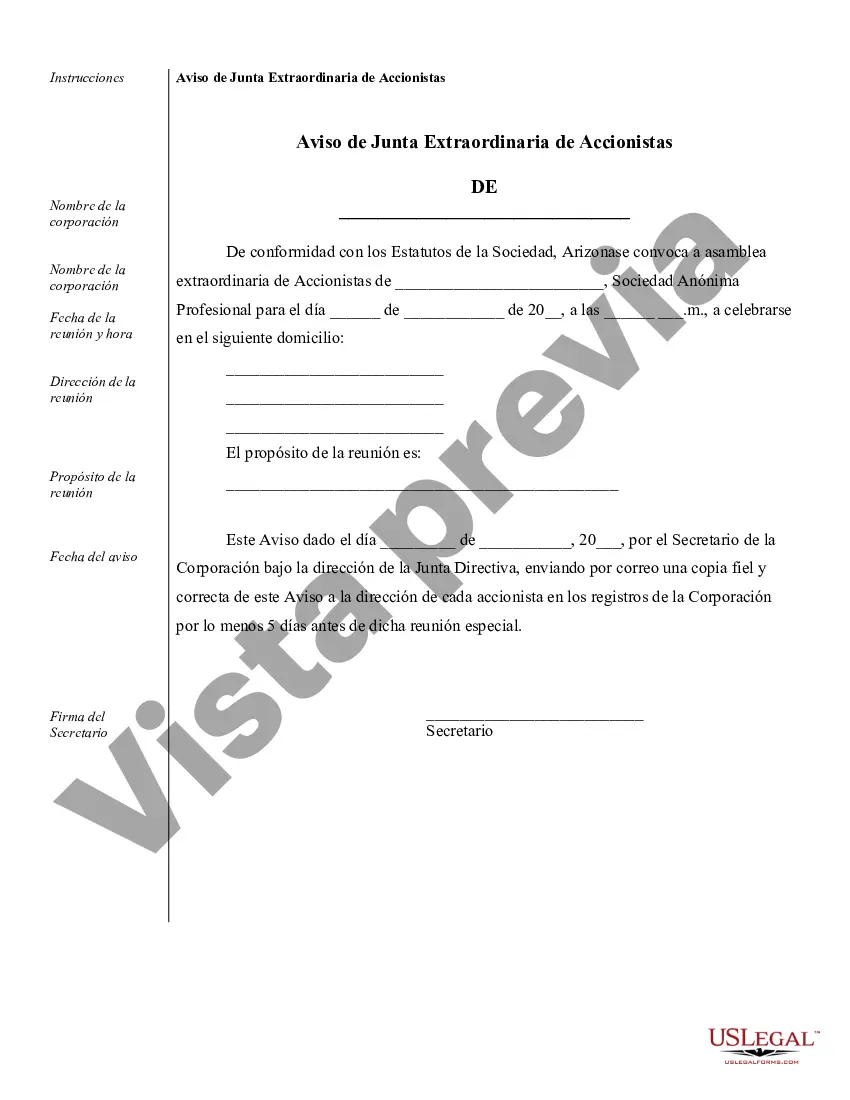

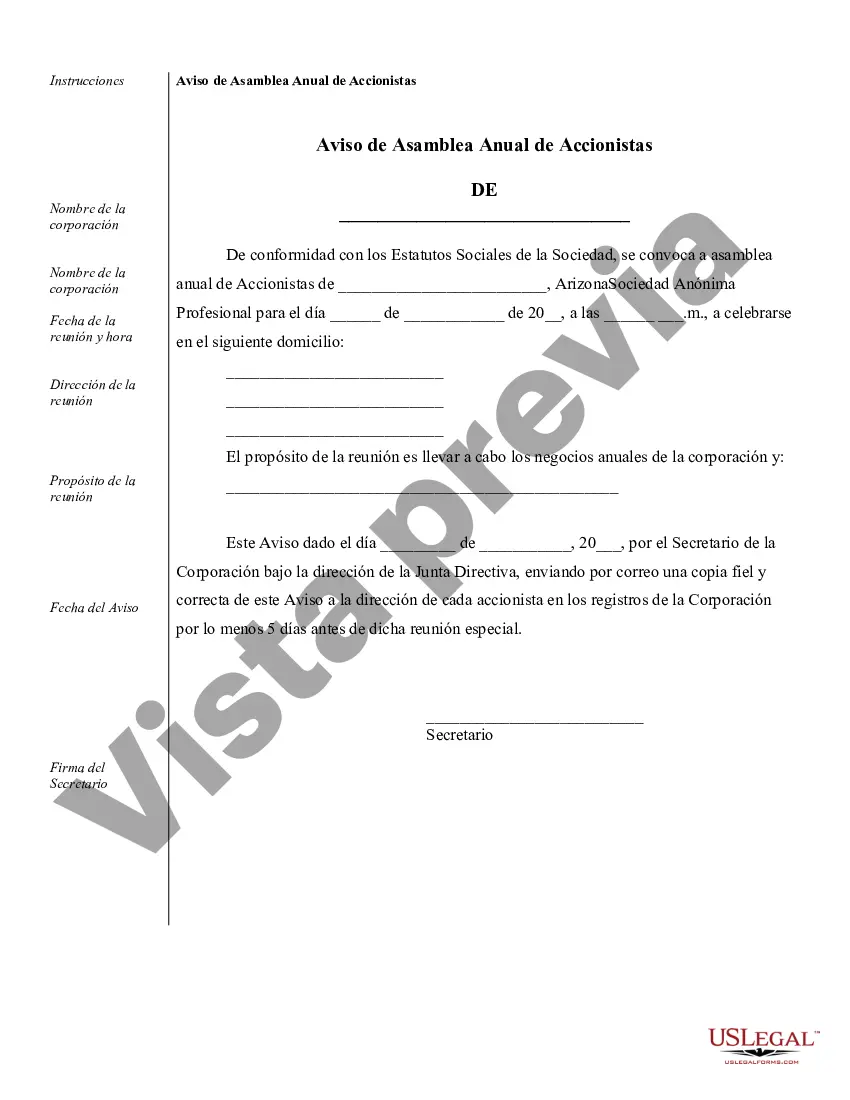

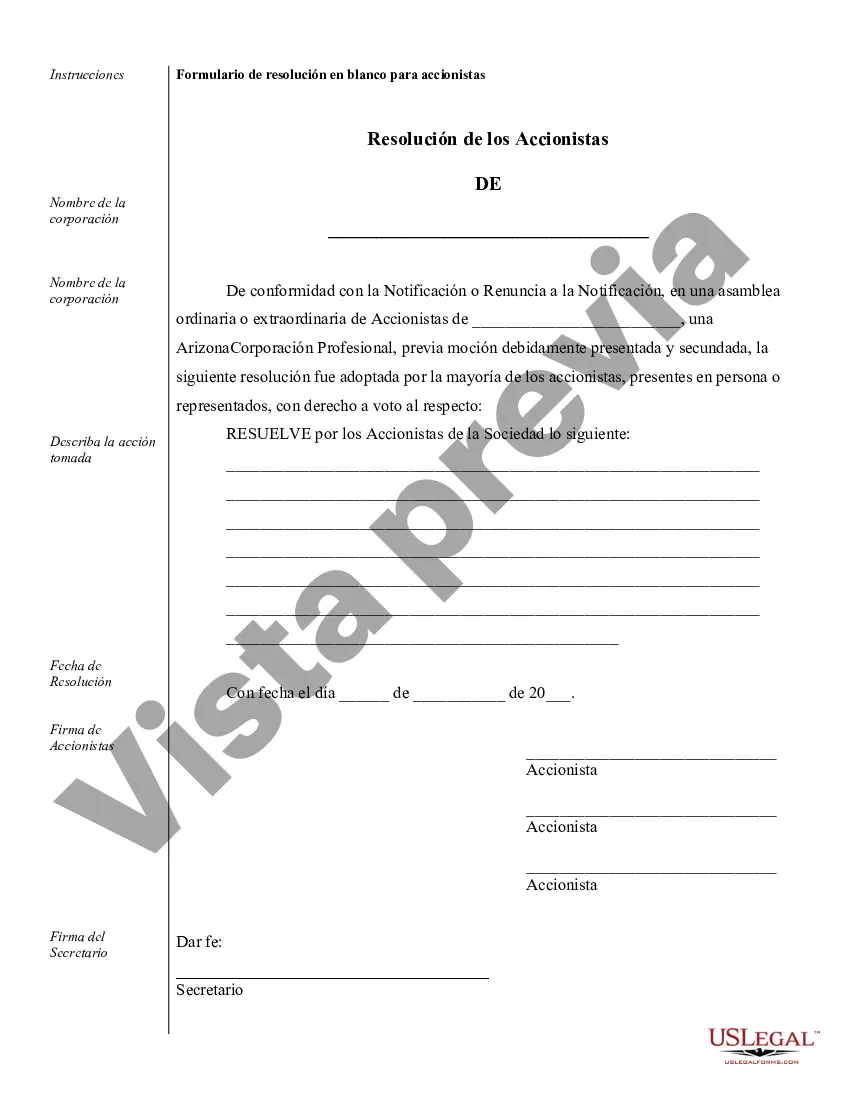

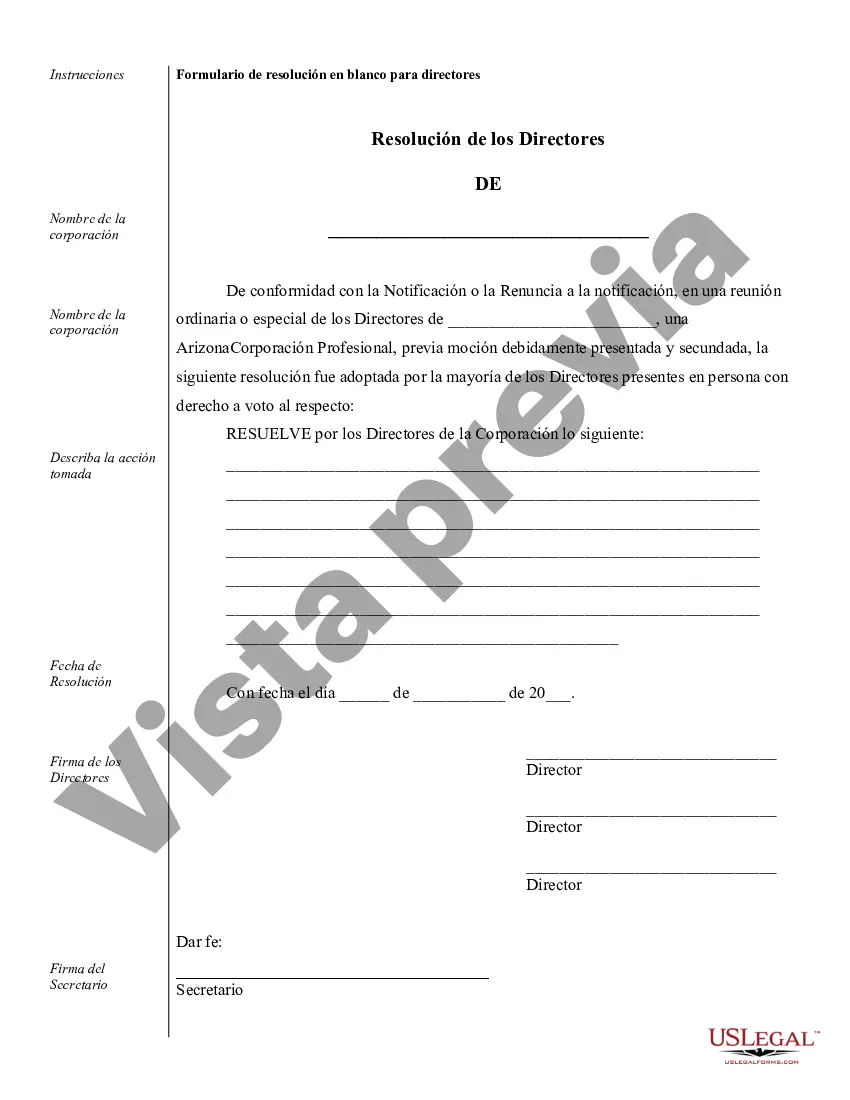

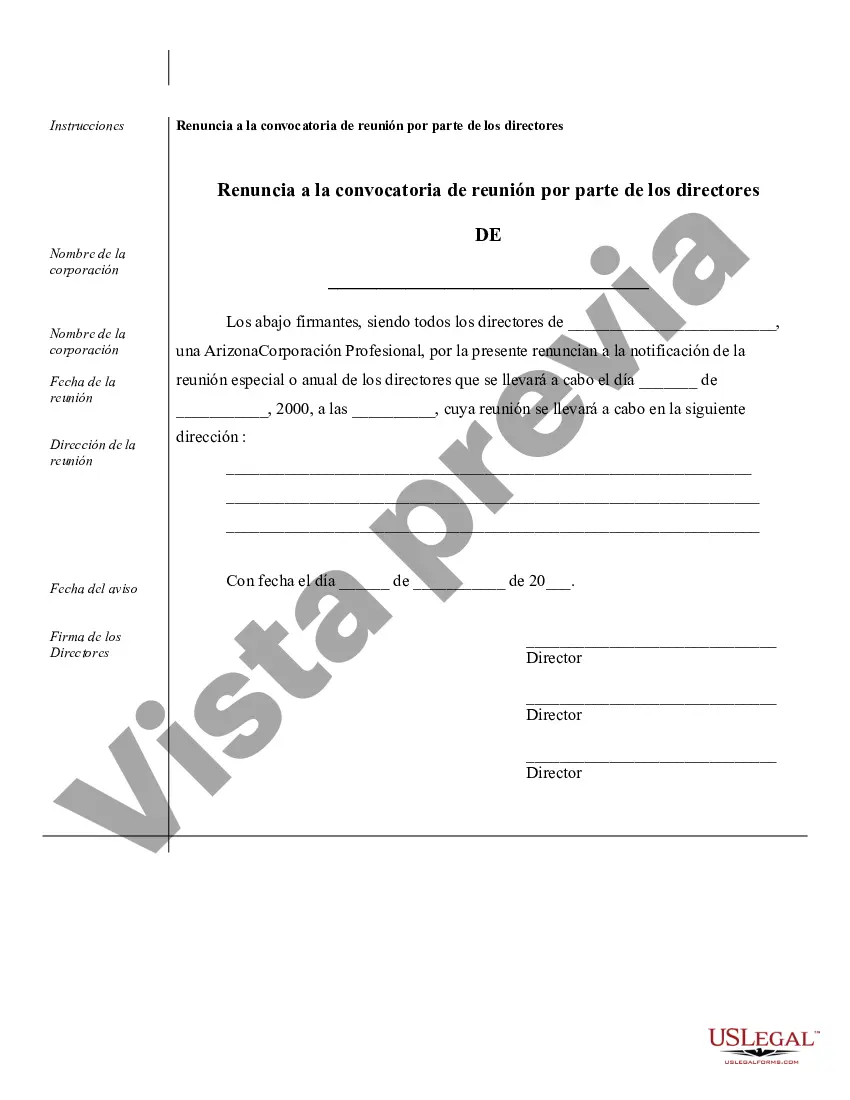

Surprise Sample Corporate Records for an Arizona Professional Corporation are essential documents that provide a comprehensive and thorough record of the company's operations, compliance, and overall organizational structure. These records serve as the foundation for legal and regulatory compliance, internal decision-making processes, and potential audits or investigations. Ensuring the accuracy and maintenance of corporate records is crucial to establishing transparency, protecting the corporation's interests, and fostering trust among stakeholders. Listed below are some different types of Surprise Sample Corporate Records for an Arizona Professional Corporation: 1. Articles of Incorporation: These foundational documents establish the corporation as a legal entity in Arizona. They include details such as the corporation's name, purpose, registered agent, initial directors, and the number of authorized shares. 