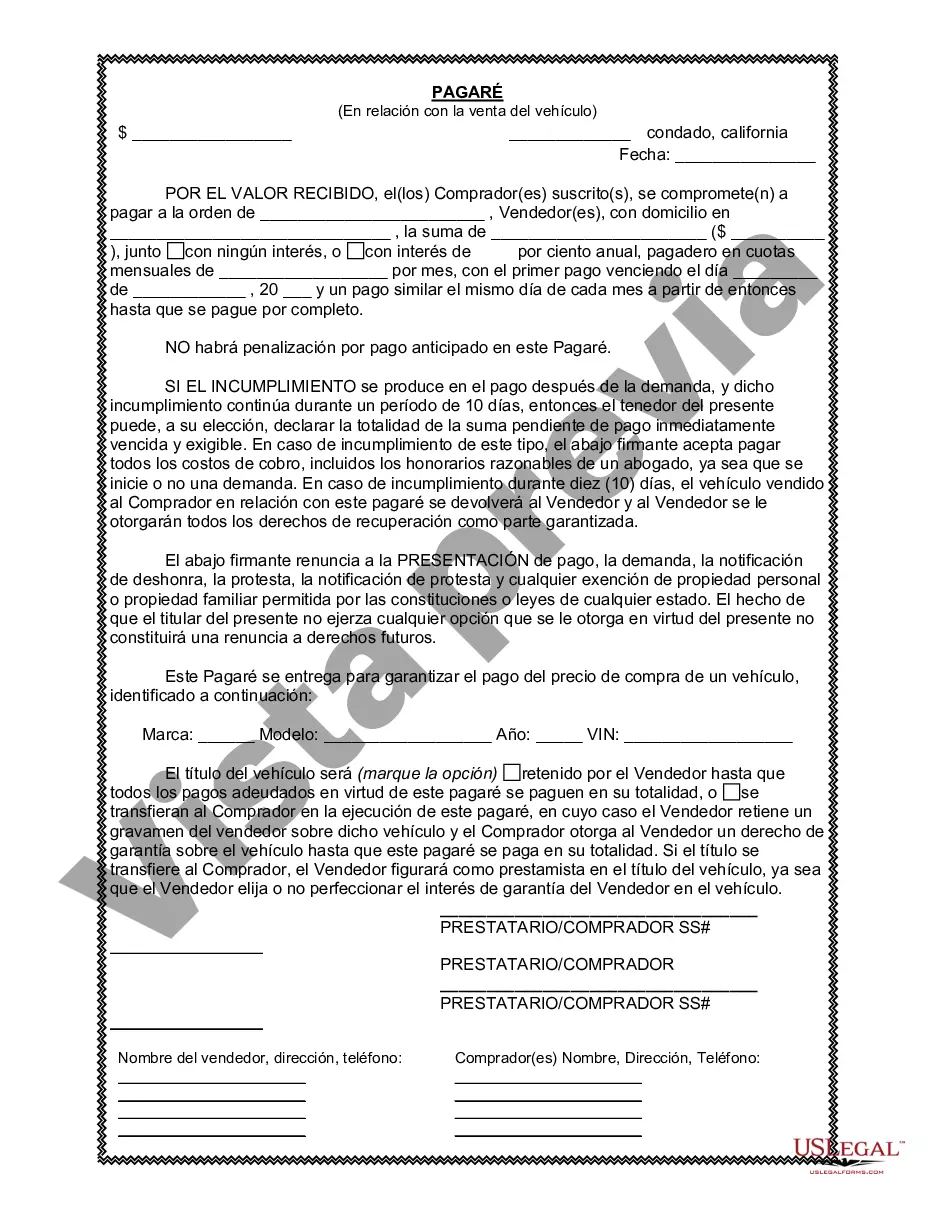

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Contra Costa California Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document used to formalize and secure a loan arrangement between a buyer and a seller for the purchase of a vehicle within Contra Costa County, California. This agreement outlines the terms and conditions of the loan, including repayment schedule, interest rate, and consequences of default. Keywords: Contra Costa California, promissory note, sale of vehicle, automobile, loan arrangement, buyer, seller, purchase, terms and conditions, repayment schedule, interest rate, default. There are several types of Contra Costa California Promissory Notes in Connection with Sale of Vehicle or Automobile: 1. Fixed Interest Rate Promissory Note: This type of promissory note sets a fixed interest rate for the loan amount. The interest rate remains the same throughout the loan term, ensuring consistent payments for the buyer. 2. Adjustable Interest Rate Promissory Note: Unlike the fixed interest rate promissory note, this type of note allows for adjustments in the interest rate during the loan term. The interest rate may fluctuate based on market conditions, potentially affecting the buyer's monthly payments. 3. Secured Promissory Note: A secured promissory note involves collateral, usually the vehicle being purchased with the loan. This provides added security for the lender in case of default, as they have the right to repossess the vehicle if the borrower fails to repay the loan as agreed. 4. Unsecured Promissory Note: An unsecured promissory note does not involve any collateral, making it a riskier option for the lender. In this case, the lender relies solely on the borrower's promise to repay the loan as specified in the agreement. 5. Installment Promissory Note: This type of note divides the loan amount into manageable monthly installments, specifying both the principal amount and the interest due with each payment. It helps the buyer plan their finances accordingly over the loan term. When preparing a Contra Costa California Promissory Note in Connection with Sale of Vehicle or Automobile, it is essential to include accurate information about the buyer, seller, vehicle details, loan amount, repayment terms, interest rate, and any other relevant clauses specific to the agreement. Seeking legal advice or using a template provided by a reputable source can help ensure compliance with local laws and protect the interests of both parties involved in the transaction.Contra Costa California Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document used to formalize and secure a loan arrangement between a buyer and a seller for the purchase of a vehicle within Contra Costa County, California. This agreement outlines the terms and conditions of the loan, including repayment schedule, interest rate, and consequences of default. Keywords: Contra Costa California, promissory note, sale of vehicle, automobile, loan arrangement, buyer, seller, purchase, terms and conditions, repayment schedule, interest rate, default. There are several types of Contra Costa California Promissory Notes in Connection with Sale of Vehicle or Automobile: 1. Fixed Interest Rate Promissory Note: This type of promissory note sets a fixed interest rate for the loan amount. The interest rate remains the same throughout the loan term, ensuring consistent payments for the buyer. 2. Adjustable Interest Rate Promissory Note: Unlike the fixed interest rate promissory note, this type of note allows for adjustments in the interest rate during the loan term. The interest rate may fluctuate based on market conditions, potentially affecting the buyer's monthly payments. 3. Secured Promissory Note: A secured promissory note involves collateral, usually the vehicle being purchased with the loan. This provides added security for the lender in case of default, as they have the right to repossess the vehicle if the borrower fails to repay the loan as agreed. 4. Unsecured Promissory Note: An unsecured promissory note does not involve any collateral, making it a riskier option for the lender. In this case, the lender relies solely on the borrower's promise to repay the loan as specified in the agreement. 5. Installment Promissory Note: This type of note divides the loan amount into manageable monthly installments, specifying both the principal amount and the interest due with each payment. It helps the buyer plan their finances accordingly over the loan term. When preparing a Contra Costa California Promissory Note in Connection with Sale of Vehicle or Automobile, it is essential to include accurate information about the buyer, seller, vehicle details, loan amount, repayment terms, interest rate, and any other relevant clauses specific to the agreement. Seeking legal advice or using a template provided by a reputable source can help ensure compliance with local laws and protect the interests of both parties involved in the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.