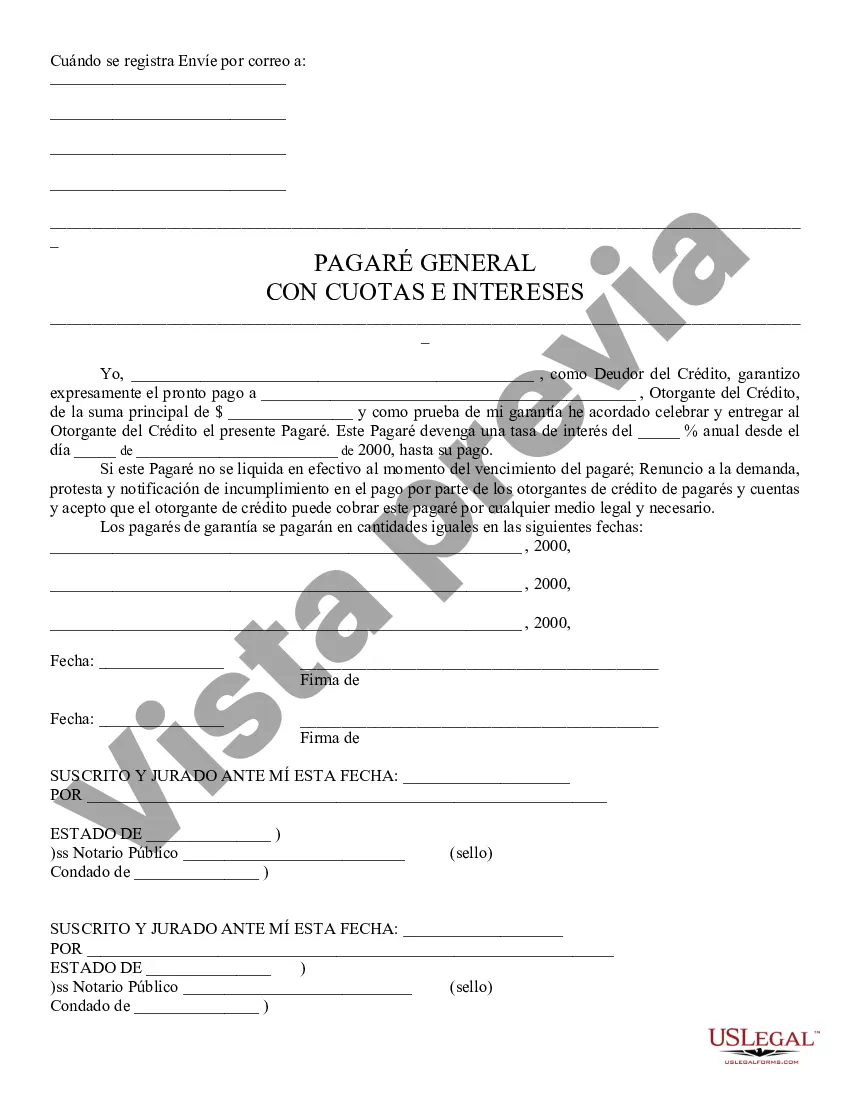

A promissory note is a promise to pay a debt. In this general promissory note, the credit debtor expressly guarantees prompt payment to the credit grantor of a certain principal sum. The credit debtor states that if the note is not settled for in cash at the time of the expiration of the note, then he/she waives demand, protest, and notice of default in payment by credit grantors of notes and accounts and agrees that the credit grantor may collect on the note by any legal means necessary.

A Tempe Arizona negotiable promissory note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the city of Tempe, Arizona. This type of note serves as evidence of a loan and provides important details on the amount borrowed, interest rates, repayment schedule, and other relevant provisions. It is a valuable tool for both parties involved in a loan transaction, ensuring that all terms are clearly defined and agreed upon. In Tempe, Arizona, there may be different types of negotiable promissory notes, each designed to meet specific needs and circumstances. Some common types include: 1. Secured Negotiable Promissory Note: This note requires collateral to secure the loan, providing the lender with an added layer of protection in case the borrower defaults on the loan. The collateral can be any valuable asset owned by the borrower, such as real estate, vehicles, or valuable personal property. 2. Unsecured Negotiable Promissory Note: Unlike a secured note, this type of note does not require any collateral. It relies solely on the borrower's promise to repay the loan. As there is no collateral involved, lenders may charge higher interest rates or impose stricter terms to offset the higher risk. 3. Demand Negotiable Promissory Note: In this case, the lender can demand repayment of the loan balance at any time they choose. This type of note is often used for short-term loans or in situations where the borrower's payment ability may change suddenly. 4. Installment Negotiable Promissory Note: This note establishes a structured repayment plan. The borrower agrees to make a series of regular payments over a specified period until the loan is fully repaid. Each payment consists of both principal and interest. 5. Acceleration Clause: This is an additional provision that can be added to any type of negotiable promissory note. It grants the lender the right to accelerate the repayment schedule in the event of a default, allowing them to demand immediate payment of the full loan balance. It is essential for both borrowers and lenders in Tempe, Arizona, to understand the specific terms and conditions of the negotiable promissory note they are using. Seeking legal advice or consulting with a financial professional is recommended to ensure compliance with state laws and to protect the interests of all parties involved.A Tempe Arizona negotiable promissory note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the city of Tempe, Arizona. This type of note serves as evidence of a loan and provides important details on the amount borrowed, interest rates, repayment schedule, and other relevant provisions. It is a valuable tool for both parties involved in a loan transaction, ensuring that all terms are clearly defined and agreed upon. In Tempe, Arizona, there may be different types of negotiable promissory notes, each designed to meet specific needs and circumstances. Some common types include: 1. Secured Negotiable Promissory Note: This note requires collateral to secure the loan, providing the lender with an added layer of protection in case the borrower defaults on the loan. The collateral can be any valuable asset owned by the borrower, such as real estate, vehicles, or valuable personal property. 2. Unsecured Negotiable Promissory Note: Unlike a secured note, this type of note does not require any collateral. It relies solely on the borrower's promise to repay the loan. As there is no collateral involved, lenders may charge higher interest rates or impose stricter terms to offset the higher risk. 3. Demand Negotiable Promissory Note: In this case, the lender can demand repayment of the loan balance at any time they choose. This type of note is often used for short-term loans or in situations where the borrower's payment ability may change suddenly. 4. Installment Negotiable Promissory Note: This note establishes a structured repayment plan. The borrower agrees to make a series of regular payments over a specified period until the loan is fully repaid. Each payment consists of both principal and interest. 5. Acceleration Clause: This is an additional provision that can be added to any type of negotiable promissory note. It grants the lender the right to accelerate the repayment schedule in the event of a default, allowing them to demand immediate payment of the full loan balance. It is essential for both borrowers and lenders in Tempe, Arizona, to understand the specific terms and conditions of the negotiable promissory note they are using. Seeking legal advice or consulting with a financial professional is recommended to ensure compliance with state laws and to protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.