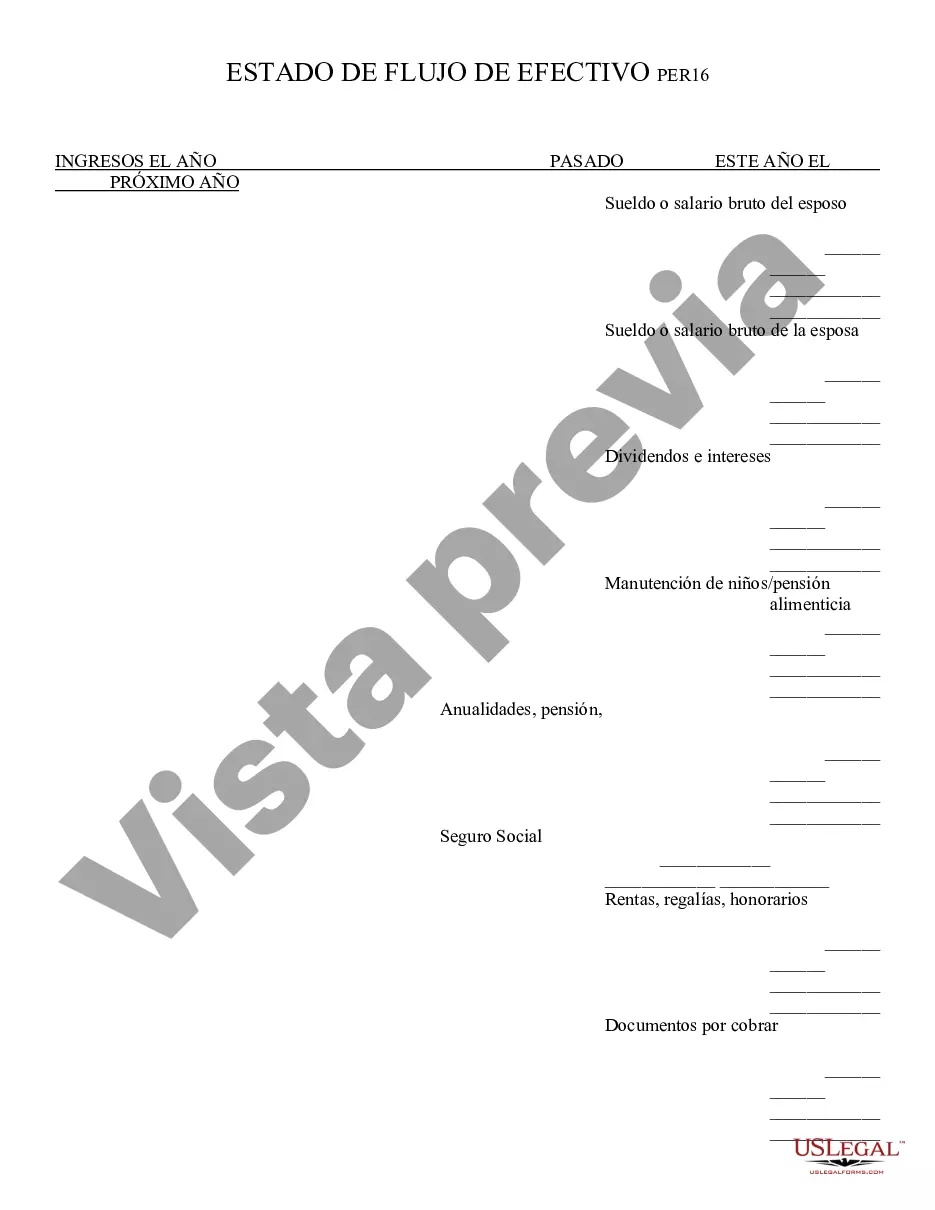

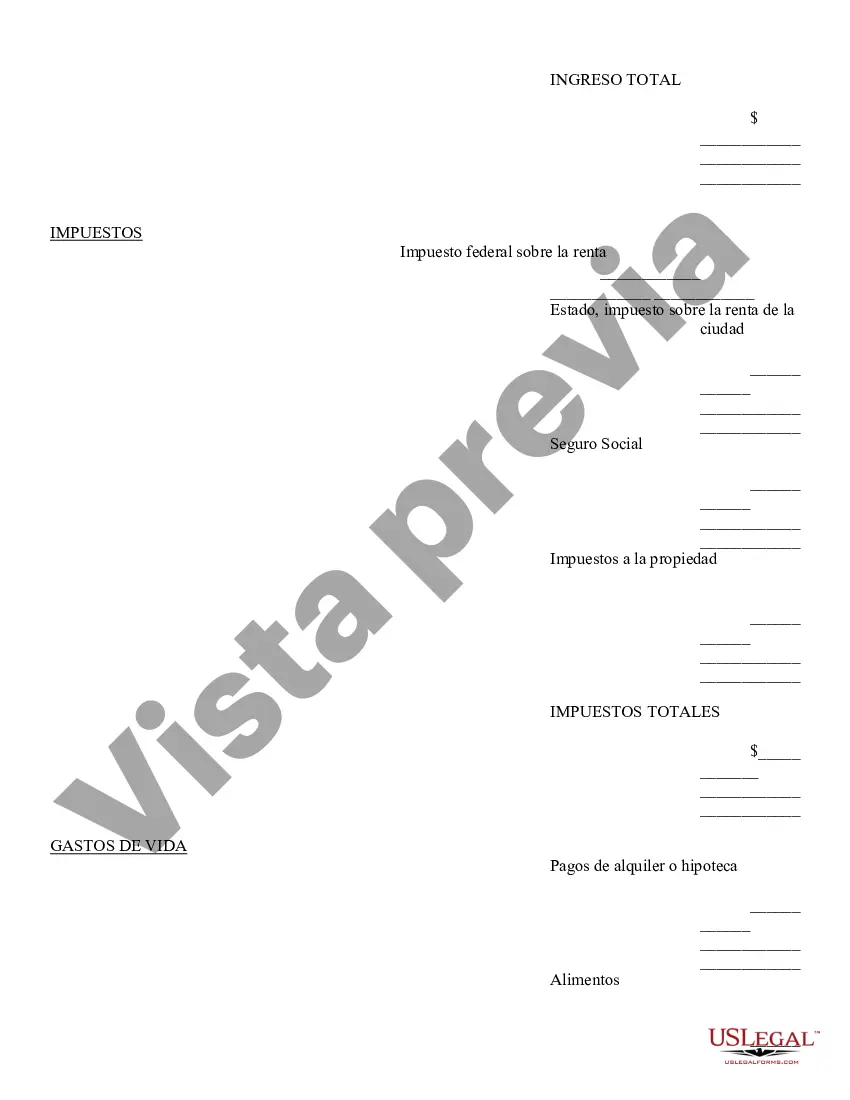

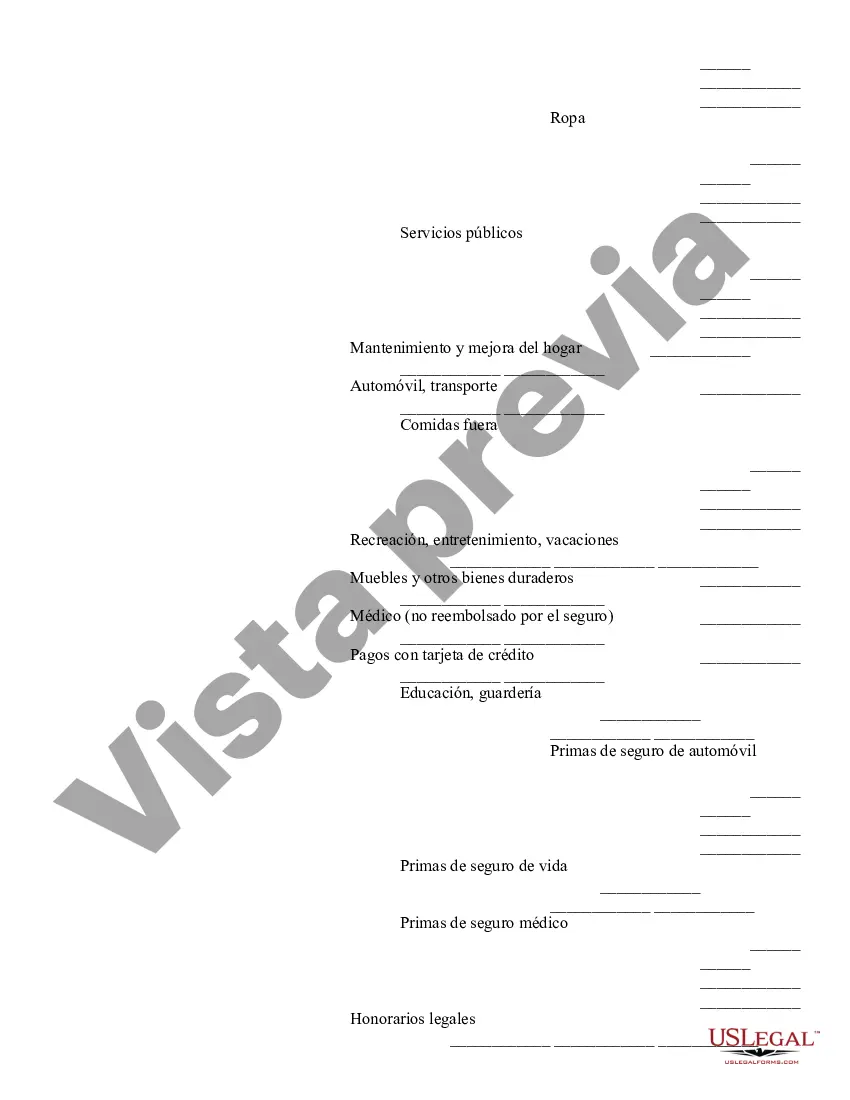

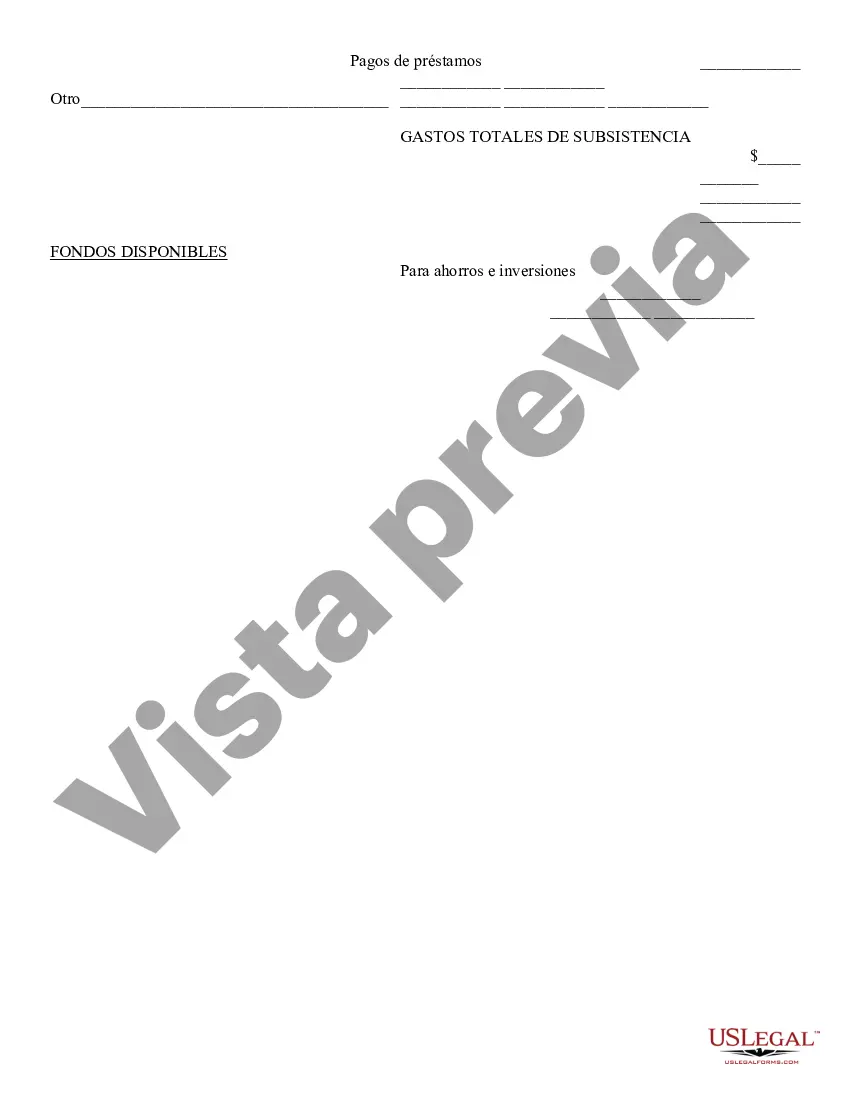

Cash Flow Statement - Arizona: This is a standard statement which includes all the money coming in and the money going out each month. There are places for wage information, as well as debt payment information. It is available for download in both Word and Rich Text formats.

The Phoenix Arizona Cash Flow Statement is a financial document that provides a detailed overview of the cash inflows and outflows of an individual or company located in Phoenix, Arizona. This statement is an essential component of financial reporting, as it showcases the movement of cash and cash equivalents over a specified period. The Phoenix Arizona Cash Flow Statement consists of three main categories: operating activities, investing activities, and financing activities. 