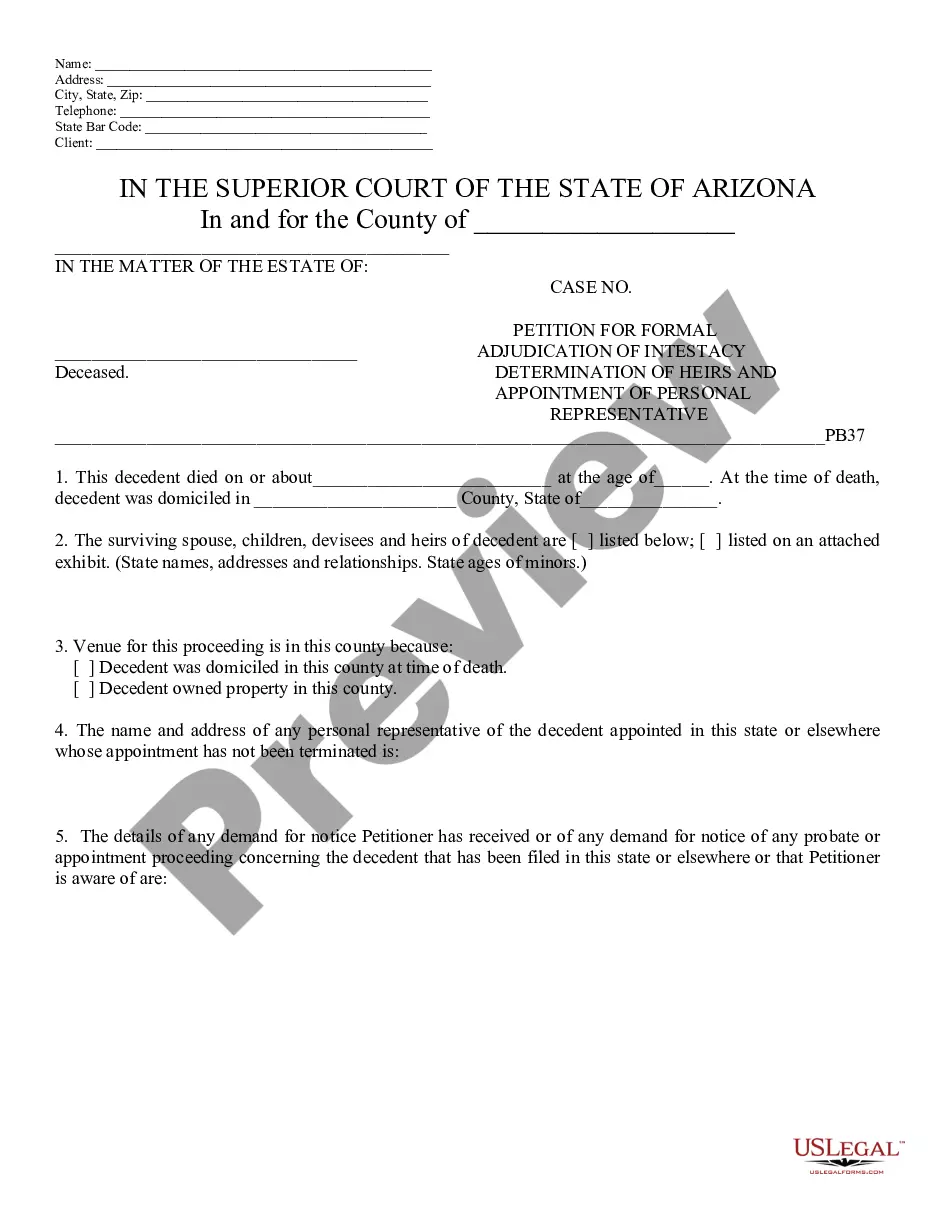

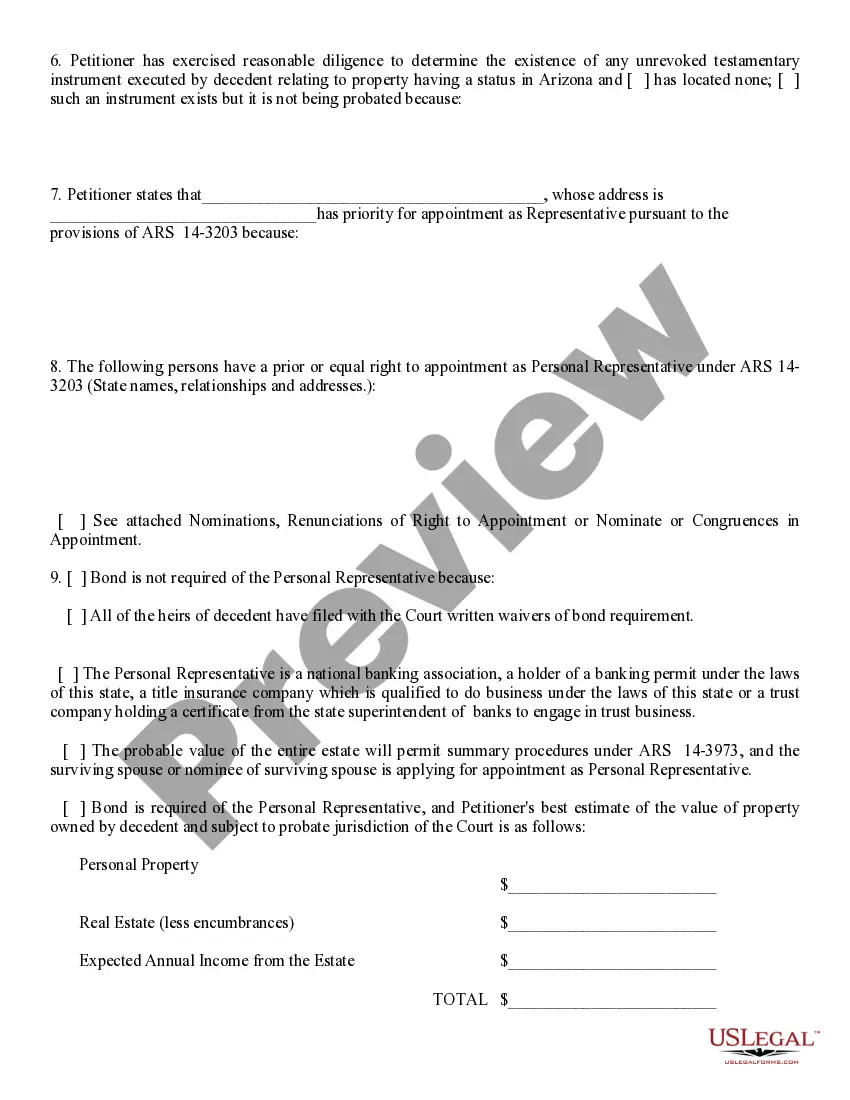

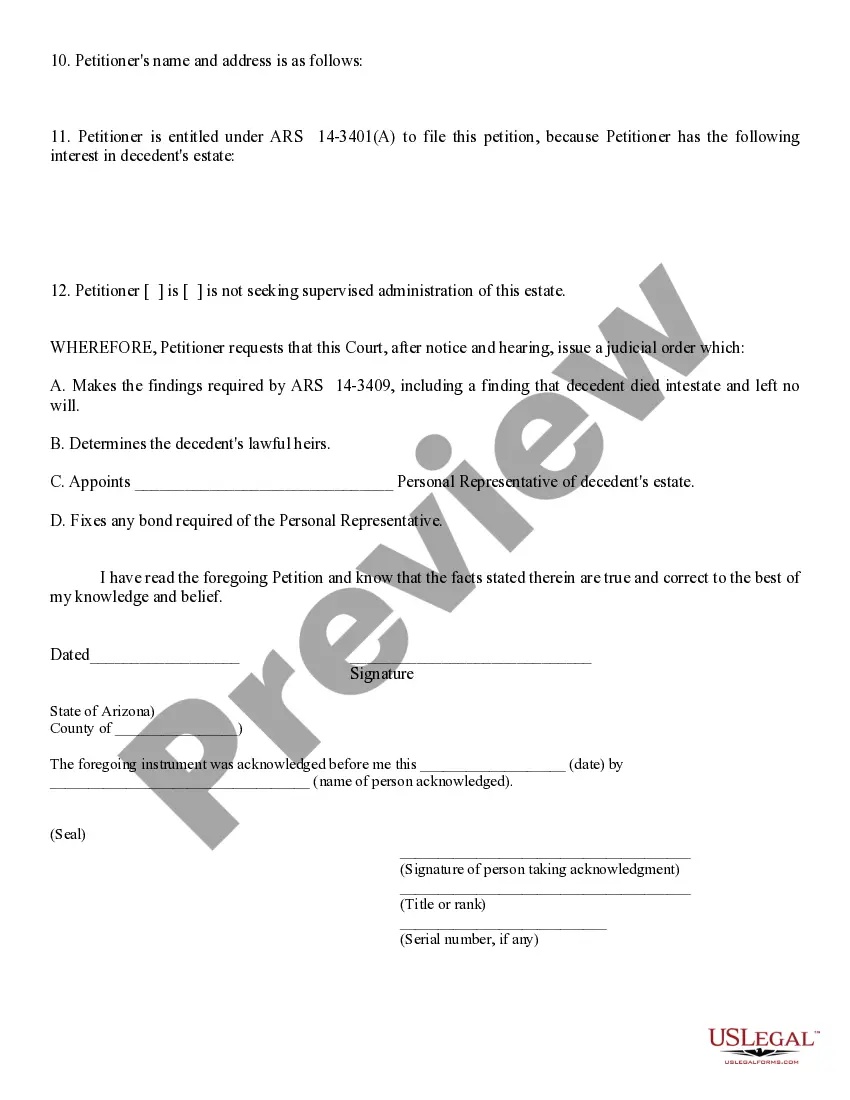

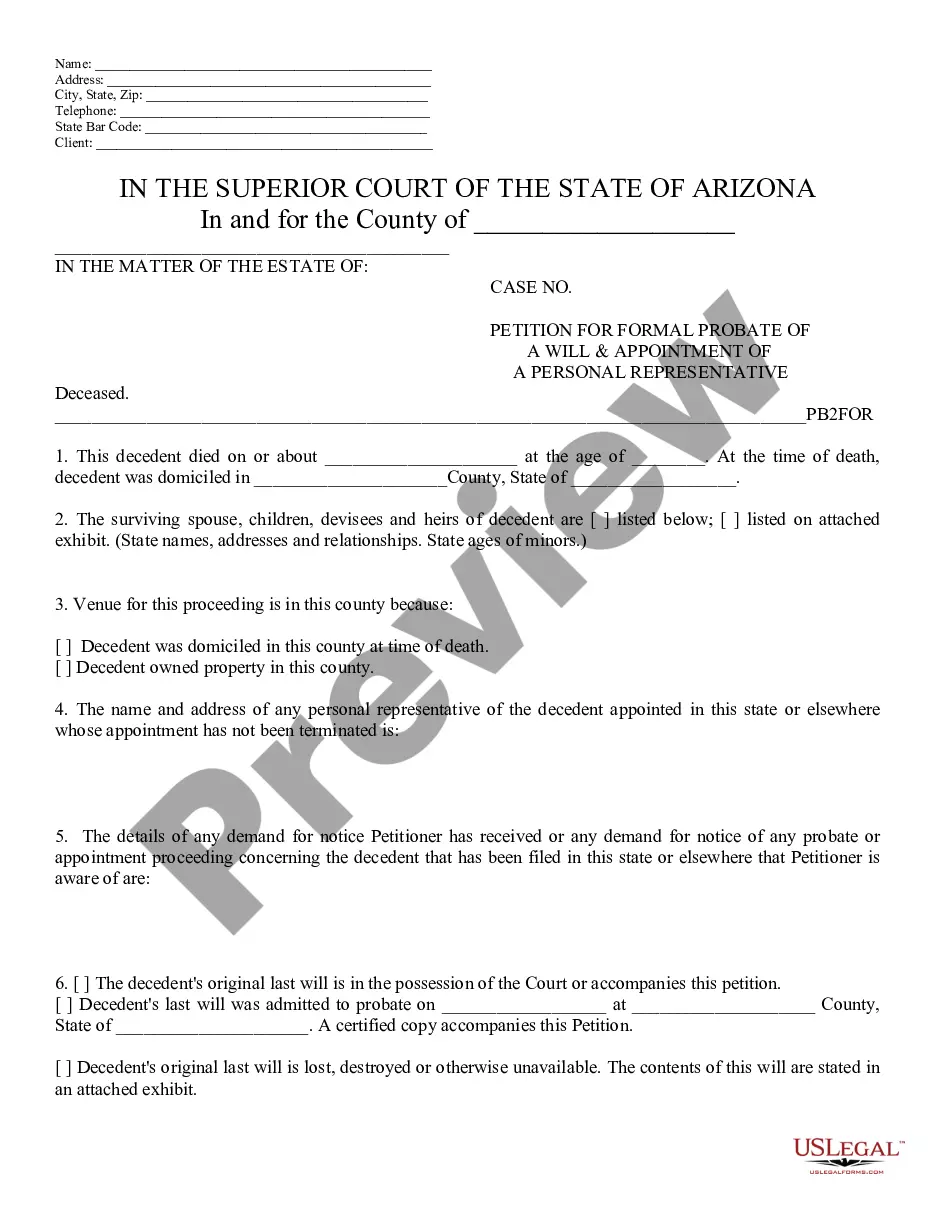

This model form, a Petition for Formal Adjunction of Intestacy Debt of Heirs and; Appt. of Personal Rep. - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative

Description

How to fill out Arizona Petition For Formal Adjunction Of Intestacy Debt Of Heirs And Appointment Of Personal Representative?

Are you seeking a reliable and cost-effective supplier of legal documents to obtain the Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative.

US Legal Forms is your ideal option.

Whether you require a simple agreement to establish rules for living together with your partner or a set of paperwork to progress your divorce through the court system, we have you covered.

Our platform offers over 85,000 current legal document templates for personal and business applications. All templates that we provide access to are not generic and are tailored to meet the needs of individual states and counties.

Review the details of the form (if available) to understand its purpose and suitability.

If the form isn’t appropriate for your particular needs, restart the search. Now you can register for your account. After that, select the subscription option and proceed to payment. Once payment is confirmed, download the Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative in any available format. You can revisit the website anytime and redownload the document at no extra cost.

