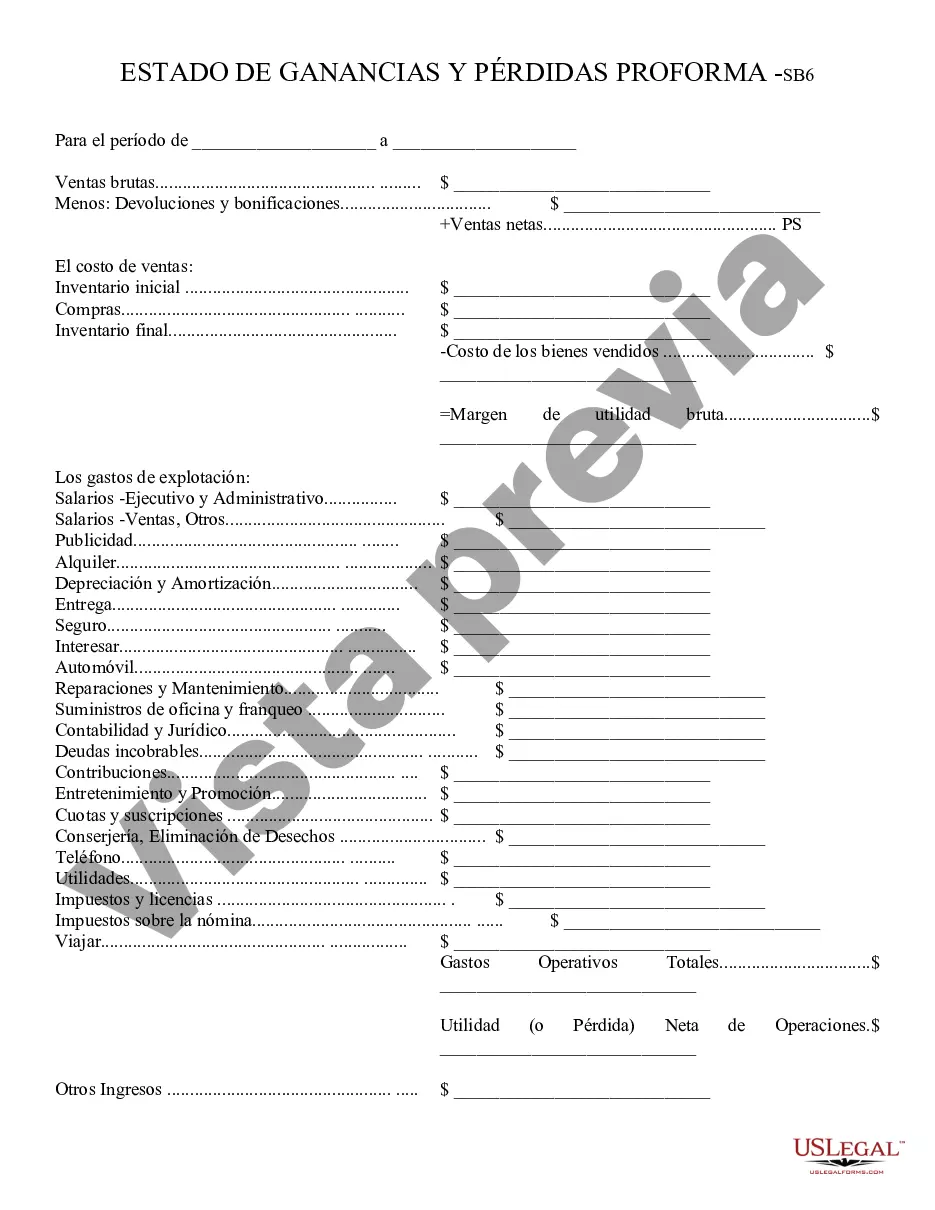

Profit and Loss Statement: This is a general Statement of Profits and Losses for a company. It lists in detail, all profits, or gains, as well as all losses the business may have suffered. This form can be used by any type of company, whether a corporation or a sole proprietor. This form is available in both Word and Rich Text formats.

