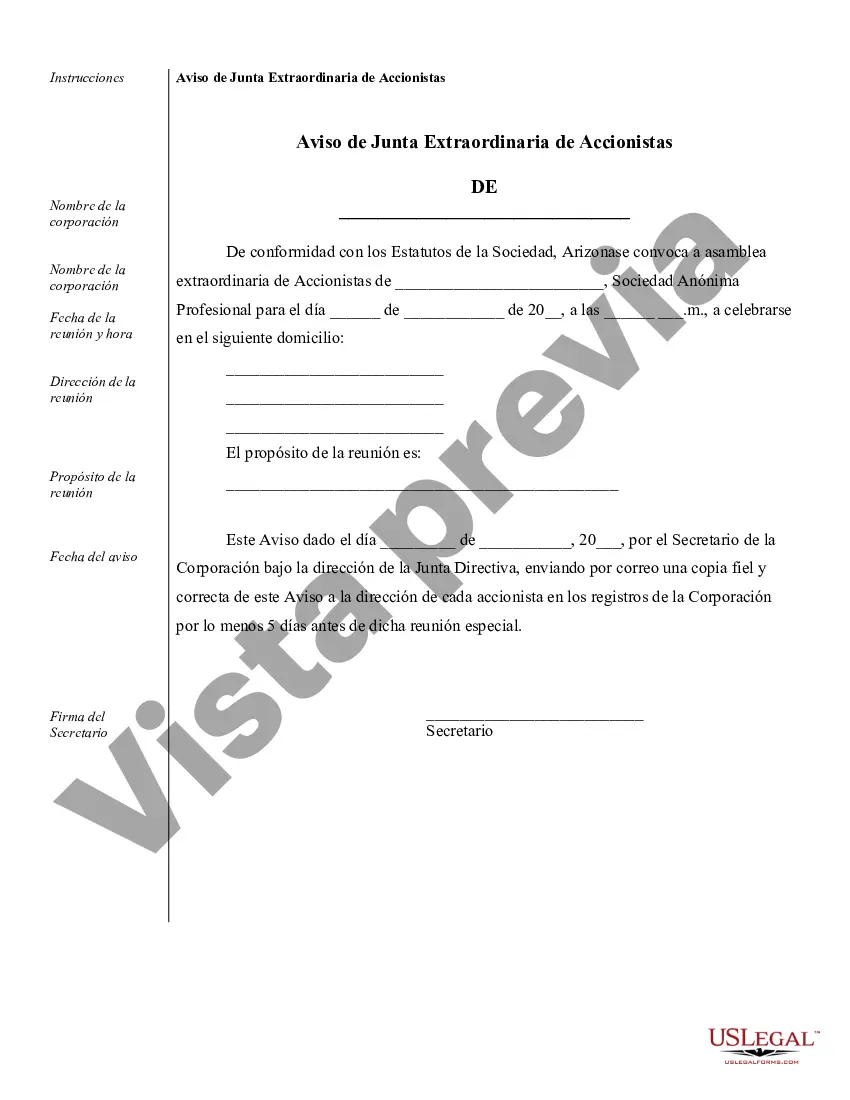

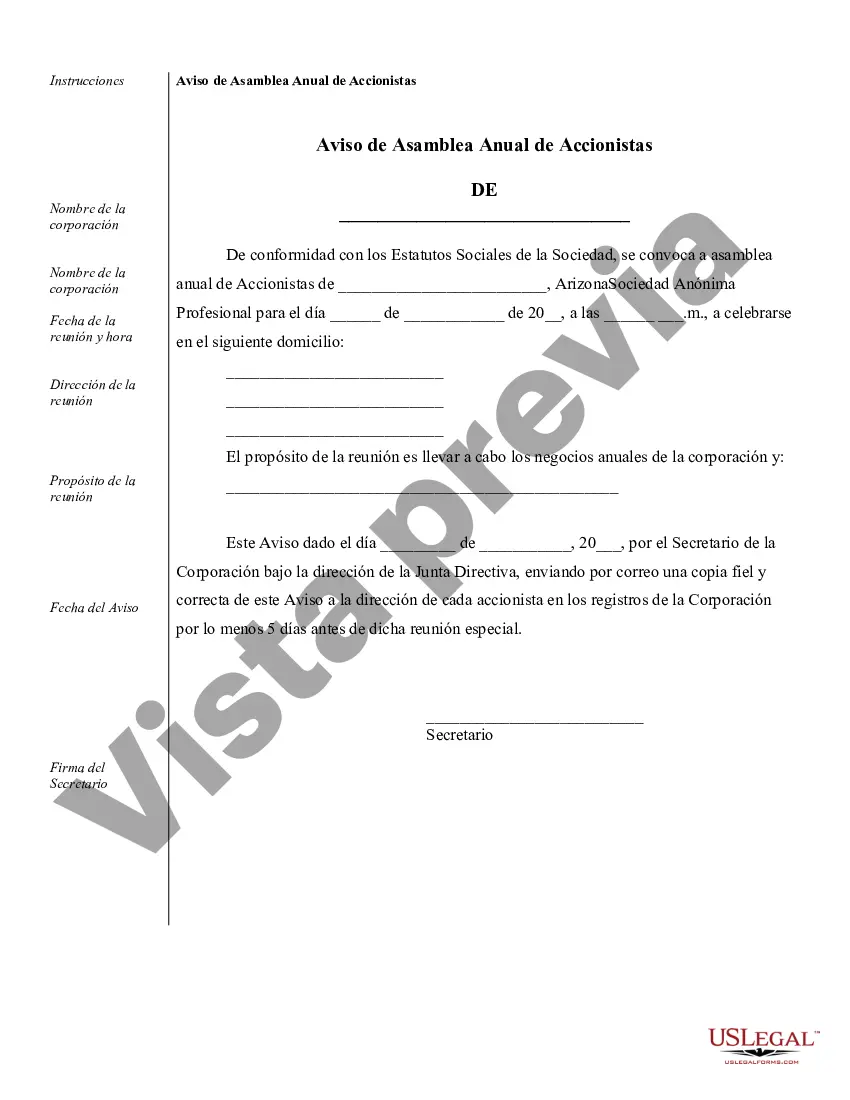

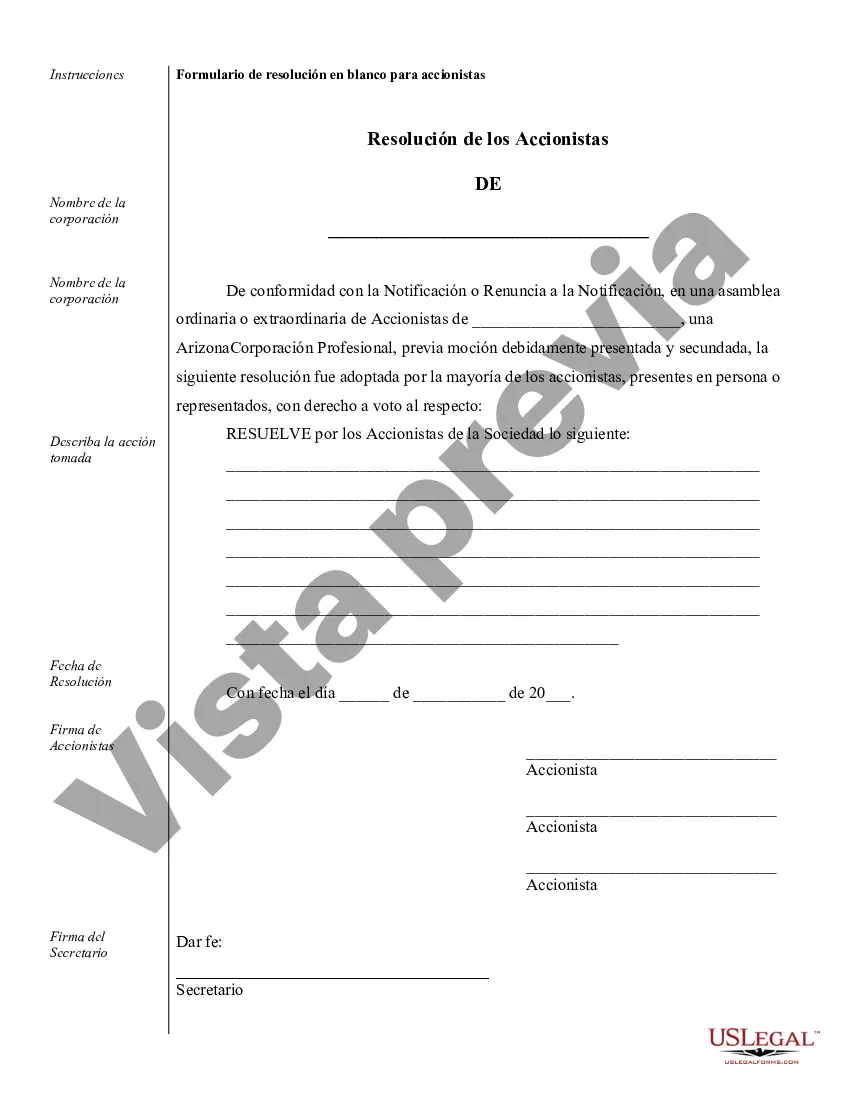

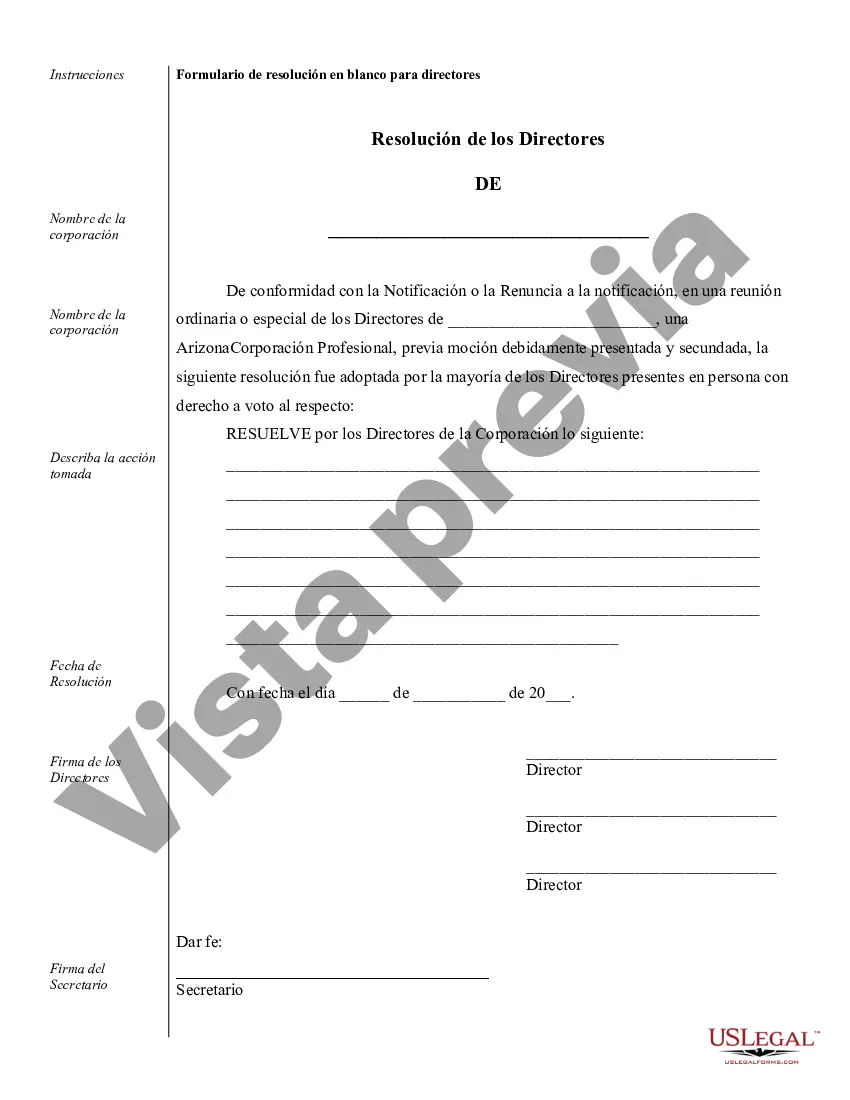

Phoenix Sample Corporate Records for an Arizona Professional Corporation refer to the official documents and records that a professional corporation in Arizona is required to maintain. These records play a vital role in documenting the corporation's activities, compliance with legal regulations, and financial transactions. The different types of Phoenix Sample Corporate Records for an Arizona Professional Corporation may include: 1. Articles of Incorporation: These documents provide information about the corporation's formation, including its name, purpose, registered agent, and duration. 2. Bylaws: Bylaws are the internal rules and regulations that govern the corporation's operations, such as the roles of directors and officers, voting procedures, and meeting protocols. 3. Board of Directors' Meeting Minutes: These records document the discussions, decisions, and actions taken during the meetings of the corporation's board of directors. They may cover topics such as corporate governance, financial matters, and strategic decisions. 