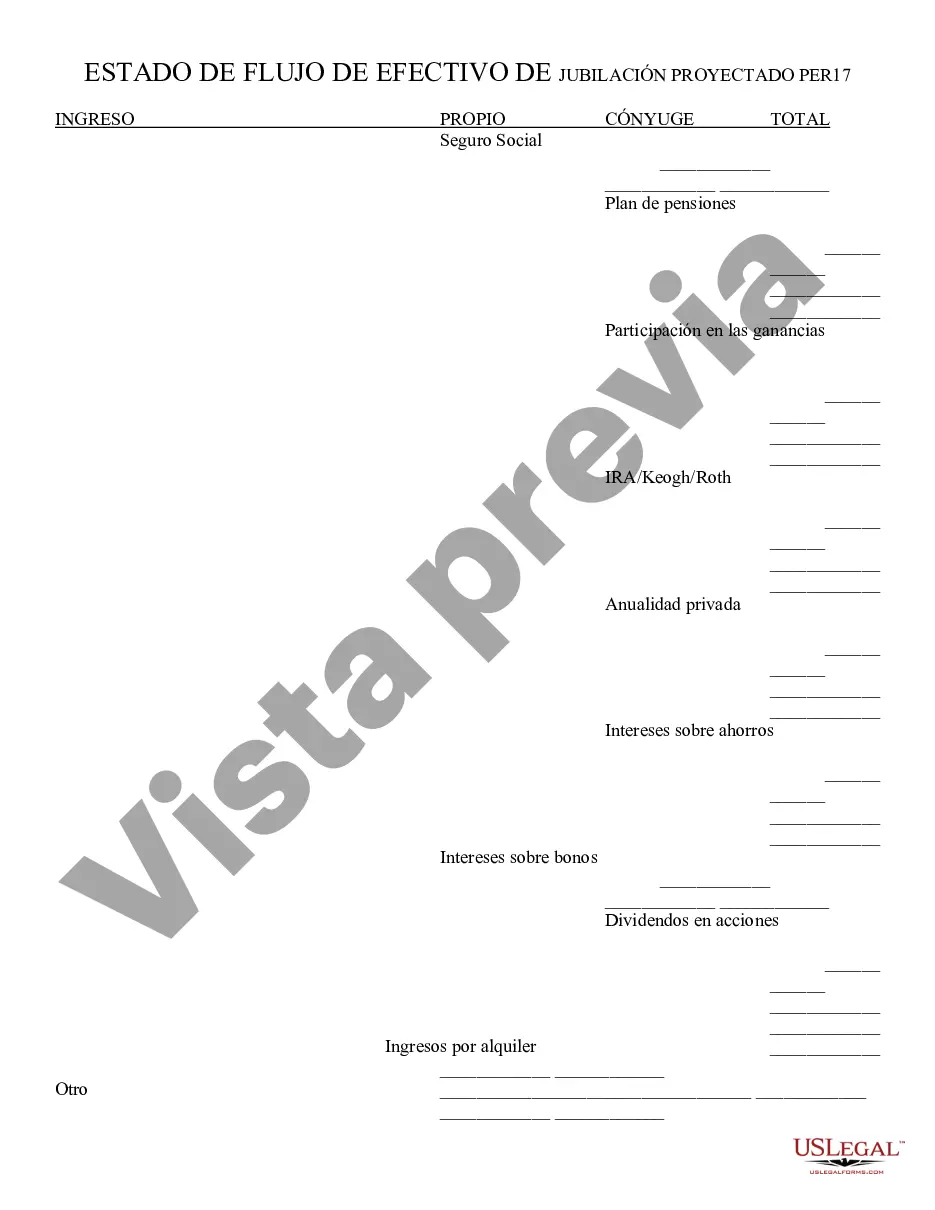

Retirement Cash Flow - Arizona: This is a standard statement which includes all the money coming in after retirement, including annuities, IRA's, pension, etc. It also includes a place for money going out each month, such as rent. It is available for download in both Word and Rich Text formats.

