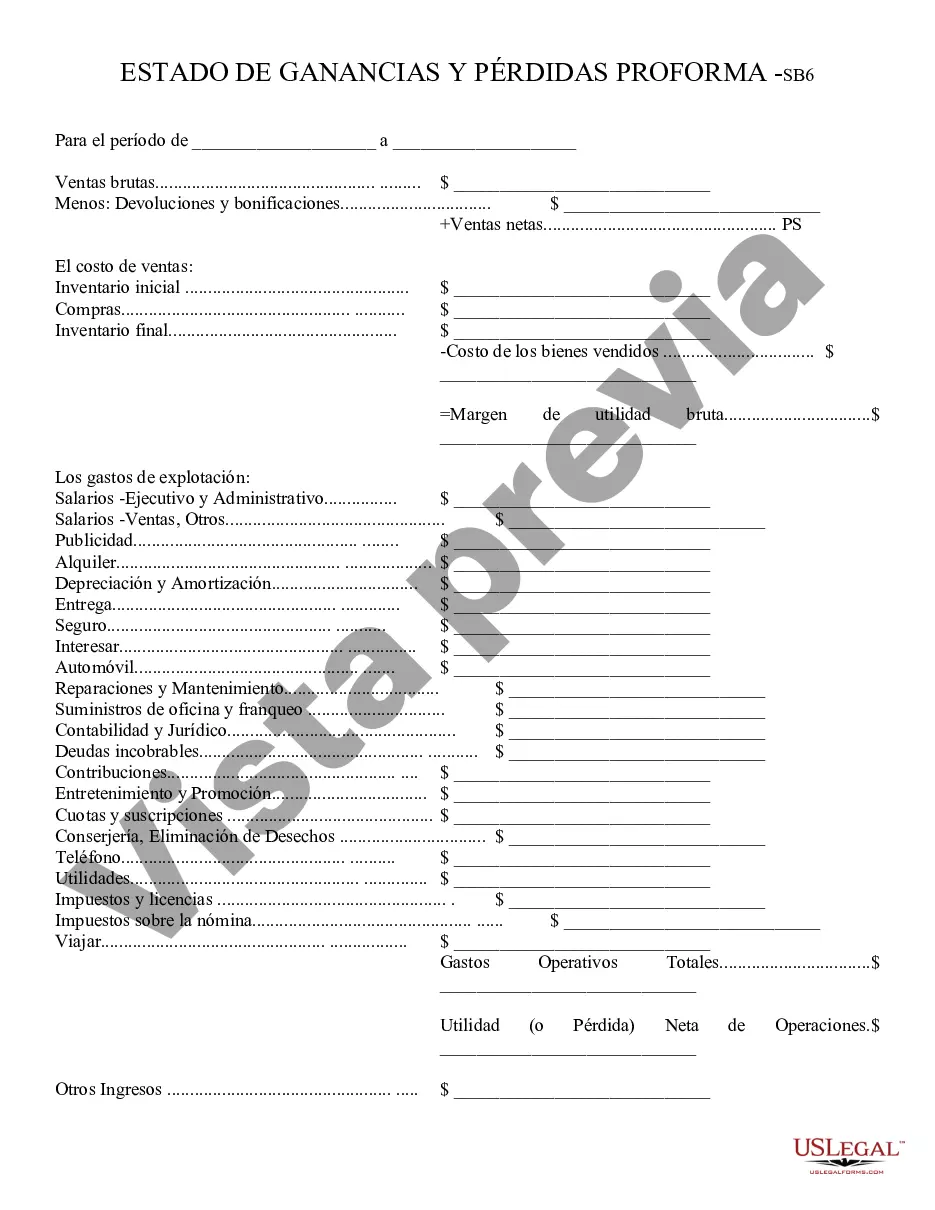

Profit and Loss Statement: This is a general Statement of Profits and Losses for a company. It lists in detail, all profits, or gains, as well as all losses the business may have suffered. This form can be used by any type of company, whether a corporation or a sole proprietor. This form is available in both Word and Rich Text formats.

