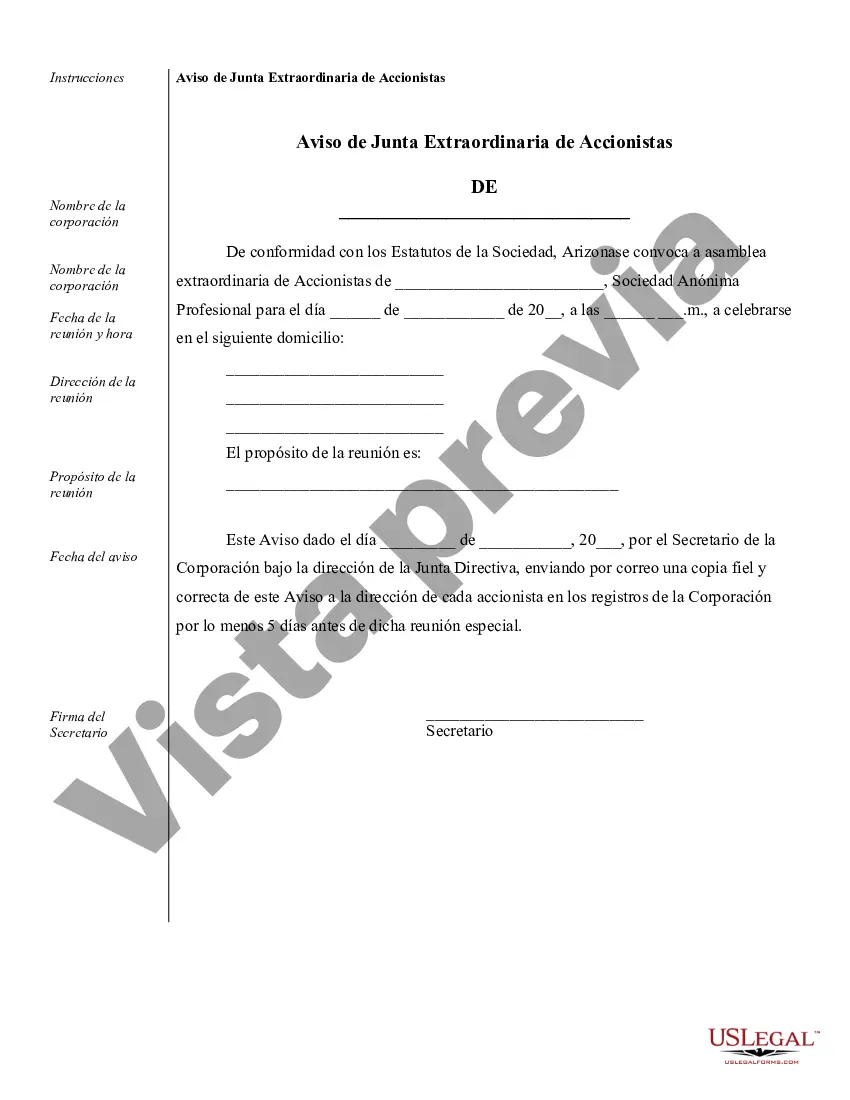

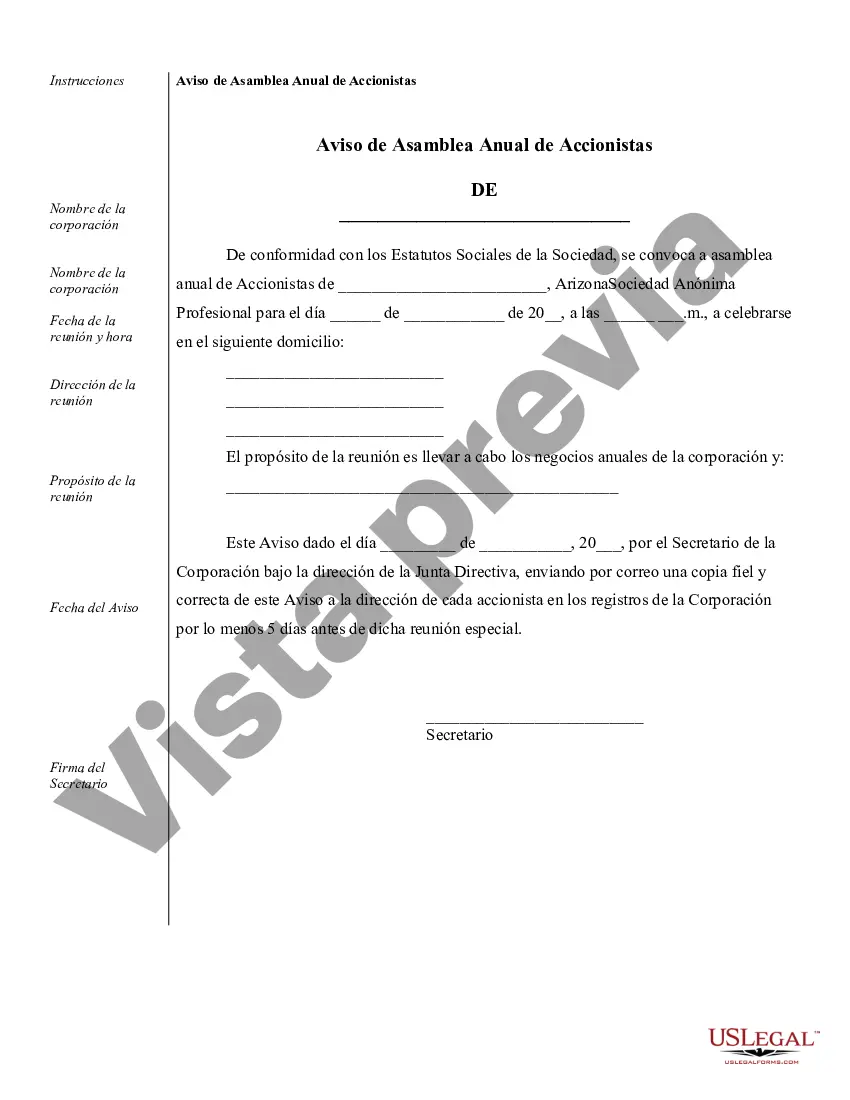

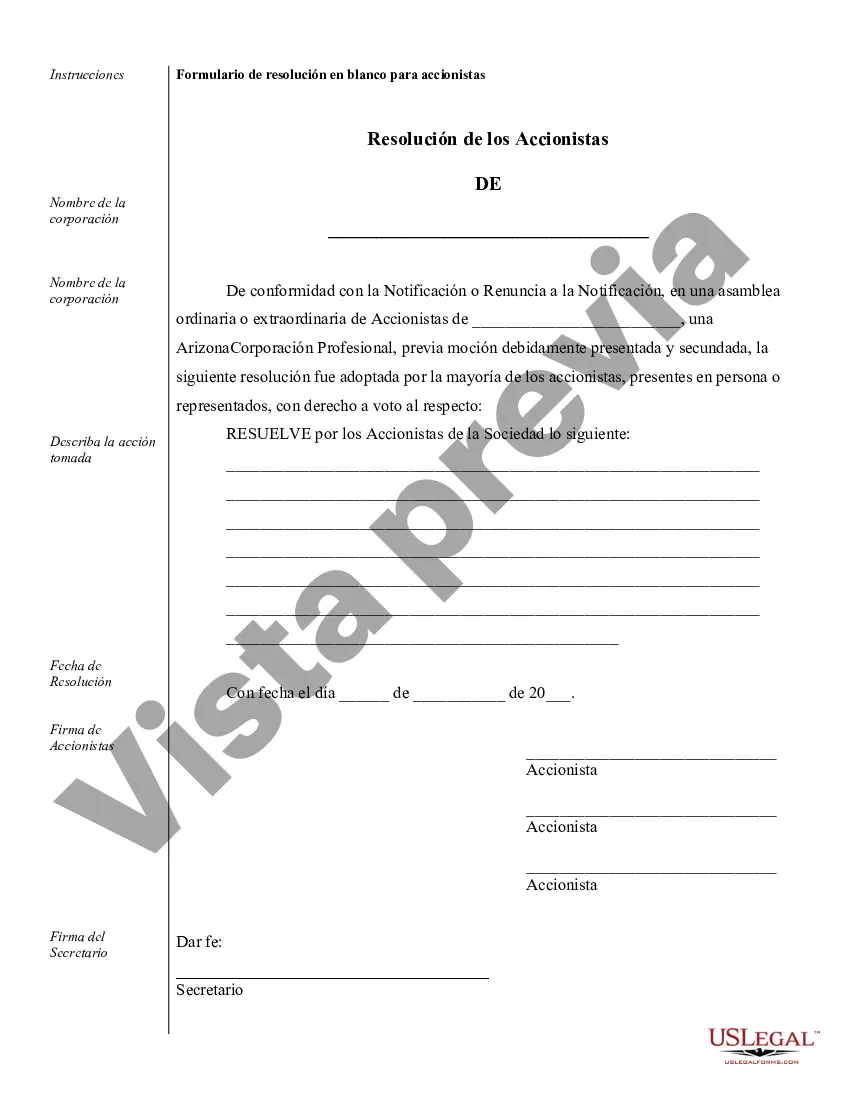

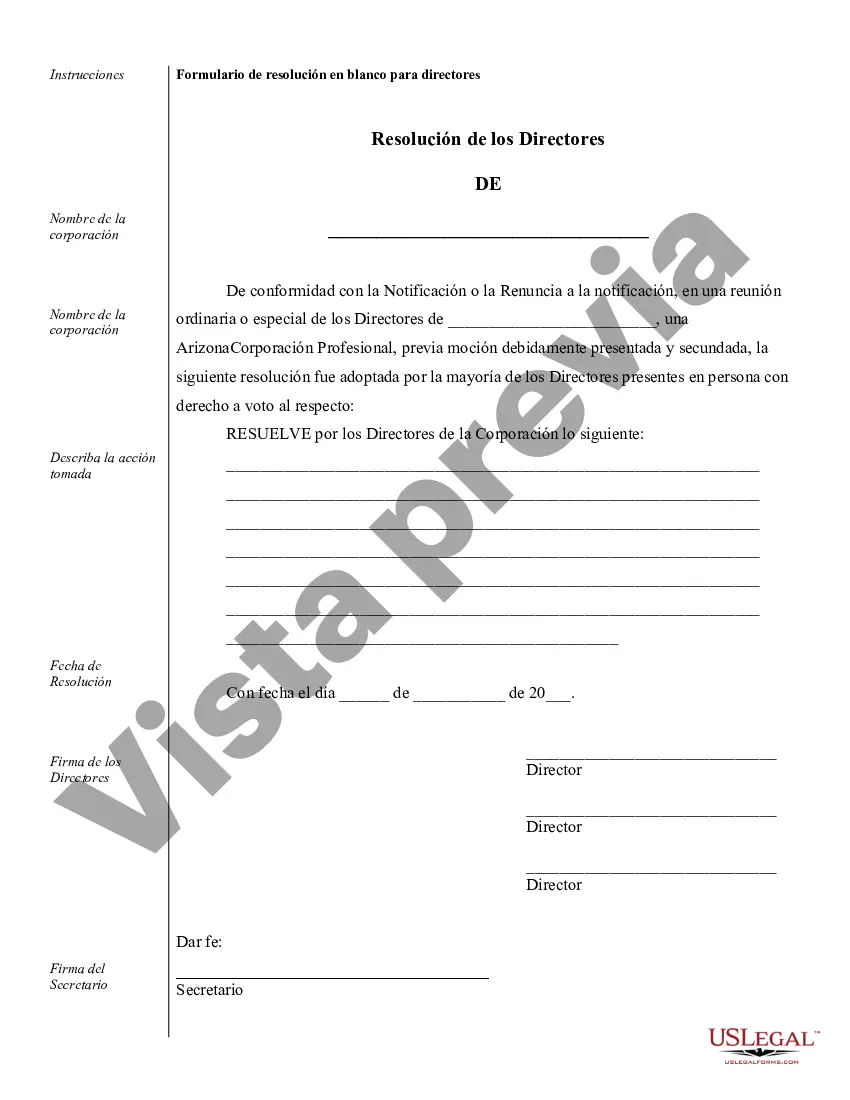

Maricopa Sample Corporate Records for an Arizona Professional Corporation are essential documents that help maintain accurate and detailed records of the company's activities, transactions, and legal compliance. These records ensure transparency, protect the corporation's interests, and facilitate smooth operations. Various types of corporate records exist for an Arizona Professional Corporation in Maricopa County. Let's explore some of them: 1. Articles of Incorporation: This record outlines vital information about the corporation, including its name, purpose, registered agent, and type of professional services offered. 2. Bylaws: These documents serve as an internal rule book, governing how the corporation operates, its structure, roles, responsibilities, and decision-making processes. 3. Shareholders' Meeting Minutes: These are detailed records of meetings held among the corporation's shareholders to discuss and document important decisions, such as electing board members, approving financial matters, or amending bylaws. 4. Board of Directors Meeting Minutes: Similar to shareholders' meeting minutes, these records document board meetings where directors discuss and decision matters that affect the corporation's operations, strategy, and long-term plans. 5. Stock Ledgers: This record maintains a ledger of all outstanding shares issued by the corporation, detailing the shareholders' names, the number of shares held, and any transfers or changes in ownership. 