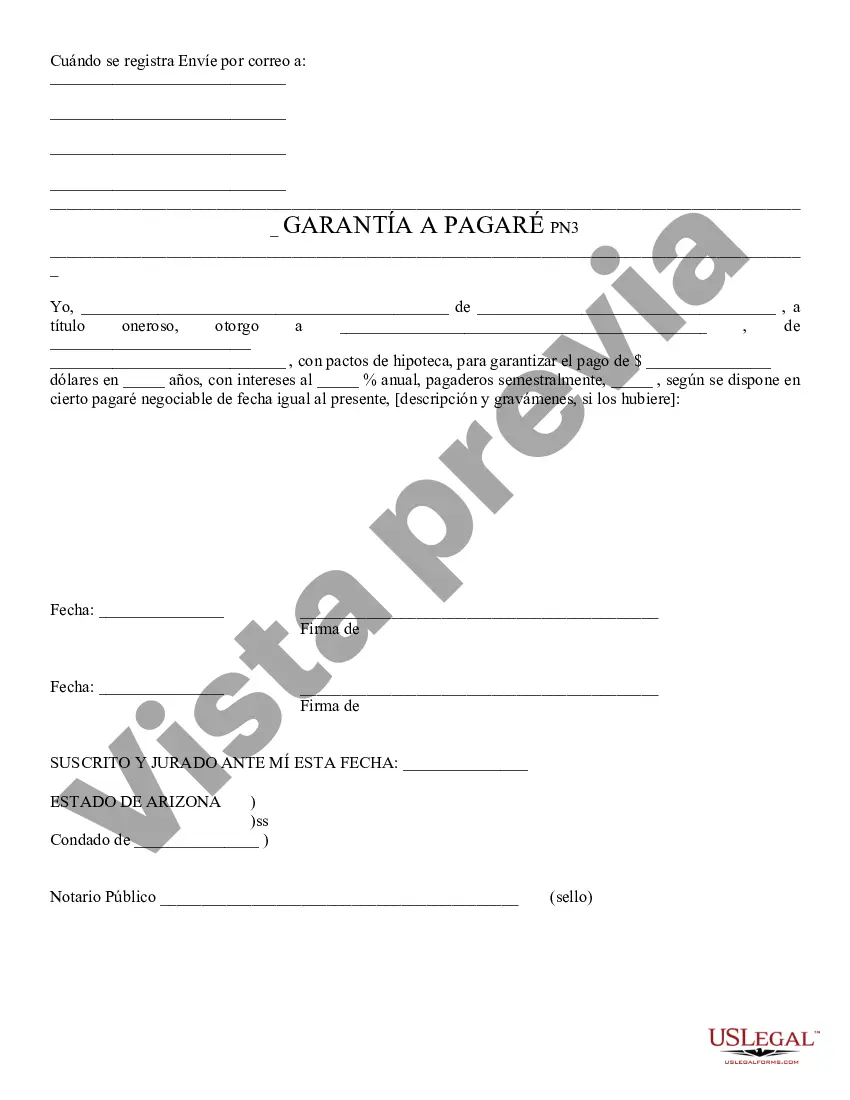

Security to Promissory Note - Arizona: This is a form which gives a type of security, or collateral, in exchange for the signing of a promissory note. It is to be signed by both parties, in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Surprise Arizona Security to Promissory Note is a legal document that outlines the terms of a loan agreement and provides security for the lender in the event of default by the borrower. It serves as collateral to ensure repayment of the borrowed funds. This document is crucial in protecting both parties involved in the lending process. The Surprise Arizona Security to Promissory Note can take different forms depending on the specific requirements of the loan and the preferences of the parties involved. Some common types of security that can be included in this document are: 1. Real Estate: This type of security involves using real property as collateral. The borrower grants a lien on their property, such as a home, land, or commercial building, to secure the loan. In case of default, the lender has the right to foreclose on the property and sell it to recover the outstanding debt. 2. Personal Property: Personal property can also be used as security in a Surprise Arizona Security to Promissory Note. This may include vehicles, equipment, inventory, or other valuable assets owned by the borrower. Similar to real estate, in case of default, the lender can seize and sell the collateral to recover the loan amount. 3. Cash Collateral: Sometimes, borrowers may pledge cash or cash equivalents, like marketable securities or certificates of deposit, as security for the loan. These funds are held by the lender in a designated account and may be used to repay the debt if the borrower fails to do so. 4. Guarantor or Co-Signer: In certain cases, a third party may agree to act as a guarantor or co-signer for the loan. This person becomes responsible for the debt if the borrower defaults. Their assets or income can be used as security to ensure repayment. The Surprise Arizona Security to Promissory Note includes essential information such as the loan amount, interest rate, payment schedule, and any late fees or penalties. It specifies the rights and responsibilities of both the lender and borrower and highlights the consequences of default. In conclusion, Surprise Arizona Security to Promissory Note is a legal document that provides security to the lender when entering into a loan agreement. It can take different forms depending on the type of collateral used, including real estate, personal property, cash collateral, or a guarantor. This document is crucial in ensuring the repayment of borrowed funds and protecting the interests of both parties involved.Surprise Arizona Security to Promissory Note is a legal document that outlines the terms of a loan agreement and provides security for the lender in the event of default by the borrower. It serves as collateral to ensure repayment of the borrowed funds. This document is crucial in protecting both parties involved in the lending process. The Surprise Arizona Security to Promissory Note can take different forms depending on the specific requirements of the loan and the preferences of the parties involved. Some common types of security that can be included in this document are: 1. Real Estate: This type of security involves using real property as collateral. The borrower grants a lien on their property, such as a home, land, or commercial building, to secure the loan. In case of default, the lender has the right to foreclose on the property and sell it to recover the outstanding debt. 2. Personal Property: Personal property can also be used as security in a Surprise Arizona Security to Promissory Note. This may include vehicles, equipment, inventory, or other valuable assets owned by the borrower. Similar to real estate, in case of default, the lender can seize and sell the collateral to recover the loan amount. 3. Cash Collateral: Sometimes, borrowers may pledge cash or cash equivalents, like marketable securities or certificates of deposit, as security for the loan. These funds are held by the lender in a designated account and may be used to repay the debt if the borrower fails to do so. 4. Guarantor or Co-Signer: In certain cases, a third party may agree to act as a guarantor or co-signer for the loan. This person becomes responsible for the debt if the borrower defaults. Their assets or income can be used as security to ensure repayment. The Surprise Arizona Security to Promissory Note includes essential information such as the loan amount, interest rate, payment schedule, and any late fees or penalties. It specifies the rights and responsibilities of both the lender and borrower and highlights the consequences of default. In conclusion, Surprise Arizona Security to Promissory Note is a legal document that provides security to the lender when entering into a loan agreement. It can take different forms depending on the type of collateral used, including real estate, personal property, cash collateral, or a guarantor. This document is crucial in ensuring the repayment of borrowed funds and protecting the interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.