Guarantee of Payment of Rent: This form is available for download in both Word and Rich Text formats.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

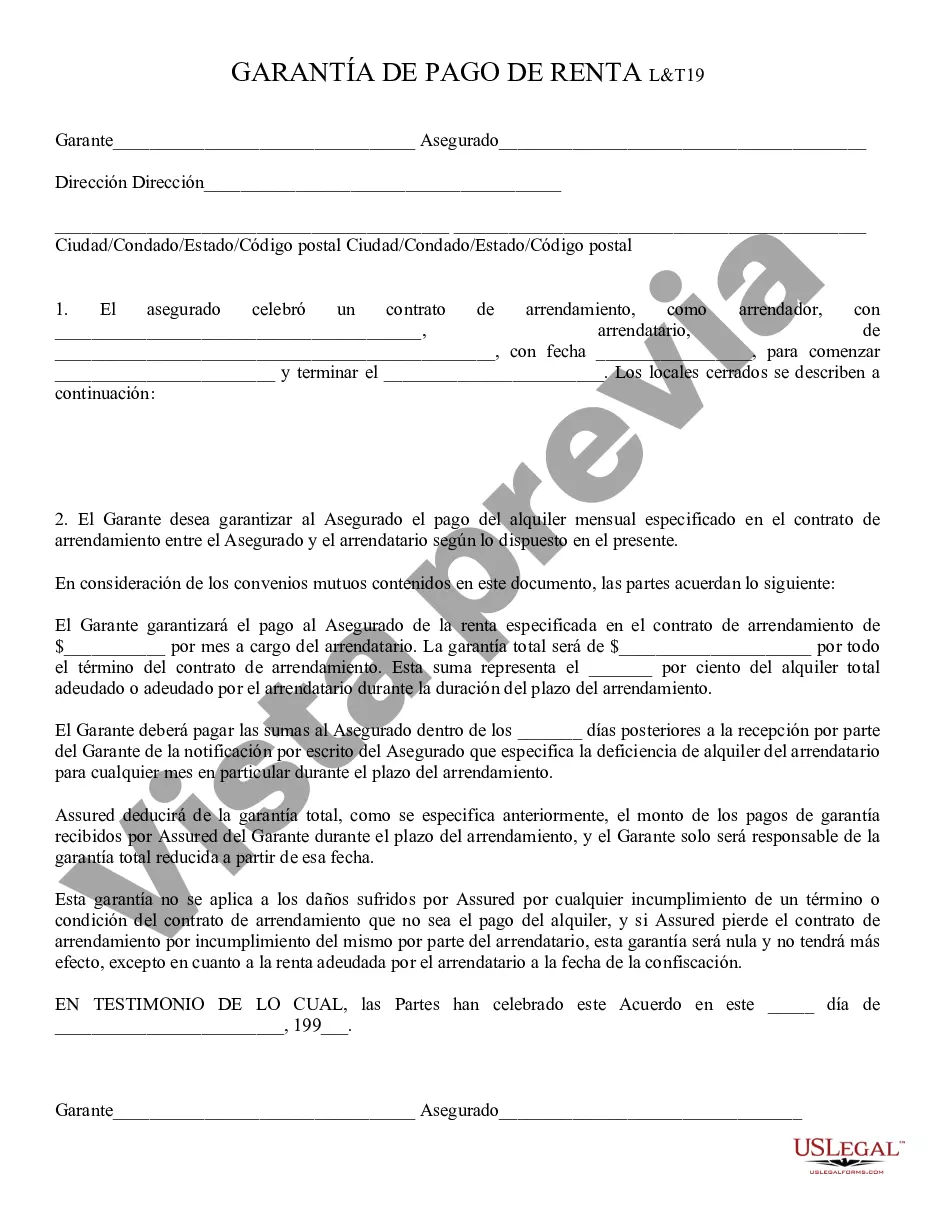

Tempe Arizona Guarantee of Payment of Rent is a legal document that provides security to landlords in ensuring timely payment of rent by tenants. This guarantee acts as a binding agreement between the tenant, landlord, and a third-party guarantor, who agrees to guarantee the payment of rent on behalf of the tenant if they default. The Tempe Arizona Guarantee of Payment of Rent serves as a safeguard for landlords against potential financial risks and ensures a steady income flow. Landlords often require a guarantee of payment of rent when renting out properties to tenants with limited creditworthiness, insufficient income, or those with no rental history. There are different types of Tempe Arizona Guarantee of Payment of Rent, including: 1. Individual Guarantor: This is the most common type of guarantee, where a person, usually a family member or close friend, acts as the guarantor for the tenant. The individual guarantor provides their personal financial information and credit history to reassure the landlord that they can cover the rent if the tenant fails to pay. 2. Corporate Guarantor: In some cases, a corporation may act as a guarantor for the tenant. This typically occurs when a tenant is a small business or a subsidiary of a larger corporation. The corporate guarantor ensures the landlord that they will be responsible for paying the rent on behalf of the tenant if necessary. 3. Institutional Guarantor: This type of guarantee involves obtaining a letter of credit or a rental guarantee certificate from a bank or financial institution. The bank or institution provides a written assurance stating that they will pay the rent to the landlord if the tenant defaults. The Tempe Arizona Guarantee of Payment of Rent typically includes detailed information about the tenant, landlord, and guarantor. It outlines the responsibilities and obligations of all parties involved, including the duration of the guarantee, the maximum amount of rent guaranteed, and the conditions under which the guarantee will be activated, such as non-payment of rent or violation of lease terms. By having a Tempe Arizona Guarantee of Payment of Rent in place, landlords can minimize the financial risks associated with renting out properties and ensure a smooth tenancy. It provides peace of mind to landlords, knowing that their rental income is protected, and