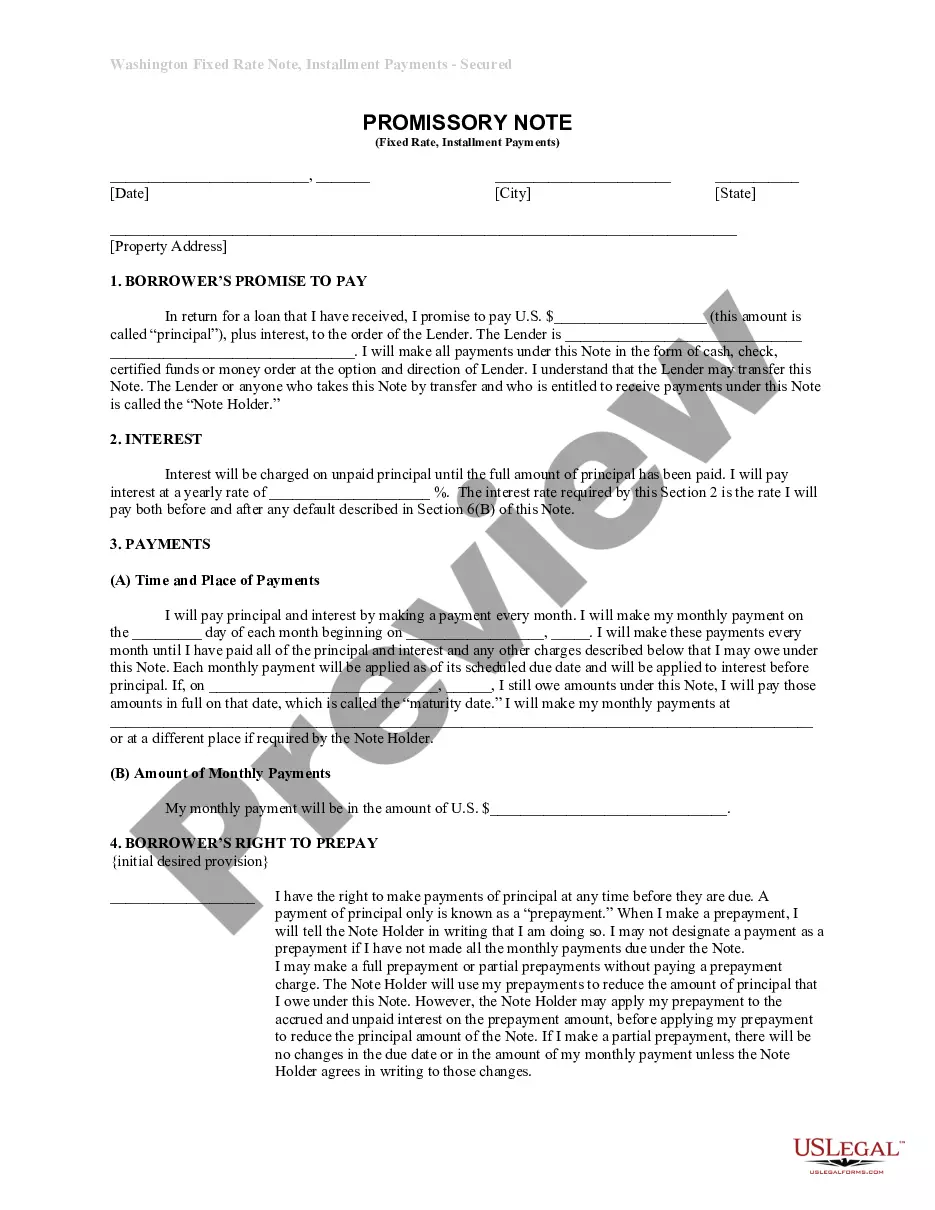

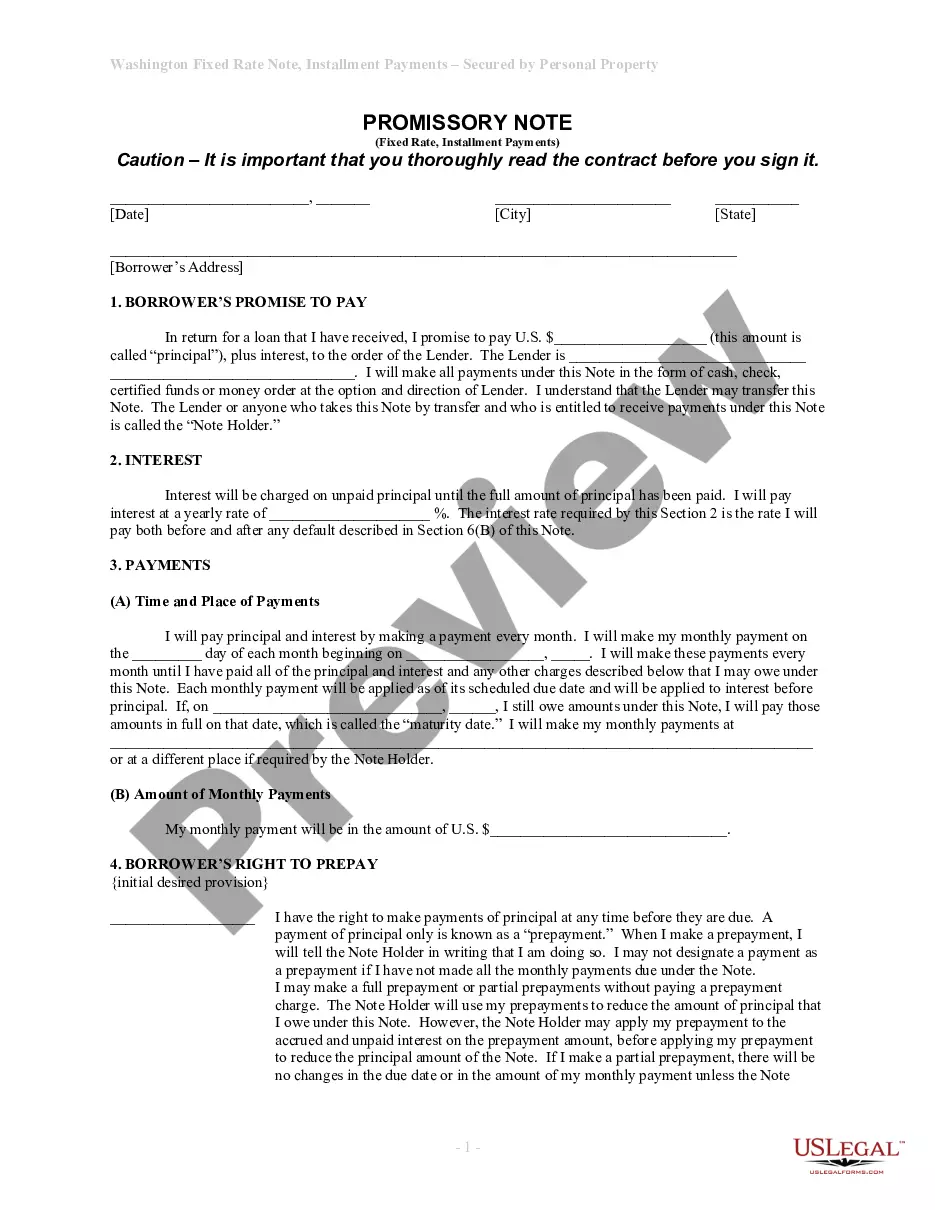

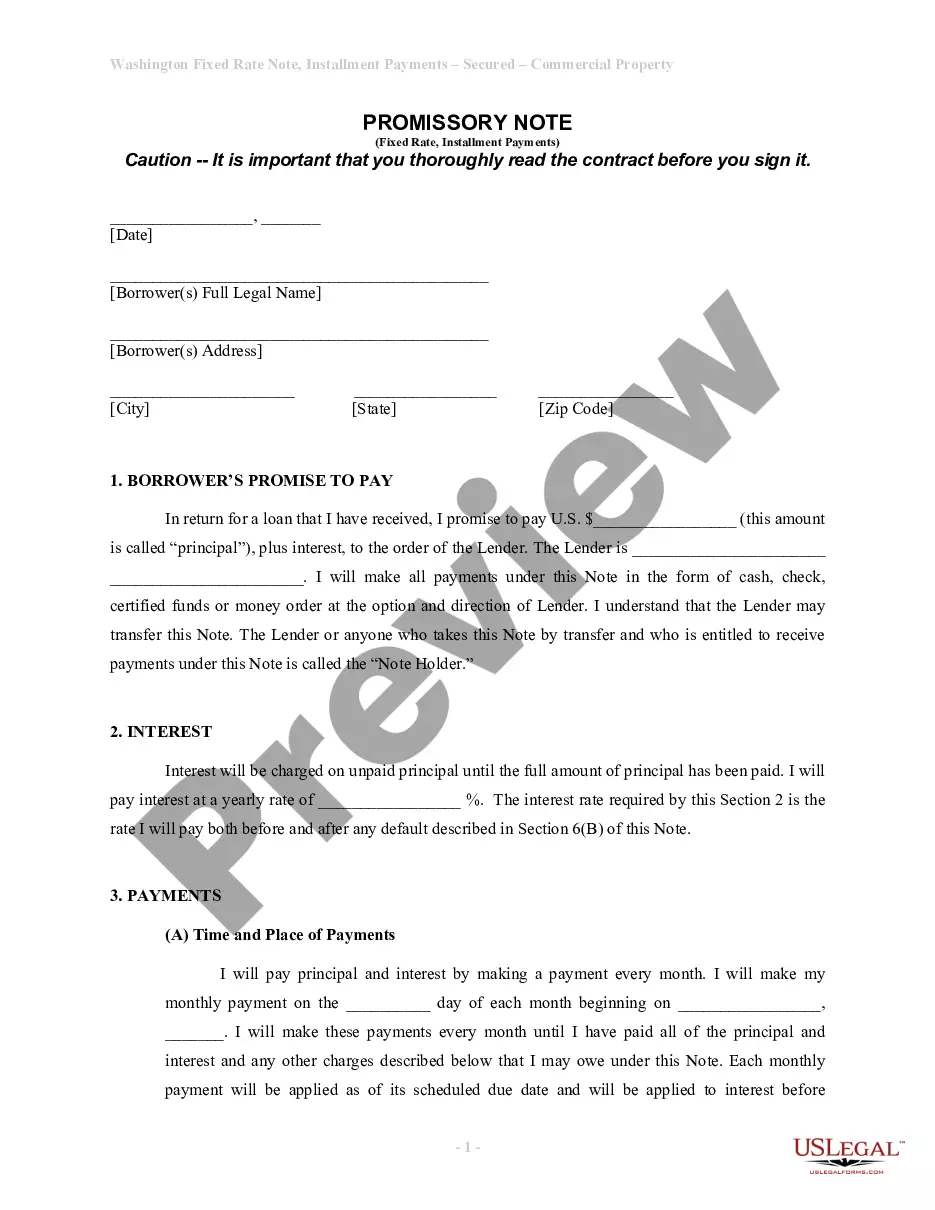

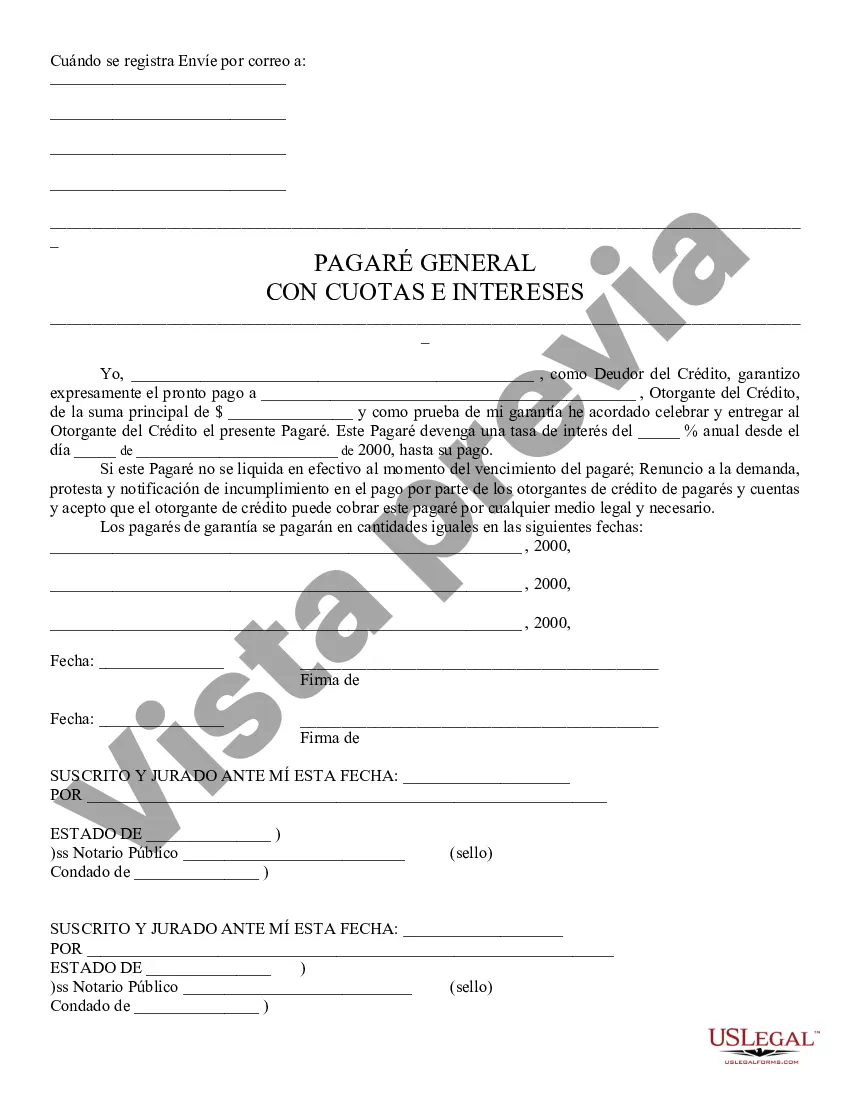

A promissory note is a promise to pay a debt. In this general promissory note, the credit debtor expressly guarantees prompt payment to the credit grantor of a certain principal sum. The credit debtor states that if the note is not settled for in cash at the time of the expiration of the note, then he/she waives demand, protest, and notice of default in payment by credit grantors of notes and accounts and agrees that the credit grantor may collect on the note by any legal means necessary.

