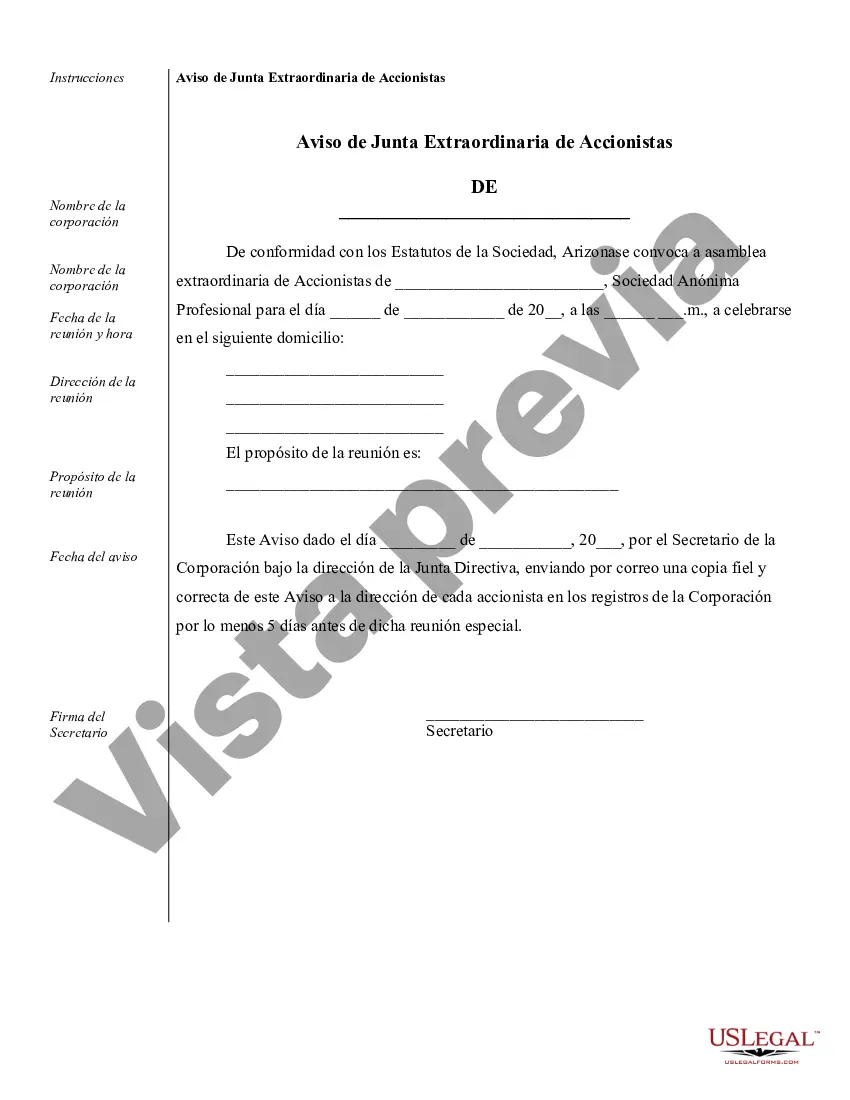

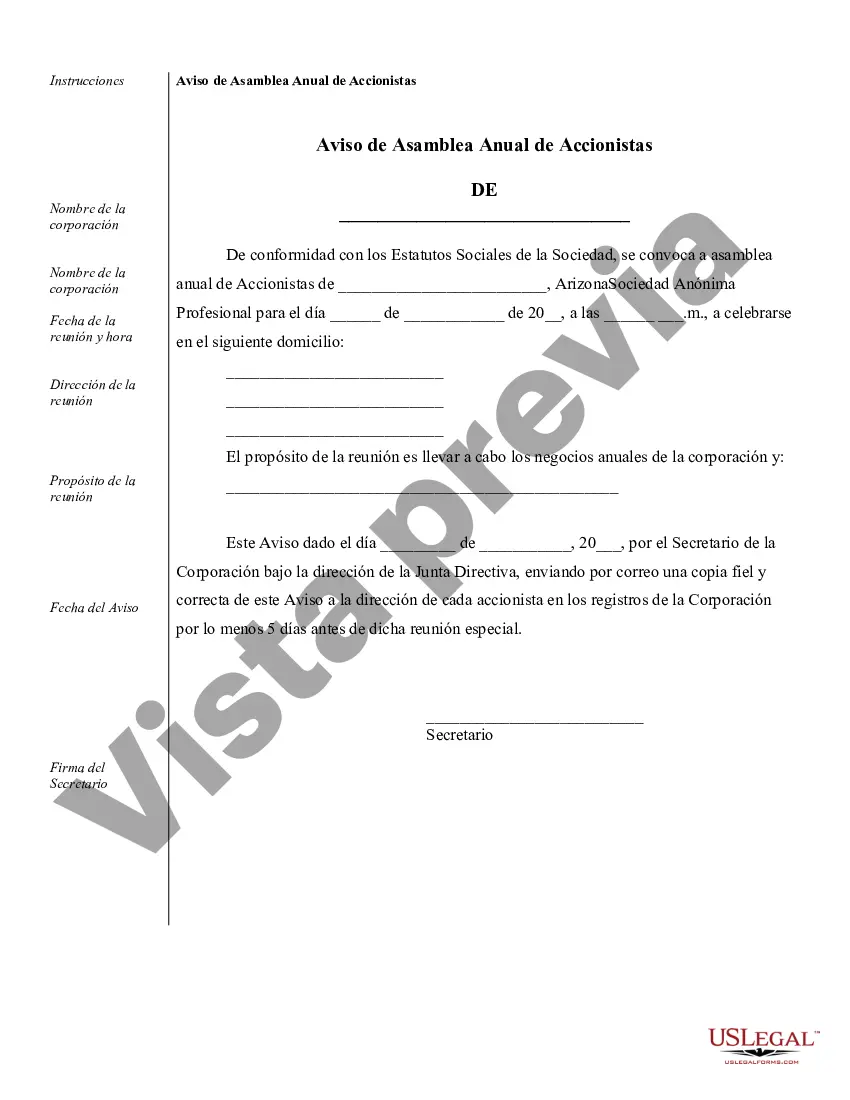

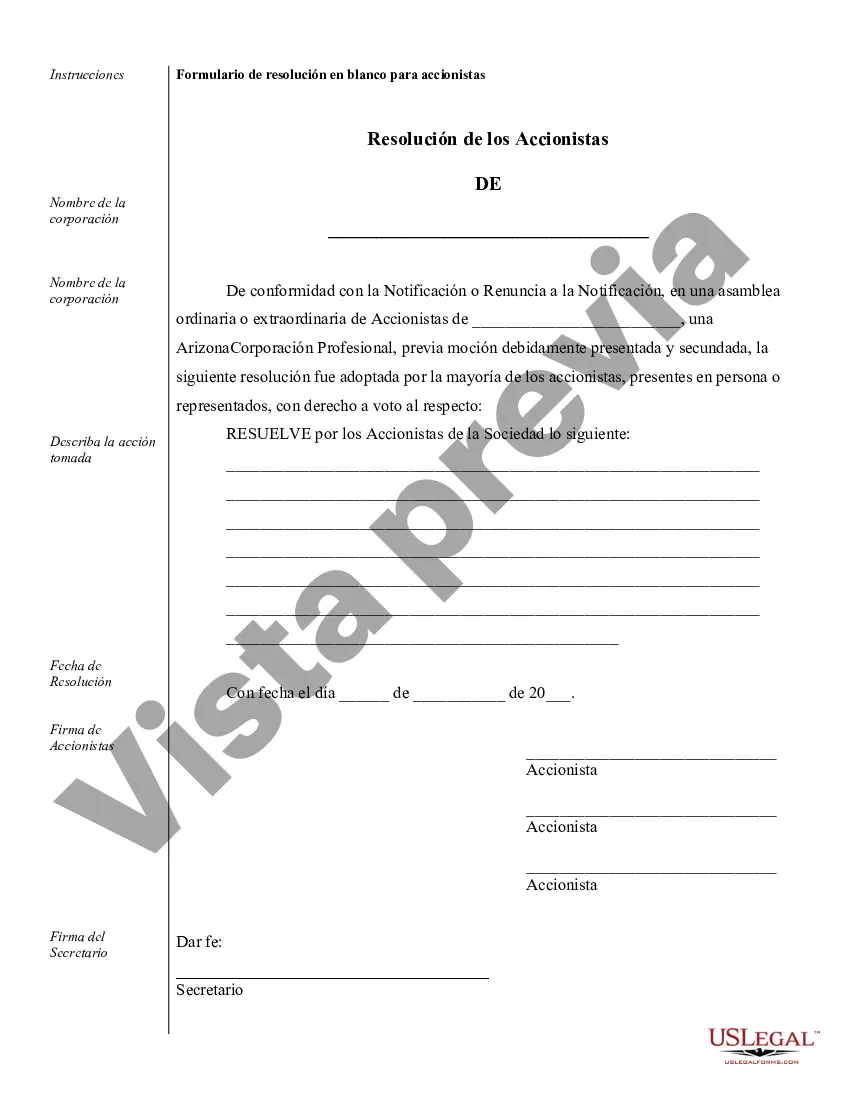

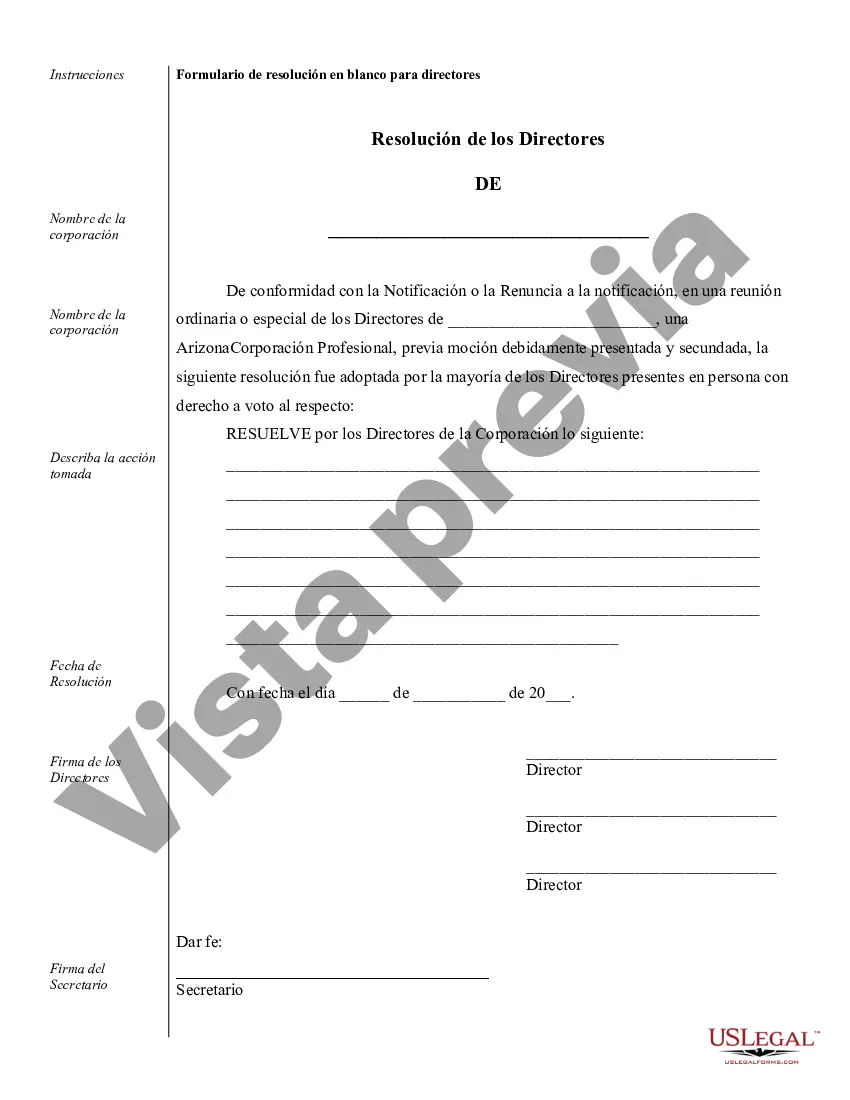

Lima Sample Corporate Records for an Arizona Professional Corporation are essential documents that provide a comprehensive record of the company's activities, operations, and compliance with state regulations. These records serve as an invaluable resource for the corporation's management, shareholders, auditors, and regulatory authorities. Here are some key aspects and types of records typically included in a Lima Sample Corporate Records package: 1. Articles of Incorporation: The Articles of Incorporation is a legal document filed with the Arizona Corporation Commission that establishes the existence of the Professional Corporation in Pima County, Arizona. It contains vital information about the company, such as its name, purpose, registered agent, directors, and shareholders. 