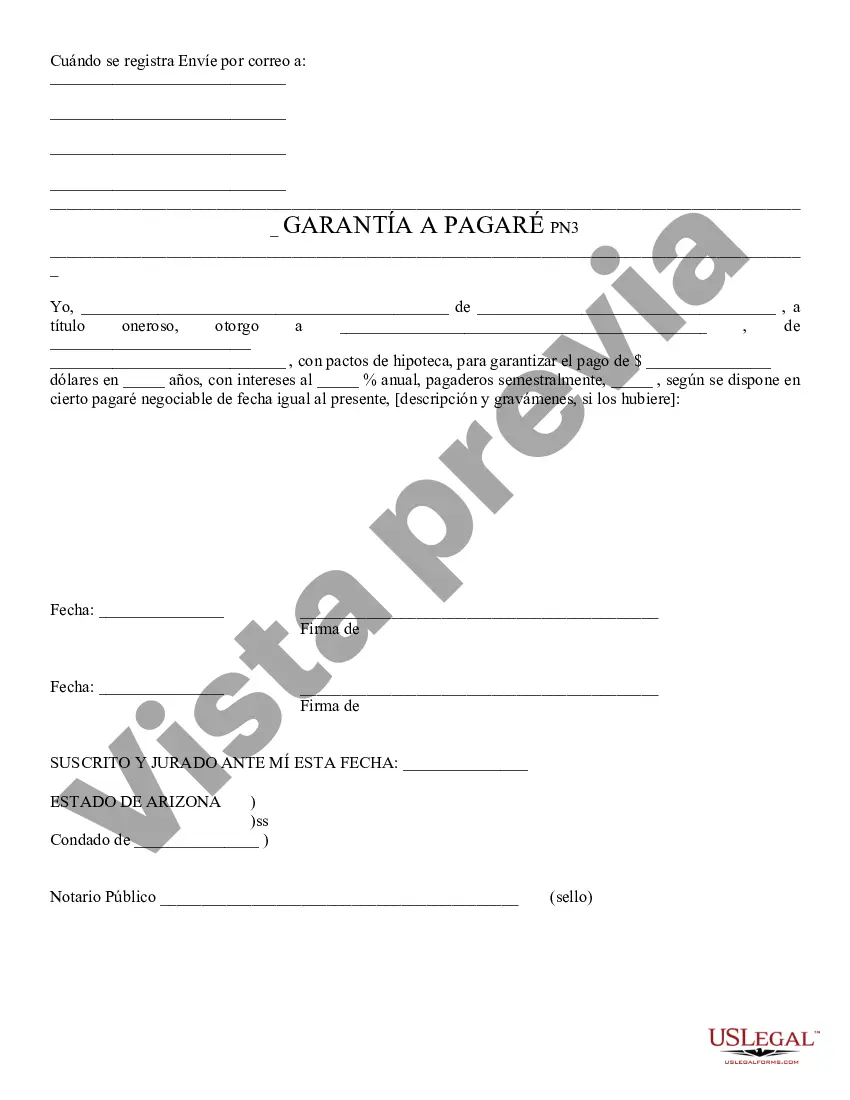

Security to Promissory Note - Arizona: This is a form which gives a type of security, or collateral, in exchange for the signing of a promissory note. It is to be signed by both parties, in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Title: Understanding Tucson, Arizona Security to Promissory Note: Types and Detailed Description Introduction: In the city of Tucson, Arizona, several types of security to promissory notes are in used to ensure loan repayment and protect the interests of lenders. This article aims to provide a comprehensive overview of Tucson, Arizona security to promissory notes, explaining their importance and various types. 1. Definition and Purpose of Tucson, Arizona Security to Promissory Note: A Tucson, Arizona security to promissory note is a legal document that outlines the terms of a promissory note and includes additional security measures to protect the lender's investment. Its primary purpose is to provide collateral to cover the loan amount in case the borrower defaults or is unable to repay. It establishes a sense of trust and accountability between the lender and the borrower. 2. Types of Tucson, Arizona Security to Promissory Note: a. Real Estate Mortgage: A real estate mortgage serves as security for a promissory note by pledging a property as collateral. If the borrower fails to repay the loan, the lender can foreclose on the property and use the proceeds to recover the outstanding debt. b. UCC Financing Statement: The Uniform Commercial Code (UCC) filing is used when the collateral involved isn't real estate. It typically applies to movable assets, such as vehicles, equipment, inventory, or receivables. This filing provides public notice of the lender's interest in the collateral and allows them to seize it if the borrower defaults. c. Deed of Trust: Similar to a mortgage, a deed of trust secures the repayment of a promissory note with real estate collateral. It involves three parties: the borrower, the lender, and a trustee who legally holds the title until the loan is paid. If the borrower defaults, the trustee can sell the property and use the proceeds to satisfy the outstanding debt. d. Personal Guarantee: In some cases, lenders may require a personal guarantee, which makes a third party (usually a guarantor) responsible for loan repayment if the borrower defaults. This provides an additional layer of security, especially when dealing with businesses or entities. e. Pledge of Assets: A pledge of assets involves the borrower pledging specific assets, such as stocks, bonds, or valuable possessions, to secure the promissory note. If the borrower fails to repay the loan, the lender can seize and sell these assets to recover their investment. Conclusion: Tucson, Arizona security to promissory notes play a crucial role in safeguarding the interests of lenders and ensuring loan repayment. In this city, various types of security measures are employed, including real estate mortgages, UCC filings, deeds of trust, personal guarantees, and pledges of assets. By