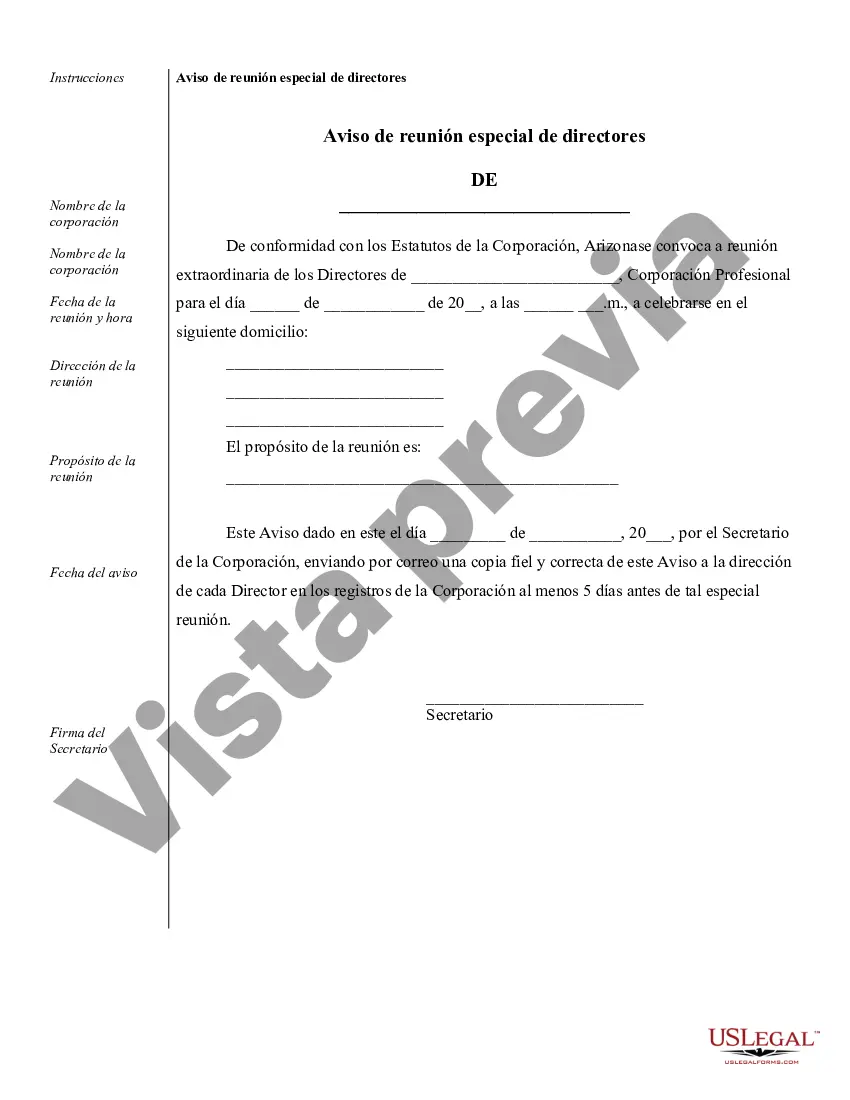

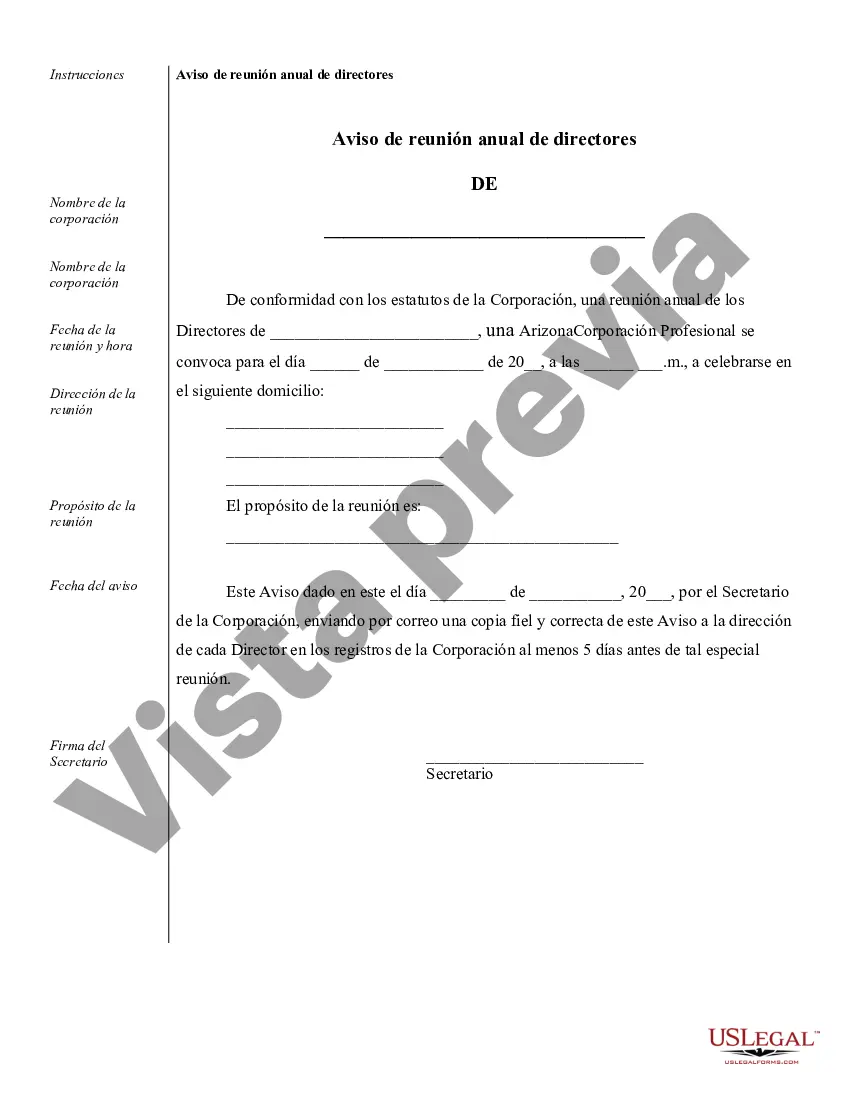

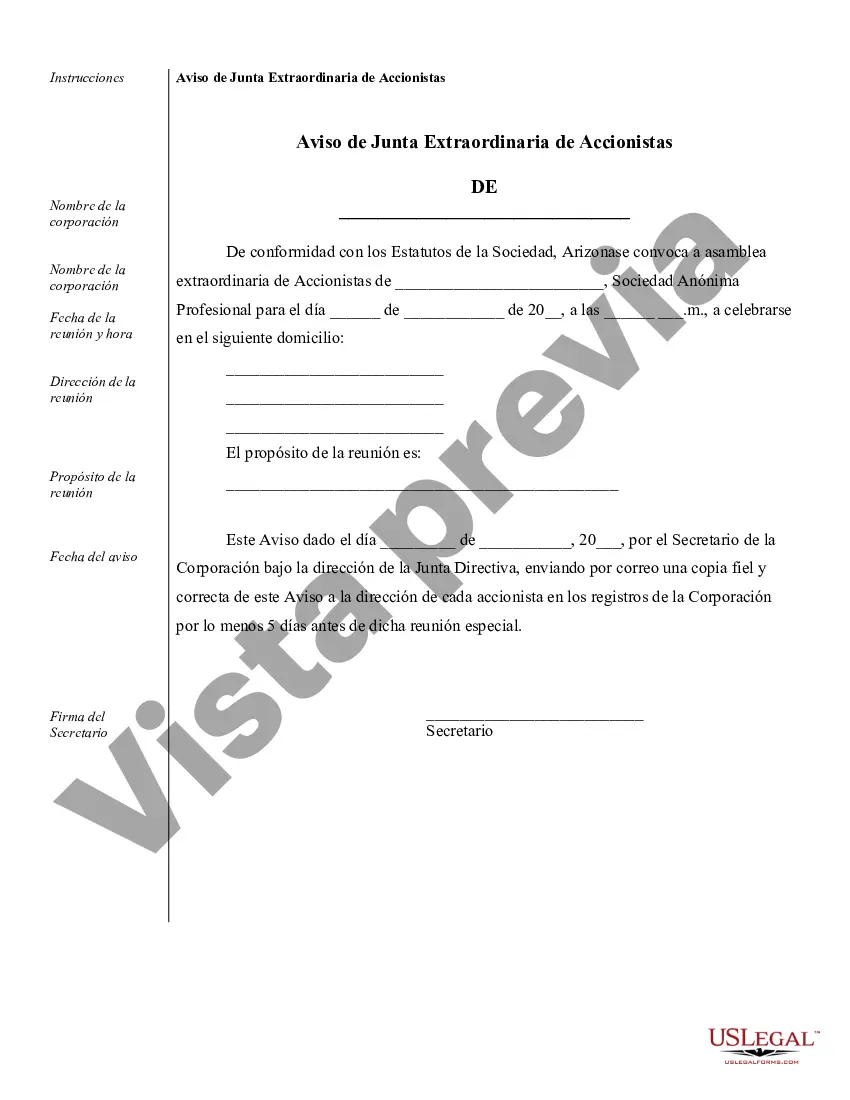

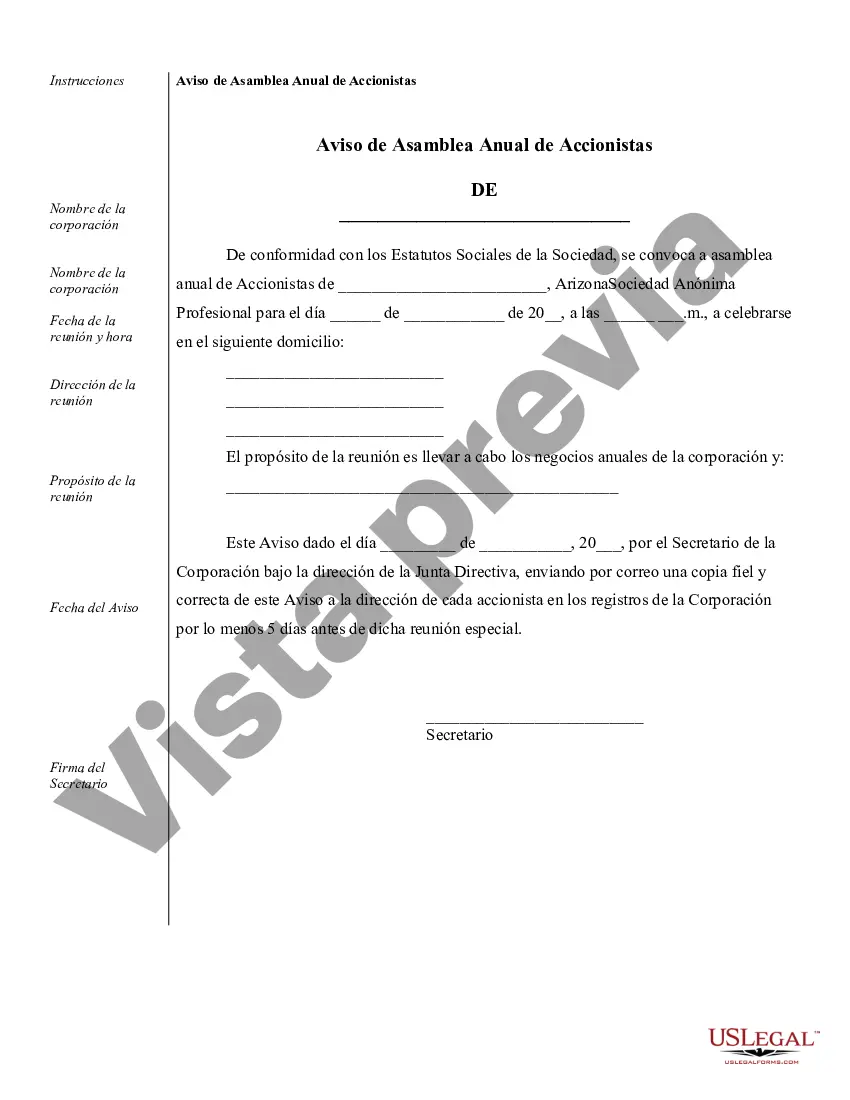

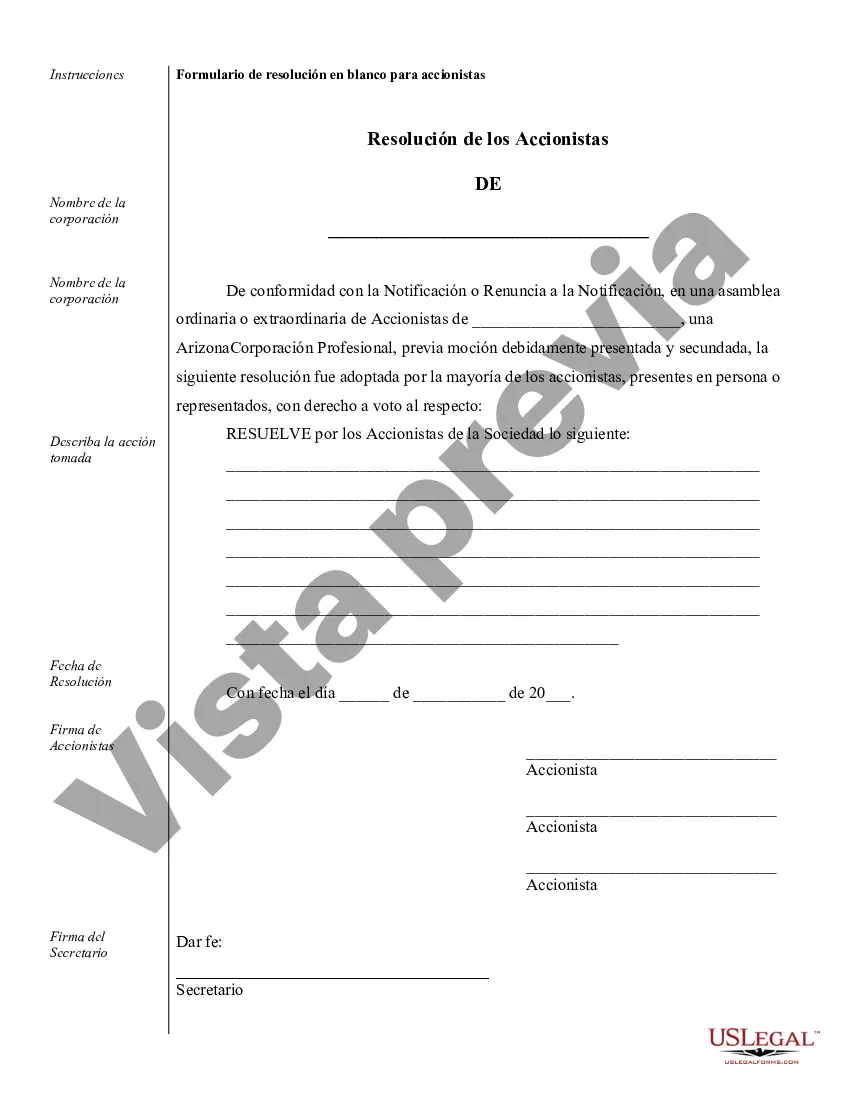

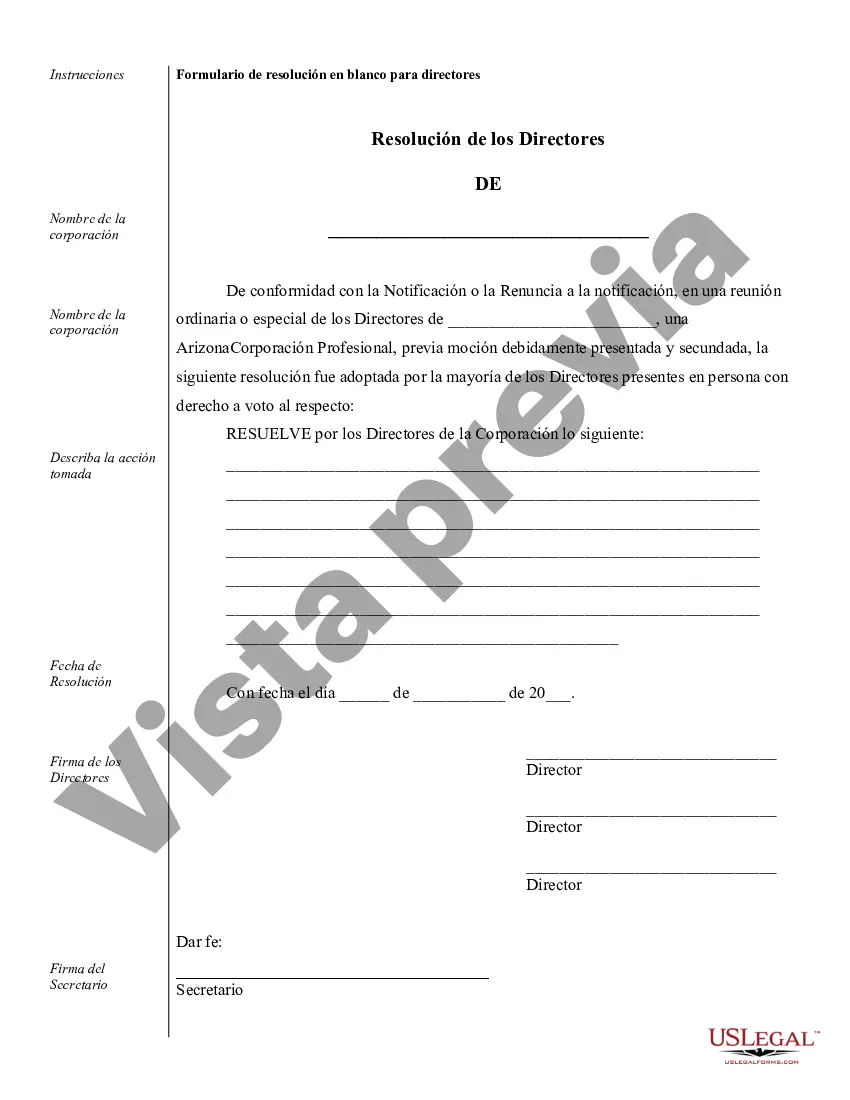

Title: Tucson Sample Corporate Records for an Arizona Professional Corporation: A Comprehensive Overview Introduction: When operating a professional corporation in the vibrant city of Tucson, Arizona, it is essential to maintain accurate and organized corporate records. These records serve as valuable evidence of the company's legal structure, financial health, and overall compliance with the state's corporate governance regulations. This article aims to provide a detailed description of Tucson Sample Corporate Records for an Arizona Professional Corporation, shedding light on their significance and various types. Types of Tucson Sample Corporate Records for an Arizona Professional Corporation: 1. Articles of Incorporation: The Articles of Incorporation is the foundational document required