Maricopa Arizona Retirement Cash Flow refers to the income or financial resources that retirees in Maricopa, Arizona, have available to them during their retirement years. It encompasses various sources of income, such as pensions, Social Security payments, investment returns, rental income, and any other form of passive or active income generated during retirement. Maricopa is an ideal retirement destination due to its favorable climate, affordable cost of living, and numerous retirement communities that offer a range of amenities and services tailored to retirees. As such, there may be different types of cash flow specific to Maricopa Arizona Retirement, including: 1. Pension Income: Many individuals rely on pension plans, such as those from their former employers, which provide a regular income stream throughout retirement. Maricopa retirees may have pension cash flow from previous employment. 2. Social Security Benefits: Retirees in Maricopa can receive Social Security payments, which can significantly contribute to their cash flow. These benefits are based on an individual's lifetime earnings and the age at which they choose to start receiving them. 3. Investment Income: Some retirees in Maricopa Arizona have invested their savings in stocks, bonds, mutual funds, or real estate properties. This investment income can supplement their retirement cash flow and provide additional financial security. 4. Rental Income: Another source of cash flow for Maricopa retirees might be rental properties. Retirees who own residential or commercial real estate in Maricopa can generate a steady income by renting out their properties. 5. Part-time Work or Self-Employment: Some retirees in Maricopa may choose to work part-time or engage in self-employment to supplement their retirement cash flow. This might include consulting, freelancing, or starting a small business in their area of expertise or interest. 6. Annuities or Retirement Funds: Retirees may have invested in annuities or retirement funds, such as individual retirement accounts (IRAs) or 401(k) plans, which can act as additional sources of cash flow during retirement. It is worth noting that Maricopa Arizona Retirement Cash Flow can vary significantly based on an individual's unique circumstances, such as their retirement savings, investment choices, and lifestyle preferences. It is recommended for retirees to carefully plan their cash flow strategy to ensure a comfortable retirement in Maricopa, Arizona.Maricopa Arizona Retirement Cash Flow refers to the income or financial resources that retirees in Maricopa, Arizona, have available to them during their retirement years. It encompasses various sources of income, such as pensions, Social Security payments, investment returns, rental income, and any other form of passive or active income generated during retirement. Maricopa is an ideal retirement destination due to its favorable climate, affordable cost of living, and numerous retirement communities that offer a range of amenities and services tailored to retirees. As such, there may be different types of cash flow specific to Maricopa Arizona Retirement, including: 1. Pension Income: Many individuals rely on pension plans, such as those from their former employers, which provide a regular income stream throughout retirement. Maricopa retirees may have pension cash flow from previous employment. 2. Social Security Benefits: Retirees in Maricopa can receive Social Security payments, which can significantly contribute to their cash flow. These benefits are based on an individual's lifetime earnings and the age at which they choose to start receiving them. 3. Investment Income: Some retirees in Maricopa Arizona have invested their savings in stocks, bonds, mutual funds, or real estate properties. This investment income can supplement their retirement cash flow and provide additional financial security. 4. Rental Income: Another source of cash flow for Maricopa retirees might be rental properties. Retirees who own residential or commercial real estate in Maricopa can generate a steady income by renting out their properties. 5. Part-time Work or Self-Employment: Some retirees in Maricopa may choose to work part-time or engage in self-employment to supplement their retirement cash flow. This might include consulting, freelancing, or starting a small business in their area of expertise or interest. 6. Annuities or Retirement Funds: Retirees may have invested in annuities or retirement funds, such as individual retirement accounts (IRAs) or 401(k) plans, which can act as additional sources of cash flow during retirement. It is worth noting that Maricopa Arizona Retirement Cash Flow can vary significantly based on an individual's unique circumstances, such as their retirement savings, investment choices, and lifestyle preferences. It is recommended for retirees to carefully plan their cash flow strategy to ensure a comfortable retirement in Maricopa, Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.