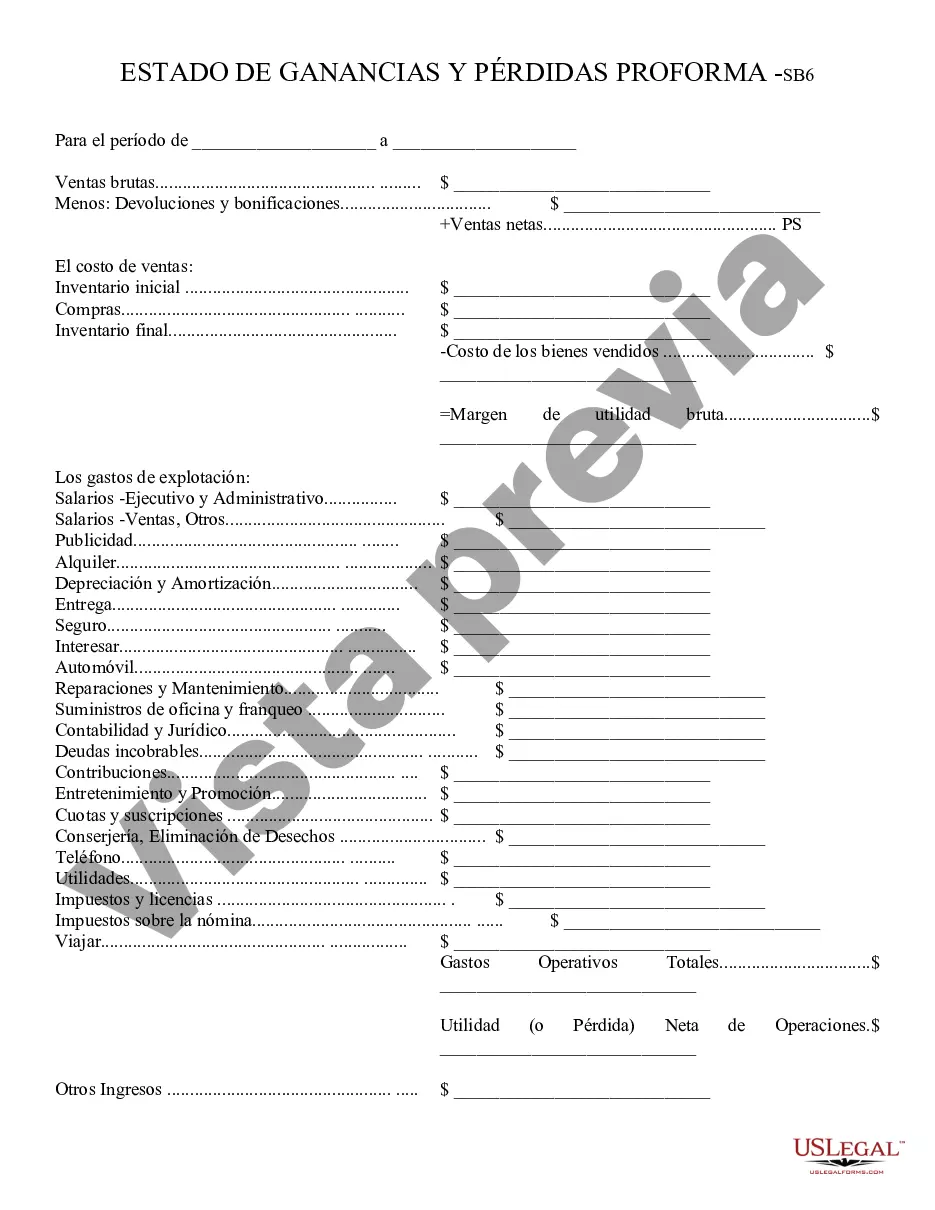

Profit and Loss Statement: This is a general Statement of Profits and Losses for a company. It lists in detail, all profits, or gains, as well as all losses the business may have suffered. This form can be used by any type of company, whether a corporation or a sole proprietor. This form is available in both Word and Rich Text formats.