to create a professional corporation in Arizona. This record contains pertinent information such as the corporation's name, purpose, location, registered agent, duration, and organizational structure. 2. Bylaws: Bylaws delineate the governing rules and regulations under which the Arizona Professional Corporation operates. This important corporate record outlines directors' powers and responsibilities, the company's decision-making processes, provisions for shareholder meetings, voting procedures, and other vital operational details. 3. Organizational Minutes: Organizational minutes are comprehensive records of the initial meeting of the corporation's directors and officers. These minutes capture significant discussions and decisions made during the meeting, such as the appointment of officers, adoption of bylaws, issuance of shares, and other essential actions necessary for establishing the corporation. 4. Shareholder Agreements: Shareholder agreements outline the rights, obligations, and responsibilities of individual shareholders within the professional corporation. This document addresses matters like share transfer restrictions, voting rights, dividend policies, dispute resolution mechanisms, and other contractual arrangements among shareholders. 5. Stock Certificates: Stock certificates provide physical or digital evidence of ownership in the professional corporation. These certificates typically include details such as the shareholder's name, the number and class of shares owned, unique identification numbers, and the date of issuance. 6. Board Resolutions: Board resolutions document significant decisions made by the board of directors of an Arizona Professional Corporation. These resolutions cover various matters such as major investments, approval of contracts, changes in officer positions, declaration of dividends, and other matters requiring the board's authorization. 7. Financial Reports: Accurate financial records, including income statements, balance sheets, cash flow statements, and tax filings, are crucial for demonstrating the company's financial stability