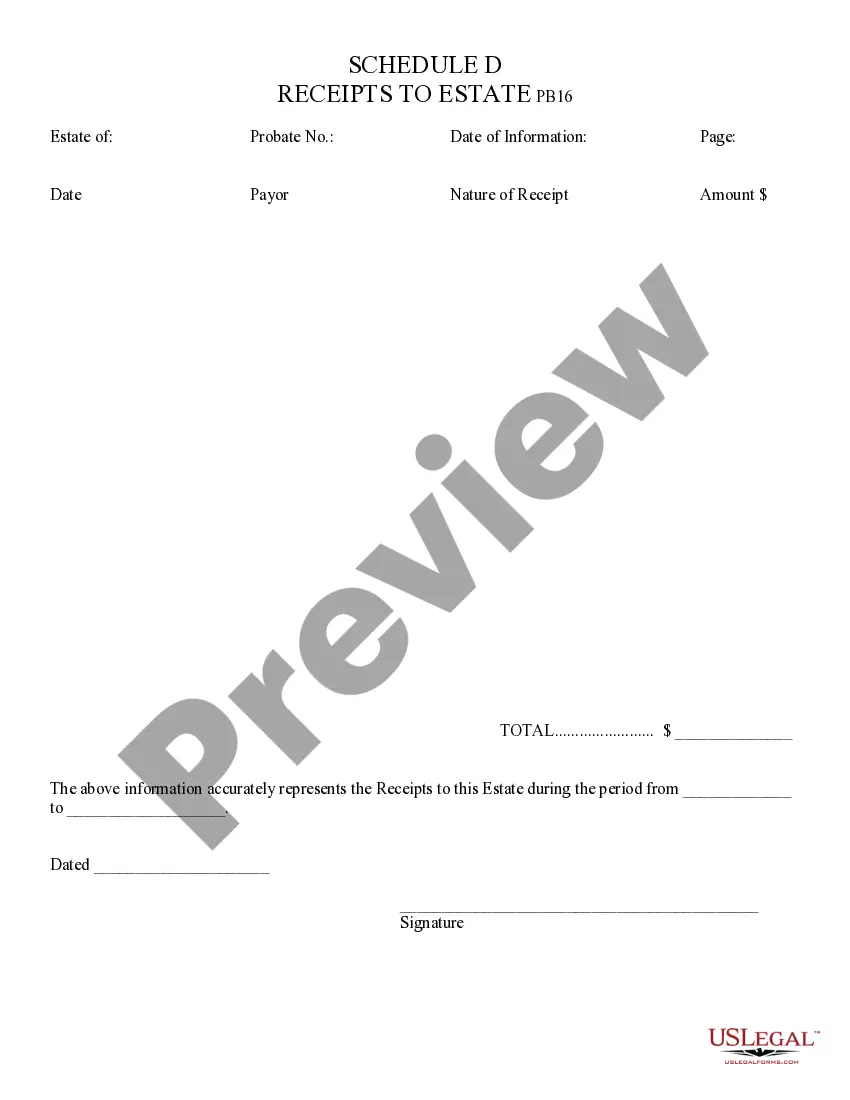

Receipts to Estate - Arizona: This form is used when an administrator of an estate is called upon to list all the receipts of any payments made by the estate. It states the amount of the receipt, as well as the Payor. It is available for download in both Word and Rich Text formats.

