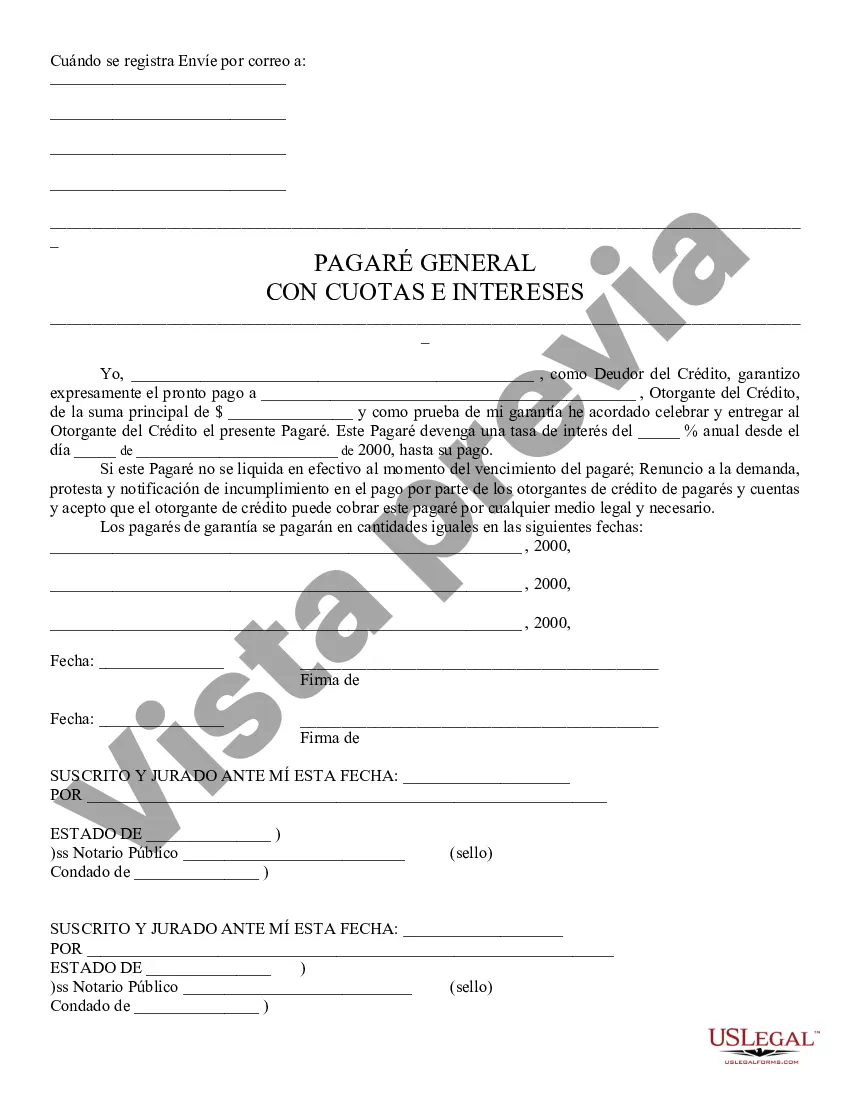

A promissory note is a promise to pay a debt. In this general promissory note, the credit debtor expressly guarantees prompt payment to the credit grantor of a certain principal sum. The credit debtor states that if the note is not settled for in cash at the time of the expiration of the note, then he/she waives demand, protest, and notice of default in payment by credit grantors of notes and accounts and agrees that the credit grantor may collect on the note by any legal means necessary.

A Lima Arizona Negotiable Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Lima, Arizona. This type of promissory note is considered negotiable, meaning it can be transferred or assigned to another party. Key features of a Lima Arizona Negotiable Promissory Note include the principal amount borrowed, the interest rate, the repayment schedule, and any penalties or fees associated with late or missed payments. It also identifies the parties involved, including the borrower and the lender, along with their contact information. Additionally, this document may include provisions regarding default, acceleration, and any collateral that may secure the loan. There are various types of Lima Arizona Negotiable Promissory Notes, including: 1. Secured Promissory Note: This type of promissory note includes collateral, such as real estate or personal property, that the lender may seize in the event of non-payment. 2. Unsecured Promissory Note: Unlike a secured note, this type of promissory note does not have any collateral backing it. It relies solely on the borrower's promise to repay the loan. 3. Installment Promissory Note: This type of note involves regular periodic payments made by the borrower to the lender, typically on a monthly basis, until the loan is fully repaid. 4. Balloon Promissory Note: In a balloon note, the borrower agrees to make smaller payments over the term of the loan, with a larger "balloon" payment due at the end. 5. Demand Promissory Note: This note requires the borrower to repay the loan upon the lender's request, instead of having a predefined repayment schedule. It is important to note that a Lima Arizona Negotiable Promissory Note should be drafted with the assistance of legal professionals to ensure compliance with state laws and to protect the rights and interests of both the borrower and the lender.A Lima Arizona Negotiable Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Lima, Arizona. This type of promissory note is considered negotiable, meaning it can be transferred or assigned to another party. Key features of a Lima Arizona Negotiable Promissory Note include the principal amount borrowed, the interest rate, the repayment schedule, and any penalties or fees associated with late or missed payments. It also identifies the parties involved, including the borrower and the lender, along with their contact information. Additionally, this document may include provisions regarding default, acceleration, and any collateral that may secure the loan. There are various types of Lima Arizona Negotiable Promissory Notes, including: 1. Secured Promissory Note: This type of promissory note includes collateral, such as real estate or personal property, that the lender may seize in the event of non-payment. 2. Unsecured Promissory Note: Unlike a secured note, this type of promissory note does not have any collateral backing it. It relies solely on the borrower's promise to repay the loan. 3. Installment Promissory Note: This type of note involves regular periodic payments made by the borrower to the lender, typically on a monthly basis, until the loan is fully repaid. 4. Balloon Promissory Note: In a balloon note, the borrower agrees to make smaller payments over the term of the loan, with a larger "balloon" payment due at the end. 5. Demand Promissory Note: This note requires the borrower to repay the loan upon the lender's request, instead of having a predefined repayment schedule. It is important to note that a Lima Arizona Negotiable Promissory Note should be drafted with the assistance of legal professionals to ensure compliance with state laws and to protect the rights and interests of both the borrower and the lender.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.