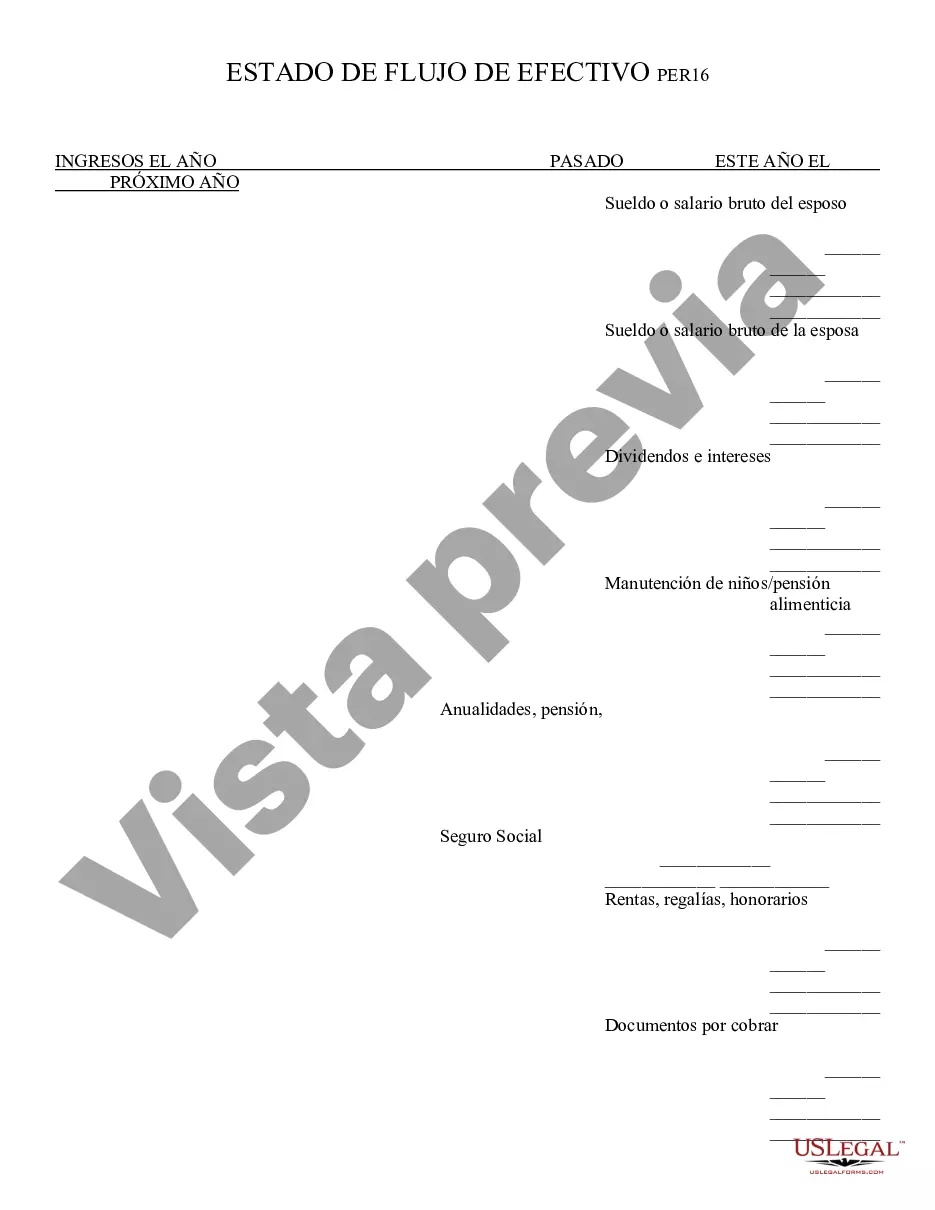

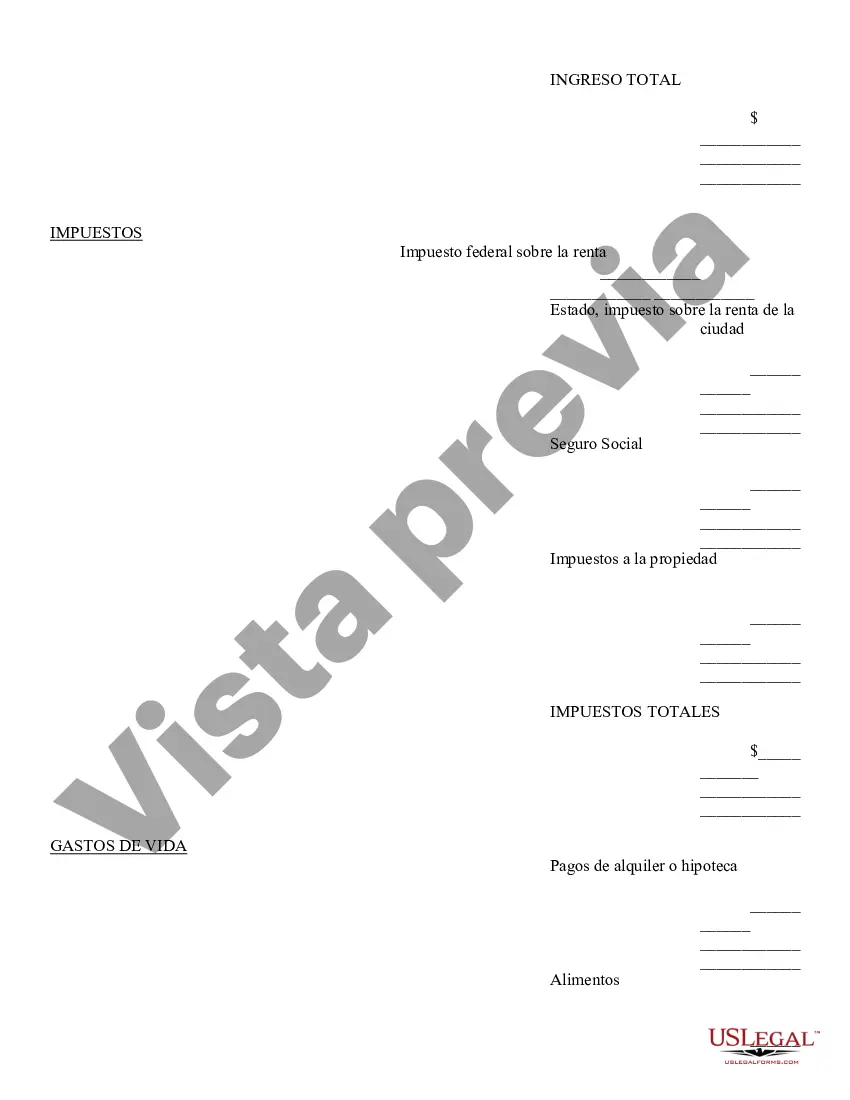

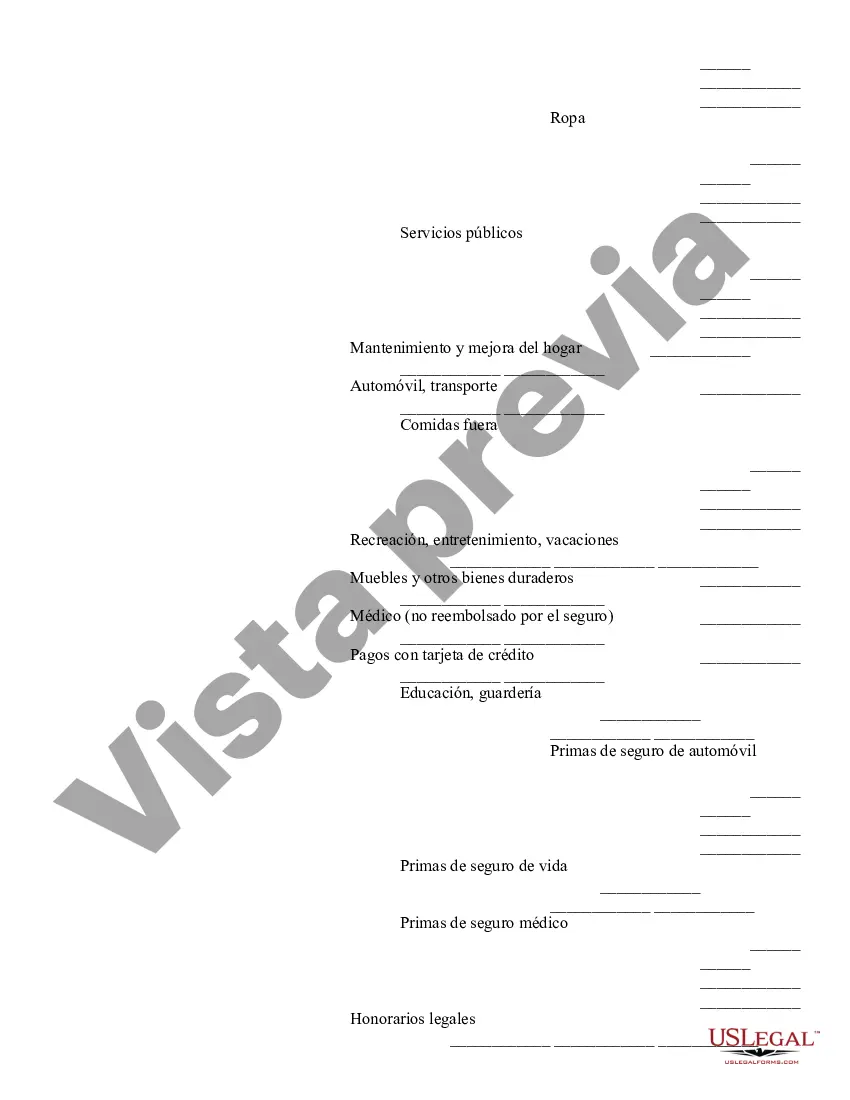

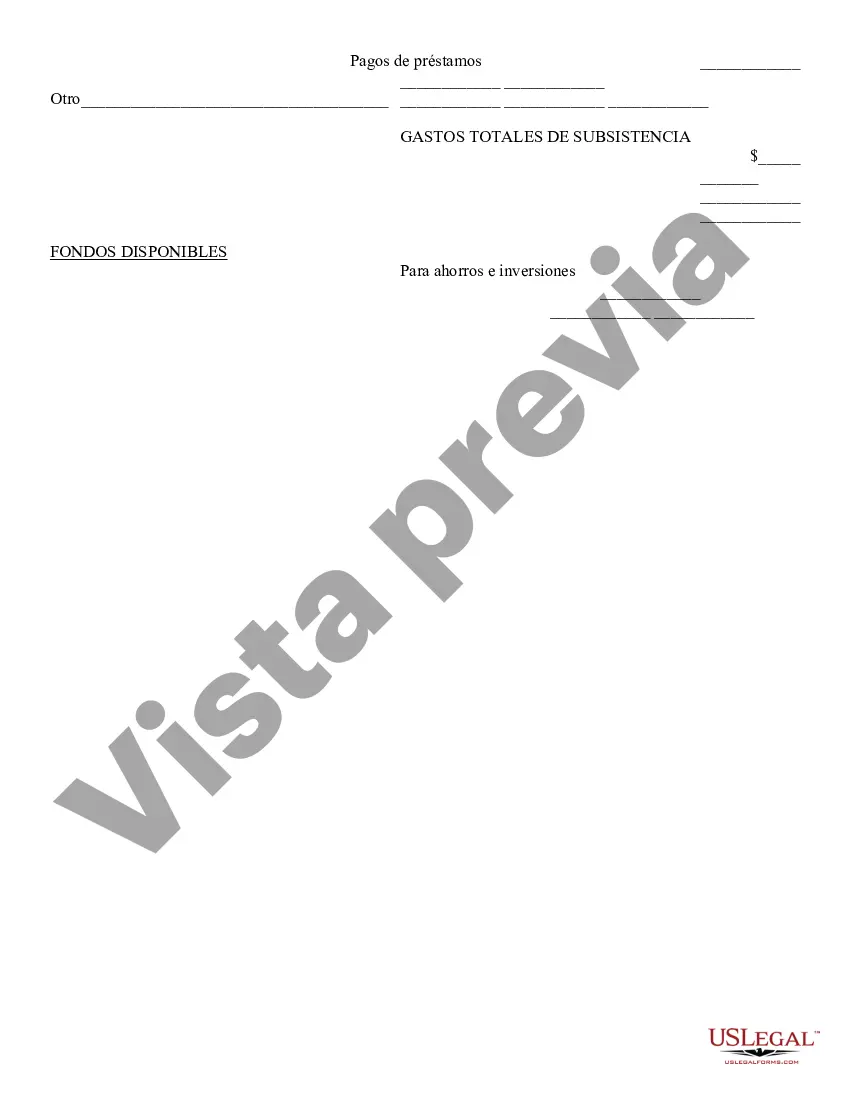

Cash Flow Statement - Arizona: This is a standard statement which includes all the money coming in and the money going out each month. There are places for wage information, as well as debt payment information. It is available for download in both Word and Rich Text formats.