Maricopa Arizona Profit and Loss Statement, commonly known as an income statement, is a financial document that displays the revenue, expenses, and resulting net profit or loss of a Maricopa, Arizona-based business over a specific period of time. It provides valuable insights into the financial performance and profitability of a company. The Maricopa Arizona Profit and Loss Statement presents a comprehensive breakdown of a company's income and expenses, allowing business owners, stakeholders, and investors to evaluate the financial health and efficiency of the organization. It serves as a vital tool for making informed decisions, setting future goals, and assessing the overall financial viability of the business. Keywords: Maricopa Arizona, Profit and Loss Statement, income statement, financial document, revenue, expenses, net profit, net loss, financial performance, profitability, company, period of time, financial health, efficiency, business owners, stakeholders, investors, informed decisions, goals, financial viability. Different types of Maricopa Arizona Profit and Loss Statements may include: 1. Monthly Profit and Loss Statement: This type of statement provides a breakdown of revenue, expenses, and net profit or loss for a specific month. It helps track short-term financial performance and identify any fluctuations in profitability on a monthly basis. 2. Quarterly Profit and Loss Statement: This statement presents the financial results over a three-month period. It allows for a broader view of the business's performance, enabling the identification of trends and patterns over a longer time frame. 3. Annual Profit and Loss Statement: This statement summarizes the revenue, expenses, and net profit or loss for an entire year. It offers a comprehensive overview of the company's financial performance, facilitating year-on-year comparisons and long-term strategic planning. 4. Comparative Profit and Loss Statement: This type of statement provides a side-by-side comparison of multiple periods, such as monthly, quarterly, or annual results. It helps analyze changes in revenue, expenses, and profitability over time and identify key factors influencing the financial performance of the business. 5. Projected Profit and Loss Statement: This statement forecasts the anticipated revenue, expenses, and resulting net profit or loss for a future period. It assists in estimating the financial outcomes of potential business strategies, investments, or projects, aiding in decision-making and financial planning. 6. Departmental Profit and Loss Statement: This statement breaks down the revenue, expenses, and net profit or loss by specific departments or business units within an organization. It enables assessment of the individual performance of different divisions, highlighting areas of strength or weakness within the company. Keywords: Monthly, Quarterly, Annual, Comparative, Projected, Departmental Profit and Loss Statement, breakdown, revenue, expenses, net profit, net loss, financial performance, short-term, long-term, trends, patterns, year-on-year, side-by-side, forecasting, anticipated, strategic planning, investments, projects, individual performance, divisions.Maricopa Arizona Profit and Loss Statement, commonly known as an income statement, is a financial document that displays the revenue, expenses, and resulting net profit or loss of a Maricopa, Arizona-based business over a specific period of time. It provides valuable insights into the financial performance and profitability of a company. The Maricopa Arizona Profit and Loss Statement presents a comprehensive breakdown of a company's income and expenses, allowing business owners, stakeholders, and investors to evaluate the financial health and efficiency of the organization. It serves as a vital tool for making informed decisions, setting future goals, and assessing the overall financial viability of the business. Keywords: Maricopa Arizona, Profit and Loss Statement, income statement, financial document, revenue, expenses, net profit, net loss, financial performance, profitability, company, period of time, financial health, efficiency, business owners, stakeholders, investors, informed decisions, goals, financial viability. Different types of Maricopa Arizona Profit and Loss Statements may include: 1. Monthly Profit and Loss Statement: This type of statement provides a breakdown of revenue, expenses, and net profit or loss for a specific month. It helps track short-term financial performance and identify any fluctuations in profitability on a monthly basis. 2. Quarterly Profit and Loss Statement: This statement presents the financial results over a three-month period. It allows for a broader view of the business's performance, enabling the identification of trends and patterns over a longer time frame. 3. Annual Profit and Loss Statement: This statement summarizes the revenue, expenses, and net profit or loss for an entire year. It offers a comprehensive overview of the company's financial performance, facilitating year-on-year comparisons and long-term strategic planning. 4. Comparative Profit and Loss Statement: This type of statement provides a side-by-side comparison of multiple periods, such as monthly, quarterly, or annual results. It helps analyze changes in revenue, expenses, and profitability over time and identify key factors influencing the financial performance of the business. 5. Projected Profit and Loss Statement: This statement forecasts the anticipated revenue, expenses, and resulting net profit or loss for a future period. It assists in estimating the financial outcomes of potential business strategies, investments, or projects, aiding in decision-making and financial planning. 6. Departmental Profit and Loss Statement: This statement breaks down the revenue, expenses, and net profit or loss by specific departments or business units within an organization. It enables assessment of the individual performance of different divisions, highlighting areas of strength or weakness within the company. Keywords: Monthly, Quarterly, Annual, Comparative, Projected, Departmental Profit and Loss Statement, breakdown, revenue, expenses, net profit, net loss, financial performance, short-term, long-term, trends, patterns, year-on-year, side-by-side, forecasting, anticipated, strategic planning, investments, projects, individual performance, divisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.