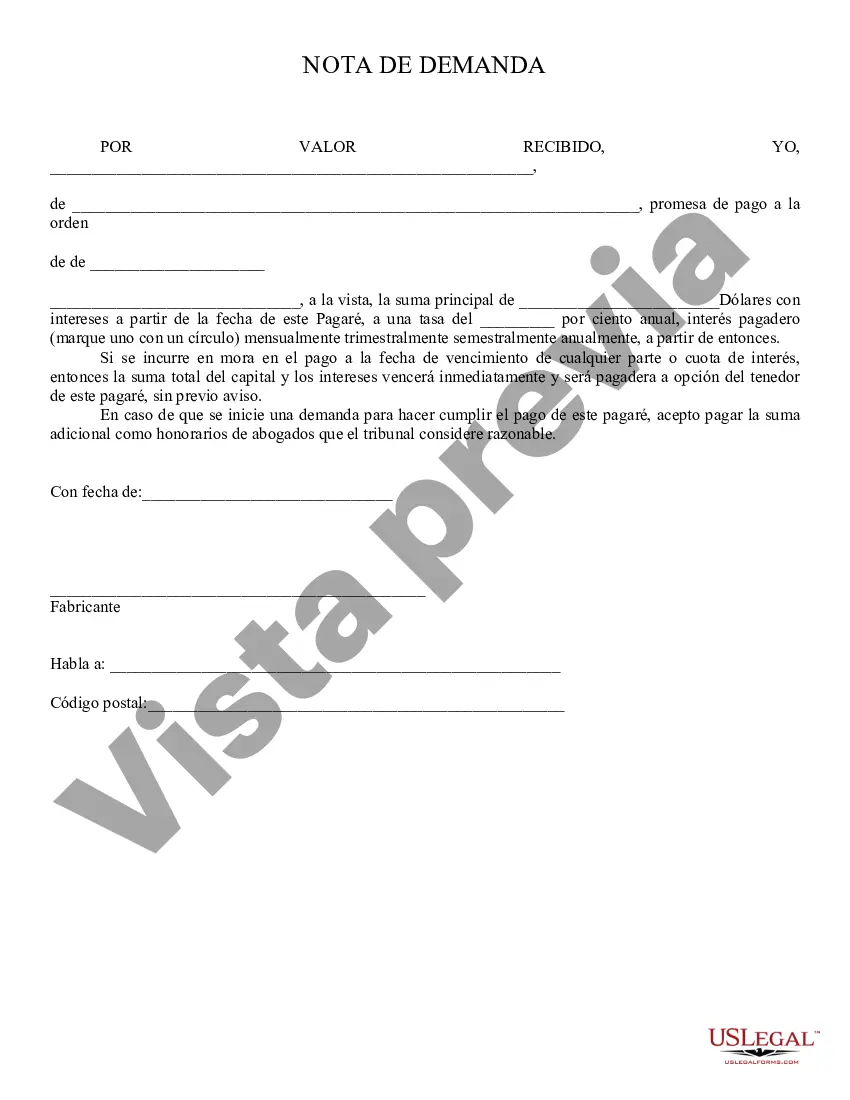

Demand Note: A Demand Note is signed by both the Borrower and the Lender. The note details and explains that if the Borrower misses any payments, the Lender can ask that he/she pay the entire amount, with interest, without prior warning. This form is available for download in both Word and Rich Text formats.