4. Shareholder Meeting Minutes: Similar to board meeting minutes, shareholder meeting minutes document the discussions, decisions, and actions taken during the meetings of the corporation's shareholders. These minutes are particularly relevant when the corporation's shareholders need to vote on important matters, such as electing directors or making significant corporate changes. 5. Stock Ledgers: Stock ledgers keep track of the corporation's ownership structure and the issuance and transfer of its stocks. They record details about each shareholder, including their names, addresses, and ownership percentages. 6. Annual Reports: Arizona professional corporations are required to file annual reports with the Arizona Corporation Commission (ACC). These reports provide an update on the corporation's current standing, including details of its officers, directors, and shareholders. 7. Tax Filings and Financial Statements: Professional corporations must maintain tax filings, including federal and state income tax returns, payroll tax records, and any other relevant tax documents. Financial statements, such as balance sheets and income statements, reflect the corporation's financial position and performance. 8. Stock Certificates: Stock certificates serve as legal proof of ownership for shareholders. They indicate the number of shares owned by a shareholder and may contain additional information about the corporation. 9. Employment Contracts and Licensing: Professional corporations often have employment contracts with their officers, directors, and key employees. These contracts outline the terms of employment, compensation, and any other obligations. Licensing documents, such as professional licenses or permits, are also part of the corporate records if applicable to the corporation's activities. 10. Contracts and Agreements: Corporate records may include copies of contracts and agreements the corporation has entered into, such as lease agreements, client contracts, vendor agreements, and partnership agreements. 11. Minutes of Committee Meetings: If the corporation has established committees, such as an audit committee, these minutes record the discussions and actions taken during committee meetings. It is important for a professional corporation in Arizona to maintain these corporate records in an organized and easily accessible manner, as they not only ensure compliance with legal requirements, but also facilitate transparency and accountability within the corporation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Muestra de registros corporativos para una corporación profesional de Arizona - Sample Corporate Records for a Arizona Professional Corporation

Description

How to fill out Phoenix Muestra De Registros Corporativos Para Una Corporación Profesional De Arizona?

Do you need a trustworthy and inexpensive legal forms provider to get the Phoenix Sample Corporate Records for a Arizona Professional Corporation? US Legal Forms is your go-to solution.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of separate state and area.

To download the document, you need to log in account, find the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Phoenix Sample Corporate Records for a Arizona Professional Corporation conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the document is intended for.

- Restart the search in case the template isn’t good for your legal scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Phoenix Sample Corporate Records for a Arizona Professional Corporation in any provided format. You can get back to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time researching legal paperwork online for good.