- To retrieve the document, you must Log In to your account, locate the desired form, and click the Download button next to it.

- Please keep in mind that you can download your previously acquired document templates at any time from the My documents tab.

- Is this your first visit to our site? No problem.

- Creating an account is quick and easy, but first, ensure that you.

- Verify that the Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative aligns with the laws of your state and locality.

Form popularity

FAQ

In Arizona, when there is no will, the state’s intestacy laws determine who inherits the deceased’s assets. Generally, the surviving spouse, children, and other close relatives are first in line to inherit. If you need assistance navigating this process, consider using resources like uslegalforms to help with the Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative.

To file for executor of an estate in Arizona, first, gather necessary documents pertaining to the deceased’s assets, debts, and family information. Then, submit the Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative along with any required fees to the probate court. After filing, attend any hearings that may be scheduled to finalize your appointment as executor.

Becoming an executor of an estate without a will in Arizona involves filing the Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative. As part of this process, you must provide information about the deceased, potential heirs, and any debts or assets involved. Once the court approves your petition, you can begin managing the estate's affairs responsibly.

To become an executor of an estate without a will in Arizona, you typically need to file a Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative. This petition must be submitted to the probate court in the county where the deceased resided. The court will review your petition to determine if you should be appointed as the executor based on state law and the heirs' interests.

Creditors have up to one year after a person's death to collect debts from the estate in Arizona. During this period, they should file claims to ensure they receive what is owed. Filing the Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative can assist in managing the estate's debts effectively and fairly.

In Arizona, creditors can pursue debts against an estate for a considerable time, typically up to a year following the death. This is essential for creditors to ensure that legitimate claims are addressed. However, working through the Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative can streamline this process and minimize complications.

Adjudication of intestacy refers to the legal process used to determine how a deceased person's assets are distributed when there is no valid will. In Arizona, this process often begins with the Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative, which helps in appointing a representative to manage the estate. This ensures that heirs receive their rightful shares according to state laws.

Creditors in Arizona have a period of six months from the date of the notice to creditors to file claims against the estate. This timeline is crucial for ensuring that all debts are settled accordingly. Utilizing the Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative can help manage these claims systematically.

The formal appointment often involves a court hearing and may require the use of the Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative. On the other hand, an informal appointment generally does not require court involvement and is simpler. Choosing the right approach depends on the complexities of the estate and whether disputes a rise among heirs.

In Arizona, creditors can generally collect debts owed by a deceased person for up to a year after their death. This period allows creditors to file claims against the estate using the Surprise Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative. However, specific circumstances may affect this timeframe, so it's wise to consult a legal professional.