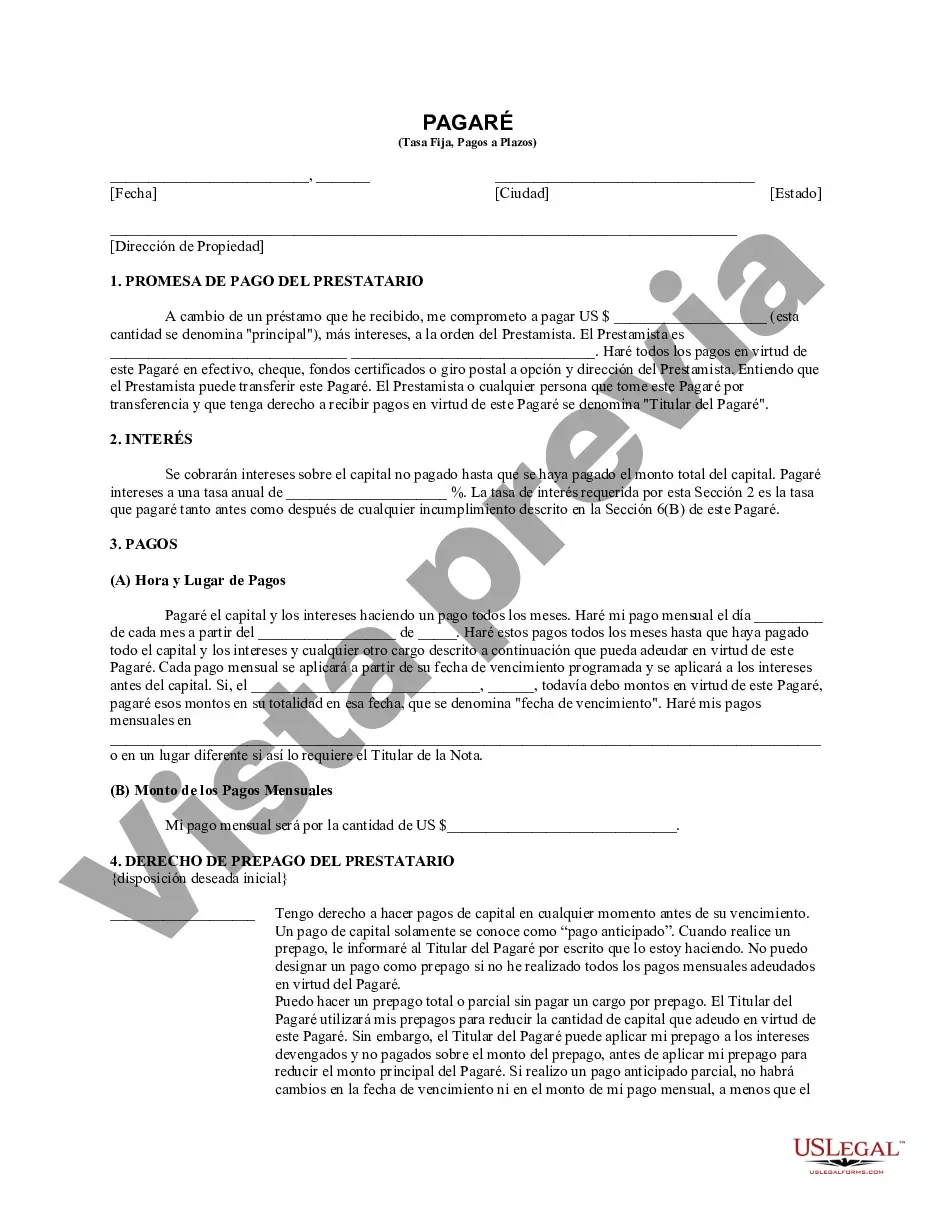

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

A Tempe Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. In this case, the loan is specifically secured by residential real estate property located in Tempe, Arizona. This type of promissory note offers several key features that make it appealing to both lenders and borrowers. Firstly, it provides a fixed interest rate, meaning that the interest rate remains constant throughout the loan term. This can provide stability and ease of budgeting for the borrower, as they will know exactly how much they need to pay each month. Additionally, the note is structured with installment payments, spreading out the repayment of the loan over a certain period. This enables the borrower to make regular payments, often monthly, until the loan is fully repaid. Installments can help in avoiding large lump sum payments and can be adjusted to fit the borrower's financial capability. The secured aspect of this promissory note is also significant. The lender holds a lien on the residential real estate property as collateral, providing a level of security. In the event of default, the lender may have legal rights to sell the property to recoup the outstanding balance. Within the realm of Tempe Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, there may be various types differentiated by loan duration, loan amount, and specific terms agreed upon between the lender and borrower. Some common variations include: 1. Short-term fixed-rate promissory note: With a shorter loan term, often ranging from 1-5 years, this type of promissory note may have a higher fixed interest rate but allows borrowers to repay the loan quicker, reducing overall interest paid. 2. Long-term fixed-rate promissory note: This variation typically has a longer loan term, ranging from 10-30 years, and might offer a lower fixed interest rate, making it more suitable for borrowers seeking stability and predictability in their payments over a longer period. 3. Jumbo fixed-rate promissory note: This type is specifically designed for loans exceeding the conforming loan limits set by Fannie Mae and Freddie Mac. Borrowers requiring larger loan amounts can opt for these notes, which may have specific terms and conditions tailored to their needs. In summary, a Tempe Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal contract specifying the terms and conditions of a loan agreement secured by residential real estate property in Tempe, Arizona. It offers borrowers a fixed interest rate and structured installment payments, providing stability and predictability throughout the loan term. Various types of this note exist, differing, loan amount, and specific terms.A Tempe Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. In this case, the loan is specifically secured by residential real estate property located in Tempe, Arizona. This type of promissory note offers several key features that make it appealing to both lenders and borrowers. Firstly, it provides a fixed interest rate, meaning that the interest rate remains constant throughout the loan term. This can provide stability and ease of budgeting for the borrower, as they will know exactly how much they need to pay each month. Additionally, the note is structured with installment payments, spreading out the repayment of the loan over a certain period. This enables the borrower to make regular payments, often monthly, until the loan is fully repaid. Installments can help in avoiding large lump sum payments and can be adjusted to fit the borrower's financial capability. The secured aspect of this promissory note is also significant. The lender holds a lien on the residential real estate property as collateral, providing a level of security. In the event of default, the lender may have legal rights to sell the property to recoup the outstanding balance. Within the realm of Tempe Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, there may be various types differentiated by loan duration, loan amount, and specific terms agreed upon between the lender and borrower. Some common variations include: 1. Short-term fixed-rate promissory note: With a shorter loan term, often ranging from 1-5 years, this type of promissory note may have a higher fixed interest rate but allows borrowers to repay the loan quicker, reducing overall interest paid. 2. Long-term fixed-rate promissory note: This variation typically has a longer loan term, ranging from 10-30 years, and might offer a lower fixed interest rate, making it more suitable for borrowers seeking stability and predictability in their payments over a longer period. 3. Jumbo fixed-rate promissory note: This type is specifically designed for loans exceeding the conforming loan limits set by Fannie Mae and Freddie Mac. Borrowers requiring larger loan amounts can opt for these notes, which may have specific terms and conditions tailored to their needs. In summary, a Tempe Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal contract specifying the terms and conditions of a loan agreement secured by residential real estate property in Tempe, Arizona. It offers borrowers a fixed interest rate and structured installment payments, providing stability and predictability throughout the loan term. Various types of this note exist, differing, loan amount, and specific terms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.