and compliance with regulatory requirements. These records aid in evaluating the professional corporation's profitability, liquidity, and financial health over time. Conclusion: Maintaining meticulous and up-to-date Tucson Sample Corporate Records for an Arizona Professional Corporation is essential for smooth operation, regulatory compliance, and effective corporate governance. From the Articles of Incorporation to financial reports, each record serves a unique purpose in maintaining transparency, protecting shareholders' rights, and ensuring the corporation operates within legal boundaries. By adhering to these record-keeping practices, professional corporations in Tucson can demonstrate credibility and maintain a strong foothold in Arizona's bustling business landscape.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tucson Muestra de registros corporativos para una corporación profesional de Arizona - Sample Corporate Records for a Arizona Professional Corporation

Description

How to fill out Tucson Muestra De Registros Corporativos Para Una Corporación Profesional De Arizona?

If you are looking for a relevant form template, it’s extremely hard to find a more convenient place than the US Legal Forms website – one of the most comprehensive libraries on the web. With this library, you can find a huge number of form samples for business and individual purposes by categories and regions, or key phrases. Using our high-quality search function, getting the latest Tucson Sample Corporate Records for a Arizona Professional Corporation is as elementary as 1-2-3. Furthermore, the relevance of every record is confirmed by a team of skilled attorneys that regularly review the templates on our platform and revise them in accordance with the most recent state and county regulations.

If you already know about our platform and have an account, all you need to receive the Tucson Sample Corporate Records for a Arizona Professional Corporation is to log in to your account and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have chosen the sample you need. Look at its description and use the Preview feature to check its content. If it doesn’t meet your needs, use the Search field at the top of the screen to get the appropriate document.

- Affirm your decision. Click the Buy now option. Following that, choose your preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Get the form. Select the format and save it to your system.

- Make modifications. Fill out, revise, print, and sign the acquired Tucson Sample Corporate Records for a Arizona Professional Corporation.

Each form you add to your account has no expiry date and is yours permanently. You always have the ability to gain access to them via the My Forms menu, so if you want to receive an extra duplicate for modifying or creating a hard copy, you can come back and export it once more anytime.

Take advantage of the US Legal Forms extensive library to get access to the Tucson Sample Corporate Records for a Arizona Professional Corporation you were looking for and a huge number of other professional and state-specific templates on a single website!