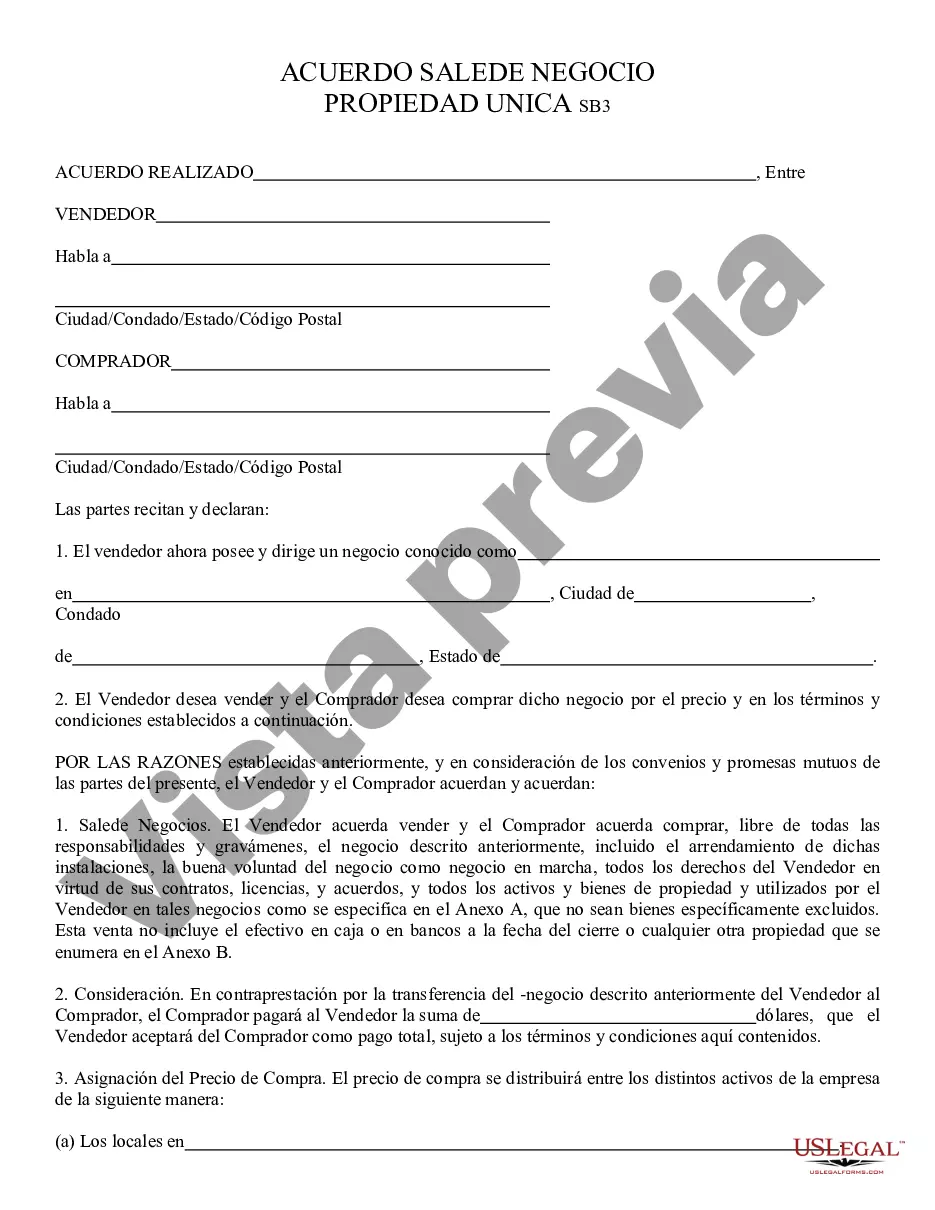

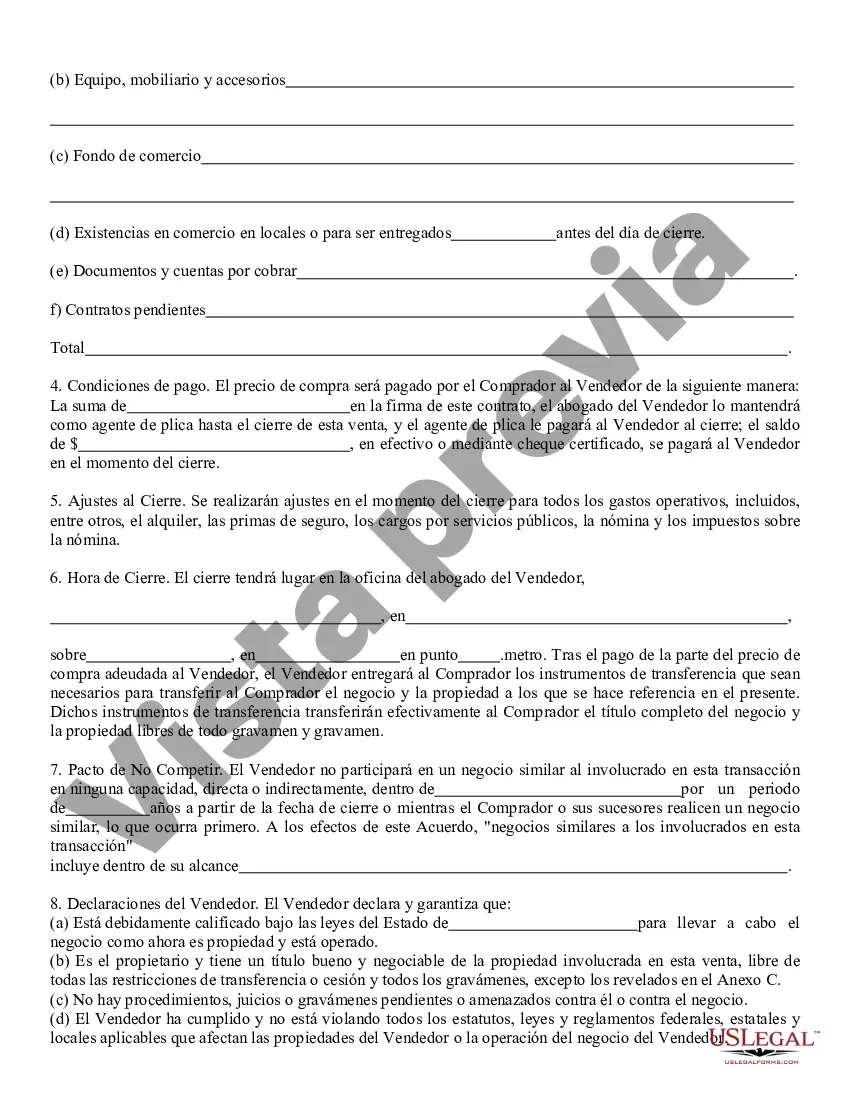

Sale of Business, Sole Proprietorship: This is a contract between an Owner of a Sole Proprietorship and an intended Buyer. This contract lists the conditions to the sell, as well as the agreed upon purchase price. Both the Seller and Buyer must sign this form in front of a Notary Public, in order to be a valid agreement. This form is available in both Word and Rich Text formats.