A Profit and Loss Statement, also known as an income statement or P&L statement, is a financial document that provides a detailed summary of a business's revenues, costs, and expenses. It calculates the profit or loss generated by a company over a specific period, usually monthly, quarterly, or annually. For businesses located in Mesa, Arizona, the Mesa Arizona Profit and Loss Statement is a critical tool used to evaluate their financial performance and make informed decisions. The Mesa Arizona Profit and Loss Statement encompasses various components relevant to a business's financial activities. These components include revenue/sales, cost of goods sold, gross profit, operating expenses, operating income, interest expenses, taxes, and net income. Each section plays a crucial role in assessing the profitability and financial health of a business entity. In Mesa, Arizona, there are no specific types of Profit and Loss Statements that differ from those found elsewhere. However, businesses in different industries and sectors may have specific variations or adjustments to their P&L statements to better align with their unique operations. Some common types of Profit and Loss Statements used in Mesa, Arizona include: 1. Retail Profit and Loss Statement: This type focuses on businesses involved in retail sales, such as clothing stores, supermarkets, or electronic shops. It highlights key performance indicators like sales volumes, gross profit margins, and operating expenses specific to the retail industry. 2. Service-Based Profit and Loss Statement: Service-oriented businesses, such as consulting firms, law practices, or healthcare providers, utilize this type. It takes into account revenue generated from providing services, direct costs associated with service delivery, and operating expenses common to service-based industries. 3. Manufacturing Profit and Loss Statement: Manufacturers in Mesa, Arizona, use this type of P&L statement. It factors in revenue from product sales, material and labor costs, and manufacturing overhead expenses. It often includes additional metrics like cost of goods manufactured and sold. 4. Restaurant Profit and Loss Statement: Restaurants and food establishments utilize this specific type. It focuses on revenue from food and beverage sales, cost of ingredients, labor expenses, overhead costs, and other related expenditures unique to the food service industry. 5. Real Estate Profit and Loss Statement: Real estate businesses, including property management companies or real estate developers, require this type. It incorporates revenue from property rentals, property sales, leasing expenses, property maintenance costs, and other related expenses pertinent to the real estate industry. In conclusion, the Mesa Arizona Profit and Loss Statement is an essential financial statement utilized by businesses in Mesa to evaluate their financial performance. While there are no specific variations unique to the region, businesses in different industries may adapt certain elements of their P&L statements to better align with their operations. Retail, service-based, manufacturing, restaurant, and real estate are common types of P&L statements used in Mesa, Arizona, which incorporate industry-specific revenues, costs, and expenses.A Profit and Loss Statement, also known as an income statement or P&L statement, is a financial document that provides a detailed summary of a business's revenues, costs, and expenses. It calculates the profit or loss generated by a company over a specific period, usually monthly, quarterly, or annually. For businesses located in Mesa, Arizona, the Mesa Arizona Profit and Loss Statement is a critical tool used to evaluate their financial performance and make informed decisions. The Mesa Arizona Profit and Loss Statement encompasses various components relevant to a business's financial activities. These components include revenue/sales, cost of goods sold, gross profit, operating expenses, operating income, interest expenses, taxes, and net income. Each section plays a crucial role in assessing the profitability and financial health of a business entity. In Mesa, Arizona, there are no specific types of Profit and Loss Statements that differ from those found elsewhere. However, businesses in different industries and sectors may have specific variations or adjustments to their P&L statements to better align with their unique operations. Some common types of Profit and Loss Statements used in Mesa, Arizona include: 1. Retail Profit and Loss Statement: This type focuses on businesses involved in retail sales, such as clothing stores, supermarkets, or electronic shops. It highlights key performance indicators like sales volumes, gross profit margins, and operating expenses specific to the retail industry. 2. Service-Based Profit and Loss Statement: Service-oriented businesses, such as consulting firms, law practices, or healthcare providers, utilize this type. It takes into account revenue generated from providing services, direct costs associated with service delivery, and operating expenses common to service-based industries. 3. Manufacturing Profit and Loss Statement: Manufacturers in Mesa, Arizona, use this type of P&L statement. It factors in revenue from product sales, material and labor costs, and manufacturing overhead expenses. It often includes additional metrics like cost of goods manufactured and sold. 4. Restaurant Profit and Loss Statement: Restaurants and food establishments utilize this specific type. It focuses on revenue from food and beverage sales, cost of ingredients, labor expenses, overhead costs, and other related expenditures unique to the food service industry. 5. Real Estate Profit and Loss Statement: Real estate businesses, including property management companies or real estate developers, require this type. It incorporates revenue from property rentals, property sales, leasing expenses, property maintenance costs, and other related expenses pertinent to the real estate industry. In conclusion, the Mesa Arizona Profit and Loss Statement is an essential financial statement utilized by businesses in Mesa to evaluate their financial performance. While there are no specific variations unique to the region, businesses in different industries may adapt certain elements of their P&L statements to better align with their operations. Retail, service-based, manufacturing, restaurant, and real estate are common types of P&L statements used in Mesa, Arizona, which incorporate industry-specific revenues, costs, and expenses.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.