The Lima Arizona Profit and Loss Statement is a financial document that showcases the revenues, expenses, and net income or loss of a business operating in Lima, Arizona. This statement is a vital tool for business owners, investors, and stakeholders as it provides an overview of the company's financial performance over a specific period. Keywords: Lima Arizona, Profit and Loss Statement, financial document, revenues, expenses, net income, net loss, business owners, investors, stakeholders, financial performance. The Lima Arizona Profit and Loss Statement is typically divided into sections, each representing a different aspect of the business's financial operations. It allows the reader to analyze the company's sources of income and identify areas where expenses may be impacting profitability. Some common sections that can be found in a Lima Arizona Profit and Loss Statement include: 1. Revenue: This section outlines the various sources of income for the business, such as sales of goods or services, interest earned, or rental income. It provides a breakdown of revenue generated during the specified period, highlighting the contributions from each income source. 2. Cost of Goods Sold (COGS): This section covers the direct costs associated with producing goods or providing services. It includes expenses like raw materials, direct labor, and manufacturing overheads. 3. Operating Expenses: These are non-production costs incurred in the day-to-day operations of the business. Examples include rent, utilities, salaries, marketing expenses, insurance, and professional fees. 4. Gross Profit: Gross profit is obtained by subtracting the COGS from the total revenue. It reflects the profitability of the core operations of the business without considering operating expenses. 5. Operating Income (or Loss): Operating income is calculated by deducting the operating expenses from the gross profit. This figure represents the profit or loss generated solely from the business's core operations. 6. Other Income and Expenses: This section includes any income or expenses not directly related to the core operations of the business. It may include gains or losses from the sale of assets, interest income, or extraordinary expenses. 7. Net Income (or Loss): Net income is the final figure obtained after subtracting all operating and non-operating expenses from the operating income. It represents the overall profitability of the business during the specified period. A positive net income indicates profit, while a negative net income signifies a loss. In addition to the standard profit and loss statement, there may be variations or specialized Lima Arizona Profit and Loss Statements designed for specific industries or purposes. Some examples include: 1. Projected Profit and Loss Statement: This statement is used to forecast future financial performance based on projected revenues and expenses. It helps businesses in planning and decision-making. 2. Comparative Profit and Loss Statement: This statement compares the financial performance of a business across different periods, such as month-to-month or year-to-year. It allows for the identification of trends and patterns. 3. Consolidated Profit and Loss Statement: This statement combines the financial results of multiple entities under common control. It provides a comprehensive overview of the combined financial performance of a group of companies. In summary, the Lima Arizona Profit and Loss Statement is a key financial document that showcases the revenues, expenses, and net income or loss of a business operating in Lima, Arizona. It provides valuable insights into the profitability and financial health of the company, aiding in decision-making and financial analysis.The Lima Arizona Profit and Loss Statement is a financial document that showcases the revenues, expenses, and net income or loss of a business operating in Lima, Arizona. This statement is a vital tool for business owners, investors, and stakeholders as it provides an overview of the company's financial performance over a specific period. Keywords: Lima Arizona, Profit and Loss Statement, financial document, revenues, expenses, net income, net loss, business owners, investors, stakeholders, financial performance. The Lima Arizona Profit and Loss Statement is typically divided into sections, each representing a different aspect of the business's financial operations. It allows the reader to analyze the company's sources of income and identify areas where expenses may be impacting profitability. Some common sections that can be found in a Lima Arizona Profit and Loss Statement include: 1. Revenue: This section outlines the various sources of income for the business, such as sales of goods or services, interest earned, or rental income. It provides a breakdown of revenue generated during the specified period, highlighting the contributions from each income source. 2. Cost of Goods Sold (COGS): This section covers the direct costs associated with producing goods or providing services. It includes expenses like raw materials, direct labor, and manufacturing overheads. 3. Operating Expenses: These are non-production costs incurred in the day-to-day operations of the business. Examples include rent, utilities, salaries, marketing expenses, insurance, and professional fees. 4. Gross Profit: Gross profit is obtained by subtracting the COGS from the total revenue. It reflects the profitability of the core operations of the business without considering operating expenses. 5. Operating Income (or Loss): Operating income is calculated by deducting the operating expenses from the gross profit. This figure represents the profit or loss generated solely from the business's core operations. 6. Other Income and Expenses: This section includes any income or expenses not directly related to the core operations of the business. It may include gains or losses from the sale of assets, interest income, or extraordinary expenses. 7. Net Income (or Loss): Net income is the final figure obtained after subtracting all operating and non-operating expenses from the operating income. It represents the overall profitability of the business during the specified period. A positive net income indicates profit, while a negative net income signifies a loss. In addition to the standard profit and loss statement, there may be variations or specialized Lima Arizona Profit and Loss Statements designed for specific industries or purposes. Some examples include: 1. Projected Profit and Loss Statement: This statement is used to forecast future financial performance based on projected revenues and expenses. It helps businesses in planning and decision-making. 2. Comparative Profit and Loss Statement: This statement compares the financial performance of a business across different periods, such as month-to-month or year-to-year. It allows for the identification of trends and patterns. 3. Consolidated Profit and Loss Statement: This statement combines the financial results of multiple entities under common control. It provides a comprehensive overview of the combined financial performance of a group of companies. In summary, the Lima Arizona Profit and Loss Statement is a key financial document that showcases the revenues, expenses, and net income or loss of a business operating in Lima, Arizona. It provides valuable insights into the profitability and financial health of the company, aiding in decision-making and financial analysis.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.