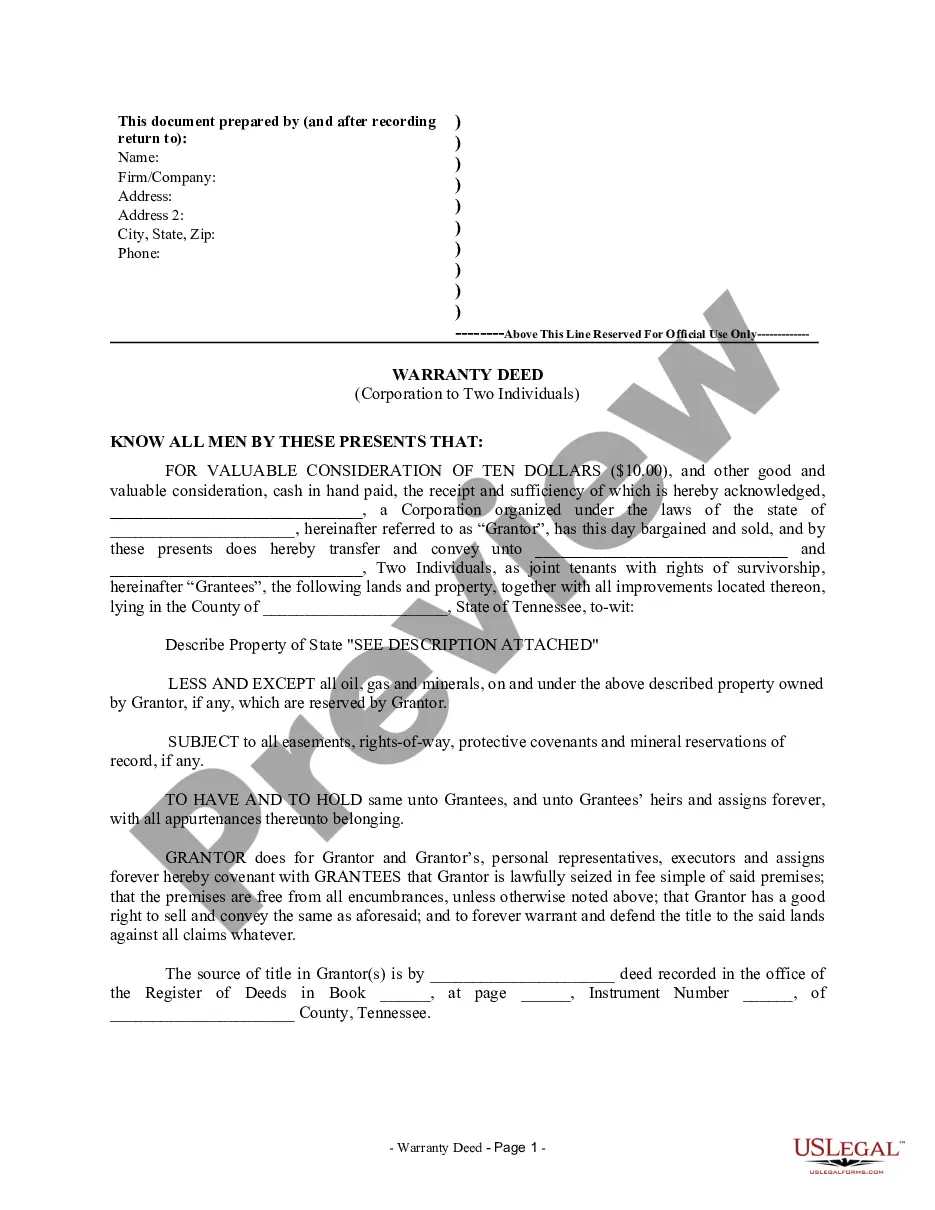

The sale of business, sole in Phoenix, Arizona refers to the process of transferring ownership and control of a business from one individual, known as the "sole proprietor," to another party. In this transaction, the sole proprietor sells all assets, liabilities, and goodwill associated with the business to the new owner, who becomes responsible for its daily operations and future growth. The sale of business, sole can take various forms in Phoenix, Arizona, with different types of transactions catering to specific business needs. Some common types include: 1. Asset Sale: This type of sale involves the transfer of tangible and intangible assets of the business, such as equipment, inventory, customer lists, licenses, and contracts. The buyer acquires these assets and assumes certain liabilities, giving them a fresh start while leaving behind any unwanted debts or obligations. 2. Stock Sale: In a stock sale, the buyer purchases the shares or ownership interest in the business, including all its assets and liabilities. By acquiring the shares, the buyer essentially steps into the shoes of the seller, assuming both the company's successes and risks. 3. Merger or Acquisition: Rather than selling the business outright, a sole proprietor may opt for a merger or acquisition, where their business combines with another company. This can offer synergistic benefits, increased market share, and a potential boost in productivity and profitability. 4. Franchise Sale: Some sole proprietors operate franchises, and the sale of a franchise involves transferring ownership of the franchise business to a new operator. The buyer becomes the new franchisee and gains the rights to use the franchisor's brand, trademarks, and established business model. During the sale of a business, sole in Phoenix, Arizona, several key steps need to be considered. These include: 1. Valuation: Determining the worth of the business using methods such as market analysis, asset valuation, and financial assessment. 2. Negotiation: Negotiating the terms and conditions of the sale, including price, payment structure, non-compete agreements, and any contingencies. 3. Due Diligence: Both parties conduct a comprehensive review of the business's financial records, legal compliance, contracts, leases, and other pertinent details to ensure transparency and mitigate risks. 4. Documentation: Drafting and reviewing legal documents such as purchase agreements, asset transfer agreements, non-disclosure agreements, and any necessary filings with the appropriate government authorities. It is crucial for both buyers and sellers involved in the sale of business, sole in Phoenix, Arizona, to seek professional advice from business brokers, attorneys, and accountants to ensure a smooth and legally compliant transaction. Additionally, understanding the specific type of sale and its associated implications can help buyers and sellers make informed decisions tailored to their unique business circumstances.The