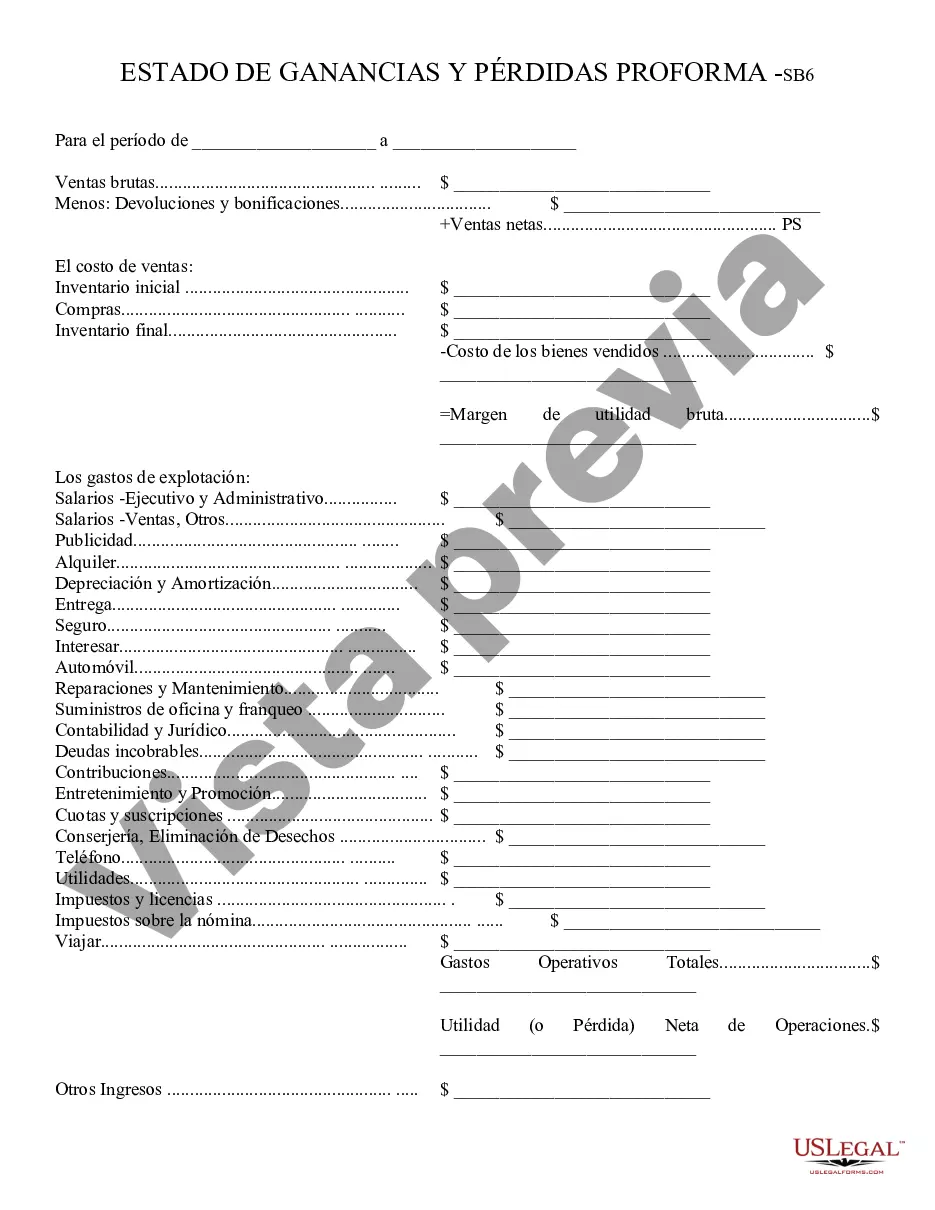

Profit and Loss Statement: This is a general Statement of Profits and Losses for a company. It lists in detail, all profits, or gains, as well as all losses the business may have suffered. This form can be used by any type of company, whether a corporation or a sole proprietor. This form is available in both Word and Rich Text formats.

