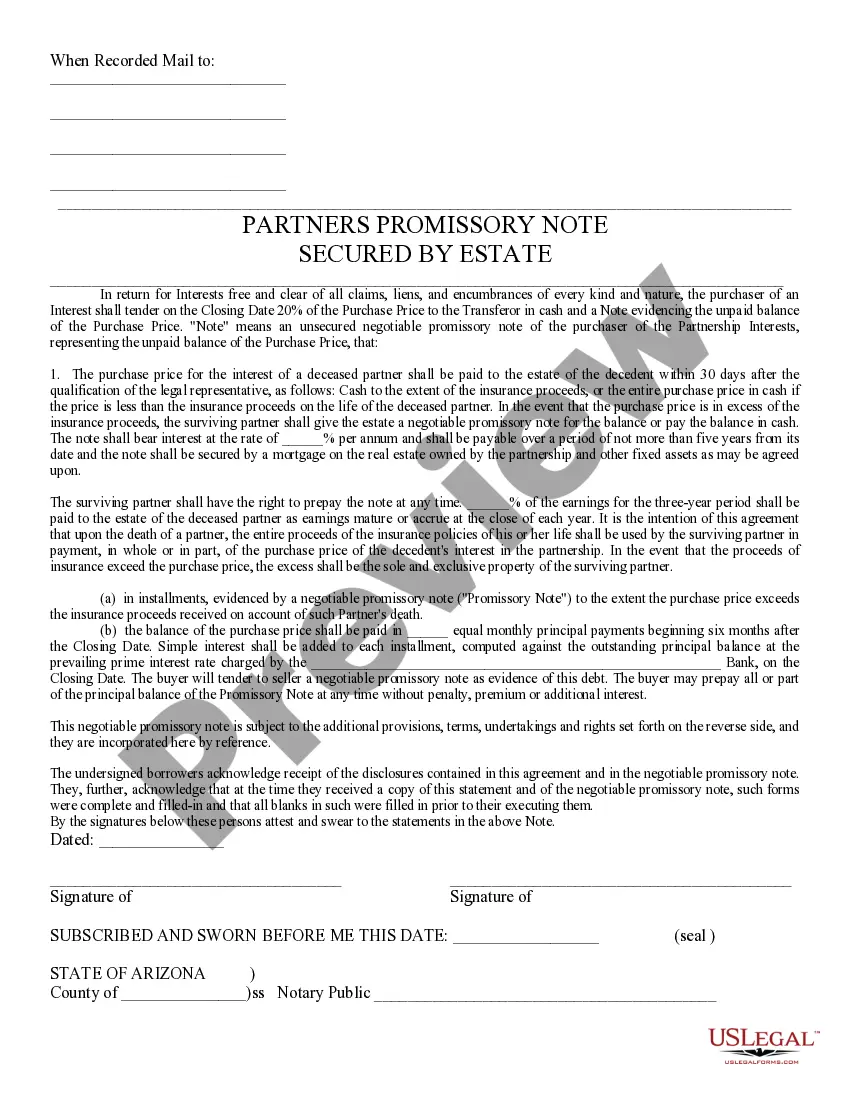

In return for interests free and clear of all claims, liens, and encumbrances of every kind and nature, the purchaser of an interest shall tender on the closing date a certain percentage of the purchase price to the transferor in cash and a note evidencing the unpaid balance of the purchase price.