2. Bylaws: The Bylaws define the internal rules and regulations governing the Professional Corporation's operations, including procedures for holding meetings, electing directors, appointing officers, and conducting business. These rules help ensure transparency and consistency within the company. 3. Meeting Minutes: Meeting minutes are detailed records of the discussions, decisions, and resolutions made during board meetings, annual general meetings, and other important gatherings. These minutes serve as a historical account of corporate decision-making and can be used as evidence of compliance with corporate governance standards. 4. Shareholder Records: Shareholder records outline the ownership details, including the names, contact information, and the number of shares held by each shareholder. These records are crucial for verifying the legitimacy of shareholder claims, determining voting rights, and distributing dividends. 5. Financial Statements: Lima Sample Corporate Records often include audited financial statements, including balance sheets, income statements, and cash flow statements. These statements depict the financial health and performance of the Professional Corporation, providing crucial information for shareholders, potential investors, lenders, and tax authorities. 6. Employment Contracts: This category includes employment agreements with key personnel, directors, and officers of the corporation. These contracts outline the terms and conditions of employment, including compensation, benefits, job responsibilities, and termination clauses. 7. Licenses and Permits: Records pertaining to licenses, permits, and certifications obtained by the Professional Corporation to operate legally in Pima County, Arizona. This includes any professional licenses and permits necessary to offer specific services or operate within regulated industries. 8. Intellectual Property Records: If the Arizona Professional Corporation holds any patents, trademarks, copyrights, or trade secrets, records related to protecting and managing these intellectual properties should be included. This ensures that the corporation's intellectual property rights are safeguarded. 9. Taxation Records: Comprehensive tax records detailing the payment of federal, state, and local taxes by the Professional Corporation. This includes tax returns, related schedules, supporting documents, and correspondence with tax authorities. 10. Contracts and Agreements: Copies of important contracts and agreements entered into by the corporation, such as client contracts, vendor agreements, lease agreements, and partnership agreements. These records help preserve legal rights, obligations, and commitments made by the Professional Corporation. By maintaining a meticulously organized set of Lima Sample Corporate Records, the Arizona Professional Corporation can demonstrate its compliance with legal requirements, its financial stability, and its commitment to transparent business practices.

