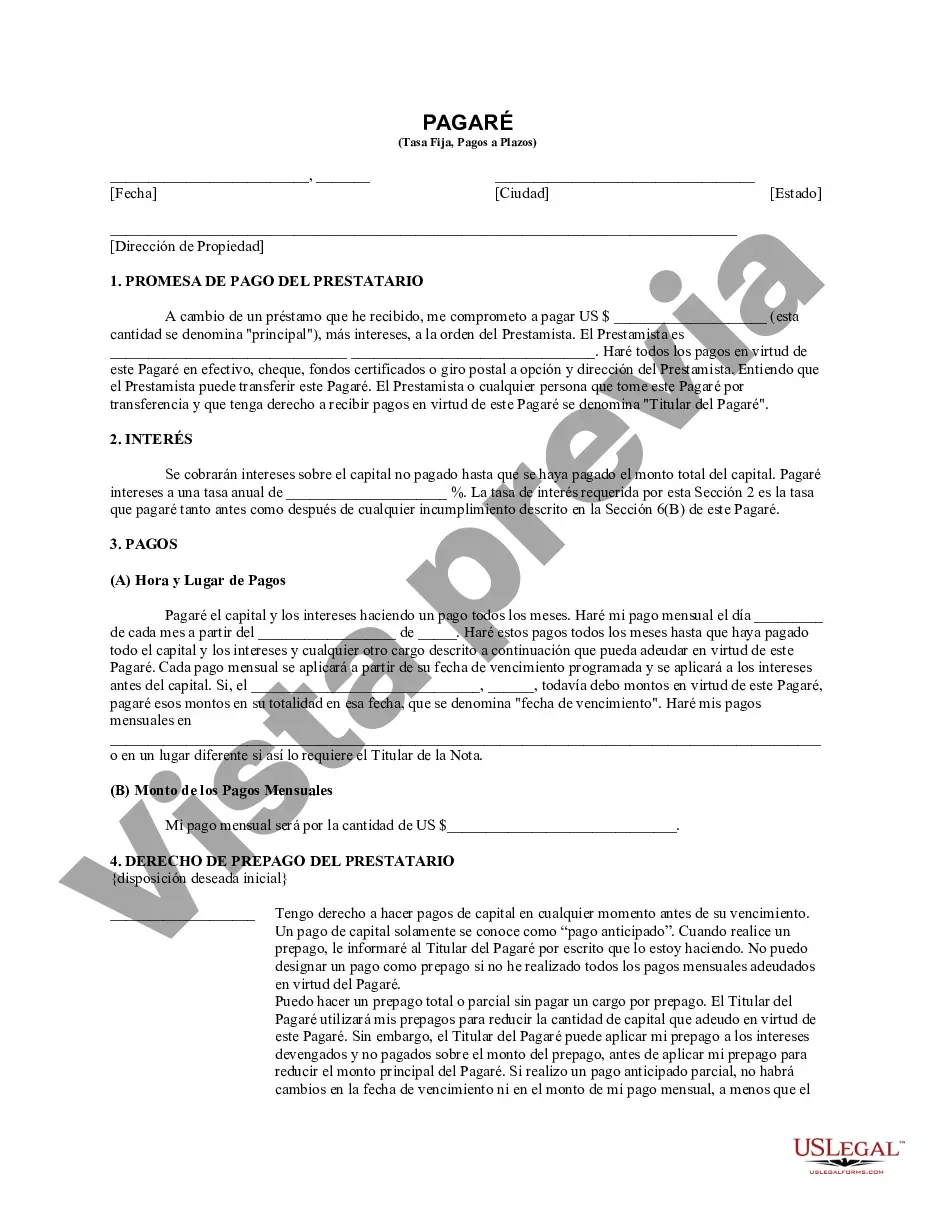

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Maricopa, Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Maricopa, Arizona. This type of promissory note is specifically secured by residential real estate, providing added assurance to the lender in case of default. The Maricopa, Arizona Installments Fixed Rate Promissory Note is designed with specific details to ensure both parties are protected. It establishes the loan's principal amount, fixed interest rate, repayment schedule, and the property that will serve as collateral for the loan. The promissory note contains provisions that specify the borrower's obligation to pay the loan amount in regular installments over a designated period. The fixed interest rate ensures that the interest rate remains consistent throughout the repayment term, offering financial stability for both the borrower and the lender. It's crucial to note that there may be different types of Maricopa, Arizona Installments Fixed Rate Promissory Notes Secured by Residential Real Estate, tailored to meet specific needs or circumstances of the borrower and lender. These variations could include: 1. Maricopa, Arizona Installments Fixed Rate Promissory Note with Balloon Payment: This type of promissory note features regular monthly installments along with a larger lump sum payment due at the end, commonly referred to as a balloon payment. This structure can be useful for borrowers seeking lower monthly payments but are capable of making a substantial payment at the end of the loan term. 2. Maricopa, Arizona Installments Fixed Rate Promissory Note with Prepayment Penalty: Some promissory notes may include a prepayment penalty clause, which imposes a fee on borrowers who choose to repay the loan before its scheduled maturity date. This type of note provides flexibility for the lender, allowing them to earn a set interest income for a specific term. 3. Maricopa, Arizona Installments Fixed Rate Promissory Note with Variable Interest Rate: While fixed-rate promissory notes have a constant interest rate, there are also notes available with variable interest rates. These notes often include a fixed rate for an initial period; afterward, the rate may adjust periodically based on market conditions. This option offers borrowers the potential advantage of lower monthly payments during periods of low-interest rates, but the uncertainty of varying rates as well. Regardless of the type, Maricopa, Arizona Installments Fixed Rate Promissory Notes Secured by Residential Real Estate serve as important legal instruments to formalize loan agreements, providing detailed terms and conditions for both borrowers and lenders. It is always recommended consulting with legal professionals to draft or review these documents to ensure