A profit and loss statement, also known as an income statement or an income and expense statement, is a financial document that summarizes the revenues, costs, and expenses incurred by a business over a specific time period, usually on a quarterly or annual basis. It is an essential tool for businesses in Phoenix, Arizona, as it provides a snapshot of their financial performance and helps in assessing profitability. The Phoenix Arizona Profit and Loss Statement includes several key components. Firstly, it lists the total revenues generated by the business during the period, which encompass all sales, services, and other sources of income. It also outlines the cost of goods sold (COGS), which includes the direct expenses incurred in producing or providing the products or services sold. Next, the statement deducts the COGS from the revenues to calculate the gross profit. This figure represents the income remaining after accounting for the direct costs associated with production. Gross profit is a significant indicator of a business's ability to control expenses and generate profit from its core operations. Following the gross profit calculation, the statement includes a detailed breakdown of operating expenses. These expenses include items such as rent, utilities, salaries, marketing costs, taxes, and insurance. This section helps businesses in Phoenix, Arizona, identify the primary expenses impacting their profitability and make informed decisions regarding cost management and efficiency. After subtracting the operating expenses from the gross profit, the statement arrives at the operating profit, also known as operating income or earnings before interest and taxes (EBIT). This figure represents the income generated solely from the business's core operations before taking into account interest and tax expenses. The next section of the Phoenix Arizona Profit and Loss Statement covers non-operating income and expenses. This category includes income or expenses that don't directly relate to the core operations of the business, such as interest income or expenses, investment gains or losses, and any extraordinary or one-time items. Finally, the statement deducts the non-operating income and expenses from the operating profit to arrive at the net profit or net income. This figure represents the total income remaining after accounting for all expenses, including both operating and non-operating items. Net profit is a vital measure of a business's overall profitability and is closely monitored by business owners, investors, and lenders alike. In conclusion, the Phoenix Arizona Profit and Loss Statement provides a comprehensive overview of a business's financial performance by summarizing its revenues, costs, and expenses. It helps businesses in Phoenix assess profitability, identify areas of improvement, and make informed decisions to optimize their financial outcomes.A profit and loss statement, also known as an income statement or an income and expense statement, is a financial document that summarizes the revenues, costs, and expenses incurred by a business over a specific time period, usually on a quarterly or annual basis. It is an essential tool for businesses in Phoenix, Arizona, as it provides a snapshot of their financial performance and helps in assessing profitability. The Phoenix Arizona Profit and Loss Statement includes several key components. Firstly, it lists the total revenues generated by the business during the period, which encompass all sales, services, and other sources of income. It also outlines the cost of goods sold (COGS), which includes the direct expenses incurred in producing or providing the products or services sold. Next, the statement deducts the COGS from the revenues to calculate the gross profit. This figure represents the income remaining after accounting for the direct costs associated with production. Gross profit is a significant indicator of a business's ability to control expenses and generate profit from its core operations. Following the gross profit calculation, the statement includes a detailed breakdown of operating expenses. These expenses include items such as rent, utilities, salaries, marketing costs, taxes, and insurance. This section helps businesses in Phoenix, Arizona, identify the primary expenses impacting their profitability and make informed decisions regarding cost management and efficiency. After subtracting the operating expenses from the gross profit, the statement arrives at the operating profit, also known as operating income or earnings before interest and taxes (EBIT). This figure represents the income generated solely from the business's core operations before taking into account interest and tax expenses. The next section of the Phoenix Arizona Profit and Loss Statement covers non-operating income and expenses. This category includes income or expenses that don't directly relate to the core operations of the business, such as interest income or expenses, investment gains or losses, and any extraordinary or one-time items. Finally, the statement deducts the non-operating income and expenses from the operating profit to arrive at the net profit or net income. This figure represents the total income remaining after accounting for all expenses, including both operating and non-operating items. Net profit is a vital measure of a business's overall profitability and is closely monitored by business owners, investors, and lenders alike. In conclusion, the Phoenix Arizona Profit and Loss Statement provides a comprehensive overview of a business's financial performance by summarizing its revenues, costs, and expenses. It helps businesses in Phoenix assess profitability, identify areas of improvement, and make informed decisions to optimize their financial outcomes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.