A cash flow statement is a financial document that provides a detailed breakdown of the cash inflows and outflows of a business in Surprise, Arizona. It allows businesses to track and analyze the movement of cash within their operations, helping them understand their financial performance and make informed decisions. The Surprise Arizona cash flow statement includes three main sections: operating activities, investing activities, and financing activities. 1. Operating Activities: This section highlights the cash flows generated from the company's core business operations. It includes cash receipts from sales, payments to suppliers and employees, interest and dividends received, and taxes paid. Operating activities analyze the day-to-day operational cash flow of the business. 2. Investing Activities: This section accounts for the cash flows related to investments in long-term assets. It includes cash inflows from the sale of fixed assets, investments, and collection of loans made, as well as cash outflows from the purchase of new assets, loans given, and investments made by the business. 3. Financing Activities: This section focuses on cash flows related to the company's financing activities. It includes cash inflows from the issuance of debt, equity or borrowing, and loans received from financial institutions. Additionally, cash outflows are recorded from dividend payments, repayment of loans, and repurchasing of the company's own shares. By analyzing the Surprise Arizona cash flow statement, businesses can gain valuable insights into their liquidity, solvency, and overall financial health. They can evaluate their ability to generate cash, meet financial obligations, and invest in future growth opportunities. While the basic structure of a cash flow statement remains the same, different types or formats may exist depending on the reporting requirements or specific industry standards. Some variations include indirect cash flow statement and direct cash flow statement. The indirect method reconciles net income to cash flows, while the direct method directly reports cash inflows and outflows from operating activities. In conclusion, the Surprise Arizona cash flow statement is a crucial financial tool that provides a comprehensive overview of a business's cash movements over a specific period. It helps organizations in Surprise, Arizona, monitor their cash flow, make informed decisions, and maintain financial stability.A cash flow statement is a financial document that provides a detailed breakdown of the cash inflows and outflows of a business in Surprise, Arizona. It allows businesses to track and analyze the movement of cash within their operations, helping them understand their financial performance and make informed decisions. The Surprise Arizona cash flow statement includes three main sections: operating activities, investing activities, and financing activities. 1. Operating Activities: This section highlights the cash flows generated from the company's core business operations. It includes cash receipts from sales, payments to suppliers and employees, interest and dividends received, and taxes paid. Operating activities analyze the day-to-day operational cash flow of the business. 2. Investing Activities: This section accounts for the cash flows related to investments in long-term assets. It includes cash inflows from the sale of fixed assets, investments, and collection of loans made, as well as cash outflows from the purchase of new assets, loans given, and investments made by the business. 3. Financing Activities: This section focuses on cash flows related to the company's financing activities. It includes cash inflows from the issuance of debt, equity or borrowing, and loans received from financial institutions. Additionally, cash outflows are recorded from dividend payments, repayment of loans, and repurchasing of the company's own shares. By analyzing the Surprise Arizona cash flow statement, businesses can gain valuable insights into their liquidity, solvency, and overall financial health. They can evaluate their ability to generate cash, meet financial obligations, and invest in future growth opportunities. While the basic structure of a cash flow statement remains the same, different types or formats may exist depending on the reporting requirements or specific industry standards. Some variations include indirect cash flow statement and direct cash flow statement. The indirect method reconciles net income to cash flows, while the direct method directly reports cash inflows and outflows from operating activities. In conclusion, the Surprise Arizona cash flow statement is a crucial financial tool that provides a comprehensive overview of a business's cash movements over a specific period. It helps organizations in Surprise, Arizona, monitor their cash flow, make informed decisions, and maintain financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.