Tempe Arizona Receipts to Estate: Comprehensive Reporting and Financial Management for Estates In Tempe, Arizona, the process of managing estates involves various financial transactions and documentations. One essential aspect of this process is keeping track of all receipts related to the estate's financial inflow and outflow. Tempe Arizona Receipts to Estate is a meticulous system that ensures accurate recording and reporting of these transactions. The Tempe Arizona Receipts to Estate system encompasses different types of receipts to provide a comprehensive overview of the estate's financial activities. These include: 1. Income Receipts: This category includes all receipts related to the estate's sources of income, such as rent, dividend payments, interest earned on investments, or any other monetary gains accrued by the estate. 2. Expense Receipts: Estate management involves numerous expenses, ranging from property maintenance and repairs to legal fees and insurance payments. Expense receipts capture these financial outflows, allowing for a thorough assessment of the estate's expenses. 3. Tax Receipts: Tax obligations are a crucial aspect of estate management. Tempe Arizona Receipts to Estate enables the proper collection and organization of all relevant tax receipts, ensuring compliance with state and federal tax regulations. 4. Asset Acquisition and Sale Receipts: Any transactions involving the purchase or sale of assets owned by the estate are documented and recorded through acquisition and sale receipts. These receipts provide valuable insight into the estate's asset portfolio. 5. Charitable Donation Receipts: Estate owners often engage in philanthropic endeavors, making charitable donations. These receipts verify the estate's charitable contributions, enabling the estate manager to claim appropriate tax deductions and maintain records of the estate's philanthropic activities. Tempe Arizona Receipts to Estate ensures that all receipts are accurately classified, stored, and easily accessible when needed. It employs modern digital systems and software tools to streamline the process, reducing the chances of errors and facilitating efficient data management. With this comprehensive system in place, estate owners, administrators, or legal representatives can maintain detailed records of financial activities, making it easier to prepare accurate financial reports, settle tax liabilities, and ensure smooth estate administration. In conclusion, Tempe Arizona Receipts to Estate is a robust system that offers meticulous reporting and financial management for estates. By organizing and documenting various types of receipts, it provides estate owners and administrators with a comprehensive overview of their financial transactions, facilitating effective decision-making and smooth estate administration.Tempe Arizona Receipts to Estate: Comprehensive Reporting and Financial Management for Estates In Tempe, Arizona, the process of managing estates involves various financial transactions and documentations. One essential aspect of this process is keeping track of all receipts related to the estate's financial inflow and outflow. Tempe Arizona Receipts to Estate is a meticulous system that ensures accurate recording and reporting of these transactions. The Tempe Arizona Receipts to Estate system encompasses different types of receipts to provide a comprehensive overview of the estate's financial activities. These include: 1. Income Receipts: This category includes all receipts related to the estate's sources of income, such as rent, dividend payments, interest earned on investments, or any other monetary gains accrued by the estate. 2. Expense Receipts: Estate management involves numerous expenses, ranging from property maintenance and repairs to legal fees and insurance payments. Expense receipts capture these financial outflows, allowing for a thorough assessment of the estate's expenses. 3. Tax Receipts: Tax obligations are a crucial aspect of estate management. Tempe Arizona Receipts to Estate enables the proper collection and organization of all relevant tax receipts, ensuring compliance with state and federal tax regulations. 4. Asset Acquisition and Sale Receipts: Any transactions involving the purchase or sale of assets owned by the estate are documented and recorded through acquisition and sale receipts. These receipts provide valuable insight into the estate's asset portfolio. 5. Charitable Donation Receipts: Estate owners often engage in philanthropic endeavors, making charitable donations. These receipts verify the estate's charitable contributions, enabling the estate manager to claim appropriate tax deductions and maintain records of the estate's philanthropic activities. Tempe Arizona Receipts to Estate ensures that all receipts are accurately classified, stored, and easily accessible when needed. It employs modern digital systems and software tools to streamline the process, reducing the chances of errors and facilitating efficient data management. With this comprehensive system in place, estate owners, administrators, or legal representatives can maintain detailed records of financial activities, making it easier to prepare accurate financial reports, settle tax liabilities, and ensure smooth estate administration. In conclusion, Tempe Arizona Receipts to Estate is a robust system that offers meticulous reporting and financial management for estates. By organizing and documenting various types of receipts, it provides estate owners and administrators with a comprehensive overview of their financial transactions, facilitating effective decision-making and smooth estate administration.