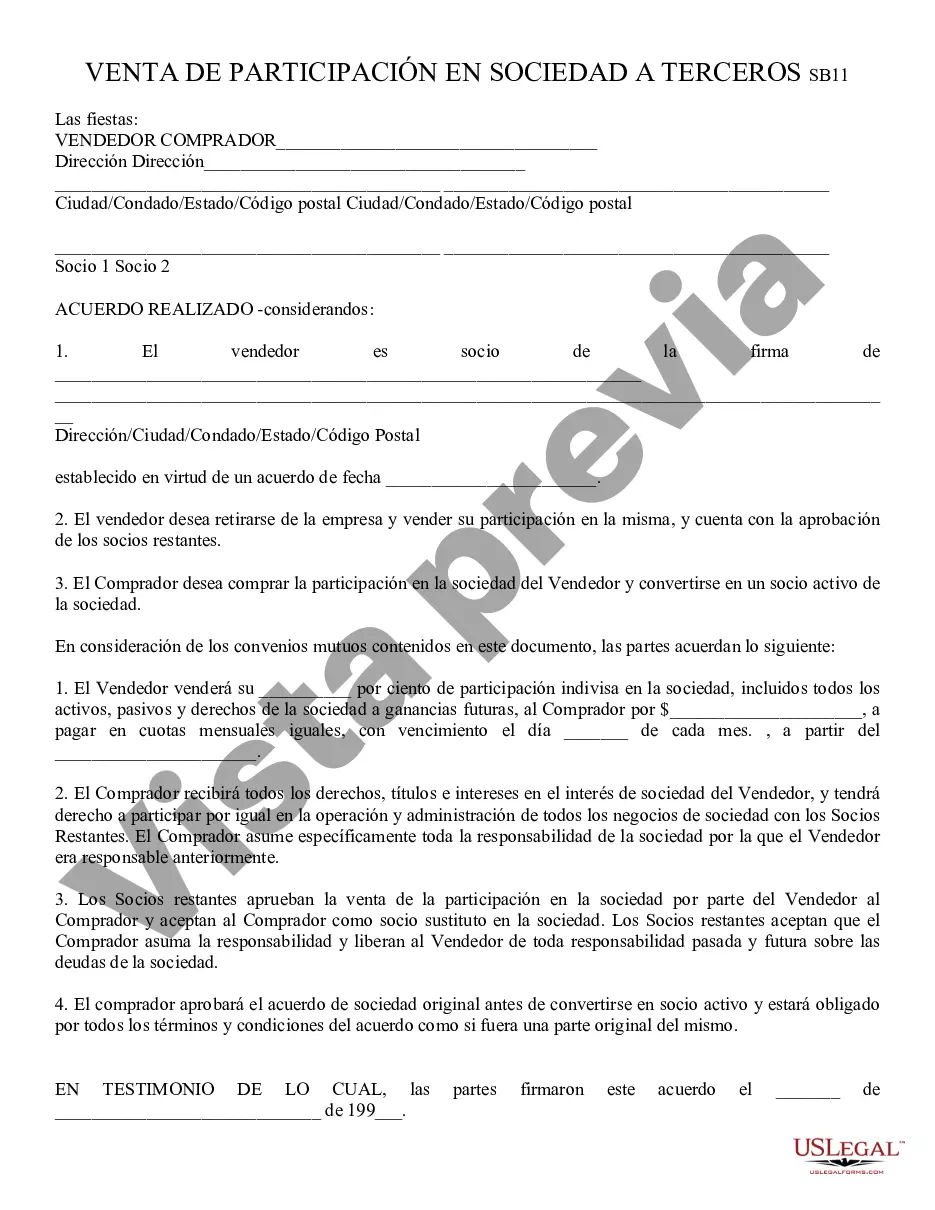

This is a contract between a Partner in a business and an intended Purchaser of his/her interest in the company. When a Partner wishes to sell his/her interest in a company, he/she must seek the approval of the remaining Partners. If they agree to the sell, the Partner may sell his/her interest to a Third Party. Both the Partner/Seller and the Third Party Purchaser must sign this form in front of a Notary Public, in order to be a valid agreement. This form is available in both Word and Rich Text formats.

