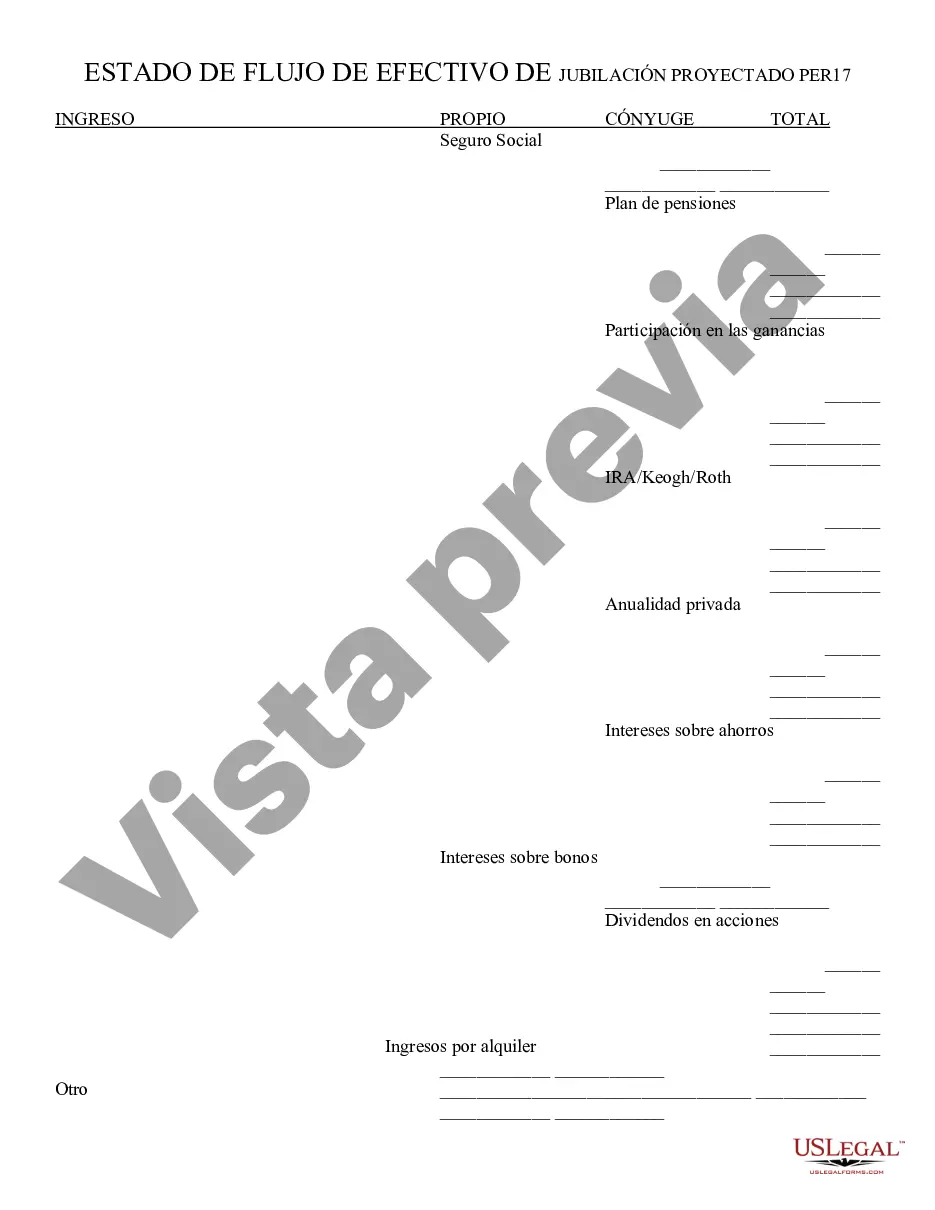

Retirement Cash Flow - Arizona: This is a standard statement which includes all the money coming in after retirement, including annuities, IRA's, pension, etc. It also includes a place for money going out each month, such as rent. It is available for download in both Word and Rich Text formats.

Mesa Arizona Retirement Cash Flow refers to the income and financial resources that retirees in Mesa, Arizona have to sustain their living expenses and lifestyle choices during their golden years. This cash flow can include various sources of income such as pensions, Social Security benefits, investment returns, rental income, and part-time employment. Retirement Cash Flow in Mesa, Arizona is a crucial aspect of retirement planning as it determines the level of financial security and the ability to maintain a desired standard of living. It involves careful management of savings, investments, and other income streams to ensure a steady inflow of funds during retirement. There are different types of Retirement Cash Flow options available to retirees in Mesa, Arizona. These include: 1. Social Security Benefits: Mesa retirees are eligible to receive Social Security retirement benefits based on their earnings history and age. These benefits serve as a foundation for retirement cash flow and can be claimed as early as age 62 or delayed until full retirement age for increased payments. 2. Pension Plans: Some retirees in Mesa, Arizona may have access to a pension plan through their former employers. Pensions provide a reliable and steady income stream throughout retirement, typically based on years of service and the final salary earned. 3. Personal Savings and Investments: Mesa retirees can rely on personal savings, such as 401(k) accounts or Individual Retirement Accounts (IRAs), that have been accumulated over their working years. These investments can be strategically managed to generate cash flow through interest, dividends, or capital gains. 4. Rental Income: Retirees who own rental properties in Mesa, Arizona can benefit from a rental income stream. By renting out properties like homes, apartments, or commercial space, retirees can generate extra cash flow to support their retirement lifestyle. 5. Part-time Employment: Some retirees in Mesa may choose to continue working part-time during retirement, which can provide an additional source of cash flow. This can include consulting, freelancing, or pursuing a hobby or passion that generates income. In conclusion, Mesa Arizona Retirement Cash Flow encompasses the various financial resources retirees have to sustain their living expenses and lifestyle choices. Social Security benefits, pension plans, personal savings, rental income, and part-time employment are some different types of cash flow options available to retirees in Mesa, Arizona. By carefully managing these income sources, retirees can enjoy a comfortable and financially secure retirement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.