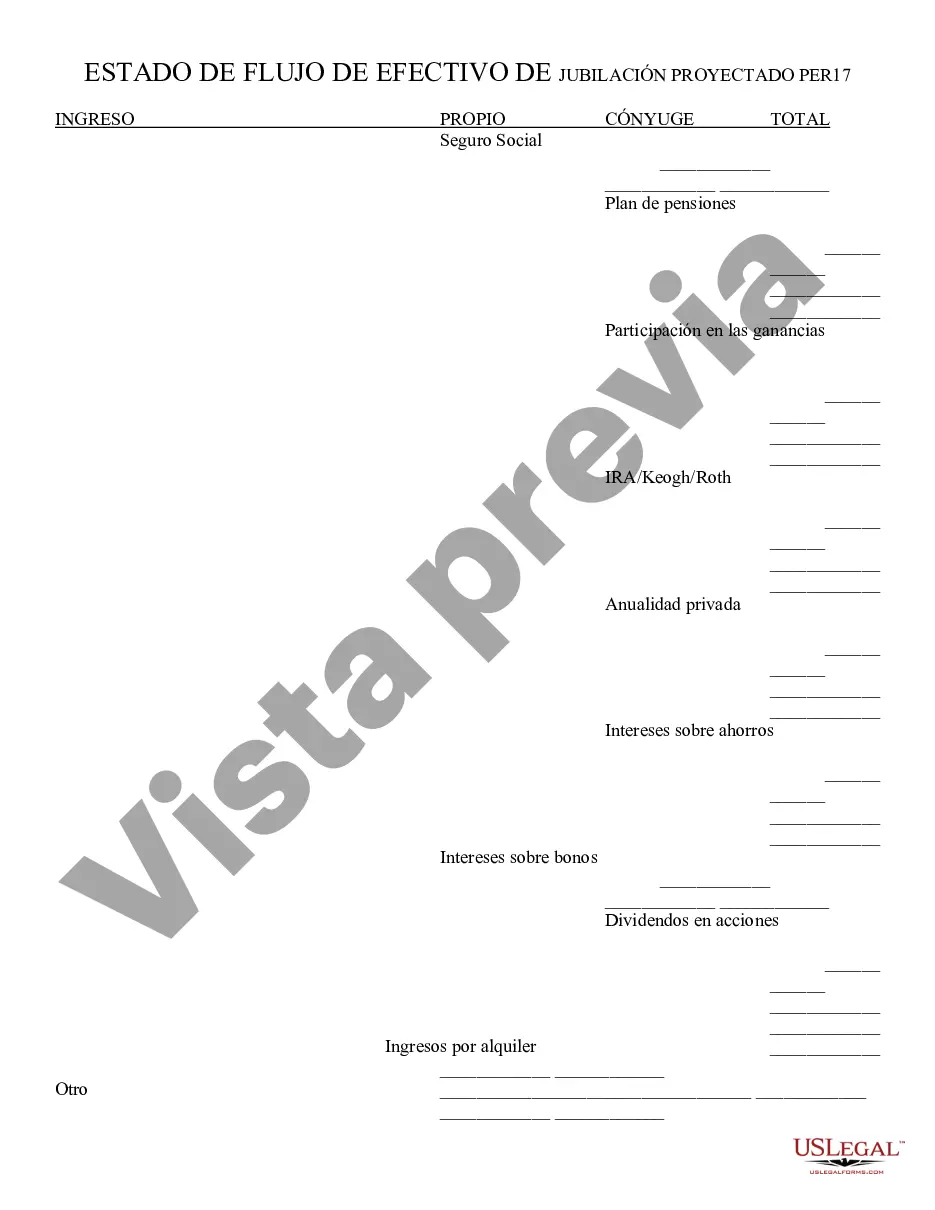

Retirement Cash Flow - Arizona: This is a standard statement which includes all the money coming in after retirement, including annuities, IRA's, pension, etc. It also includes a place for money going out each month, such as rent. It is available for download in both Word and Rich Text formats.

