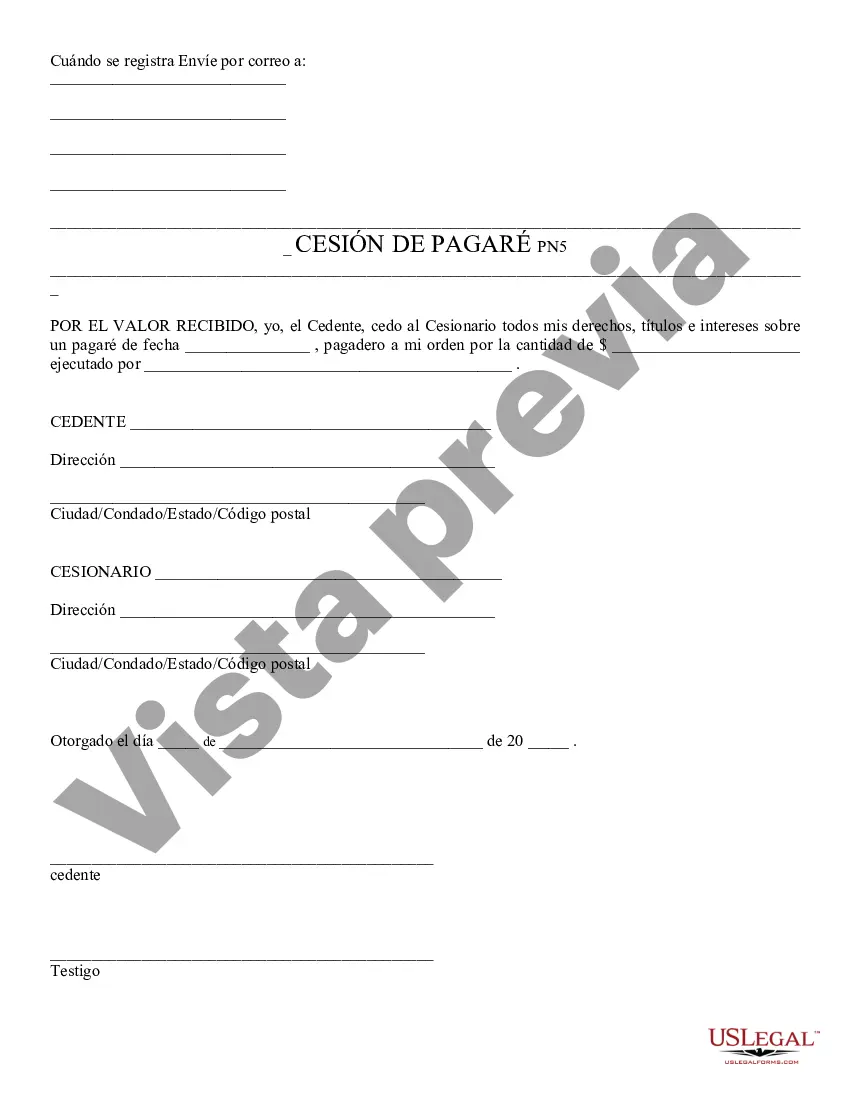

Assignment of Promissory Note - Arizona: This form gives any rights which a party may have had in a promissory note, over to another individual. Both the Assignee and the Assignor should sign this document in front of a Notary Public. It is available for download in both Word and Rich Text formats.

The Tempe Arizona Assignment of Promissory Note is a legal document used to transfer the rights and obligations of a promissory note from one party to another. It is commonly utilized in various financial transactions such as real estate sales, business loans, or private lending agreements. This assignment enables the original lender, also known as the assignor, to transfer their rights to the promissory note to a third party, known as the assignee. This transfer of rights includes the right to collect payments, enforce terms, and take legal action if necessary. The Tempe Arizona Assignment of Promissory Note outlines specific details required for a legal transfer. These details typically include the names and contact information of all parties involved, the original promissory note's date, amount, and terms, and the transfer price or consideration, if applicable. The document should also include provisions for the assignor's warranties and representations regarding the note's validity and enforceability. There are various types of Tempe Arizona Assignment of Promissory Note, depending on the specific nature of the transaction and parties involved: 1. Absolute Assignment: This type of assignment involves the complete transfer of the promissory note, including all rights, title, and interest, from the assignor to the assignee. The assignee assumes all responsibilities and benefits related to the note. 2. Collateral Assignment: In some cases, the assignor may transfer only a portion of their rights as collateral for a separate obligation. This partial transfer allows the assignee to receive payments directly from the debtor, but the assignor retains certain rights and interests until the separate obligation is fulfilled. 3. Assignment of Security Interest: This type of assignment occurs when the assignor pledges the promissory note as collateral for a loan or credit agreement. The assignee obtains a security interest in the note, enabling them to seize the collateral if the debtor defaults on the loan. 4. Equitable Assignment: An equitable assignment refers to the transfer of an expectancy or contingent interest in the promissory note. While not recognized as a legal transfer, it creates an equitable relationship between the assignor and assignee, allowing the assignee to enforce their rights once the contingency or condition is met. The Tempe Arizona Assignment of Promissory Note is an essential legal instrument for parties seeking to transfer or acquire rights to a promissory note in Tempe, Arizona. By executing this document correctly, all parties can ensure a smooth and lawful transfer of rights, thus safeguarding their interests in the promissory note transaction.The Tempe Arizona Assignment of Promissory Note is a legal document used to transfer the rights and obligations of a promissory note from one party to another. It is commonly utilized in various financial transactions such as real estate sales, business loans, or private lending agreements. This assignment enables the original lender, also known as the assignor, to transfer their rights to the promissory note to a third party, known as the assignee. This transfer of rights includes the right to collect payments, enforce terms, and take legal action if necessary. The Tempe Arizona Assignment of Promissory Note outlines specific details required for a legal transfer. These details typically include the names and contact information of all parties involved, the original promissory note's date, amount, and terms, and the transfer price or consideration, if applicable. The document should also include provisions for the assignor's warranties and representations regarding the note's validity and enforceability. There are various types of Tempe Arizona Assignment of Promissory Note, depending on the specific nature of the transaction and parties involved: 1. Absolute Assignment: This type of assignment involves the complete transfer of the promissory note, including all rights, title, and interest, from the assignor to the assignee. The assignee assumes all responsibilities and benefits related to the note. 2. Collateral Assignment: In some cases, the assignor may transfer only a portion of their rights as collateral for a separate obligation. This partial transfer allows the assignee to receive payments directly from the debtor, but the assignor retains certain rights and interests until the separate obligation is fulfilled. 3. Assignment of Security Interest: This type of assignment occurs when the assignor pledges the promissory note as collateral for a loan or credit agreement. The assignee obtains a security interest in the note, enabling them to seize the collateral if the debtor defaults on the loan. 4. Equitable Assignment: An equitable assignment refers to the transfer of an expectancy or contingent interest in the promissory note. While not recognized as a legal transfer, it creates an equitable relationship between the assignor and assignee, allowing the assignee to enforce their rights once the contingency or condition is met. The Tempe Arizona Assignment of Promissory Note is an essential legal instrument for parties seeking to transfer or acquire rights to a promissory note in Tempe, Arizona. By executing this document correctly, all parties can ensure a smooth and lawful transfer of rights, thus safeguarding their interests in the promissory note transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.