2. Bylaws: Bylaws outline the rules and procedures governing the corporation's internal affairs, including shareholder and director meetings, voting procedures, and the roles and responsibilities of officers and directors. 3. Stock Ledger: This record maintains an accurate account of the corporation's stockholders, their respective shareholdings, stock certificates issued, and any transfers or changes in ownership. 4. Meeting Minutes: Detailed notes or minutes of all board of directors and shareholder meetings should be recorded. These minutes reflect matters discussed, decisions made, and actions taken during these meetings. 5. Financial Statements: Comprehensive financial statements, including balance sheets, income statements, and cash flow statements, provide an overview of the corporation's financial position and performance. These records should adhere to generally accepted accounting principles (GAAP). 6. Annual Reports: An annual report summarizes the corporation's activities, financial performance, and future prospects. It typically includes a message from the CEO or President, financial statements, and other pertinent information required by the Arizona Corporation Commission. 7. Shareholder Agreements: These agreements outline the rights, obligations, and responsibilities of shareholders, addressing matters such as stock transfers, buy-sell provisions, shareholder voting, and dispute resolution mechanisms. 8. Employment Contracts: Employment contracts should be maintained for key executives and employees, outlining terms and conditions of employment, compensation details, benefits, and expectations. 9. Licenses, Permits, and Certifications: Copies of licenses, permits, and certifications obtained by the corporation to conduct its professional services should be kept to evidence compliance with applicable regulations. 10. Tax Records: All tax-related documents, including federal and state tax returns, tax payments, and correspondence with tax authorities, should be retained for compliance and audit purposes. Overall, Surprise Sample Corporate Records for an Arizona Professional Corporation encompass a wide range of documents that are indispensable for demonstrating legal compliance, financial stability, and operational transparency. The particular records required may vary based on industry-specific regulations and the corporation's business structure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Surprise Muestra de registros corporativos para una corporación profesional de Arizona - Sample Corporate Records for a Arizona Professional Corporation

