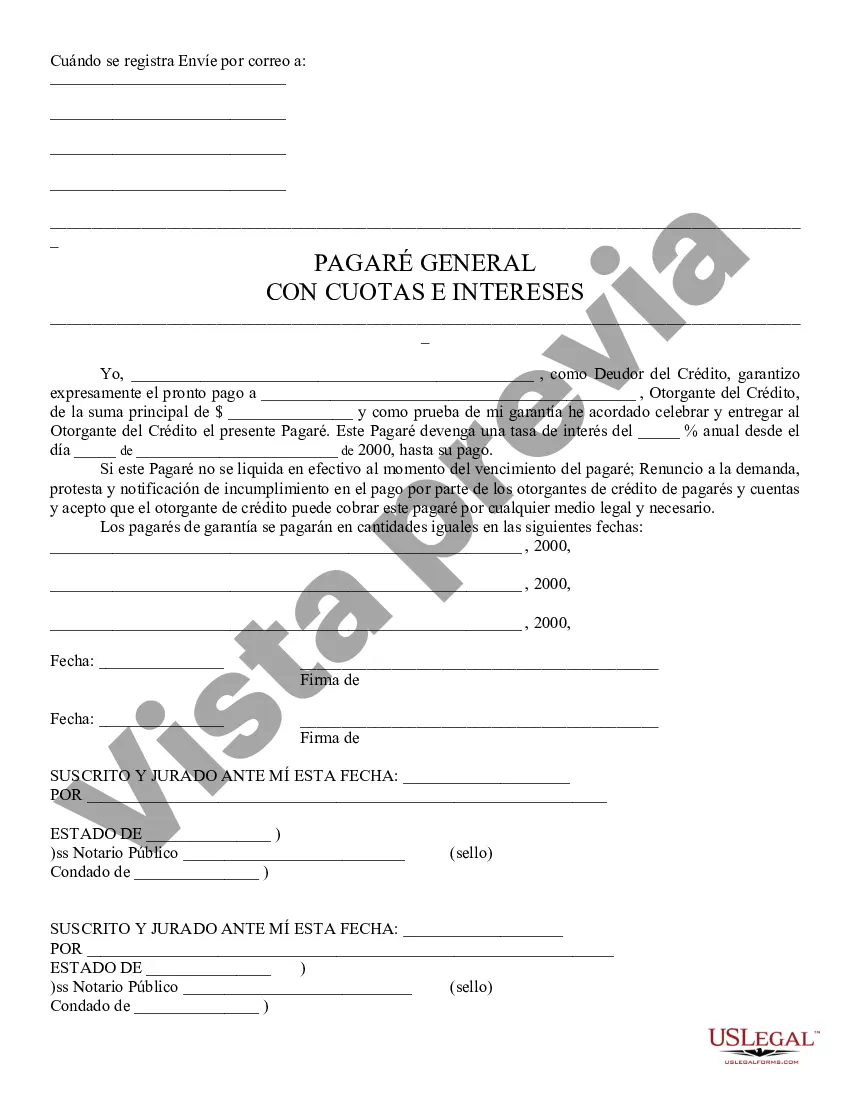

A promissory note is a promise to pay a debt. In this general promissory note, the credit debtor expressly guarantees prompt payment to the credit grantor of a certain principal sum. The credit debtor states that if the note is not settled for in cash at the time of the expiration of the note, then he/she waives demand, protest, and notice of default in payment by credit grantors of notes and accounts and agrees that the credit grantor may collect on the note by any legal means necessary.

A Tucson Arizona Negotiable Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the Tucson, Arizona area. This note serves as a formal promise from the borrower to repay a specific amount of money borrowed, along with any accrued interest, within a predetermined timeframe. Negotiable Promissory Notes are commonly used in various financial transactions in Tucson, Arizona, offering flexibility and convenience to both parties involved. These notes allow for the transfer of the loan from the original lender to a third-party buyer, making them easily sellable and transferable. There are different types of Tucson Arizona Negotiable Promissory Notes, tailored to specific lending situations and requirements. Some common types include: 1. Unsecured Promissory Note: This type of note does not require any collateral from the borrower, making it ideal for borrowers who may not have substantial assets to pledge as security. 2. Secured Promissory Note: Unlike the unsecured note, this note requires the borrower to provide collateral, such as real estate or valuable assets, to secure the loan. In case of default, the lender can claim and sell the collateral to recover the outstanding loan amount. 3. Installment Promissory Note: This note divides the loan repayment into periodic installments, typically monthly or annually, including both principal and interest. Such notes provide borrowers with a structured repayment plan. 4. Balloon Promissory Note: In a balloon note, the borrower agrees to make regular payments for a set period, after which a large, lump-sum payment is due. This type of note is suitable for borrowers who anticipate having additional funds at the end of the loan term. 5. Personal Promissory Note: This note is commonly used for personal loans between family members, friends, or acquaintances. It may have customized terms and interest rates specific to the borrower's relationship with the lender. When drafting or entering into a Tucson Arizona Negotiable Promissory Note, it is crucial to ensure that all terms are clear, comprehensive, and in compliance with local laws and regulations. Seeking legal advice or utilizing templates provided by financial institutions can help create a well-crafted note that protects the rights and interests of all parties involved.A Tucson Arizona Negotiable Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the Tucson, Arizona area. This note serves as a formal promise from the borrower to repay a specific amount of money borrowed, along with any accrued interest, within a predetermined timeframe. Negotiable Promissory Notes are commonly used in various financial transactions in Tucson, Arizona, offering flexibility and convenience to both parties involved. These notes allow for the transfer of the loan from the original lender to a third-party buyer, making them easily sellable and transferable. There are different types of Tucson Arizona Negotiable Promissory Notes, tailored to specific lending situations and requirements. Some common types include: 1. Unsecured Promissory Note: This type of note does not require any collateral from the borrower, making it ideal for borrowers who may not have substantial assets to pledge as security. 2. Secured Promissory Note: Unlike the unsecured note, this note requires the borrower to provide collateral, such as real estate or valuable assets, to secure the loan. In case of default, the lender can claim and sell the collateral to recover the outstanding loan amount. 3. Installment Promissory Note: This note divides the loan repayment into periodic installments, typically monthly or annually, including both principal and interest. Such notes provide borrowers with a structured repayment plan. 4. Balloon Promissory Note: In a balloon note, the borrower agrees to make regular payments for a set period, after which a large, lump-sum payment is due. This type of note is suitable for borrowers who anticipate having additional funds at the end of the loan term. 5. Personal Promissory Note: This note is commonly used for personal loans between family members, friends, or acquaintances. It may have customized terms and interest rates specific to the borrower's relationship with the lender. When drafting or entering into a Tucson Arizona Negotiable Promissory Note, it is crucial to ensure that all terms are clear, comprehensive, and in compliance with local laws and regulations. Seeking legal advice or utilizing templates provided by financial institutions can help create a well-crafted note that protects the rights and interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.