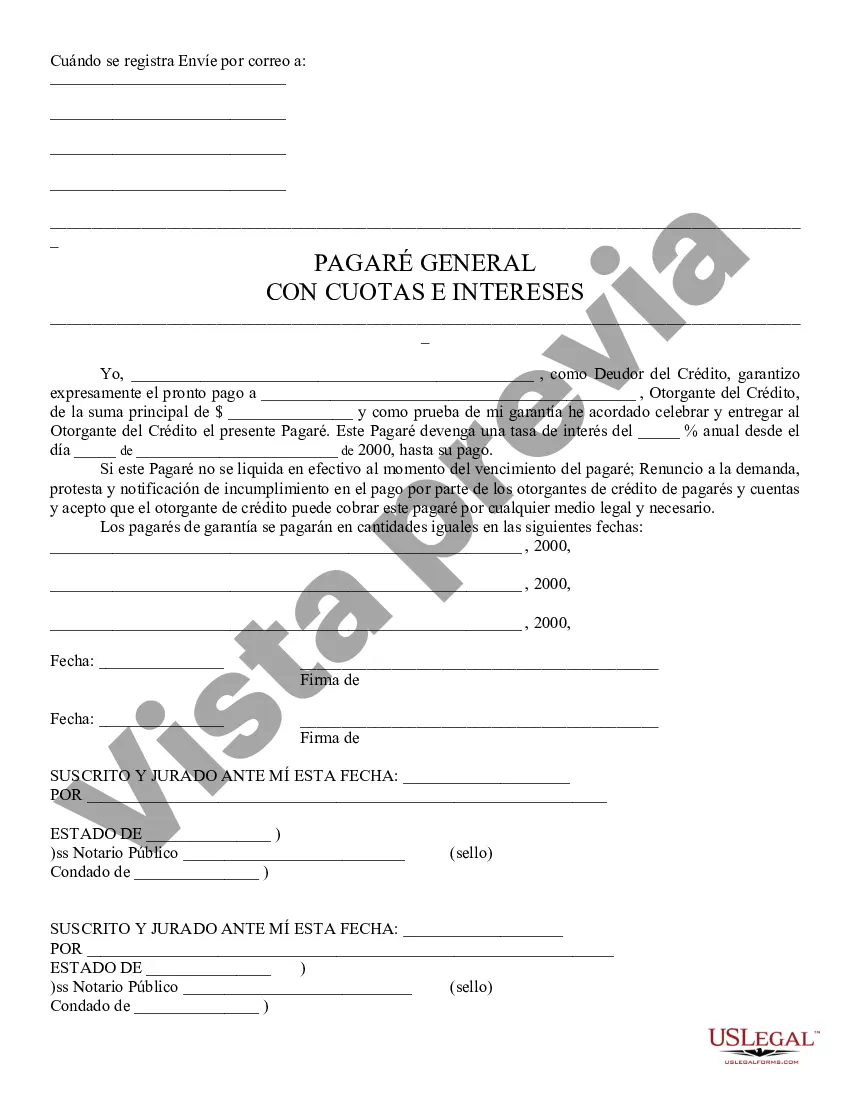

A promissory note is a promise to pay a debt. In this general promissory note, the credit debtor expressly guarantees prompt payment to the credit grantor of a certain principal sum. The credit debtor states that if the note is not settled for in cash at the time of the expiration of the note, then he/she waives demand, protest, and notice of default in payment by credit grantors of notes and accounts and agrees that the credit grantor may collect on the note by any legal means necessary.

A Surprise Arizona negotiable promissory note is a legal document that outlines a promise made by one party (the borrower) to repay a specific amount of money to another party (the lender) within a predetermined time frame. It is a flexible financial instrument used for various purposes, such as personal loans, business loans, real estate transactions, or other monetary lending arrangements in the city of Surprise, Arizona. A negotiable promissory note in Surprise, Arizona follows certain legal requirements and can be transferred or sold to other individuals or entities as a means of raising capital or securing a loan. These notes can be tailored to meet the specific needs of the involved parties, allowing for negotiable terms, interest rates, repayment schedules, and enforcement clauses. Some types of Surprise Arizona negotiable promissory notes include: 1. Personal Loan Promissory Note: This type of note is commonly used for personal lending between friends, family members, or acquaintances within the Surprise, Arizona community. It outlines the terms of repayment, including interest rates (if applicable), and any collateral or penalties involved. 2. Business Loan Promissory Note: Surprise, Arizona businesses often utilize negotiable promissory notes to secure capital or finance projects. This note includes details about the loan amount, repayment schedule, interest rates, and any specific business-related terms. 3. Real Estate Promissory Note: This type of note is prevalent in Surprise, Arizona's real estate sector. It outlines the terms and conditions of a loan used to purchase or invest in real estate properties in the city. It may include provisions related to property collateral, interest rates, and repayment options. 4. Secured Promissory Note: This type of note involves a borrower providing collateral (such as real estate, vehicles, or other assets) as a form of security against the loan. In Surprise, Arizona, a secured promissory note protects the lender's interest in offering recourse in case of default. 5. Unsecured Promissory Note: In contrast to a secured promissory note, an unsecured note does not require collateral from the borrower. It is based solely on the borrower's creditworthiness and trust. However, lenders in Surprise, Arizona may impose higher interest rates or stricter repayment terms due to the increased risk. In summary, a Surprise Arizona negotiable promissory note is a versatile financial agreement that allows for flexible lending arrangements. Whether for personal or business purposes, these notes provide a legally binding framework to ensure transparency, trust, and repayment security in the city of Surprise, Arizona.A Surprise Arizona negotiable promissory note is a legal document that outlines a promise made by one party (the borrower) to repay a specific amount of money to another party (the lender) within a predetermined time frame. It is a flexible financial instrument used for various purposes, such as personal loans, business loans, real estate transactions, or other monetary lending arrangements in the city of Surprise, Arizona. A negotiable promissory note in Surprise, Arizona follows certain legal requirements and can be transferred or sold to other individuals or entities as a means of raising capital or securing a loan. These notes can be tailored to meet the specific needs of the involved parties, allowing for negotiable terms, interest rates, repayment schedules, and enforcement clauses. Some types of Surprise Arizona negotiable promissory notes include: 1. Personal Loan Promissory Note: This type of note is commonly used for personal lending between friends, family members, or acquaintances within the Surprise, Arizona community. It outlines the terms of repayment, including interest rates (if applicable), and any collateral or penalties involved. 2. Business Loan Promissory Note: Surprise, Arizona businesses often utilize negotiable promissory notes to secure capital or finance projects. This note includes details about the loan amount, repayment schedule, interest rates, and any specific business-related terms. 3. Real Estate Promissory Note: This type of note is prevalent in Surprise, Arizona's real estate sector. It outlines the terms and conditions of a loan used to purchase or invest in real estate properties in the city. It may include provisions related to property collateral, interest rates, and repayment options. 4. Secured Promissory Note: This type of note involves a borrower providing collateral (such as real estate, vehicles, or other assets) as a form of security against the loan. In Surprise, Arizona, a secured promissory note protects the lender's interest in offering recourse in case of default. 5. Unsecured Promissory Note: In contrast to a secured promissory note, an unsecured note does not require collateral from the borrower. It is based solely on the borrower's creditworthiness and trust. However, lenders in Surprise, Arizona may impose higher interest rates or stricter repayment terms due to the increased risk. In summary, a Surprise Arizona negotiable promissory note is a versatile financial agreement that allows for flexible lending arrangements. Whether for personal or business purposes, these notes provide a legally binding framework to ensure transparency, trust, and repayment security in the city of Surprise, Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.