Tempe, Arizona Demand Note: A Comprehensive Overview A Tempe, Arizona Demand Note refers to a type of financial instrument issued by the city of Tempe, Arizona, typically used to raise funds for various municipal projects and developments. Being a demand note, it has unique characteristics that distinguish it from other debt instruments. The Tempe Demand Note is an unsecured, short-term debt instrument with a fixed maturity date, usually ranging from a few months to a year. It represents an obligation of the city to repay the principal amount borrowed along with accrued interest upon demand by the note holder. Since these notes are unsecured, they do not provide any collateral to ensure repayment. One of the main advantages of a Tempe Demand Note is its flexibility in terms of repayment. The holder has the authority to demand repayment at any time before the maturity date. This allows investors to have easy access to their funds when needed, ensuring liquidity and convenience for the note holder. The Tempe, Arizona Demand Note is typically issued in various types to suit the specific requirements of different investors or municipal financing needs. Some key types of Tempe Demand Notes include: 1. General Obligation Demand Notes: These are backed by the full faith and credit of the city of Tempe, which means the city's taxing authority is utilized to repay the note's principal and interest. This type of demand note provides a higher level of security to investors, as it has a lower risk of default compared to other types. 2. Revenue Demand Notes: These notes are secured by a specific revenue stream, such as income from infrastructure projects, parking facilities, or other dedicated sources. Revenue demand notes offer different risk profiles based on the stability and reliability of the revenue source supporting repayment. 3. Lease Revenue Demand Notes: This type of demand note is supported by lease payments received from the city's leased assets, such as public buildings, recreational facilities, or equipment. It is essential to consider the specific terms and conditions of the lease agreements when evaluating the risk associated with lease revenue demand notes. 4. Special Assessment Demand Notes: These notes are secured by special assessments levied on property within the city. Special assessments are typically imposed on properties benefitting from specific public improvements, ensuring a higher level of repayment security. Investors considering Tempe, Arizona Demand Notes should carefully assess the creditworthiness of the city, evaluate the specific type of demand note, and consider factors like interest rates, maturity, and any further terms and conditions associated with the note. Tempe, Arizona Demand Notes provide an opportunity to invest in the development and growth of Tempe's municipal projects while benefiting from the potential return on investment and the flexibility of repayment.Tempe, Arizona Demand Note: A Comprehensive Overview A Tempe, Arizona Demand Note refers to a type of financial instrument issued by the city of Tempe, Arizona, typically used to raise funds for various municipal projects and developments. Being a demand note, it has unique characteristics that distinguish it from other debt instruments. The Tempe Demand Note is an unsecured, short-term debt instrument with a fixed maturity date, usually ranging from a few months to a year. It represents an obligation of the city to repay the principal amount borrowed along with accrued interest upon demand by the note holder. Since these notes are unsecured, they do not provide any collateral to ensure repayment. One of the main advantages of a Tempe Demand Note is its flexibility in terms of repayment. The holder has the authority to demand repayment at any time before the maturity date. This allows investors to have easy access to their funds when needed, ensuring liquidity and convenience for the note holder. The Tempe, Arizona Demand Note is typically issued in various types to suit the specific requirements of different investors or municipal financing needs. Some key types of Tempe Demand Notes include: 1. General Obligation Demand Notes: These are backed by the full faith and credit of the city of Tempe, which means the city's taxing authority is utilized to repay the note's principal and interest. This type of demand note provides a higher level of security to investors, as it has a lower risk of default compared to other types. 2. Revenue Demand Notes: These notes are secured by a specific revenue stream, such as income from infrastructure projects, parking facilities, or other dedicated sources. Revenue demand notes offer different risk profiles based on the stability and reliability of the revenue source supporting repayment. 3. Lease Revenue Demand Notes: This type of demand note is supported by lease payments received from the city's leased assets, such as public buildings, recreational facilities, or equipment. It is essential to consider the specific terms and conditions of the lease agreements when evaluating the risk associated with lease revenue demand notes. 4. Special Assessment Demand Notes: These notes are secured by special assessments levied on property within the city. Special assessments are typically imposed on properties benefitting from specific public improvements, ensuring a higher level of repayment security. Investors considering Tempe, Arizona Demand Notes should carefully assess the creditworthiness of the city, evaluate the specific type of demand note, and consider factors like interest rates, maturity, and any further terms and conditions associated with the note. Tempe, Arizona Demand Notes provide an opportunity to invest in the development and growth of Tempe's municipal projects while benefiting from the potential return on investment and the flexibility of repayment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.