6. Financial Statements: These statements provide an overview of the corporation's financial health, including balance sheets, income statements, and cash flow statements. They illustrate the company's financial performance and help stakeholders understand its profitability and stability. 7. Annual Reports: This comprehensive document summarizes the corporation's activities and achievements over a fiscal year, including financial information, operational highlights, and future plans. It is often shared with shareholders and regulatory bodies. 8. Contracts and Agreements: These records encompass various legal contracts and agreements the corporation enters into, such as client contracts, partnership agreements, leases, or employment contracts. They ensure clarity and outline the rights and obligations of the involved parties. 9. Licenses and Permits: In regulated industries, maintaining records of licenses, permits, and certifications is crucial to demonstrate compliance with legal requirements in providing professional services. 10. Tax Records: These records include tax returns, supporting financial documentation, payroll records, and other tax-related documents required by federal, state, and local tax authorities. Effectively managing and organizing these Maricopa Sample Corporate Records is crucial to ensure legal compliance, facilitate audits, attract investors or lenders, and maintain a professional reputation. While the specific record-keeping requirements may vary based on the corporation's nature and industry, maintaining a comprehensive set of corporate records is essential for the smooth and successful operation of an Arizona Professional Corporation in Maricopa County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Muestra de registros corporativos para una corporación profesional de Arizona - Sample Corporate Records for a Arizona Professional Corporation

Description

How to fill out Maricopa Muestra De Registros Corporativos Para Una Corporación Profesional De Arizona?

Benefit from the US Legal Forms and obtain instant access to any form sample you require. Our useful website with a huge number of documents makes it simple to find and get virtually any document sample you want. You are able to save, complete, and sign the Maricopa Sample Corporate Records for a Arizona Professional Corporation in just a matter of minutes instead of browsing the web for many hours attempting to find the right template.

Utilizing our collection is a great strategy to raise the safety of your document filing. Our professional attorneys regularly review all the documents to ensure that the forms are appropriate for a particular state and compliant with new acts and regulations.

How can you obtain the Maricopa Sample Corporate Records for a Arizona Professional Corporation? If you have a profile, just log in to the account. The Download button will appear on all the documents you look at. Furthermore, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction listed below:

- Open the page with the template you need. Ensure that it is the form you were hoping to find: examine its headline and description, and use the Preview function when it is available. Otherwise, make use of the Search field to find the needed one.

- Start the saving process. Click Buy Now and select the pricing plan you like. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the document. Choose the format to get the Maricopa Sample Corporate Records for a Arizona Professional Corporation and revise and complete, or sign it for your needs.

US Legal Forms is among the most significant and trustworthy template libraries on the internet. We are always ready to assist you in virtually any legal procedure, even if it is just downloading the Maricopa Sample Corporate Records for a Arizona Professional Corporation.

Feel free to take advantage of our platform and make your document experience as straightforward as possible!

Form popularity

Interesting Questions

More info

's×. For more information on filing fees and forms for organizations, visit our Guide to Nonprofit Organizations (PDF) or look up your legal options through the Secretary of State. The LLC is created for exclusive business use only, it is not for resale nor for the use of other individuals or entities. An LLC is not a limited liability company (LLC) or a corporation. Only individuals are allowed to form LLC, including sole proprietors. LLC's are created by a written instrument or by the registered owner. It is essential to maintain the registered owners name accurately. You must provide your full legal name on the application, and you may use a different legal name than your business name. The registered owner must be the entity being formed, which you must include on the application.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.