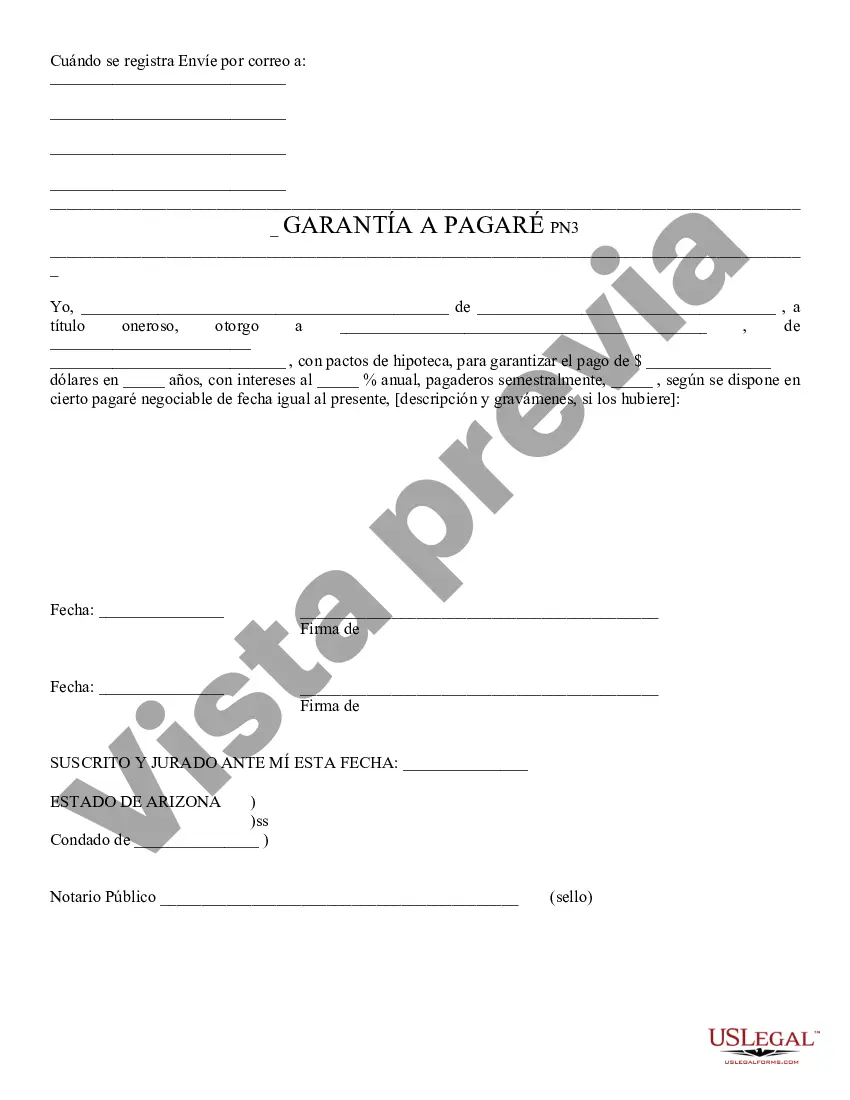

Security to Promissory Note - Arizona: This is a form which gives a type of security, or collateral, in exchange for the signing of a promissory note. It is to be signed by both parties, in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Tempe Arizona Security to Promissory Note is a legal document that provides protection and assurance to lenders in any financial transaction involving promissory notes in the Tempe, Arizona area. It establishes a security interest to secure the repayment of the debt mentioned in the promissory note. 1. Key Features: The Tempe Arizona Security to Promissory Note contains specific features to safeguard the lender's investment: a) Identification of Parties: This document precisely identifies the lender (secured party) and borrower (debtor) involved in the transaction. Their contact information and legal names are clearly stated. b) Collateral Description: The security to promissory note specifies the collateral offered by the borrower to secure repayment. The description should be detailed and include all pertinent information about the collateral, such as its market value, location, and condition. c) Obligations and Terms: The document outlines the obligations and terms of repayment, including the principal amount, interest rate, payment schedule, late fees, and default consequences. d) Default Provision: In case the borrower fails to fulfill their payment obligations, this section elaborates on the consequences and remedies available to the lender, such as repossession or foreclosure of collateral. 2. Types of Tempe Arizona Security to Promissory Note: Depending on the nature and specific requirements of the financing transaction in Tempe, Arizona, there can be several types of security to promissory notes, including: a) Real Estate Security to Promissory Note: This type of security is commonly used when the promissory note is associated with real estate transactions. The collateral offered can be a property, land, or building to secure the repayment. b) Vehicle Security to Promissory Note: In cases where the promissory note relates to the financing of a vehicle purchase or loan, this type of security comes into play. The collateral provided can be the vehicle itself. c) Business Security to Promissory Note: This type of security applies when the promissory note is associated with business financing or loans, and the collateral offered can be assets, equipment, or inventory owned by the business. d) Personal Property Security to Promissory Note: When the promissory note involves personal loans or financing, this type of security may be used. The collateral can include personal assets like jewelry, electronics, or valuable collections. In conclusion, the Tempe Arizona Security to Promissory Note is a vital legal document that provides protection and security to lenders during financial transactions involving promissory notes. Different types of security to promissory notes exist, such as real estate, vehicle, business, and personal property, depending on the nature of the transaction and the collateral involved.Tempe Arizona Security to Promissory Note is a legal document that provides protection and assurance to lenders in any financial transaction involving promissory notes in the Tempe, Arizona area. It establishes a security interest to secure the repayment of the debt mentioned in the promissory note. 1. Key Features: The Tempe Arizona Security to Promissory Note contains specific features to safeguard the lender's investment: a) Identification of Parties: This document precisely identifies the lender (secured party) and borrower (debtor) involved in the transaction. Their contact information and legal names are clearly stated. b) Collateral Description: The security to promissory note specifies the collateral offered by the borrower to secure repayment. The description should be detailed and include all pertinent information about the collateral, such as its market value, location, and condition. c) Obligations and Terms: The document outlines the obligations and terms of repayment, including the principal amount, interest rate, payment schedule, late fees, and default consequences. d) Default Provision: In case the borrower fails to fulfill their payment obligations, this section elaborates on the consequences and remedies available to the lender, such as repossession or foreclosure of collateral. 2. Types of Tempe Arizona Security to Promissory Note: Depending on the nature and specific requirements of the financing transaction in Tempe, Arizona, there can be several types of security to promissory notes, including: a) Real Estate Security to Promissory Note: This type of security is commonly used when the promissory note is associated with real estate transactions. The collateral offered can be a property, land, or building to secure the repayment. b) Vehicle Security to Promissory Note: In cases where the promissory note relates to the financing of a vehicle purchase or loan, this type of security comes into play. The collateral provided can be the vehicle itself. c) Business Security to Promissory Note: This type of security applies when the promissory note is associated with business financing or loans, and the collateral offered can be assets, equipment, or inventory owned by the business. d) Personal Property Security to Promissory Note: When the promissory note involves personal loans or financing, this type of security may be used. The collateral can include personal assets like jewelry, electronics, or valuable collections. In conclusion, the Tempe Arizona Security to Promissory Note is a vital legal document that provides protection and security to lenders during financial transactions involving promissory notes. Different types of security to promissory notes exist, such as real estate, vehicle, business, and personal property, depending on the nature of the transaction and the collateral involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.