compliance with local laws and regulations.Maricopa, Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Maricopa, Arizona. This type of promissory note is specifically secured by residential real estate, providing added assurance to the lender in case of default. The Maricopa, Arizona Installments Fixed Rate Promissory Note is designed with specific details to ensure both parties are protected. It establishes the loan's principal amount, fixed interest rate, repayment schedule, and the property that will serve as collateral for the loan. The promissory note contains provisions that specify the borrower's obligation to pay the loan amount in regular installments over a designated period. The fixed interest rate ensures that the interest rate remains consistent throughout the repayment term, offering financial stability for both the borrower and the lender. It's crucial to note that there may be different types of Maricopa, Arizona Installments Fixed Rate Promissory Notes Secured by Residential Real Estate, tailored to meet specific needs or circumstances of the borrower and lender. These variations could include: 1. Maricopa, Arizona Installments Fixed Rate Promissory Note with Balloon Payment: This type of promissory note features regular monthly installments along with a larger lump sum payment due at the end, commonly referred to as a balloon payment. This structure can be useful for borrowers seeking lower monthly payments but are capable of making a substantial payment at the end of the loan term. 2. Maricopa, Arizona Installments Fixed Rate Promissory Note with Prepayment Penalty: Some promissory notes may include a prepayment penalty clause, which imposes a fee on borrowers who choose to repay the loan before its scheduled maturity date. This type of note provides flexibility for the lender, allowing them to earn a set interest income for a specific term. 3. Maricopa, Arizona Installments Fixed Rate Promissory Note with Variable Interest Rate: While fixed-rate promissory notes have a constant interest rate, there are also notes available with variable interest rates. These notes often include a fixed rate for an initial period; afterward, the rate may adjust periodically based on market conditions. This option offers borrowers the potential advantage of lower monthly payments during periods of low-interest rates, but the uncertainty of varying rates as well. Regardless of the type, Maricopa, Arizona Installments Fixed Rate Promissory Notes Secured by Residential Real Estate serve as important legal instruments to formalize loan agreements, providing detailed terms and conditions for both borrowers and lenders. It is always recommended consulting with legal professionals to draft or review these documents to ensure compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.