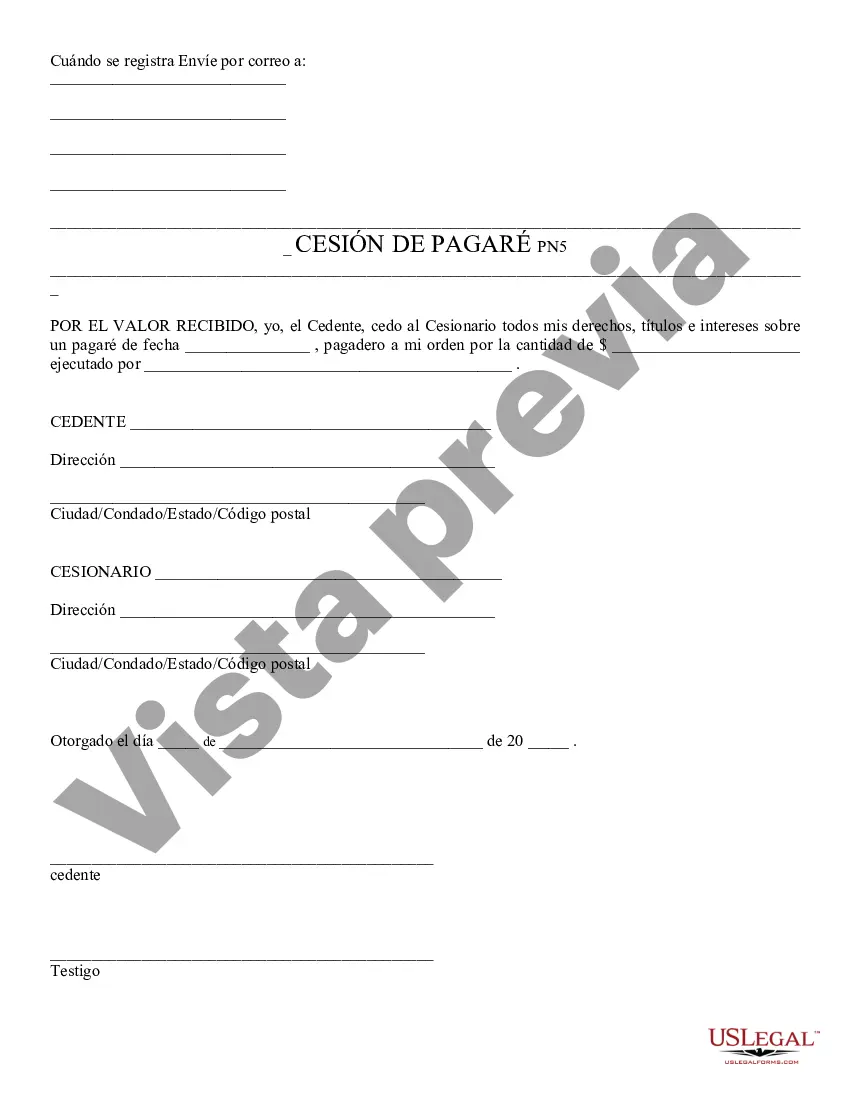

Assignment of Promissory Note - Arizona: This form gives any rights which a party may have had in a promissory note, over to another individual. Both the Assignee and the Assignor should sign this document in front of a Notary Public. It is available for download in both Word and Rich Text formats.

The Maricopa Arizona Assignment of Promissory Note is a legal document used to transfer the rights and obligations associated with a promissory note from one party to another. This assignment is a common practice in the financial industry when the original lender wants to sell or transfer the promissory note to a new holder. A promissory note is a written agreement in which one party, known as the issuer or the debtor, promises to repay a specific amount of money to another party, known as the payee or the lender, on or before a predetermined date. It includes details such as the loan amount, interest rate, repayment terms, and any associated fees or collateral. The Maricopa Arizona Assignment of Promissory Note serves as a legal proof that the rights and interests in the promissory note have been transferred. It allows the new holder to enforce the terms of the promissory note, collect payments, and handle any default or breach of contract if it occurs. There are different types of Maricopa Arizona Assignment of Promissory Note, including: 1. Absolute Assignment: In this type, the original lender (assignor) transfers all rights, title, and interest in the promissory note to the new holder (assignee). The assignee becomes the legal owner of the promissory note and assumes all future rights to receive payments. 2. Collateral Assignment: This type of assignment occurs when the promissory note is used as collateral for a loan or other credit arrangement. The assignor pledges the promissory note as security for an obligation to a creditor. In case of default, the creditor can take possession of the promissory note and use it to fulfill the debt owed. 3. Partial Assignment: In certain situations, the assignor may choose to transfer only a portion of their rights to the assignee. For example, the assignor might assign a specific number of payments or a certain percentage of the total owed on the promissory note. The remaining rights will still belong to the assignor. When executing a Maricopa Arizona Assignment of Promissory Note, it is essential to include specific details to make the assignment legally valid and enforceable. These details may include the names and contact information of the assignor and assignee, the original promissory note details, the effective date of the assignment, and any special conditions or terms agreed upon by both parties. It is advisable to consult with an attorney or legal professional to ensure that the Maricopa Arizona Assignment of Promissory Note fulfills all legal requirements and provides the necessary protection for both the assignor and assignee.The Maricopa Arizona Assignment of Promissory Note is a legal document used to transfer the rights and obligations associated with a promissory note from one party to another. This assignment is a common practice in the financial industry when the original lender wants to sell or transfer the promissory note to a new holder. A promissory note is a written agreement in which one party, known as the issuer or the debtor, promises to repay a specific amount of money to another party, known as the payee or the lender, on or before a predetermined date. It includes details such as the loan amount, interest rate, repayment terms, and any associated fees or collateral. The Maricopa Arizona Assignment of Promissory Note serves as a legal proof that the rights and interests in the promissory note have been transferred. It allows the new holder to enforce the terms of the promissory note, collect payments, and handle any default or breach of contract if it occurs. There are different types of Maricopa Arizona Assignment of Promissory Note, including: 1. Absolute Assignment: In this type, the original lender (assignor) transfers all rights, title, and interest in the promissory note to the new holder (assignee). The assignee becomes the legal owner of the promissory note and assumes all future rights to receive payments. 2. Collateral Assignment: This type of assignment occurs when the promissory note is used as collateral for a loan or other credit arrangement. The assignor pledges the promissory note as security for an obligation to a creditor. In case of default, the creditor can take possession of the promissory note and use it to fulfill the debt owed. 3. Partial Assignment: In certain situations, the assignor may choose to transfer only a portion of their rights to the assignee. For example, the assignor might assign a specific number of payments or a certain percentage of the total owed on the promissory note. The remaining rights will still belong to the assignor. When executing a Maricopa Arizona Assignment of Promissory Note, it is essential to include specific details to make the assignment legally valid and enforceable. These details may include the names and contact information of the assignor and assignee, the original promissory note details, the effective date of the assignment, and any special conditions or terms agreed upon by both parties. It is advisable to consult with an attorney or legal professional to ensure that the Maricopa Arizona Assignment of Promissory Note fulfills all legal requirements and provides the necessary protection for both the assignor and assignee.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.