understanding the different types, borrowers and lenders can make informed decisions that protect their financial interests.Title: Understanding Tucson, Arizona Security to Promissory Note: Types and Detailed Description Introduction: In the city of Tucson, Arizona, several types of security to promissory notes are in used to ensure loan repayment and protect the interests of lenders. This article aims to provide a comprehensive overview of Tucson, Arizona security to promissory notes, explaining their importance and various types. 1. Definition and Purpose of Tucson, Arizona Security to Promissory Note: A Tucson, Arizona security to promissory note is a legal document that outlines the terms of a promissory note and includes additional security measures to protect the lender's investment. Its primary purpose is to provide collateral to cover the loan amount in case the borrower defaults or is unable to repay. It establishes a sense of trust and accountability between the lender and the borrower. 2. Types of Tucson, Arizona Security to Promissory Note: a. Real Estate Mortgage: A real estate mortgage serves as security for a promissory note by pledging a property as collateral. If the borrower fails to repay the loan, the lender can foreclose on the property and use the proceeds to recover the outstanding debt. b. UCC Financing Statement: The Uniform Commercial Code (UCC) filing is used when the collateral involved isn't real estate. It typically applies to movable assets, such as vehicles, equipment, inventory, or receivables. This filing provides public notice of the lender's interest in the collateral and allows them to seize it if the borrower defaults. c. Deed of Trust: Similar to a mortgage, a deed of trust secures the repayment of a promissory note with real estate collateral. It involves three parties: the borrower, the lender, and a trustee who legally holds the title until the loan is paid. If the borrower defaults, the trustee can sell the property and use the proceeds to satisfy the outstanding debt. d. Personal Guarantee: In some cases, lenders may require a personal guarantee, which makes a third party (usually a guarantor) responsible for loan repayment if the borrower defaults. This provides an additional layer of security, especially when dealing with businesses or entities. e. Pledge of Assets: A pledge of assets involves the borrower pledging specific assets, such as stocks, bonds, or valuable possessions, to secure the promissory note. If the borrower fails to repay the loan, the lender can seize and sell these assets to recover their investment. Conclusion: Tucson, Arizona security to promissory notes play a crucial role in safeguarding the interests of lenders and ensuring loan repayment. In this city, various types of security measures are employed, including real estate mortgages, UCC filings, deeds of trust, personal guarantees, and pledges of assets. By understanding the different types, borrowers and lenders can make informed decisions that protect their financial interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.