A Phoenix Arizona Negotiable Promissory Note is a legally binding document that establishes a promise to repay a loan amount along with any agreed-upon interest within a specific timeframe. This note acts as evidence of a debt between a lender and a borrower, outlining the terms and conditions of the loan agreement. The negotiable aspect of the note emphasizes that it is transferable, meaning that the lender can sell or transfer the ownership rights to another party. This allows the lender to potentially recoup their money sooner by selling the promissory note to a third party, who then assumes the role of the lender. There are different types of Phoenix Arizona Negotiable Promissory Notes that vary based on the details and terms of the loan. Some common types include: 1. Installment Promissory Note: This type of note specifies that the loan amount will be repaid in regular, equal installments over a predetermined period. The note typically includes the principal amount, interest rate, repayment schedule, and any penalties for late payments. 2. Balloon Promissory Note: In this type of note, the borrower agrees to make regular interest payments for a specific period, followed by a larger final payment that covers the remaining principal amount. Balloon promissory notes are often used when the borrower expects to have access to a significant sum of money in the future, allowing them to clear the debt with a lump-sum payment. 3. Demand Promissory Note: A demand promissory note does not include a predetermined repayment schedule. Instead, it allows the lender to request repayment of the loan at any time they deem appropriate. This type of note grants flexibility to the lender, who can choose when to enforce the repayment. No matter the type, a Phoenix Arizona Negotiable Promissory Note is a legally binding agreement that protects the rights and obligations of both parties involved in a loan transaction. It serves as evidence of the debt, sets the terms of repayment, and ensures that the borrower understands their responsibilities while providing reassurance to the lender regarding the expected repayment terms.A Phoenix Arizona Negotiable Promissory Note is a legally binding document that establishes a promise to repay a loan amount along with any agreed-upon interest within a specific timeframe. This note acts as evidence of a debt between a lender and a borrower, outlining the terms and conditions of the loan agreement. The negotiable aspect of the note emphasizes that it is transferable, meaning that the lender can sell or transfer the ownership rights to another party. This allows the lender to potentially recoup their money sooner by selling the promissory note to a third party, who then assumes the role of the lender. There are different types of Phoenix Arizona Negotiable Promissory Notes that vary based on the details and terms of the loan. Some common types include: 1. Installment Promissory Note: This type of note specifies that the loan amount will be repaid in regular, equal installments over a predetermined period. The note typically includes the principal amount, interest rate, repayment schedule, and any penalties for late payments. 2. Balloon Promissory Note: In this type of note, the borrower agrees to make regular interest payments for a specific period, followed by a larger final payment that covers the remaining principal amount. Balloon promissory notes are often used when the borrower expects to have access to a significant sum of money in the future, allowing them to clear the debt with a lump-sum payment. 3. Demand Promissory Note: A demand promissory note does not include a predetermined repayment schedule. Instead, it allows the lender to request repayment of the loan at any time they deem appropriate. This type of note grants flexibility to the lender, who can choose when to enforce the repayment. No matter the type, a Phoenix Arizona Negotiable Promissory Note is a legally binding agreement that protects the rights and obligations of both parties involved in a loan transaction. It serves as evidence of the debt, sets the terms of repayment, and ensures that the borrower understands their responsibilities while providing reassurance to the lender regarding the expected repayment terms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.