sale of business, sole in Phoenix, Arizona refers to the process of transferring ownership and control of a business from one individual, known as the "sole proprietor," to another party. In this transaction, the sole proprietor sells all assets, liabilities, and goodwill associated with the business to the new owner, who becomes responsible for its daily operations and future growth. The sale of business, sole can take various forms in Phoenix, Arizona, with different types of transactions catering to specific business needs. Some common types include: 1. Asset Sale: This type of sale involves the transfer of tangible and intangible assets of the business, such as equipment, inventory, customer lists, licenses, and contracts. The buyer acquires these assets and assumes certain liabilities, giving them a fresh start while leaving behind any unwanted debts or obligations. 2. Stock Sale: In a stock sale, the buyer purchases the shares or ownership interest in the business, including all its assets and liabilities. By acquiring the shares, the buyer essentially steps into the shoes of the seller, assuming both the company's successes and risks. 3. Merger or Acquisition: Rather than selling the business outright, a sole proprietor may opt for a merger or acquisition, where their business combines with another company. This can offer synergistic benefits, increased market share, and a potential boost in productivity and profitability. 4. Franchise Sale: Some sole proprietors operate franchises, and the sale of a franchise involves transferring ownership of the franchise business to a new operator. The buyer becomes the new franchisee and gains the rights to use the franchisor's brand, trademarks, and established business model. During the sale of a business, sole in Phoenix, Arizona, several key steps need to be considered. These include: 1. Valuation: Determining the worth of the business using methods such as market analysis, asset valuation, and financial assessment. 2. Negotiation: Negotiating the terms and conditions of the sale, including price, payment structure, non-compete agreements, and any contingencies. 3. Due Diligence: Both parties conduct a comprehensive review of the business's financial records, legal compliance, contracts, leases, and other pertinent details to ensure transparency and mitigate risks. 4. Documentation: Drafting and reviewing legal documents such as purchase agreements, asset transfer agreements, non-disclosure agreements, and any necessary filings with the appropriate government authorities. It is crucial for both buyers and sellers involved in the sale of business, sole in Phoenix, Arizona, to seek professional advice from business brokers, attorneys, and accountants to ensure a smooth and legally compliant transaction. Additionally, understanding the specific type of sale and its associated implications can help buyers and sellers make informed decisions tailored to their unique business circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.