Surprise Arizona Sale of Partnership Interest to Third Party refers to the transaction where a partner in a business partnership located in Surprise, Arizona transfers their ownership stake or interest in the partnership to an outside individual or entity. This sale allows the partner to cash out their investment and exit the partnership, while enabling the third party to acquire a financial interest in the partnership and potentially participate in its management and profits. This sale may be conducted for various reasons such as retirement, pursuing other business opportunities, or simply wanting to liquidate their investment. The terms of the sale, including the price and conditions, are typically determined through negotiations between the selling partner and the potential third party buyer. It is important for both parties to engage in a thorough due diligence process to assess the financial health of the partnership, its assets and liabilities, and any potential risks or obligations associated with the partnership. In Surprise, Arizona, there may be different types of sales of partnership interest to a third party, including: 1. Partial Sale of Partnership Interest: In this scenario, a partner sells only a portion of their interest in the partnership to a third party. This allows the selling partner to retain some ownership in the partnership while still benefiting from the proceeds of the sale. 2. Complete Sale of Partnership Interest: In a complete sale, the partner transfers their entire ownership stake or interest in the partnership to the third party. This effectively withdraws the partner from any ongoing involvement in the partnership and relinquishes all rights and responsibilities associated with it. 3. Outright Sale vs. Installment Sale: The sale of partnership interest can be structured as an outright sale, where the selling partner receives the full payment upon sale completion. Alternatively, it can be structured as an installment sale, where the payment is spread over a certain period, typically with interest. This provides the buyer with more flexibility in managing their cash flow. 4. Restrictive Sale Agreements: Some partnership agreements might include restrictions on the sale of partnership interest to third parties. These restrictions could require the approval of other partners, impose limitations on the types of buyers, or outline specific conditions that must be met before a sale can proceed. Compliance with these restrictions is crucial to avoid potential legal disputes. Overall, the Surprise Arizona Sale of Partnership Interest to Third Party is an important mechanism for partners to exit a partnership while providing an opportunity for new investors to acquire a financial stake in a business located in Surprise, Arizona. Proper due diligence and legal compliance should be a priority for both parties to ensure a smooth and successful transaction.Surprise Arizona Sale of Partnership Interest to Third Party refers to the transaction where a partner in a business partnership located in Surprise, Arizona transfers their ownership stake or interest in the partnership to an outside individual or entity. This sale allows the partner to cash out their investment and exit the partnership, while enabling the third party to acquire a financial interest in the partnership and potentially participate in its management and profits. This sale may be conducted for various reasons such as retirement, pursuing other business opportunities, or simply wanting to liquidate their investment. The terms of the sale, including the price and conditions, are typically determined through negotiations between the selling partner and the potential third party buyer. It is important for both parties to engage in a thorough due diligence process to assess the financial health of the partnership, its assets and liabilities, and any potential risks or obligations associated with the partnership. In Surprise, Arizona, there may be different types of sales of partnership interest to a third party, including: 1. Partial Sale of Partnership Interest: In this scenario, a partner sells only a portion of their interest in the partnership to a third party. This allows the selling partner to retain some ownership in the partnership while still benefiting from the proceeds of the sale. 2. Complete Sale of Partnership Interest: In a complete sale, the partner transfers their entire ownership stake or interest in the partnership to the third party. This effectively withdraws the partner from any ongoing involvement in the partnership and relinquishes all rights and responsibilities associated with it. 3. Outright Sale vs. Installment Sale: The sale of partnership interest can be structured as an outright sale, where the selling partner receives the full payment upon sale completion. Alternatively, it can be structured as an installment sale, where the payment is spread over a certain period, typically with interest. This provides the buyer with more flexibility in managing their cash flow. 4. Restrictive Sale Agreements: Some partnership agreements might include restrictions on the sale of partnership interest to third parties. These restrictions could require the approval of other partners, impose limitations on the types of buyers, or outline specific conditions that must be met before a sale can proceed. Compliance with these restrictions is crucial to avoid potential legal disputes. Overall, the Surprise Arizona Sale of Partnership Interest to Third Party is an important mechanism for partners to exit a partnership while providing an opportunity for new investors to acquire a financial stake in a business located in Surprise, Arizona. Proper due diligence and legal compliance should be a priority for both parties to ensure a smooth and successful transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.