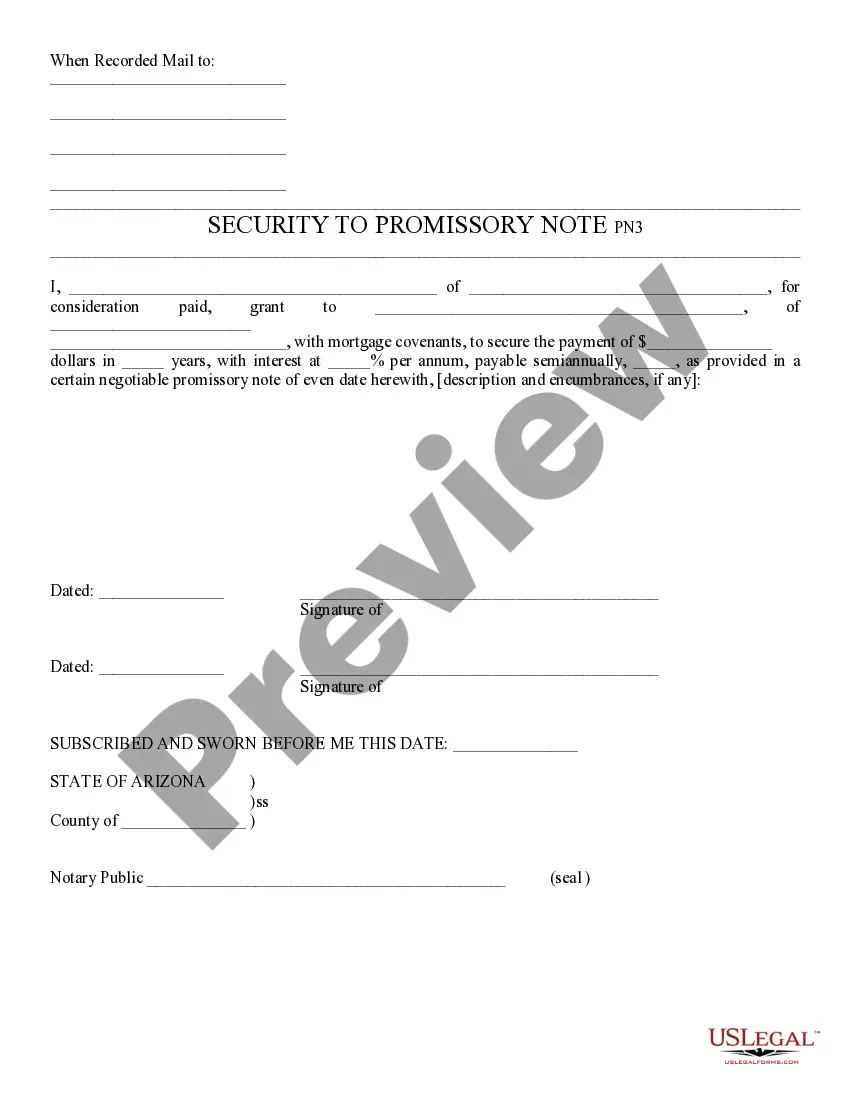

Security to Promissory Note - Arizona: This is a form which gives a type of security, or collateral, in exchange for the signing of a promissory note. It is to be signed by both parties, in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Phoenix Arizona Security to Promissory Note

Description

How to fill out Arizona Security To Promissory Note?

Acquiring certified templates tailored to your regional laws can be challenging unless you utilize the US Legal Forms repository.

This is a virtual collection of over 85,000 legal documents for both personal and professional requirements and various real-life situations.

All the files are accurately categorized by area of application and jurisdiction, making it as straightforward and simple as ABC to find the Phoenix Arizona Security to Promissory Note.

Take your credit card information or utilize your PayPal account to buy the subscription.

- Review the Preview mode and document overview.

- Ensure you've selected the correct document that aligns with your specifications and fully meets your local regulatory standards.

- Search for another document, if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one. If it fits your needs, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

So, what's the difference between secured and unsecured promissory notes? It's actually quite simple. A secured note is any debt collateralized with real property like a first deed of trust or car title. Conversely, an unsecured note is any debt not secured by collateral (or uncollateralized).

There is no legal requirement for a promissory note to be witnessed or notarized in Arizona. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

A promissory note is like a written promise or IOU for everything from car loans to loans between family members. Even without a signature from a notary public, it can still be a valid promissory note.

Collateral. This Note is secured by the Collateral Documents. Reference is made to the Collateral Documents for the terms and conditions governing the Collateral which secures the Obligations.

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.