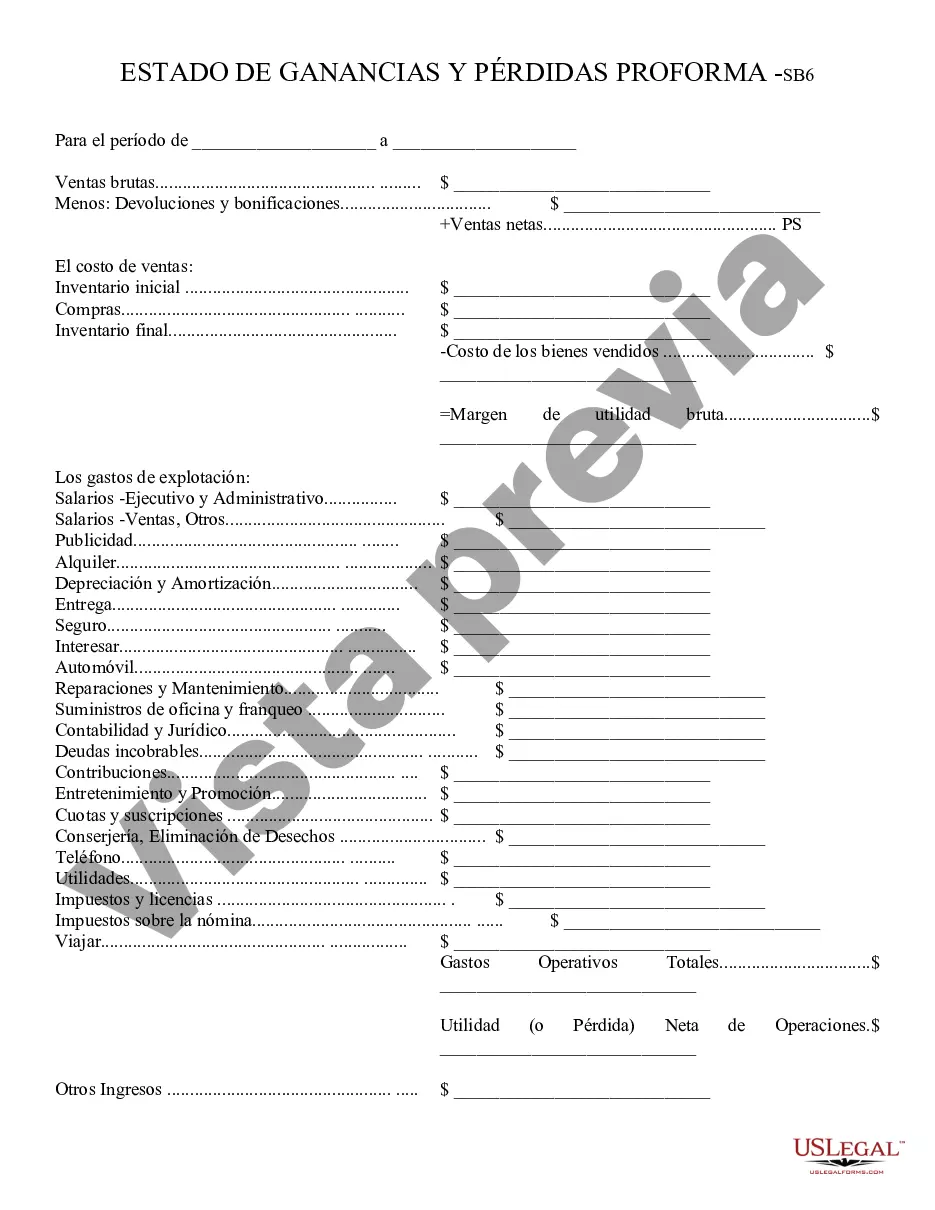

Profit and Loss Statement: This is a general Statement of Profits and Losses for a company. It lists in detail, all profits, or gains, as well as all losses the business may have suffered. This form can be used by any type of company, whether a corporation or a sole proprietor. This form is available in both Word and Rich Text formats.

Surprise Arizona Profit and Loss Statement, also known as an income statement, is a financial document that provides a detailed summary of a business's revenue, expenses, and net profit (or loss) over a specific period of time. It is a crucial component of any financial analysis, helping businesses evaluate their financial performance and make informed decisions. The Surprise Arizona Profit and Loss Statement calculates the net profit by subtracting total expenses from total revenue. It begins with the revenue section, which includes all the income generated from the business operations, such as sales, service fees, or rental income. Then, the statement lists various expense categories, categorizing costs incurred to generate revenue, such as cost of goods sold, salaries and wages, marketing expenses, utilities, rent, and insurance costs. This detailed statement provides insights into the various components that contribute to a business's profitability. By closely examining and analyzing each expense item, business owners can identify areas of inefficiency, control costs, and identify opportunities for improvement. It helps them understand the financial health of their business, make informed decisions about pricing, marketing strategies, and cost-cutting measures. There are no specific types of Surprise Arizona Profit and Loss Statement. However, businesses can prepare them monthly, quarterly, or annually, depending on their reporting requirements. Monthly statements are typically used by small businesses or startups to monitor their financial performance regularly. Quarterly statements are prepared by larger businesses to provide a summary of financial results during a specific quarter. Annual statements provide a comprehensive overview of the business's financial performance over the fiscal year. In summary, Surprise Arizona Profit and Loss Statement is a vital financial tool that provides a detailed breakdown of a business's revenue, expenses, and net profit (or loss) over a specific period. By analyzing this statement, business owners can gain valuable insights into their financial performance, make informed decisions, and improve their overall profitability.Surprise Arizona Profit and Loss Statement, also known as an income statement, is a financial document that provides a detailed summary of a business's revenue, expenses, and net profit (or loss) over a specific period of time. It is a crucial component of any financial analysis, helping businesses evaluate their financial performance and make informed decisions. The Surprise Arizona Profit and Loss Statement calculates the net profit by subtracting total expenses from total revenue. It begins with the revenue section, which includes all the income generated from the business operations, such as sales, service fees, or rental income. Then, the statement lists various expense categories, categorizing costs incurred to generate revenue, such as cost of goods sold, salaries and wages, marketing expenses, utilities, rent, and insurance costs. This detailed statement provides insights into the various components that contribute to a business's profitability. By closely examining and analyzing each expense item, business owners can identify areas of inefficiency, control costs, and identify opportunities for improvement. It helps them understand the financial health of their business, make informed decisions about pricing, marketing strategies, and cost-cutting measures. There are no specific types of Surprise Arizona Profit and Loss Statement. However, businesses can prepare them monthly, quarterly, or annually, depending on their reporting requirements. Monthly statements are typically used by small businesses or startups to monitor their financial performance regularly. Quarterly statements are prepared by larger businesses to provide a summary of financial results during a specific quarter. Annual statements provide a comprehensive overview of the business's financial performance over the fiscal year. In summary, Surprise Arizona Profit and Loss Statement is a vital financial tool that provides a detailed breakdown of a business's revenue, expenses, and net profit (or loss) over a specific period. By analyzing this statement, business owners can gain valuable insights into their financial performance, make informed decisions, and improve their overall profitability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.