1. Operating activities: This section represents cash flows generated from the primary operations of the business. It includes revenue from sales, payments to suppliers, salaries and wages, taxes, and other operating expenses. Operating cash flow provides insights into the core operations of the entity and its ability to generate cash from day-to-day activities. 2. Investing activities: This category focuses on cash flows related to investments in long-term assets. It involves the purchase or sale of property, plant, and equipment (PPE), acquisitions or sales of other businesses, investments in securities, and other similar transactions. Cash flows from investing activities reveal the entity's strategies and efforts to expand its asset base or divest non-essential assets. 3. Financing activities: This section records cash movements associated with external financing activities, such as obtaining or repaying loans, issuing or buying back shares, and distributing dividends. It also includes cash flows stemming from investors' capital injections or withdrawals. Financing cash flow provides insights into how the entity utilizes external financing to support its operations, growth, and return to shareholders. The Phoenix Arizona Cash Flow Statement can be further classified into different types based on the scope or level of detail they provide. These types include: 1. Direct Cash Flow Statement: This format directly lists the actual cash inflows and outflows from various activities. It details specific cash receipts and payments, offering a granular view of cash movements. 2. Indirect Cash Flow Statement: This format starts with net income and adjusts it to compute the cash flow from operating activities. It begins with the accrual-based income statement and includes adjustments for non-cash items, working capital changes, and other activities to derive the net cash flow from operations. By presenting an accurate depiction of cash flows, the Phoenix Arizona Cash Flow Statement assists businesses, investors, and financial institutions in analyzing the financial health, liquidity, and sustainability of an entity in Phoenix, Arizona. It enables decision-makers to assess the company's ability to generate sufficient cash, meet financial obligations, invest in growth opportunities, and distribute cash to stakeholders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.