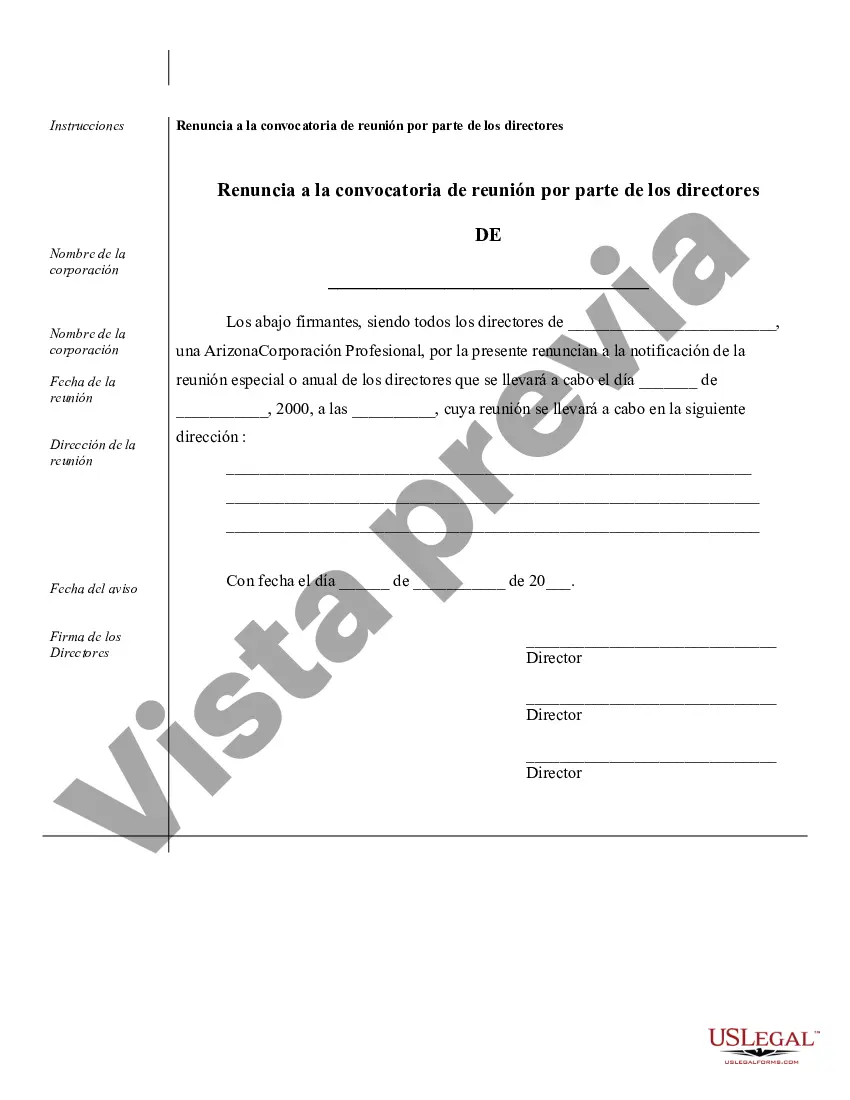

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Muestra de registros corporativos para una corporación profesional de Arizona - Sample Corporate Records for a Arizona Professional Corporation

Description

How to fill out Pima Muestra De Registros Corporativos Para Una Corporación Profesional De Arizona?

Make use of the US Legal Forms and obtain immediate access to any form you require. Our useful platform with thousands of document templates allows you to find and get virtually any document sample you want. You are able to save, fill, and sign the Pima Sample Corporate Records for a Arizona Professional Corporation in just a matter of minutes instead of browsing the web for hours looking for a proper template.

Utilizing our library is a great way to increase the safety of your record submissions. Our experienced attorneys regularly review all the records to ensure that the forms are appropriate for a particular state and compliant with new acts and regulations.

How do you get the Pima Sample Corporate Records for a Arizona Professional Corporation? If you already have a profile, just log in to the account. The Download button will be enabled on all the documents you view. Additionally, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction below:

- Find the template you need. Make sure that it is the template you were seeking: verify its name and description, and use the Preview feature when it is available. Otherwise, utilize the Search field to find the needed one.

- Start the downloading procedure. Click Buy Now and select the pricing plan you like. Then, create an account and process your order using a credit card or PayPal.

- Export the file. Pick the format to get the Pima Sample Corporate Records for a Arizona Professional Corporation and change and fill, or sign it according to your requirements.

US Legal Forms is among the most considerable and reliable template libraries on the web. Our company is always happy to assist you in virtually any legal case, even if it is just downloading the Pima Sample Corporate Records for a Arizona Professional Corporation.

Feel free to take advantage of our service and make your document experience as straightforward as possible!