Description

How to fill out Surprise Muestra De Registros Corporativos Para Una Corporación Profesional De Arizona?

If you are looking for a relevant form, it’s impossible to find a better place than the US Legal Forms site – probably the most considerable libraries on the internet. With this library, you can find thousands of templates for business and personal purposes by categories and regions, or key phrases. With the high-quality search option, finding the latest Surprise Sample Corporate Records for a Arizona Professional Corporation is as easy as 1-2-3. Furthermore, the relevance of each file is confirmed by a team of skilled attorneys that on a regular basis review the templates on our platform and update them based on the newest state and county requirements.

If you already know about our platform and have a registered account, all you should do to get the Surprise Sample Corporate Records for a Arizona Professional Corporation is to log in to your user profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have chosen the sample you want. Check its explanation and make use of the Preview option (if available) to check its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to find the proper file.

- Affirm your decision. Choose the Buy now button. Following that, select the preferred subscription plan and provide credentials to register an account.

- Process the transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Get the template. Choose the format and download it on your device.

- Make changes. Fill out, edit, print, and sign the acquired Surprise Sample Corporate Records for a Arizona Professional Corporation.

Every single template you add to your user profile does not have an expiration date and is yours forever. You can easily gain access to them via the My Forms menu, so if you need to have an additional duplicate for enhancing or printing, you can return and download it once more whenever you want.

Take advantage of the US Legal Forms extensive collection to gain access to the Surprise Sample Corporate Records for a Arizona Professional Corporation you were seeking and thousands of other professional and state-specific templates on one platform!