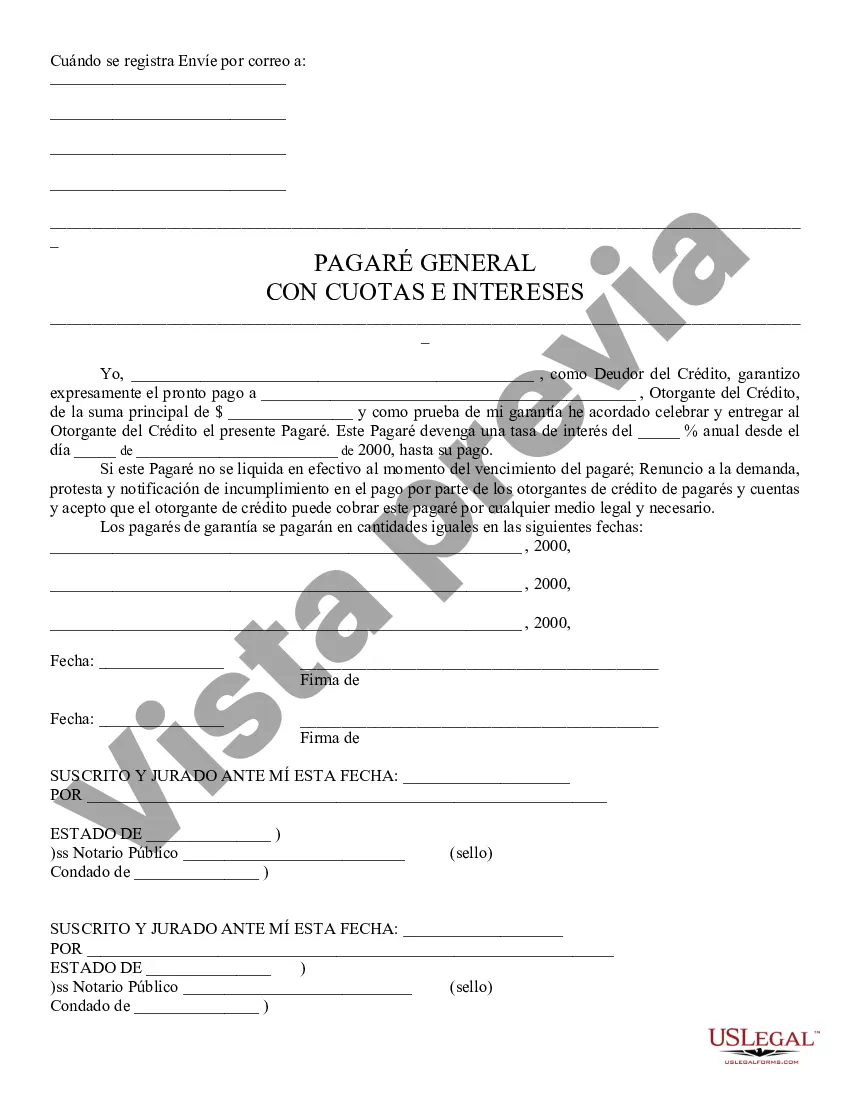

A promissory note is a promise to pay a debt. In this general promissory note, the credit debtor expressly guarantees prompt payment to the credit grantor of a certain principal sum. The credit debtor states that if the note is not settled for in cash at the time of the expiration of the note, then he/she waives demand, protest, and notice of default in payment by credit grantors of notes and accounts and agrees that the credit grantor may collect on the note by any legal means necessary.

A Mesa Arizona Negotiable Promissory Note is a legal document used in Mesa, Arizona, that outlines the terms and conditions of a loan agreement between two parties. This document signifies the borrower's commitment to repay a specific amount of money borrowed from the lender within a designated period and at a predetermined interest rate. The Mesa Arizona Negotiable Promissory Note is a powerful financial tool that offers flexibility for both the borrower and the lender. It provides assurance to the lender that they will receive their investment back along with agreed-upon interest, while the borrower can establish a trustworthy relationship with the lender and secure funds for various purposes. Different types of Mesa Arizona Negotiable Promissory Notes include: 1. Secured Promissory Note: This type of note includes collateral, such as property or assets, which can be claimed by the lender in case of default. A secured promissory note provides added security for the lender while allowing the borrower to negotiate more flexible terms. 2. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require collateral. Therefore, this note carries a higher risk for the lender, but it can enable the borrower to obtain funds without needing to provide assets as security. 3. Installment Promissory Note: This type of note sets a structured repayment plan, dividing the loan amount into equal payments over a specified period. Installment promissory notes make budgeting and repayment management easier for both parties involved. 4. Demand Promissory Note: A demand promissory note allows the lender to request repayment of the loan in full at any time they desire. This type of note does not have a predetermined maturity date, giving the lender more control over when they want their investment returned. 5. Interest-only Promissory Note: This note allows the borrower to make interest-only payments for a specific period before starting to repay the principal loan amount. It offers flexibility to borrowers who may need extra time before committing to complete loan repayment. When drafting a Mesa Arizona Negotiable Promissory Note, it is crucial to include specific details such as the names and addresses of both parties involved, the loan amount, the interest rate, the maturity date, and any applicable late payment penalties or default provisions. The note should comply with the legal requirements and regulations set forth by the state of Arizona to ensure its enforceability. In conclusion, a Mesa Arizona Negotiable Promissory Note is a legally binding document used to establish a loan agreement between a borrower and a lender. Its flexible nature allows for various types, such as secured, unsecured, installment, demand, and interest-only promissory notes, catering to different financial situations and needs.A Mesa Arizona Negotiable Promissory Note is a legal document used in Mesa, Arizona, that outlines the terms and conditions of a loan agreement between two parties. This document signifies the borrower's commitment to repay a specific amount of money borrowed from the lender within a designated period and at a predetermined interest rate. The Mesa Arizona Negotiable Promissory Note is a powerful financial tool that offers flexibility for both the borrower and the lender. It provides assurance to the lender that they will receive their investment back along with agreed-upon interest, while the borrower can establish a trustworthy relationship with the lender and secure funds for various purposes. Different types of Mesa Arizona Negotiable Promissory Notes include: 1. Secured Promissory Note: This type of note includes collateral, such as property or assets, which can be claimed by the lender in case of default. A secured promissory note provides added security for the lender while allowing the borrower to negotiate more flexible terms. 2. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require collateral. Therefore, this note carries a higher risk for the lender, but it can enable the borrower to obtain funds without needing to provide assets as security. 3. Installment Promissory Note: This type of note sets a structured repayment plan, dividing the loan amount into equal payments over a specified period. Installment promissory notes make budgeting and repayment management easier for both parties involved. 4. Demand Promissory Note: A demand promissory note allows the lender to request repayment of the loan in full at any time they desire. This type of note does not have a predetermined maturity date, giving the lender more control over when they want their investment returned. 5. Interest-only Promissory Note: This note allows the borrower to make interest-only payments for a specific period before starting to repay the principal loan amount. It offers flexibility to borrowers who may need extra time before committing to complete loan repayment. When drafting a Mesa Arizona Negotiable Promissory Note, it is crucial to include specific details such as the names and addresses of both parties involved, the loan amount, the interest rate, the maturity date, and any applicable late payment penalties or default provisions. The note should comply with the legal requirements and regulations set forth by the state of Arizona to ensure its enforceability. In conclusion, a Mesa Arizona Negotiable Promissory Note is a legally binding document used to establish a loan agreement between a borrower and a lender. Its flexible nature allows for various types, such as secured, unsecured, installment, demand, and interest-only promissory notes, catering to different financial situations and needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.