Tempe Arizona Partners Note Secured by Estate

Description

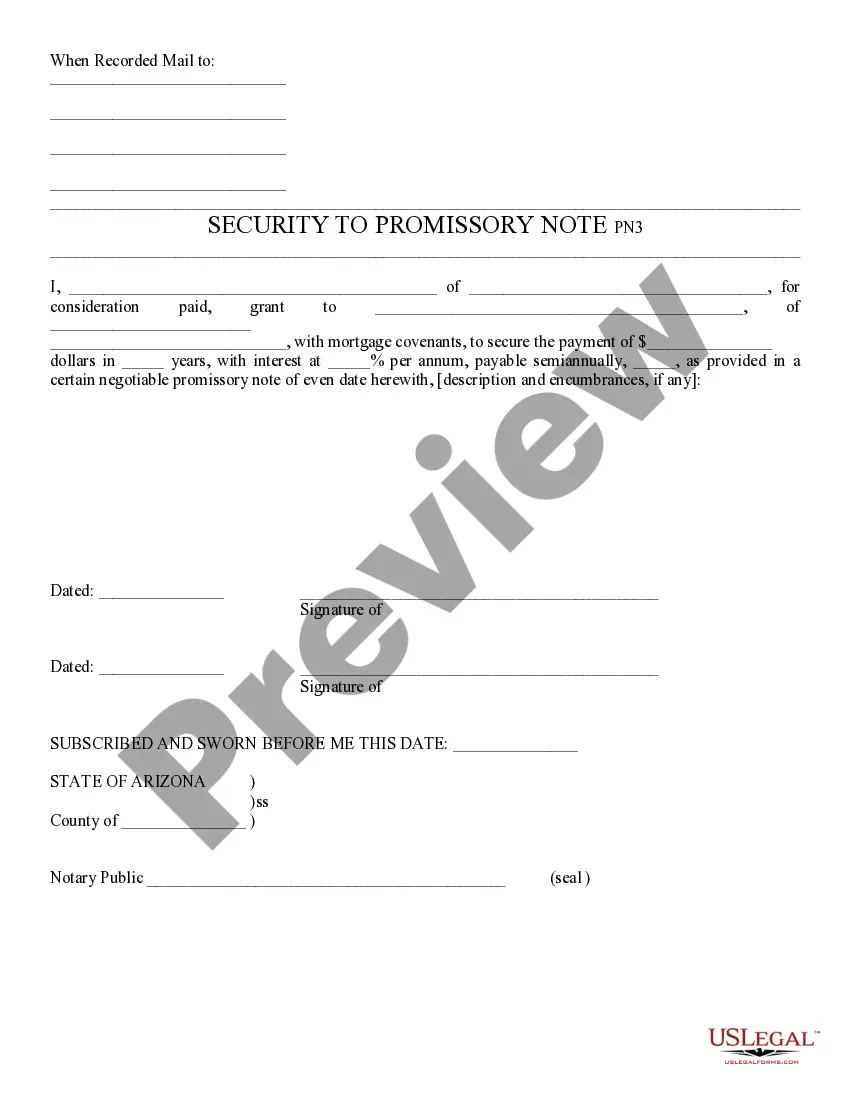

How to fill out Arizona Partners Note Secured By Estate?

We consistently endeavor to reduce or avert legal complications when handling intricate law-related or financial matters.

To achieve this, we seek legal remedies that, generally, are quite costly.

However, not all legal issues are equally complicated. The majority of them can be managed independently.

US Legal Forms is an online repository of current DIY legal documents that cover everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always retrieve it again from within the My documents tab.

- Our library enables you to take control of your affairs without resorting to an attorney.

- We provide access to legal form templates that are not always available to the public.

- Our templates are tailored to specific states and regions, which greatly simplifies the search.

- Utilize US Legal Forms whenever you need to locate and download the Tempe Arizona Partners Note Secured by Estate or any other form effortlessly and securely.

Form popularity

FAQ

In Arizona, a promissory note does not legally require witnesses or notarization to be valid, although having either can reinforce its credibility. Notarization can help prevent disputes later by providing a formal record of the agreement. Leveraging solutions such as the Tempe Arizona Partners Note Secured by Estate can enhance your confidence in these transactions.

In Arizona, a promissory note is generally valid for six years, assuming there is no written agreement dictating otherwise. This timeframe allows for the collection of debts owed to the note holder. Familiarizing yourself with the Tempe Arizona Partners Note Secured by Estate can help you effectively manage and secure your financial interests.

Settling an estate in Arizona can take anywhere from a few months to over a year, depending on factors such as the estate's complexity and any disputes among heirs. The process involves gathering assets, paying debts, and distributing the remaining assets. Understanding the details of Tempe Arizona Partners Note Secured by Estate can streamline aspects of this process.

To become a personal representative for an estate in Arizona, you typically need to file a petition with the probate court. This process requires validation of your relationship to the deceased and a willingness to handle estate duties. Using resources like the Tempe Arizona Partners Note Secured by Estate can help simplify your role, ensuring that all financial obligations are adequately managed.

Yes, a power of attorney must be notarized in Arizona to be considered valid. The notarization process helps verify the identity of the individuals involved and their willingness to sign the document. If you’re managing a Tempe Arizona Partners Note Secured by Estate, obtaining notarization can help assure banks and other institutions of the document's legitimacy.

When formatting a power of attorney, start with the title clearly stating it as a power of attorney document. Outline the powers you grant to your agent, provide spaces for signatures, and include notary sections if needed. For those dealing with a Tempe Arizona Partners Note Secured by Estate, it’s vital to clearly specify responsibilities to avoid misunderstandings.

In Arizona, you do not formally record a living trust, but you should fund your trust by transferring assets into it. This can include real property, like a Tempe Arizona Partners Note Secured by Estate. It’s advisable to prepare a certification of trust document, which can simplify asset management and transactions involving the trust.

A power of attorney does not need to be recorded in Arizona unless it is used for real estate transactions. However, if your power of attorney involves significant estate matters, like a Tempe Arizona Partners Note Secured by Estate, recording can be helpful. Recording your document helps ensure its acceptance by institutions and can prevent challenges to its validity later.

In Arizona, a promissory note does not need to be notarized to be legally binding. However, having a notarized document can add an extra layer of security, especially if it is tied to a Tempe Arizona Partners Note Secured by Estate. Notarization provides evidence that both parties have signed willingly and can help avoid disputes in the future.

Settling an estate in Arizona involves several steps, including filing the will with the probate court, notifying beneficiaries, and paying off debts. It’s crucial to understand that if you have a Tempe Arizona Partners Note Secured by Estate, you might need specific legal assistance to navigate the complexities involved. Using platforms like uslegalforms can simplify documentation and ensure you fulfill all legal requirements efficiently.