Glendale Arizona Retirement Cash Flow refers to the income and financial resources that retirees in Glendale, Arizona receive to support their post-career lifestyle. It encompasses various sources of income, including pensions, Social Security benefits, retirement savings, and investments. This cash flow enables retirees to cover their living expenses, healthcare costs, leisure activities, and other financial commitments during their retirement years. There are several types of retirement cash flow options available in Glendale, Arizona: 1. Pension Cash Flow: Many retirees in Glendale, Arizona may have access to pension plans established by their former employers. These plans provide a steady stream of income throughout retirement, often based on factors such as length of service and salary history. 2. Social Security Cash Flow: Social Security benefits play a significant role in retirement cash flow for Glendale, Arizona residents. Retirees become eligible for Social Security payments based on their employment history, and the amount received is determined by factors such as earnings and age of retirement. 3. Individual Retirement Accounts (IRAs): IRAs are popular retirement savings vehicles that allow individuals to invest and grow their money tax-deferred. Upon retirement, IRA owners can withdraw funds, either as a lump sum or through regular distributions, to supplement their cash flow. 4. 401(k) and Other Employer-Sponsored Plans: Many Glendale, Arizona residents contribute to employer-sponsored retirement plans, such as 401(k)s, throughout their careers. These plans provide a retirement cash flow stream by allowing employees to save and invest a portion of their salary, often with employer matching contributions. 5. Real Estate and Rental Income: Some retirees in Glendale, Arizona may generate cash flow from real estate investments or rental properties they own. This additional income source can contribute to their overall retirement cash flow strategy. 6. Dividend and Investment Income: Retirees who have built a diversified investment portfolio may benefit from cash flow generated by dividends, interest, or capital gains from their investments. These sources can provide regular income to supplement their retirement cash flow. Glendale Arizona Retirement Cash Flow is an essential aspect of retirees' financial planning, ensuring they have sufficient funds to sustain their desired lifestyle during their golden years. Individuals nearing retirement in Glendale should carefully assess their retirement needs and consider various cash flow sources to build a well-rounded and sustainable financial strategy.Glendale Arizona Retirement Cash Flow refers to the income and financial resources that retirees in Glendale, Arizona receive to support their post-career lifestyle. It encompasses various sources of income, including pensions, Social Security benefits, retirement savings, and investments. This cash flow enables retirees to cover their living expenses, healthcare costs, leisure activities, and other financial commitments during their retirement years. There are several types of retirement cash flow options available in Glendale, Arizona: 1. Pension Cash Flow: Many retirees in Glendale, Arizona may have access to pension plans established by their former employers. These plans provide a steady stream of income throughout retirement, often based on factors such as length of service and salary history. 2. Social Security Cash Flow: Social Security benefits play a significant role in retirement cash flow for Glendale, Arizona residents. Retirees become eligible for Social Security payments based on their employment history, and the amount received is determined by factors such as earnings and age of retirement. 3. Individual Retirement Accounts (IRAs): IRAs are popular retirement savings vehicles that allow individuals to invest and grow their money tax-deferred. Upon retirement, IRA owners can withdraw funds, either as a lump sum or through regular distributions, to supplement their cash flow. 4. 401(k) and Other Employer-Sponsored Plans: Many Glendale, Arizona residents contribute to employer-sponsored retirement plans, such as 401(k)s, throughout their careers. These plans provide a retirement cash flow stream by allowing employees to save and invest a portion of their salary, often with employer matching contributions. 5. Real Estate and Rental Income: Some retirees in Glendale, Arizona may generate cash flow from real estate investments or rental properties they own. This additional income source can contribute to their overall retirement cash flow strategy. 6. Dividend and Investment Income: Retirees who have built a diversified investment portfolio may benefit from cash flow generated by dividends, interest, or capital gains from their investments. These sources can provide regular income to supplement their retirement cash flow. Glendale Arizona Retirement Cash Flow is an essential aspect of retirees' financial planning, ensuring they have sufficient funds to sustain their desired lifestyle during their golden years. Individuals nearing retirement in Glendale should carefully assess their retirement needs and consider various cash flow sources to build a well-rounded and sustainable financial strategy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.