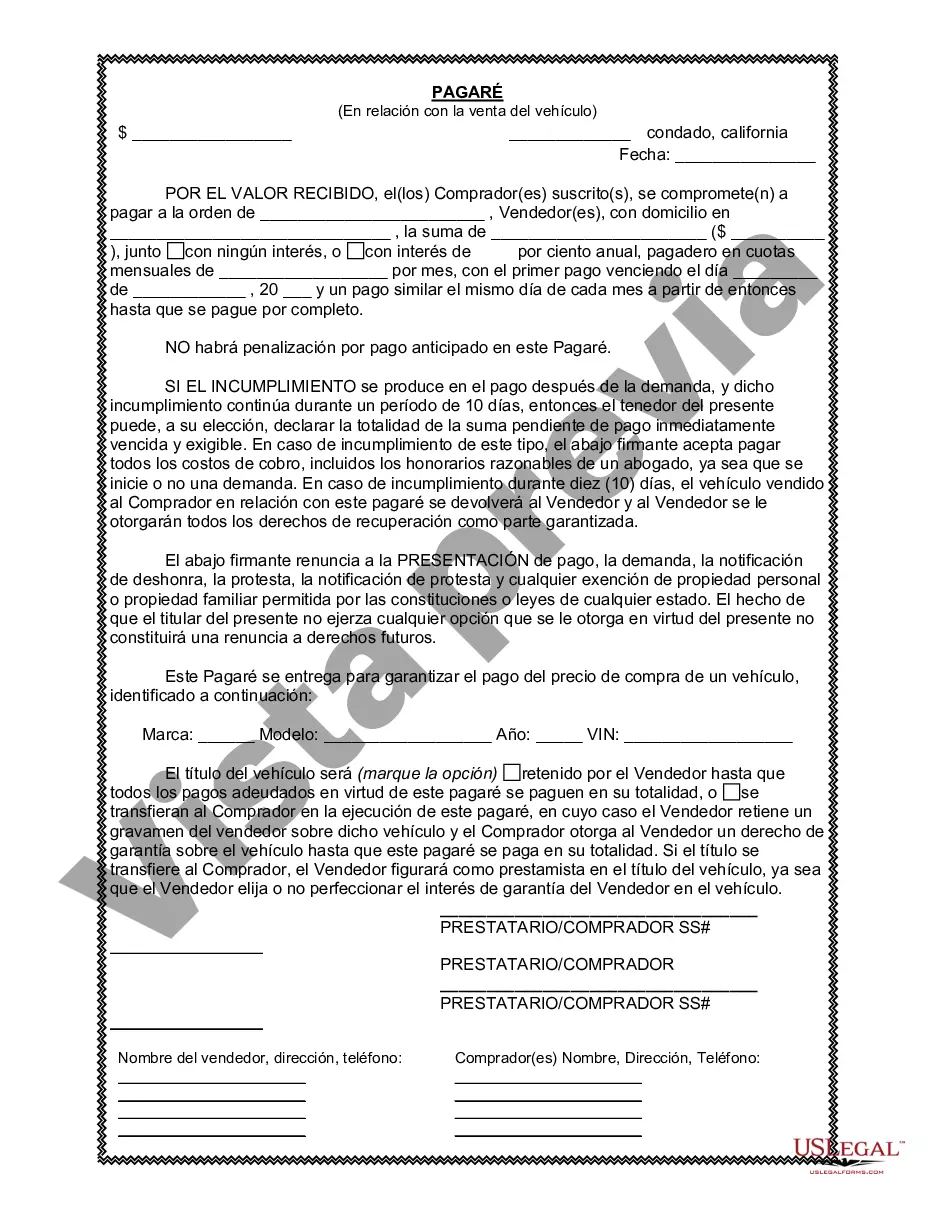

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Carlsbad California Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan or financing agreement for the purchase of a vehicle in Carlsbad, California. This promissory note serves as official evidence of the borrower's promise to repay the lender the agreed-upon amount of money in a timely manner. Some important keywords and phrases to include in the description are: 1. Carlsbad, California: Signifies that the promissory note is applicable and enforceable within the jurisdiction of Carlsbad, California. 2. Promissory Note: A written promise to repay a loan or debt, detailing the terms and conditions of repayment. 3. Sale of Vehicle or Automobile: Refers to the transaction where a vehicle is being sold, providing the necessary funds for the promissory note. 4. Legally Binding: Indicates that the promissory note holds legal significance and can be enforced by law. 5. Loan or Financing Agreement: Pertains to the financial arrangement made between the borrower and lender for the purchase of the vehicle. 6. Terms and Conditions: Specifies the agreed-upon repayment schedule, interest rate (if any), consequences of default or late payment, and other pertinent details. 7. Borrower: The individual responsible for receiving the loan or financing to purchase the vehicle. 8. Lender: The entity or person providing the loan or financing to the borrower. 9. Timely Repayment: The borrower's commitment to making the scheduled payments promptly as outlined in the promissory note. Different types of Carlsbad California Promissory Notes in Connection with Sale of Vehicle or Automobile may include variations based on specific terms or conditions. Examples could be: 1. Fixed Interest Rate Promissory Note: Specifies a predetermined interest rate on the loan amount throughout the repayment period. 2. Variable Interest Rate Promissory Note: Allows for fluctuating interest rates based on market conditions or other agreed-upon factors. 3. Secured Promissory Note: Requires the borrower to provide collateral, such as the vehicle being purchased, to secure the loan. 4. Unsecured Promissory Note: Does not require any specific collateral to be provided, relying solely on the borrower's creditworthiness and promise to repay. It is essential to consult with legal experts or professionals familiar with Carlsbad's specific laws to ensure the accuracy and compliance of any promissory note used in connection with the sale of a vehicle or automobile.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.