encourages responsible tenant behavior when it comes to paying rent on time.Tempe Arizona Guarantee of Payment of Rent is a legal document that provides security to landlords in ensuring timely payment of rent by tenants. This guarantee acts as a binding agreement between the tenant, landlord, and a third-party guarantor, who agrees to guarantee the payment of rent on behalf of the tenant if they default. The Tempe Arizona Guarantee of Payment of Rent serves as a safeguard for landlords against potential financial risks and ensures a steady income flow. Landlords often require a guarantee of payment of rent when renting out properties to tenants with limited creditworthiness, insufficient income, or those with no rental history. There are different types of Tempe Arizona Guarantee of Payment of Rent, including: 1. Individual Guarantor: This is the most common type of guarantee, where a person, usually a family member or close friend, acts as the guarantor for the tenant. The individual guarantor provides their personal financial information and credit history to reassure the landlord that they can cover the rent if the tenant fails to pay. 2. Corporate Guarantor: In some cases, a corporation may act as a guarantor for the tenant. This typically occurs when a tenant is a small business or a subsidiary of a larger corporation. The corporate guarantor ensures the landlord that they will be responsible for paying the rent on behalf of the tenant if necessary. 3. Institutional Guarantor: This type of guarantee involves obtaining a letter of credit or a rental guarantee certificate from a bank or financial institution. The bank or institution provides a written assurance stating that they will pay the rent to the landlord if the tenant defaults. The Tempe Arizona Guarantee of Payment of Rent typically includes detailed information about the tenant, landlord, and guarantor. It outlines the responsibilities and obligations of all parties involved, including the duration of the guarantee, the maximum amount of rent guaranteed, and the conditions under which the guarantee will be activated, such as non-payment of rent or violation of lease terms. By having a Tempe Arizona Guarantee of Payment of Rent in place, landlords can minimize the financial risks associated with renting out properties and ensure a smooth tenancy. It provides peace of mind to landlords, knowing that their rental income is protected, and encourages responsible tenant behavior when it comes to paying rent on time.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.